Citigroup Reports Higher Earnings -- 2nd Update

April 15 2021 - 9:42AM

Dow Jones News

By Orla McCaffrey

Citigroup Inc. on Thursday reported sharply higher first-quarter

profit and said it is shutting down most of its consumer-banking

operations in Asia, Europe and the Middle East.

The bank posted a profit of $7.9 billion, or $3.62 per share,

well above the $2.60 per share forecast by analysts polled by

FactSet. A year earlier, Citigroup had reported a quarterly profit

of about $2.5 billion, or $1.05 a share.

Citigroup also said it would exit its consumer operations in 13

countries, mostly across Asia, to focus on wealth management and

other businesses.

Jane Fraser, who took over as chief executive officer last

month, said in a statement that those consumer banks were excellent

businesses, but "we don't have the scale we need to compete." She

said Citigroup would continue to invest in wealth management and in

the businesses that work with corporate clients in Asia.

Citigroup is a giant on Wall Street but it is relatively small

in U.S. consumer banking, a combination that some analysts and

investors have criticized. Ms. Fraser said in January that the bank

would restructure the businesses that manage money for wealthy

customers, with the goal of getting to clients earlier and keeping

them as they grow richer. The bank said Thursday that it will

operate consumer banking in four "wealth centers" where it expects

strong growth for the wealth-management business: Singapore, Hong

Kong, the United Arab Emirates and London.

Revenue fell 7% to $19.3 billion. That was still ahead of the

$18.8 billion analysts had expected.

During the same period last year, Citigroup and other big banks

were scrambling to determine how many billions of dollars to set

aside for loan losses they feared the coronavirus pandemic could

fuel.

The New York bank released $3.85 billion in reserves, a major

driver of earnings in the first quarter and a sign the bank's

outlook on the economy has improved. The bank released $1.5 billion

in the fourth quarter.

Citigroup and other large banks have started to discharge some

of the funds earmarked last year to cover loan losses, boosting

earnings a year after coronavirus concerns burned their

profits.

The reserves weighed on earnings for much of last year, when

financial institutions believed that elevated numbers of businesses

and consumers would miss loan payments. But a resurgent U.S.

economy, plus trillions of dollars in government stimulus and

ramped-up Covid-19 vaccine distribution, means banks expect far

fewer of those losses to materialize.

Citigroup shares have risen about 18% since the beginning of the

year. The KBW Nasdaq Bank Index, which tracks shares of the largest

lenders, is up 26% so far this year, compared with a 10% gain in

the S&P 500.

A crazy quarter in markets has helped power the big Wall Street

banks. JPMorgan Chase & Co. and Goldman Sachs Group Inc. both

recorded record quarterly profits on Wednesday. Citigroup enjoyed a

46% jump in investment banking revenue, largely from a surge in

underwriting stock offerings, including special-purpose acquisition

companies. But its revenue from advising companies on deals was

down, and trading revenue was essentially flat, rising just 1%.

Expenses increased 4% to $11.1 billion, in part because of the

bank's effort to revamp its risk and control systems. Investors

have been watching that line closely after regulators ordered

Citigroup to make significant changes in its risk systems.

Earnings in the institutional clients group, which includes

investment banking and trading, rose 64% to $5.9 billion, but

revenue fell 2% to $12.2 billion.

The consumer bank reported profit of $2.2 billion, compared with

a loss a year earlier of $740 million. Revenue fell 14% to $7

billion.

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

April 15, 2021 09:27 ET (13:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

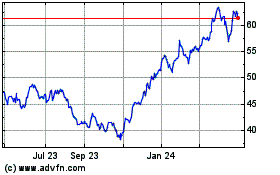

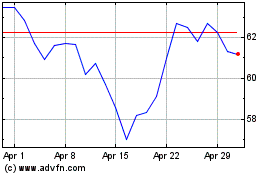

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024