City Holding Company (“City”) (Nasdaq: CHCO), the parent company

of City National Bank of West Virginia, announced today the

concurrent signing of two separate definitive merger agreements.

Under one agreement, City will acquire Poage Bankshares, Inc.,

(“Poage”) (Nasdaq: PBSK), the parent company of Town Square Bank,

Ashland, Kentucky; under the other agreement, City will acquire

Farmers Deposit Bancorp, Inc. (“Farmers Deposit”), the parent

company of Farmers Deposit Bank, Cynthiana, Kentucky. Upon

completion of the Poage merger, the subsidiary bank of Poage and

will merge into City National Bank of West Virginia. Upon

completion of the Farmers Deposit merger, the subsidiary bank of

Farmers Deposit and will merge into City National Bank of West

Virginia.

Based upon financial data as of March 31, 2018, the combined

company will have $4.8 billion in assets, deposits of $3.9 billion,

and gross loans of $3.5 billion, bolstering City’s presence in the

Huntington-Ashland and Lexington, Kentucky MSAs. “Our leadership

recognized these partnerships as strategic next steps for enhancing

our market presence throughout Kentucky and we are fortunate to be

making this move forward,” remarked Charles R. (Skip) Hageboeck,

President & Chief Executive Officer of City. Both the Poage and

Farmers Deposit merger are expected to close in the fourth quarter

of 2018, pending customary closing conditions, including receipt of

required regulatory approvals and the approval by the shareholders

of Poage and Farmers Deposit.

Subject to the terms of the Poage merger agreement, Poage

shareholders will receive 0.335 shares of City common stock for

each outstanding share of Poage common stock. Based on City’s 5-day

average closing price of $78.43 as of July 10, 2018, this equates

to a per share value of $26.27 and an aggregate deal value of $93.5

million. Upon completion of the merger, Bruce VanHorn, President,

Chief Executive Officer & Director of Poage, will enter into an

employment agreement with City. Mr. VanHorn stated, “Joining City

is a defining moment for our company, shareholders and customers.

Our shared experience in operating in overlapping markets makes me

confident that this will be a seamless transition for our employees

and customer base while providing long-term value for our

shareholders. City is a great franchise, and I look forward to the

years ahead for our combined company.”

Subject to the terms of the Farmers Deposit merger agreement,

Farmers Deposit shareholders will receive $24.9 million in cash for

all outstanding shares of Farmers Deposit common stock. “This

merger with City is an excellent opportunity for our organization

to become part of a successful and established institution,” said

W. Brent Hoptry, Chairman, President, & Chief Executive Officer

of Farmers Deposit. “With our combined markets and leadership, we

will continue to provide high-quality banking solutions for our

communities and remain well positioned for the future.”

Each of the Poage and Farmers Deposit merger agreements have

been unanimously approved by the City board of directors. The Poage

board of directors has unanimously approved the Poage merger

agreement, and the Farmers Deposit board of directors has

unanimously approved the Farmers Deposit agreement. Neither the

Poage transaction nor the Farmers Deposit transaction is

conditional upon the other.

Keefe, Bruyette & Woods, Inc. served as financial advisor

and Dinsmore & Shohl LLP served as legal counsel to City in

both transactions. Sandler O’Neill & Partners served as

financial advisor and Luse Gorman, PC served as legal counsel to

Poage in the Poage transaction. ProBank Austin served as financial

advisor and Stites & Harbison, PLLC served as legal counsel to

Farmers Deposit in the Farmers Deposit transaction.

About City Holding Company

City Holding Company, headquartered in Charleston, West

Virginia is a financial holding company which owns City

National Bank of West Virginia. City provides a full range of

consumer and commercial banking services to individuals, businesses

and industries through its 86 branches across West Virginia,

Virginia, Kentucky and Ohio. As of March 31, 2018, City had

$4.2 billion in total assets, $3.4 billion in deposits, and $3.1

billion in gross loans. For additional information, locations, and

hours of operation, please visit www.bankatcity.com.

About Poage Bankshares, Inc.

Poage Bankshares, Inc., headquartered in Ashland, Kentucky,

is the parent company of Town Square Bank, which was founded

as a savings and loan association in 1889. Poage operates nine

branches and one loan production office across northeastern

Kentucky. As of March 31, 2018, Poage had $450 million in

total assets, $375 million in deposits, and $333 million in gross

loans. For additional formation on Poage Bankshares, Inc. and Town

Square Bank, please visit www.townsquarebank.com.

About Farmers Deposit Bancorp, Inc.

