TIDMCWR

RNS Number : 7871Y

Ceres Power Holdings plc

08 March 2017

8 March 2017

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Ceres Power Holdings plc

Half-yearly results for the six months ended 31 December

2016

New partners, new markets and a growing international presence -

INCLUDING FIRST PRODUCT LAUNCH PARTNER

Ceres Power Holdings plc ("Ceres Power", the "Company" or the

"Group") (AIM: CWR.L), a world leading developer of low cost, next

generation fuel cell technology, announces its half-yearly results

for the six months ended 31 December 2016.

Highlights

-- New commercial partners including first 'go-to-market' agreement:

o Two new development agreements signed in the period, bringing

total to four including with Honda, Nissan, Cummins and a further

global OEM

o First 'go-to-market' agreement signed with global OEM to

develop and launch highly efficient combined heat and power ("CHP")

product for business markets

-- Strong revenue and pipeline: Revenue and other operating

income for first half year tripled to GBP1.5 million (FH1 2016:

GBP0.5m). Aiming for full year to at least double. Order book of

GBP4.8 million as at 31 December 2016 and 3 new evaluation

agreements underway with potential future partners.

-- First significant US commercial success with global power

leader Cummins & the US Department of Energy to develop an

energy system for Data Centre and commercial scale applications

-- New market opportunities enabled by rapid progress in

SteelCell(TM) technology. The improvements in efficiency,

robustness and power density have opened up new high growth power

markets in commercial/business sectors

-- Successful fundraise: GBP20m placing enables continued investment in business and technology

Financial Highlights:

Six months Six months

ended 31 ended 31

December December

2016 (unaudited) 2015 (unaudited)

GBP'000 GBP'000

------------------ ------------------

Total revenue and other operating

income, comprising: 1,551 453

Revenue (1) 1,026 235

Other operating income 525 218

Operating loss (6,242) (6,235)

Equity free cash flow (2) (4,176) (5,431)

Net cash and short term investments 22,174 12,753

1 2016 revenue includes the release of GBP0.4 million of

deferred revenue in respect of contracted work completed for

British Gas (2015: GBP0.1m)

2 Equity free cash outflow (EFCF) is the net change in cash and

cash equivalents in the year (GBP0.2 million) less net cash

generated from financing activities (GBP19.4 million) plus the

movement in short term investments (-GBP15.0 million)

Phil Caldwell, CEO of Ceres Power said:

"Ceres Power is on track for an excellent year, driven by new

commercial partnerships, the rapid progress of our technology and

our first 'go-to market' agreement bringing us closer to a first

product launch. We said we would sign five partners by the end of

2017 and with four to date we are on track to do just that, plus we

have three new evaluation agreements and a strong pipeline with a

series of international prospective partners.

With a forward order book of GBP4.8 million and a successful

fundraising secured, we are in a strong position to capitalise on

significant market opportunities. As the world wrestles with the

growing challenge of a decarbonising and decentralising energy

system, our proven SteelCell(TM) technology, and our work with

global power specialists, shows Ceres Power is capable of providing

a cheaper, cleaner, distributed alternative to centralised power

generation."

For further information please contact:

Ceres Power Holdings plc

Phil Caldwell, CEO

Richard Preston, CFO

Dan Caesar, Communications +44 (0)1403 273

& Marketing Director 463

Zeus Capital (Nominated Adviser

and Broker)

Phil Walker/Andrew Jones +44 (0) 20 3829

Hugh Kingsmill Moore 5000

Powerscourt +44 (0) 20 7250

Peter Ogden/Andy Jones 1446

About Ceres Power

Ceres Power is a world leader in low cost, next generation fuel

cell technology for use in distributed power products that reduce

operating costs, lower CO(2) , SOx and NOx emissions, increase

efficiency and improve energy security. The Ceres Power unique

patented SteelCell(TM) technology generates power from widely

available fuels at high efficiency and is manufactured using

standard processing equipment and conventional materials such as

steel, meaning that it can be mass produced at an affordable price

for domestic and business use. Ceres Power offer its partners the

opportunity to develop power systems and products using its unique

SteelCell technology and know-how, combined with the opportunity to

supply the SteelCell(TM) in volume through its manufacturing

partners. For further information please visit:

http://www.cerespower.com/

Chief Executive's statement

Ceres Power is well positioned to continue to execute its

strategy as an enabling technology provider for the world's leading

power systems companies. The SteelCell(TM) technology and the

Company's expertise have a growing, global reputation and we are on

target for an extremely successful year.

