By Stu Woo and Shalini Ramachandran

LONDON -- Comcast Corp. topped 21st Century Fox Inc. in a

weekend auction for Sky PLC, winning the British broadcaster with a

$38.8 billion bid that ends a monthslong takeover battle and

promises Comcast a greatly expanded international footprint.

Comcast's offer of GBP17.28 a share, or about $22.59 a share,

surpassed Fox's highest bid of GBP15.67 after three rounds of

bidding Saturday, in a rare auction held by British regulators. The

GBP29.7 billion valuation was by far the highest ever for such a

process in the U.K., which has conducted a handful of smaller-scale

auctions to settle intractable bidding wars. The winning bid

represents a premium of more than double Sky's value before Rupert

Murdoch's Fox put Sky in play some 21 months ago.

Because of the auction's setup, a sealed-bid auction in which

neither side knew what the other was bidding, Comcast paid GBP1.61

a share, or about 10%, more than needed to beat Fox.

Comcast won at a steep price. Its winning bid was up sharply

from its GBP12.50 bid in February and Fox's initial GBP10.75 bid in

December 2016.

The bidding on Saturday went down to the last of three rounds in

the unusual, government-mandated auction. In the first round, Fox

had the opportunity to raise its existing bid. Then, Comcast had

the opportunity to top that, triggering a third and final round.

That round was a "blind" round, in which neither side would be

aware of what the other was bidding.

In the end, Comcast's premium over Fox's bid translates to about

$3.6 billion for all of Sky shares. Still, auction veterans say it

is unfair to judge a bidder after the fact in a sealed-bid

auction.

Comcast used a consultant on game theory, but Comcast Chief

Executive Brian Roberts tightly oversaw the bidding, alongside a

select group of executives and advisers, according to a person

familiar with the matter. Comcast felt it needed to win by a

substantial margin to avoid difficulty winning over any significant

shareholders and ensure it can close the deal smoothly, the person

said.

The U.K. Takeover Panel had the power to mandate -- and run --

the auction after both sides appeared ready to continue to outbid

each other outside of a formal auction process. The agency polices

deals involving U.K. companies.

The jostling over Sky -- which sells phone, TV and internet

services to 23 million European customers and produces its own

news, entertainment and sports programming -- was part of a broader

scramble by media companies to fortify themselves against a rising

threat from Silicon Valley giants such as Netflix Inc.

Comcast executives say a combination with Sky -- which like

itself is a giant in both content and distribution -- will boost

its user base to 53 million and add more heft to invest in

technology, programming and valuable sports-media rights. The

merger will also help Comcast diversify its revenue base beyond the

U.S., where cable cord-cutting is taking a toll on the traditional

TV business.

"We think [Sky is] more like Comcast NBCUniversal than any

company we've seen," Mr. Roberts said in February when announcing

the deal.

Still, Sky was something of a consolation prize for the cable

giant. This summer, it lost a bidding war to Walt Disney Co. for

Fox's entertainment assets. Disney agreed to pay $71 billion for

Fox's famed Hollywood studio and international assets, including a

39% stake in Sky that Fox had long held. That bigger deal is

expected to close in coming months.

If Fox had won this weekend's auction for Sky, Disney would

ultimately have taken 100% control of the pay TV company. Instead,

attention will now turn to whether Disney will sell the 39% stake

in Sky -- its value has increased by the bidding competition -- or

remain a minority partner for Comcast.

Analysts have raised the idea that Comcast could trade its 30%

stake in Hulu to Disney -- giving Disney overwhelming control of

the streaming-video service -- in return for the rest of Sky.

Comcast has said it values its position in Hulu and just named some

NBCUniversal executives to Hulu's board.

Mr. Roberts of Comcast has said he would be prepared to jointly

own Sky with a rival. Mr. Murdoch and his family are major

shareholders in Fox and Wall Street Journal parent News Corp.

Despite Comcast's win, the takeover isn't a certainty unless it

can win support from more than 50% of Sky's shareholders to support

the offer. That seems likely given the wide gap between the bids.

But it could still prove challenging if Fox decides against

tendering to the offer and that raises concerns for other investors

that Comcast won't be able to complete the deal.

Fox kicked off the chase for Sky in December 2016, offering

GBP10.75 a share. The deal faced regulatory and political delays,

and Comcast this February made a surprise GBP12.50-a-share offer.

Fox raised its bid to GBP14 a share in July, only for Comcast to

counter with GBP14.75 a share later that day. The U.K. Takeover

Panel held the weekend auction after neither side backed down.

Comcast executives have said acquiring Sky will further the

company's ability to counter Netflix, potentially with an

international streaming service. Sky already operates a streaming

service called NOW TV in several European countries and has been

investing in premium original shows in response to Netflix's

spending.

The merger could also yield benefits in news and entertainment

programming. Sky News and NBC News could share resources, and

larger scale could help the company bargain for the best content

deals.

That is especially true in sports, where deep-pocketed tech

companies such as Amazon.com Inc. and Alphabet Inc.'s Google are

throwing their hats in the ring. NBC has rights to the Olympics,

NFL games, Nascar and the Premier League, while Sky carries matches

from marquee European soccer leagues.

Investors haven't been as positive about the Sky pursuit.

"Investors in both Comcast and Disney are hoping against hope that

their company loses, " said veteran cable analyst Craig Moffett, of

MoffettNathanson research, before the weekend auction, noting that

the valuation for Sky had already gone "above any reasonable

estimate of fair value."

Comcast investors worry that the company is buying a satellite

broadcaster at a time when U.S. satellite companies like DirecTV

and Dish Network Corp. have hemorrhaged customers under competitive

pressure. Investors have also worried that Comcast's pursuit of Sky

and its failed bid for the Fox entertainment assets showed that

management wasn't confident in Comcast's core business.

Comcast shares slid considerably after it announced its initial

Sky bid in February, but rallied more recently and are 4.5% below

their February price. The company is using debt to finance its

all-cash offer.

Mr. Roberts has sought to allay Wall Street's concerns, noting

that Sky isn't simply a satellite TV business -- it also has a

broadband offering, a content studio and has invested significantly

in video technology. In June, Sky posted strong results, including

customer additions up 39% in the quarter. He has also said that

Comcast is confident in the strength of its core U.S. cable

business.

"Right now, I feel we're in a strategically great place and any

deals we're doing we're trying to play offense in a belief that we

over the long term can create exceptional shareholder value," Mr.

Roberts said at a recent Goldman Sachs investor conference.

--Ben Dummett contributed to this article.

Write to Stu Woo at Stu.Woo@wsj.com and Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

September 22, 2018 16:50 ET (20:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

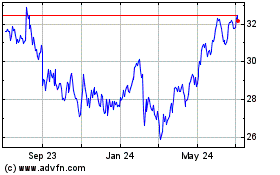

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

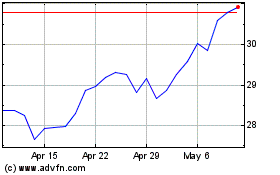

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024