Comcast Raises Sky Offer After Fox Sweetened Its Bid -- 3rd Update

July 11 2018 - 7:00PM

Dow Jones News

By Keach Hagey in Sun Valley, Idaho, and Chip Cummins and Ben Dummett in London

The battle for control of European pay-TV giant Sky PLC heated

up Wednesday, with 21st Century Fox raising its bid and cable giant

Comcast Corp. quickly countering later in the day, the latest

jockeying in a cross-Atlantic media deal showdown.

Comcast raised its offer for Sky to GBP14.75 per share, valuing

the company at $34 billion. That is a 5% premium to an offer Fox

announced earlier Wednesday and 18% above Comcast's earlier bid.

Comcast said its latest offer was recommended by Sky's independent

directors.

The fight for Sky could impact the broader fight between Comcast

and Walt Disney Co. to acquire most of Fox's entertainment assets.

Depending on how the auction for Sky plays out, Comcast could

decide to focus its efforts on the European operator and drop its

pursuit of Fox's assets, a person familiar with the matter

said.

Fox already owns 39% of Sky and is vying to consolidate

ownership. Earlier Wednesday, Fox lifted its bid to purchase the

rest of the company by more than 30% to GBP14-a-share, valuing Sky

at $32.5 billion.

Fox separately has put up for sale entertainment properties

including its Hollywood movie and TV studio, regional sports

networks and a stake in streaming service Hulu. That deal also

would include its Sky holding and other international assets.

Disney is currently in the lead for the Fox assets after

reaching an agreement to pay $71 billion in cash and stock, topping

a $65 billion all-cash offer from Comcast.

The role of the U.K. Takeover Panel, a regulatory body that

polices corporate deal-making, is creating an unusual dynamic in

the bidding war. As Disney and Comcast bid higher for the package

of Fox assets, the implied value of Sky also rises, forcing both

sides to raise their bids for Sky.

"You are basically bidding against yourself," said the person

familiar with the matter.

The panel could force Fox to raise its bid further, based on a

calculation of Sky shares derived from the Disney offer. The panel

has said it would make a ruling on the matter, but didn't say

when.

If Comcast winds up only acquiring Sky, the company believes it

would make strategic sense. "It's basically a mini-Comcast-NBCU,"

the person familiar with the matter said, referring to Comcast's

purchase of NBCUniversal, which created a mix of distribution and

content assets like those that Sky owns.

Before Comcast's latest move, Fox had said Sky's independent

directors agreed to its new offer. Fox launched its bid for all of

Sky more than 18 months ago. Since then, the deal has been

embroiled in a U.K. government review, which was expected to draw

to a close later this week.

Sky is one of the crown jewels of Rupert Murdoch's media empire.

It could help both Disney and Comcast compete with tech giants like

Netflix Inc. Sky produces its own content, while its satellite and

broadband offerings reach millions of European households. Both

Disney and Comcast view Sky as a route to expand their media and

distribution channels overseas.

Under the terms of Fox's latest bid, the company would have the

option to lower the threshold of shareholder support required to

approve the deal to just over half. At the moment, it requires

support from 75% of Sky's non-Fox shareholders.

The deal, though, continues to keep the door open for a more

streamlined approach -- should the two sides decide to change the

structure under U.K. law. Such a change would allow a simple

majority of all shareholders to wave the deal through.

A number of hedge funds, including American activist investor

Elliott Management Corp., have bought into Sky, and would likely

oppose any bid they felt undervalued Sky.

The government had been weighing for months whether Fox's

consolidation of Sky -- which operates a popular news channel in

the U.K. -- would constitute an overconcentration of ownership

among British news media. Mr. Murdoch and his family are major

shareholders in 21st Century Fox as well as News Corp, which owns

several large U.K. newspapers. News Corp also owns The Wall Street

Journal.

The U.K. culture minister has indicated a separate deal by Fox

to sell Sky News to Disney would be sufficient in preventing any

overconcentration of ownership.

Fox said it had obtained previous consent from Disney for the

higher offer. Fox will take on larger debt to fund the deal. That

liability will ultimately fall to Disney, assuming it completes its

deal for Fox.

Mr. Murdoch also hedged his bets to some extent. Fox said that

in the event the Disney and Fox deal falls apart because of

regulatory issues, Disney will pay Fox GBP1 for every share of Sky

that Fox buys as part of Wednesday's higher offer. That caps Fox's

real exposure to GBP13 a share, should it not end up being acquired

by Disney.

Write to Keach Hagey at keach.hagey@wsj.com, Chip Cummins at

chip.cummins@wsj.com and Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

July 11, 2018 18:45 ET (22:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

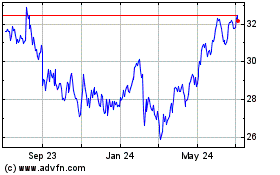

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

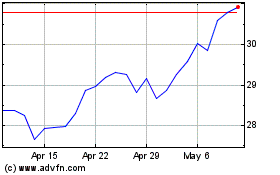

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024