The market opportunity - enabling a decarbonised and

decentralised energy system

-- Climate change and the need for clean air, reinforced by the

Paris COP21 agreement and leading global corporates, is maintaining

the momentum towards cleaner distributed power generation

-- The inexorable growth of the Electric Vehicle and Data Centre

sectors will increase the demand for electricity and, coupled with

increasing wind and solar generation, will destabilise the

centralised power generation model

-- Advancements in Ceres Power's SteelCell(TM) technology have

opened up sector opportunities beyond Residential to include the

fast-growing Data Centre, Electric Vehicle and Business sectors

-- SteelCell(TM) is a significantly superior alternative to

conventional gas and diesel engines as it produces close to zero

SOx and NOx emissions at a higher efficiency

We are working towards a vision of embedding our cutting-edge

SteelCell(TM) technology into world-leading products within the

Home, Business, Data Centre and Electric Vehicle markets. Ceres

Power has traditionally been focussed on micro-CHP in the

Residential market, however significant progress has enabled

SteelCell(TM) to rapidly establish itself as a leader in markets

where higher power output is required, significantly expanding the

business opportunity.

The majority of our customer demand is now for larger power

systems than our residential scale product offering, and to

proportionately address these high value markets, we have started

developing larger cells and stacks.

With a strong start to 2017, the Company is ready to capitalise

commercially by securing more key partners, as well as progressing

our existing relationships.

Commercial Progress

-- First 'go-to-market' agreement signed to develop and launch a

highly efficient Combined Heat and Power product to target the

business sector

-- First significant US success with agreement to develop a

power system for data centres and commercial scale applications

-- Field trials progressing well as part of the EU-funded ene.field programme

In the Autumn, Ceres Power announced its key development role in

a recently selected US Department of Energy programme which was

awarded to global power leader, Cummins Inc. Together, Ceres Power

and Cummins will work closely to develop a power system targeting

high electrical efficiency of 60% and scalable to meet multiple

distributed power applications. The initial target application will

be the fast-growing Data Centre market, this power system will be

applicable to other commercial scale uses.

Before the end of 2016, Ceres Power announced a joint

development licence agreement to develop and launch a multi-kW CHP

product its SteelCell(TM) technology with a leading global OEM.

This is Ceres Power's fourth partnership signed and most notably

its first 'go-to-market' agreement with the explicit intention of

developing and launching a product to the business sector on an

ambitious schedule. This is a highly significant step.

Furthermore, field trials, as part of the EU-funded ene.field

programme in UK homes, demonstrate the growing maturity of this

technology and underpin the reputation of the SteelCell(TM) with

our OEM customers.

As a result of this commercial progress, our order book has

increased to GBP4.8m as of 31 December 2016.

Rapid technological progress highlights Ceres Power

expertise

With a well-established R&D roadmap, real progress with the

performance of the technology continues to be made. The most recent

milestone saw the latest iteration of the SteelCell(TM) platform

(version 4) released to customers on time and budget, reinforcing

the Company's reputation for successfully executing against its

technology timelines.

Higher power density and fast start-up timescales have been

proven, making the SteelCell(TM) increasingly commercially

attractive in a growing number of markets. The technology is

well-suited as a range extender for the Electric Vehicle market and

the net electrical efficiencies now being delivered see Ceres Power

developing solutions for the Data Centre market.

The core technology is increasingly applicable to customers that

require a higher power output and we are now increasing cell size

and optimising stack design to meet their requirements.

Adding operational capability to position ourselves for

commercialization

We have seen a significant increase in customer demand for the

SteelCell(TM) technology over the past 6 months, particularly for

high power applications. This increased demand for our existing

SteelCell(TM) technology combined with the development of larger

cells and stacks for new applications has led to the need for

further investment in our manufacturing and test capability.

In the near term, additional demand is being met by increasing

manufacturing capacity in Horsham through the addition of a 3(rd)

shift pattern along with bringing through improvements to key

process steps. Beyond this, we are beginning to explore a number of

options for further manufacturing scale-up.

Financial progress

As highlighted above, the multiple customer programmes won in

the past 12 months are driving our revenues forward. Compared to

the same period last year, we have tripled revenue and other

operating income to GBP1.5 million. We expect this uplift to

continue into the full year, where we aim to at least double our

revenue and other operating income. It is encouraging that this is

being achieved across a growing portfolio of customer

programmes.

Our equity free cash outflow of GBP4.2 million in the period was

less than the prior period (GBP5.4m), mostly due to the Group

receiving its R&D tax credit of GBP2.2m in full (prior period

received GBP0.8m, part of the R&D tax credit, in the period).

Even though we are investing in people and in making the technology

more suitable for customers that require a higher power output, as

we highlighted in last year's annual report, we expect both our

operating loss and our equity free cash outflow for the full year

to decrease from the prior year.

