Chinese Yuan Jumps To 4-day High Against US Dollar

July 26 2012 - 11:23PM

RTTF2

The Chinese yuan advanced to a 4-day high of 6.3787 against the

US dollar on Friday morning in New York as the ECB President Mario

Draghi's euro supportive comments on Thursday spurred

risk-appetite.

Additional support came from a couple of upbeat economic data

from the U.S. overnight. Positive cues sent Asia-pacific stocks

higher across the board, with the Shanghai Composite rising above

0.4 percent to 2134.14.

The U.S. durable goods orders increased to a notably higher

level than expected in June, rising 1.6 percent to $221.6 billion

from May. Economist had expected orders to increase to 0.6 percent

in the month.

Meanwhile, the first-time claims for U.S. unemployment benefits

fell by much more than expected in the week ended July 21st to

353,000 from the previous week's revised figure of 388,000.

Economists had expected jobless claims to edge down to 380,000.

The current yuan exchange rate is almost 0.10 percent

higher-than yesterday's closing quote of 6.3850 per dollar. The

next resistance area for the Chinese currency is seen at

6.3750.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair at 6.3325. The central bank sets the

central parity rate, an official reference for daily trading, every

morning and allows the currency to fluctuate up to 1 percent from

that level.

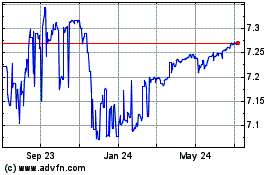

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Apr 2023 to Apr 2024