Farmers Deposit Bancorp, Inc., headquartered in Cynthiana,

Kentucky, is the parent company of Farmers Deposit Bank, which

was founded as a full service bank in 1866. Farmers Deposit

operates 3 branches around the Lexington, Kentucky market. As

of March 31, 2018, Farmers Deposit had $122 million in total

assets, $98 million in deposits, and $60 million in gross loans.

For additional formation on Farmers Deposit Bankshares, Inc. and

Farmers Deposit Bank, please visit

www.farmersdepositbankky.com.

Important Information for Investors and Poage

Shareholders:

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities of City or a

solicitation of any vote or approval. City will file a registration

statement on Form S-4 and other documents regarding the proposed

transaction referenced in this press release related to the Poage

transaction with the Securities and Exchange Commission (“SEC”) to

register the shares of City’s common stock to be issued to the

shareholders of Poage. The registration statement will include a

proxy statement/prospectus, which will be sent to the shareholders

of Poage in advance of its special meeting of shareholders to be

held to consider the proposed Poage merger. Before making any

voting or investment decision investors and security holders are

urged to read the proxy statement/prospectus and any other relevant

documents to be filed with the SEC in connection with the proposed

Poage transaction because they contain important information about

City, Poage and the proposed transaction. Shareholders are also

urged to carefully review and consider each of City’s and Poage’s

public filings with the SEC, including, but not limited to, their

Annual Reports or Form 10-K, their Quarterly Reports or Form 10-Q,

their Current Reports or Form 8-K and their proxy statements.

Investors and security holders may obtain a free copy of these

documents (when available) through the website maintained by the

SEC at www.sec.gov. These documents may also be obtained, without

charge, from City at www.bankatcity.com under the tab “Investors”

or by directing a request to City Holding Company, 25 Gatewater

Road P.O. Box 7520, Charleston, West Virginia 25356, Attn.:

Investor Relations, or from Poage at www.townsquarebank.com under

the tab “Investor Relations” or by directing a request to Poage

Bankshares, Inc., 1500 Carter Avenue, Ashland, Kentucky 41101,

Attn.: Investor Relations.

Poage and certain of its directors and executive officers may be

deemed to be participants in the solicitation of proxies from the

shareholders of Poage in connection with the proposed Poage merger.

Information about the directors and executive officers of Poage is

set forth in the definitive proxy statement for Poage’s 2018 annual

meeting of shareholders, as filed with the SEC on a Schedule 14A on

April 13, 2018. Additional information regarding the interests of

those participants and other persons who may be deemed participants

in the transaction may be obtained by reading the proxy

statement/prospectus regarding the proposed Poage merger when it

becomes available. Free copies of this document may be obtained as

described in the preceding paragraph.

Safe Harbor Statement:

Statements made in this news release that are not historical

facts are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, Section 21E

of the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. These statements are

subject to certain risks and uncertainties including, but not

limited to, the successful completion and integration of the

transaction contemplated in this release, which includes the

retention of the acquired customer relationships, adverse changes

in economic conditions, the impact of competitive products and

pricing and the other risks set forth in City’s filings with the

SEC. As a result, actual results may differ materially from the

forward-looking statements in this news release.

These factors are not necessarily all of the factors that could

cause City’s, Poage’s or the combined company’s actual results,

performance, or achievements to differ materially from those

expressed in or implied by any of the forward-looking statements.

Other unknown or unpredictable factors also could harm City’s,

Poage’s or the combined company’s results.

All forward-looking statements attributable to City’s, Poage’s

or the combined company’s, or persons acting on City’s or Poage’s

behalf are expressly qualified in their entirety by the cautionary

statements set forth above. Forward-looking statements speak only

as of the date they are made and City and Poage do not undertake or

assume any obligation to update publicly any of these statements to

reflect actual results, new information or future events, changes

in assumptions, or changes in other factors affecting

forward-looking statements, except to the extent required by

applicable laws. If City or Poage update one or more

forward-looking statements, no inference should be drawn that City

or Poage will make additional updates with respect to those or

other forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180711005872/en/

City Holding CompanyCharles R. Hageboeck, 304-769-1102Chief

Executive Officer and President

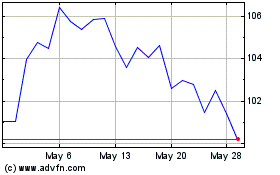

City (NASDAQ:CHCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

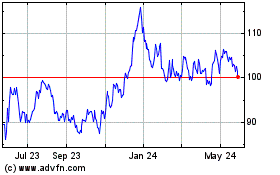

City (NASDAQ:CHCO)

Historical Stock Chart

From Apr 2023 to Apr 2024