Current Report Filing (8-k)

June 19 2017 - 3:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

June 14, 2017

![[EMSF8K_061917APG001.JPG]](http://content.edgar-online.com/edgar_conv_img/2017/06/19/0001469709-17-000135_EMSF8K_061917APG001.JPG)

EMS FIND, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

| |

|

Nevada

|

|

333-174759

|

|

30-0934969

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission file number)

|

|

(I.R.S. Employer Identification No.)

|

|

73 Buck Road, Suite 2, Huntingdon Valley, PA

|

|

19006

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

267-320-2255

|

|

(Registrant’s telephone number, including area code)

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

( ) Written communications pursuant to Rule 425 under the Securities Act (17CRF 230.425)

( ) Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

( ) Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CRF 240.14d-2(b))

( ) Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Change of Company’s Name to Integrated Ventures, Inc.

On June 12, 2017, our Board approved changing the Company’s name to Integrated Ventures, and authorized the filing by the Company in Nevada on June 14, 2017, of Articles of Merger, providing for the merger of the Company’s wholly-owned subsidiary, Interactive Ventures, Inc., into the Company, and in the merger changing the Company’s name to Interactive Ventures, Inc. The merger of the Company’s subsidiary into the Company and the Company’s assumption of a new name in the merger requires only approval of the parent company’s Board of Directors under Nevada Private Corporations Law; stockholder approval of the parent company’s stockholders is not required. The change of our name from EMS Find, Inc. to Interactive Ventures, Inc. will be effective for trading purposes when we receive approval from the Financial Industry Regulatory Authority. We plan to file shortly for such approval.

Item 8.01 Other Events.

The following table, which is unaudited and has not been reviewed by the Company’s registered independent accounting firm, shows the reduction in the principal amount of debt of the Company, as of June 15, 2017, as compared with the principal amount of such debt outstanding a March 31, 2017, as reported in the Company’s quarterly report on Form 10-Q, for the period ended March 31, 2017.

During the period from March 31, 2017 through June 15, 2017, the Company’s liquidity has improved through a $113,443 net reduction in the total principal balance of convertible notes payable. The convertible notes payable were reduced by $123,443 through the conversion of debt principal into shares of the Company’s common stock and favorable debt extinguishment agreements. The net decrease in debt principal was partially offset by the issuance of a new convertible note payable for cash of $20,000 for corporate filings and working capital.

One of the convertible notes payable with a principal balance of $18,150 and 605,000 warrants to purchase common stock of the Company were exchanged by a Note Holder for approximately $53,000 of a convertible note receivable from the April 6, 2016 sale by the Company of Viva Entertainment Group, Inc. (“OTTV”), a former wholly-owned subsidiary of the Company.

The remaining approximately $53,000 convertible note receivable from the sale of OTTV will be converted by the Company into shares of OTTV common stock, which shares will be sold to provide operating capital. Initial conversions and sales of the OTTV shares have provided the Company with approximately $53,000 in cash. The Company plans to convert the remaining balance of the convertible note and sell the shares of the OTTV stock. The Company estimates to execute two additional conversions with estimated cash proceeds to the Company totaling $70,000.

(remainder of page left intentionally blank)

2

|

|

|

|

|

| |

|

Complete Schedule of Debt Principal

|

|

|

|

|

|

As of June 15, 2017

|

|

|

|

|

|

|

|

|

|

Balance

|

Balance

|

Increase

|

|

|

Date

|

Status

|

6/15/2017

|

3/31/2017

|

(Decrease)

|

|

LG Capital Funding, LLC

|

10/22/2015

|

In Settlement

|

$

135,000.00

|

$

125,000.00

|

$

10,000.00

|

|

Old Main Capital, LLC

|

7/21/2016

|

Retired

|

$

0.00

|

$

33,333.00

|

-$33,333.00

|

|

River North Equity, LLC

|

7/25/2016

|

Aged (Converting)

