Current Report Filing (8-k)

October 11 2017 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2017

ARDELYX, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36485

|

|

26-1303944

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

34175 Ardenwood Blvd., Suite 200

Fremont, CA 94555

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code:

(510) 745-1700

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

|

Item 7.01

|

Regulation FD Disclosure.

|

Attached hereto as Exhibit 99.1 is a corporate presentation of Ardelyx, Inc.

(the “

Company

”) incorporated by reference herein.

The information furnished under this Item 7.01 shall not be considered

“filed” under the Securities Exchange Act of 1934, as amended, nor shall it be incorporated into any future filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless the Company

expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

On October 11, 2017, the Company announced positive results from

T3MPO-2,

its second Phase 3 study of tenapanor for irritable bowel syndrome with constipation (“

IBS-C

”). The study hit statistical significance for the

primary endpoint and all secondary endpoints evaluated for the topline results and demonstrated the ability to normalize bowel movements. The primary endpoint, the combined responder rate for six of 12 weeks, showed that a greater proportion of

tenapanor-treated patients compared to placebo-treated patients (36.5% vs. 23.7%, p<0.001) had at least a 30 percent reduction in abdominal pain and an increase of one or more complete spontaneous bowel movements (“

CSBM

”) in

the same week for at least six of the 12 weeks of the treatment period. In addition, tenapanor achieved statistical significance for the CSBM and abdominal pain responder rates in the six of 12 and nine of

12-treatment

weeks, with a consistent response across the 26 weeks of the study. Tenapanor was well-tolerated in treated patients.

T3MPO-2

is a

26-week,

double-blind, placebo-controlled, multi-center,

randomized trial. The trial was conducted in a total of 593 patients meeting the ROME III criteria for the diagnosis of

IBS-C.

Patients were randomized

one-to-one

to receive either 50 mg of tenapanor (n=293) or placebo (n=300) twice-daily. The trial included a

two-week

screening period, during which patients with

active disease, based on bowel movement frequency and abdominal pain score recorded in a daily phone diary, were randomized into the trial.

During the

two-week

screening period, the baseline scores were well-balanced between the tenapanor and placebo groups. The mean weekly CSBMs were 0.11 and the mean abdominal pain score was 6.26 (on a 0 - 10 scale where 0 was

no pain and 10 was very severe).

Key data are as follows:

Table 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 of 12 Treatment Week Results

|

|

Tenapanor

|

|

|

Placebo

|

|

|

P value

|

|

|

Combined responder (primary endpoint)

(abdominal pain and CSBM responder)

|

|

|

36.5

|

%

|

|

|

23.7

|

%

|

|

|

p<0.001

|

|

|

CSBM responder

(increase

³

1 CSBM from baseline)

|

|

|

47.4

|

%

|

|

|

33.3

|

%

|

|

|

p<0.001

|

|

|

Abdominal pain responder

(

³

30% abdominal pain reduction)

|

|

|

49.8

|

%

|

|

|

38.3

|

%

|

|

|

p=0.004

|

|

Table 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 of 12 Treatment Week Results

|

|

Tenapanor

|

|

|

Placebo

|

|

|

P value

|

|

|

Combined responder

(abdominal pain and CSBM responder)

|

|

|

18.4

|

%

|

|

|

5.3

|

%

|

|

|

p<0.001

|

|

|

CSBM responder

(increase

³

1 CSBM from baseline and

³

3 CSBM/week)

|

|

|

22.2

|

%

|

|

|

6.0

|

%

|

|

|

p<0.001

|

|

|

Abdominal pain responder

(

³

30% abdominal pain reduction)

|

|

|

35.8

|

%

|

|

|

26.7

|

%

|

|

|

p=0.015

|

|

Table 3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Durable Responder Results

