China Retains Borrowing Cost; Industrial Output Growth Eases

June 14 2018 - 1:48AM

RTTF2

China's central bank kept its short-term borrowing costs

unchanged after the U.S. Federal Reserve decided to hike its rate

for the second time this year.

Major economic indicators suggested a slowdown in economic

activity in May as lending curbs weigh on industrial activity.

The People's Bank of China, on Thursday, maintained the 7-day

reverse repo at 2.55 percent and the rate on 14-day tenor at 2.70

percent.

The benchmark one-year lending rate has been unchanged since

October 2015.

Industrial production climbed 6.8 percent but slower than the 7

percent increase logged a month ago, the National Bureau of

Statistics reported. The growth rate was expected to remain

unchanged at 7 percent.

Likewise, retail sales growth eased to 8.5 percent from 9.4

percent. Economists had forecast a faster increase of 9.6

percent.

During the January to May period, fixed asset investment

increased 6.1 percent compared to the expected increase of 7

percent. At the same time, property investment climbed 10.2 percent

annually in January to May period.

The surveyed jobless rate dropped marginally to 4.8 percent in

May from 4.9 percent in April.

The boost to industrial output growth from the removal of the

government's pollution controls at the end of March has now faded,

Chang Liu, an economist at Capital Economics, said.

And with headwinds from slower credit growth increasing,

economic growth looks set to continue to weaken in the second half

of 2018, the economist added.

Mao Shengyong, an NBS spokesman, said China's economic growth

remained stable. Nonetheless, uncertainties from external

environment have increased.

Further, he said the impact of the Fed's interest rate hike on

the Chinese economy is limited.

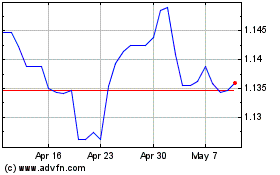

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024