Current Report Filing (8-k)

August 15 2017 - 3:47PM

Edgar (US Regulatory)

___________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 12, 2017

POCKET GAMES, INC.

(Exact Name of Registrant as Specified in Charter)

|

Florida

|

333-192939

|

46-3813936

|

|

(State of Other Jurisdiction

|

(Commission File

|

(IRS Employer

|

|

of Incorporation)

|

Number)

|

Identification No.)

|

|

|

|

|

|

909 Plainview Ave

Far Rockaway, New York

|

11691

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (347) 318-8859

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act

Item 1.01 Entry into a Material Definitive Agreement

On July 12, 2017, the Board of Directors of

Pocket Games, Inc. (the “Company”) cancelled and terminated that certain Share Exchange Agreement (“Series B

Exchange Agreement”) dated February 9, 2016, between the Company on the one hand and Social Technology Holdings, Inc., a

Delaware corporation (“STH”), AEL Irrevocable Trust (“AIT”), and Sugar House Trust (“SHT”)

(collectively, the “STH Majority Shareholders”) on the other hand. The cancellation and termination was due to a breach

by the STH Majority Shareholders in respect to their failure to provide the necessary financials to complete the Company’s

audit in accordance with the Securities Exchange Act of 1934, causing serious harm to the Company and to its shareholders, and

failing to disclose material adverse information about STH. The cancellation of the Share Exchange Agreement also involved the

cancellation of 2,000 shares of Series “A” Preferred Stock and 400,000 shares of Series “B” Preferred Stock

of the Company.

Also on July 12, 2017, the Board of Directors

of the Company cancelled and terminated that certain Share Exchange Agreement (“Series C Exchange Agreement”) dated

April 26, 2016, between the Company on the one hand and Kicksend Holdings, Inc., a Delaware corporation (“Kicksend”)

and Marlborough Brothers Family Trust (the “Trust”) (collectively, the “Kicksend Majority Shareholders”)

on the other hand. The cancellation and termination was due to a breach by the Kicksend Majority Shareholders in respect to their

failure to provide the necessary financials to complete the Company’s audit in accordance with the Securities Exchange Act

of 1934, causing serious harm to the Company and to its shareholders, and failing to disclose material adverse information about

Kicksend. The cancellation of the Share Exchange Agreement also involved the cancellation of 263,250 shares of Series “C”

Preferred Stock of the Company.

Item 2.01 Completion of Acquisition or Disposition of Assets

On July 12, 2017, the Company terminated the

Series C Exchange Agreement as described in Item 1.01 above.

Item 3.02 Unregistered Sales of

Equity Securities

On July 13, 2017, the Company designated and

issued to the Company’s Chief Executive Officer and controlling shareholder David Lovatt 1,000 shares of Series AA Preferred

Stock (the “AA Shares”). In respect to the issuance of the AA Shares, no solicitation was made and no underwriting

discounts were given or paid in connection with this transaction. The Company believes that the issuance of shares pursuant to

the Agreement was exempt from registration with the Securities and Exchange Commission pursuant to Section 4(2) of the Securities

Act of 1933.

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As described in Item 3.02 above, On July 13,

2017, the Company designated and issued the AA Shares to the Company’s Chief Executive Officer and controlling shareholder

David Lovatt.

Item 5.03 Amendments to Articles of Incorporation or Bylaws;

Change in Fiscal Year

On July 13, 2017, the Board and holders of a

majority of the voting shares of the Company amended and restated the Company’s Articles of Incorporation (the “Amendment”)

to effect the following:

Designation of Series AA Preferred

Stock

. We are designating 1,000 shares of our authorized 2,500,000 preferred shares as Series AA Preferred Stock having the

following rights and designations:

|

|

i)

|

Liquidation, Sale of Control or Winding Up.

The Series AA Preferred Stock shall not have

liquidation rights;

|

|

|

ii)

|

Voting.

Each share of Series AA Preferred Stock shall have 4 times the aggregate votes

of all other classes of capital stock of the Company divided by the number of shares of Series AA Preferred Stock issued and outstanding

at the time of voting;

|

|

|

iii)

|

Dividends.

The Series AA Preferred Stock shall not accrue or pay any dividend;

|

|

|

iv)

|

Conversion.

The Series AA Preferred Stock is not convertible into common stock.

|

Removal of Designation for Series

A Preferred Stock

. We are removing the designation for 2,000 shares of Series A Preferred Stock.

Removal of Designation for Series

B Preferred Stock

. We are removing the designation for 480,000 shares of Series B Preferred Stock.

Removal of Designation for Series

C Preferred Stock

. We are removing the designation for 300,000 shares of Series C Preferred Stock.

The Amendment is attached hereto as

an Exhibit to this Current Report.

Item 5.07 Submission of Matters to a Vote of Security Holders

On July 13, 2017, holders of a majority of the

voting rights of the Company’s capital stock approved the Amendment of the Company’s Articles of Incorporation as described

in Item 5.03 above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

3(i)

Amended and Restated Articles of Incorporation of Pocket Games, Inc.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Pocket Games, Inc.

|

|

|

|

|

|

|

|

|

|

Date: August 15, 2017

|

|

By: /s/ David Lovatt

|

|

|

|

David Lovatt

|

|

|

|

Chief Executive Officer

|

GenTech (CE) (USOTC:GTEH)

Historical Stock Chart

From Mar 2024 to Apr 2024

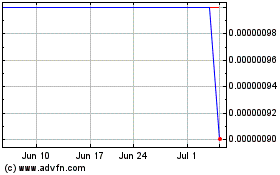

GenTech (CE) (USOTC:GTEH)

Historical Stock Chart

From Apr 2023 to Apr 2024