(9 of 12 and

³

3 of last 4 treatment weeks)

|

|

Tenapanor

|

|

|

Placebo

|

|

|

P value

|

|

|

Combined responder

(abdominal pain and CSBM responder)

|

|

|

18.1

|

%

|

|

|

5.0

|

%

|

|

|

p<0.001

|

|

|

CSBM responder

(increase

³

1 CSBM from baseline and

³

3 CSBM/week)

|

|

|

21.2

|

%

|

|

|

5.7

|

%

|

|

|

p<0.001

|

|

|

Abdominal pain responder

(

³

30% abdominal pain reduction)

|

|

|

34.8

|

%

|

|

|

26.7

|

%

|

|

|

p=0.028

|

|

Tenapanor was well-tolerated, consistent with the experience across previous clinical trials. The only adverse events observed

in greater than two percent of patients in the tenapanor-treated group that were also greater than placebo were diarrhea (16.0% vs. 3.7%), flatulence (3.1% vs. 1.0%), nasopharyngitis (4.4% vs. 3.7%) and abdominal distension (3.4% vs. 0.3%). The

placebo adjusted discontinuation rate due to diarrhea was 5.8 percent.

Based on positive results from two, positive Phase 3 trials, the Company is

on track to submit a New Drug Application (“

NDA

”) to the U.S. Food and Drug Administration for tenapanor for the treatment of

IBS-C

in the second half of 2018. Final, detailed results from the

study are expected to be presented at a medical meeting in 2018.

Patients who have completed

T3MPO-1

and

T3MPO-2

are eligible to enter

T3MPO-3,

the Company’s open-label, long-term safety trial where patients can continue to receive tenapanor for up to one year.

T3MPO-3

is expected to conclude in late 2017 and the results of the trial will be included in the NDA submission for tenapanor for the treatment of patients with

IBS-C.

T3MPO-2

Primary and Secondary Endpoint Definitions

Primary Endpoint:

|

|

•

|

|

Combined responder rate (6/12 week): A six of

12-week

combined responder is a CSBM responder and an abdominal pain responder during the same week for six of 12 weeks.

|

Secondary Endpoints:

|

|

•

|

|

CSBM responder rate (6/12 week): A six of

12-week

CSBM responder is a patient that has an increase of at least one CSBM from baseline during a week for six of 12 weeks.

|

|

|

•

|

|

Abdominal pain responder rate (6/12 week): A six of

12-week

abdominal pain responder is a patient that has at least a 30 percent decrease in abdominal pain from baseline

during a week for six of 12 weeks.

|

|

|

•

|

|

Combined responder rate (9/12 week): A nine of

12-week

combined responder is a nine of 12 week CSBM responder and an abdominal pain responder during the same week for nine of 12

weeks.

|

|

|

•

|

|

CSBM responder rate (9/12 week): A nine of

12-week

CSBM responder is a patient that has an increase of at least one CSBM from baseline and at least three CSBMs during a week for

nine of 12 weeks. Normal bowel function is characterized by at least three bowel movements a week up to three bowel movements a day.

|

|

|

•

|

|

Abdominal pain responder rate (9/12 week): A nine of

12-week

abdominal pain responder is a patient that has at least a 30 percent decrease in abdominal pain from baseline

during a week for nine of 12 weeks.

|

|

|

•

|

|

Durable responder rates (9/12 week): All three durable responder endpoints – combined responder rate, CSBM responder rate and abdominal pain responder rate – are identical to the nine of

12-week

responder endpoints, except the response must also occur in three of the last four treatment period weeks.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: October 11, 2017

|

|

|

|

ARDELYX, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Mark Kaufmann

|

|

|

|

|

|

|

|

Mark Kaufmann

|

|

|

|

|

|

|

|

Chief Financial Officer

|

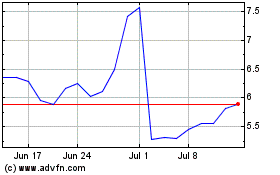

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

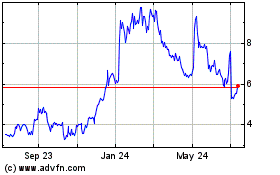

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Apr 2023 to Apr 2024