Copper Bounces Back After Trade Pummeling

July 12 2018 - 8:15AM

Dow Jones News

By David Hodari

Copper prices rallied Thursday, after receiving a pummeling on

Wednesday as the latest tariff threats from China and the U.S.

amplified worries about the impact of a trade dispute on the global

economy.

The base metal was up 0.9% at $6,192 a metric ton in late

morning trade in London, after shedding as much as 4% on Wednesday

to hit its lowest point in almost a year. Copper futures have

plunged 17% from a four-year high in June, bringing it close to a

bear market.

Gold also climbed, ticking up 0.2% to $1,244.26 a troy ounce,

recouping some of the losses from Wednesday as the effects of a

stronger dollar outweighed that of the global risk-off

sentiment.

Global equities markets--including those in China--and most

commodities staged a resurgence Thursday after coming under heavy

pressure the previous day after the White House said Tuesday that

it will assess slapping fresh 10% tariffs on $200 billion in

Chinese goods. China threatened to match U.S. tariffs with its own

countermeasures.

Those geopolitical and macroeconomic considerations appeared to

be outweighing copper-specific factors, with traders apparently

disregarding stories that would normally weigh on prices.

Freeport-McMoRan Inc. (FCX) and the Indonesian government struck

an "initial agreement" on Thursday for the joint-owned copper mine

at Grasberg to move toward state ownership. State-owned PT

Indonesia Asahan Aluminium (Inalum) will receive a 51% stake,

raising the state's holding from around 9%. Grasberg has the

world's largest gold deposits and the second-largest copper

mine.

Freeport's share of the payment will be $350 million, while Rio

Tinto PLC (RIO) will take $3.5 billion for its stake.

The deal sees one of the copper market's largest source of

uncertainty in recent years move one step closer to its conclusion

with the agreement bringing an "increase the security of copper

concentrate supply on the world market," analysts at Comemrzbank

said in a note.

Similarly, BHP Billiton PLC (BLT.LN) handed a proposal for a new

labor contract to the union at its mine at Chilean Escondida--the

world's largest--that includes inflation-linked salaries and a

$23,000 bonus for each worker, according to Reuters.

The 44-day strike that supported copper prices last year has

weighed on investors' minds in recent months, with some market

participants using the negotiations as a key plank in early 2018

forecasts for higher copper prices. Talks have proved smoother than

expected, though.

While the offer falls short of recent union demands,

geopolitical pressure on copper prices makes BHP's offer more

palatable to miners, according to John Meyer, an analyst at SP

Angel.

Investors were monitoring those negotiations and any further

trade news out of Washington and Beijing.

Among base metals, zinc rose 0.43% to $2,575, tin traded 0.7%

higher at $19,490, and nickel was up 2.76% to $14,330, with all

prices for a metric ton. Aluminum fell 0.02% to $2,060 a metric

ton, while lead declined 2.56% to $2,147.50.

Among precious metals, silver rose 0.57% to $15.88, platinum was

0.53% higher at $832.86 and palladium climbed 0.15% to $942.88, all

per troy ounce.

Write to David Hodari at david.hodari@wsj.com

(END) Dow Jones Newswires

July 12, 2018 08:00 ET (12:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

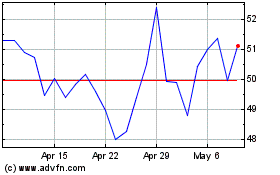

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

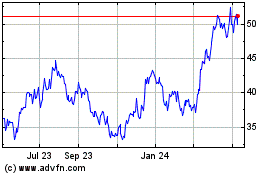

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024