Current Report Filing (8-k)

November 21 2017 - 9:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

November 20, 2017

GLOBAL

EQUITY INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54557

|

|

27-3986073

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

X3

Jumeirah Bay, Office 3305,

Jumeirah

Lake Towers

Dubai,

UAE

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code:

+ (971) 42767576 / + (1) 321 200 0142

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2., below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.133-4(c))

|

Item

1.01 Entry into a Material Definitive Agreement.

On

November 20, 2017, Global Equity International, Inc. (“Company”) entered into a Funding Agreement with William Marshal

Plc., a company incorporated under the laws of the United Kingdom (“Lender”), pursuant to which the Lender agreed

to loan the Company a minimum of £2,000,000 (approximately US$2,636,000). The loan will be funded in one or more tranches

beginning the first week of December 2017. The proceeds of the loan will be used by the Company to acquire up to four financial

advisory firms, based in the United Kingdom, Isle of Man and South East Asia.

The

first two financial advisory firms are located in the United Kingdom (“UK”) and the Isle of Man, respectively. The

UK based firm has approximately US$51,000,000 in funds under management and the Isle of Man based firm has approximately US$39,000,000

in funds under management.

The

third and fourth acquisitions are South East Asian based financial advisory firms with a similar amount of funds under management

to the UK and Isle of Man entities, which when acquired, will give our Company an initial combined $180,000,000 of funds under

management, a client base into the thousands, a small but highly effective distribution force, 20 more staff and a true regulatory

diversification with a second footing in the ever expanding Asian markets.

All

four of these firms have been in business for several years. Letters of intent have already been agreed and signed and we intend

to enter into definitive acquisition agreements for these four firms in the very near future.

The

capital funding will mainly be deployed to acquire the four advisory firms and some of the proceeds of the loan will be used for

reduction of our indebtedness and for our general working capital purposes.

Each tranche of the loan

will be evidenced by a Convertible Note, bearing interest at 6% per annum. Interest on the Convertible Notes is payable semi-annually.

The first semi-annual interest payment shall be made in cash or, at the option of the Lender, in shares of our Common Stock at

the conversion price indicated in the Convertible Notes. The Convertible Notes will mature on the 366

th

day following

issuance (“Maturity Date”). The principal and any accrued, but unpaid, interest outstanding on the Maturity Date shall

be mandatorily converted into shares of our Common Stock.

The

conversion price under the Convertible Notes shall be equal to the greater of US$0.02 or the average closing price of Borrower’s

Common Stock on the Over-the-Counter Bulletin Board for the prior 60 trading days (subject to equitable adjustments for stock

splits and similar events). A “trading day” shall mean any day on which the Common Stock is tradable for any period

on the stock exchange on which the Borrower’s Common Stock is traded or quoted.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

– See “Exhibit Index” set forth below.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

Dated:

November 21, 2017

|

|

GLOBAL

EQUITY INTERNATIONAL, INC.

|

|

|

|

|

|

|

By:

|

/s/

Enzo Taddei

|

|

|

|

Enzo

Taddei

|

|

|

|

Chief

Financial Officer

|

EXHIBIT

INDEX

List

of Exhibits attached or incorporated by reference pursuant to Item 601 of Regulation S-B

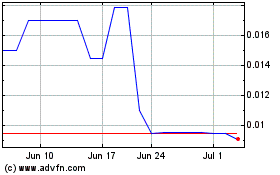

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

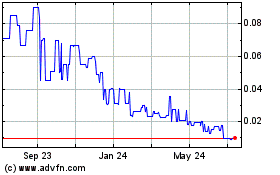

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Apr 2023 to Apr 2024