China's Meituan-Dianping Files for IPO, Reveals Loss of Nearly $3 Billion in 2017 -- Update

June 25 2018 - 12:04AM

Dow Jones News

By Liza Lin and Stella Yifan Xie

HONG KONG-- Fast-growing Chinese technology startup

Meituan-Dianping applied to list in Hong Kong and seeks to raise

billions of dollars to help finance its growth strategy in what is

a highly competitive internet marketplace.

The Beijing-based online services provider is one of the

country's most valuable private tech companies. Its current

investors include Priceline Group Inc., the Canada Pension Plan

Investment Board and Chinese social media and gaming firm Tencent

Holdings Ltd. Meituan said it lost money last year but its revenue

more than doubled, and it expects to maintain rapid growth as more

Chinese consumers spend money online.

Meituan didn't disclose how much it plans to raise in the stock

sale, but the company is targeting a valuation of more than $60

billion, according to people familiar with the matter. Companies

listing in Hong Kong typically sell at least 10% of their shares

when they go public. Goldman Sachs, Morgan Stanley, and Bank of

America Merrill Lynch are the main banks handling Meituan's

IPO.

In a filing with Hong Kong's stock exchange, Meituan said it

generated 33.9 billion yuan ($5.2 billion) in revenue in 2017, up

161% from a year earlier.

The company posted a loss of 18.99 billion yuan last year, its

prospectus said.

The company also said its adjusted net loss was 2.85 billion

yuan in 2017, about half of what it was for the two years before

that. The adjusted figure strips out share-based compensation

expenses and gains and losses from investments, asset sales and

discontinued operations. Meituan said it had 19.4 billion in cash

equivalents at the end of last year.

Write to Liza Lin at Liza.Lin@wsj.com and Stella Yifan Xie at

stella.xie@wsj.com

(END) Dow Jones Newswires

June 24, 2018 23:49 ET (03:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

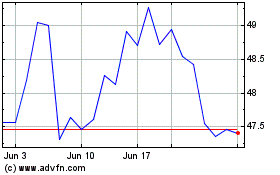

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

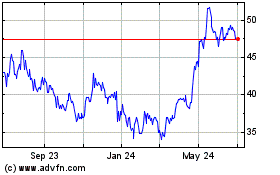

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024