|

$

4,660.00

|

$

31,297.00

|

-$26,637.00

|

|

EMA Financial, LLC

|

8/23/2016

|

Retired

|

$

0.00

|

$

16,341.00

|

-$16,341.00

|

|

Global Opportunity Group, LLC

|

12/2/2016

|

Aged

|

$

18,700.00

|

$

18,700.00

|

$

0.00

|

|

GPL Ventures, LLC

|

12/15/2016

|

Extinguished

|

$

0.00

|

$

39,193.00

|

-$39,193.00

|

|

EMA Financial, LLC

|

10/6/2016

|

Aged (Converting)

|

$

16,397.00

|

$

33,000.00

|

-$16,603.00

|

|

GPL Ventures, LLC

|

12/13/2016

|

Due 07/13/2017

|

$

10,000.00

|

$

10,000.00

|

$

0.00

|

|

Global Opportunity Group, LLC

|

2/13/2017

|

Aged

|

$

10,000.00

|

$

10,000.00

|

$

0.00

|

|

Global Opportunity Group, LLC

|

2/21/2017

|

Retired

|

$

0.00

|

$

15,840.00

|

-$15,840.00

|

|

Howard Schraub

|

3/16/2017

|

Retired

|

$

0.00

|

$

8,638.00

|

-$8,638.00

|

|

Howard Schraub

|

3/28/2017

|

Due 09/28/2017

|

$

16,500.00

|

$

16,500.00

|

$

0.00

|

|

Global Opportunity Group, LLC

|

3/28/2017

|

Extinguished Via Exchange

|

$

0.00

|

$

18,150.00

|

-$18,150.00

|

|

Howard Schraub

|

4/4/2017

|

Due 10/04/2017

|

$

20,000.00

|

$

0.00

|

$

20,000.00

|

|

Global Opportunity Group, LLC

|

5/16/2017

|

Aged (Converting)

|

$

19,577.00

|

$

0.00

|

$

19,577.00

|

|

Howard Schraub

|

6/6/2017

|

Aged (Converting)

|

$

11,715.00

|

$

0.00

|

$

11,715.00

|

|

|

|

|

$

262,549.00

|

$

375,992.00

|

$

(113,443.00)

|

Potential investors are cautioned that, since the above changes in outstanding debt and the respective amounts of such debt shown in the table are unaudited, and include in the covered period a partial month, there can be no assurance that the assumptions in preparation of amounts shown in the table will prove to be accurate. In light of the significant uncertainties inherent in the assumptions underlying preparation of the above table, and the lack of review by the Company’s independent audit firm, the amounts shown in the table shall not be regarded as a representation by the Company or any other person that the financial results shown will prove to be accurate. The debt principal amount changes for the period shown in the above table are not necessarily indicative of the results for the fourth quarter of the Company’s June 30, 2017 fiscal year, the Company’s entire June 30, 2017 fiscal year or for any other period.

Item 9.01. Financial Statements and Exhibits.

|

| |

|

Exhibit Number

|

Description of Exhibit

|

|

3.1(f)

|

Articles of Merger for the merger of the Company’s wholly-owned subsidiary, Interactive Ventures, Inc., into the Company, filed with the Secretary of State of Nevada on June 14, 2017.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Dated: June 19, 2017

|

|

|

|

EMS Find, I

NC

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Steve Rubakh

|

|

|

|

|

|

|

|

Steve Rubakh

|

|

|

|

|

|

|

|

Chief Executive Officer

|

4

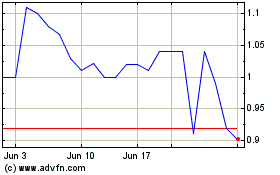

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

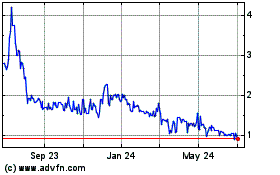

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024