Current Report Filing (8-k)

January 22 2018 - 7:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2018

AGENUS INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

000-29089

|

|

06-1562417

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

3 Forbes Road

Lexington, MA

|

|

02421

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

781-674-4400

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company

☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

As previously disclosed, on January 6, 2018,

Agenus Inc. (“Agenus”), through its wholly-owned subsidiary, Antigenics LLC (“Antigenics”), entered into a Royalty Purchase Agreement (the “Royalty Purchase Agreement”) with Healthcare Royalty Partners III, L.P. and

certain of its affiliates (collectively, “HCR”). The closing under the Royalty Purchase Agreement occurred on January 19, 2018 (the “Closing”). Pursuant to the terms of the Royalty Purchase Agreement, HCR purchased 100% of

Antigenics’ worldwide rights to receive royalties from GlaxoSmithKline (“GSK”) on sales of GSK’s vaccines containing Agenus’

QS-21

Stimulon

®

adjuvant. As consideration for the purchase of the royalty rights, HCR paid $190.0 million at Closing, less certain transaction expenses. Antigenics is also entitled to receive

up to $40.35 million in milestone payments based on sales of GSK’s vaccines as follows: (i) $15.1 million upon reaching $2.0 billion last-twelve-months net sales any time prior to 2024 and (ii) $25.25 million upon

reaching $2.75 billion last-twelve-months net sales any time prior to 2026. Antigenics would owe approximately $25.9 million to HCR in 2021 if neither of the following sales milestones are achieved: (i) 2019 sales exceed $1.0 billion

or (ii) 2020 sales exceed $1.75 billion (the “Rebate Payment”). As part of the transaction, Agenus provided a guaranty for the potential Rebate Payment and secured the obligation with substantially all of its assets pursuant to a

security agreement, subject to certain customary exceptions and excluding all assets necessary for AgenTus Therapeutics, Inc.

At the Closing,

approximately $161.9 million of the proceeds were used to redeem Antigenics’ $115.0 million principal amount of notes issued pursuant to the Note Purchase Agreement dated September 4, 2015 with Oberland Capital SA Zermatt LLC and

the purchasers named therein (the “Note Purchase Agreement”), and the Note Purchase Agreement and the notes issued thereunder have been redeemed in full and terminated.

On January 22, 2018, Agenus issued a press release relating to the Closing. A copy of this press release is attached hereto as Exhibit 99.1 and is

incorporated herein by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

The information provided above in this Current

Report on Form

8-K

is hereby incorporated by reference into this Item 2.01.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information provided above in this Current Report on Form

8-K

is hereby incorporated by reference into this

Item 2.03.

|

Item 2.04

|

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement.

|

The information provided above in this Current Report on Form

8-K

is hereby incorporated by reference into this

Item 2.04.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: January 22, 2018

|

|

|

|

AGENUS INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Christine M. Klaskin

|

|

|

|

|

|

|

|

Christine M. Klaskin

|

|

|

|

|

|

|

|

VP, Finance

|

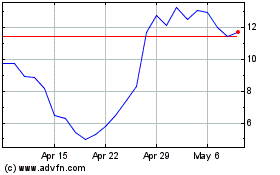

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

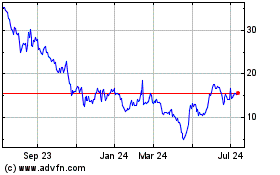

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024