We were very pleased with our GBP20m fundraise in the period,

especially given the uncertain economic conditions in the last 6

months. At 31 December 2016, the Group had cash and cash

equivalents of over GBP22 million and this financial strength, at a

key stage for the Company as we negotiate long term partnerships

with a number of the world's leading companies, gives us the runway

to further embed our SteelCell(TM) in customer development and

'go-to-market' programmes.

Outlook

Our vision is to embed our cutting-edge SteelCell(TM) technology

into world-leading products within the Home, Business, Data Centre

and Electric Vehicle markets.

The leadership team committed itself to signing five global

engineering companies as customers in joint development agreements

by the end of 2017 and being in two launch programmes with OEM

partners by the end of 2018. With four joint development agreements

and one launch programme already signed, Ceres Power is ahead of

its stated schedule. We expect to secure further commercial

partners in due course and to make further progress with our

existing partners.

We anticipate that the commercial progress we are making will

further drive revenues in the second half of FY 2016/17 and into FY

2017/18.

Ceres Power has a committed, experienced team and we would like

to offer our thanks for their continued efforts which we believe

will translate into even greater commercial progress over the next

12 months.

Philip Caldwell

Chief Executive Officer

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME

For the six months ended 31 December 2016

Six months Year

ended ended

31 December 30 June

2016 Six months

ended

31 December 2016

(Unaudited) 2015

(Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Revenue 1,026 235 1,113

Cost of sales (406) (123) (336)

Gross profit 620 112 777

Other operating

income 525 218 555

Operating costs 2 (7,387) (6,565) (14,026)

Operating loss (6,242) (6,235) (12,694)

Finance income 30 49 77

Loss before taxation (6,212) (6,186) (12,617)

Taxation credit 1,044 698 2,157

Loss for the financial

period / year and

total comprehensive

loss (5,168) (5,488) (10,460)

============= ============== ===========

Losses per GBP0.01

ordinary share

expressed in pence

per share:

Basic and diluted

loss per share 3 (0.63)p (0.71)p (1.35)p

All activities relate to the Group's continuing operations and

the loss for the financial year is fully attributable to the owners

of the parent.

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2016

31 December 30 June

2015 (Unaudited) 2016

31 December

2016 (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and

equipment 2,053 2,559 2,309

------------------

Total non-current

assets 2,053 2,559 2,309

Current assets

Trade and other receivables 2,071 755 1,109

Derivative financial

instrument 14 - 28

Current tax receivable 825 1,378 1,997

Short-term investments 6 16,000 7,000 1,000

Cash and cash equivalents 6 6,174 5,753 5,947

------------------ ------------------ ------------

Total current assets 25,084 14,886 10,081

Liabilities

Current liabilities

Trade and other payables (2,217) (2,663) (2,121)

Derivative financial

instrument (110) - (7)

Provisions for other

liabilities and charges - (77) (78)

------------------ ------------------ ------------

Total current liabilities (2,327) (2,740) (2,206)

------------------ ------------------ ------------

Net current assets 22,757 12,146 7,875

Non-current liabilities

Accruals and deferred

income - (58) (31)

Provisions for other

liabilities and charges (806) (865) (866)

------------------ ------------------ ------------

Total non-current

liabilities (806) (923) (897)

------------------

Net assets 24,004 13,782 9,287

================== ================== ============

Equity

Share capital 4 10,080 7,725 7,779

Share premium account 107,222 90,120 90,120

Capital redemption

reserve 3,449 3,449 3,449

Other reserve 7,463 7,463 7,463

Accumulated losses (104,210) (94,975) (99,524)

Total equity 24,004 13,782 9,287

================== ================== ============

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 December 2016

Year

ended

30 June

2016

Six months Six months

ended ended

31 December 31 December

2016 2015

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 5 (6,082) (5,310) (11,773)

Taxation received 2,216 839 1,679

------------- ------------- -----------

Net cash used in operating

activities (3,866) (4,471) (10,094)

------------- ------------- -----------

Cash flows from investing

activities

Purchase of property,

plant and equipment (333) (1,013) (1,302)

Movement in short-term

investments (15,000) (1,000) 5,000

Finance income received 30 49 77

------------- ------------- -----------

Net cash (used in) /

generated from investing

activities (15,303) (1,964) 3,775

------------- ------------- -----------

Cash flows from financing

activities

Proceeds from issuance

of ordinary shares 20,038 - 54

Net expenses from of

issuance of ordinary

shares (635) - -

------------- ------------- -----------

Net cash generated from

financing activities 19,403 - 54

Net increase / (decrease)

in cash and cash equivalents 234 (6,435) (6,265)

Exchange (losses) /

gains on cash and cash

equivalents (7) 4 28

------------- ------------- -----------

227 (6,431) (6,237)

Cash and cash equivalents

at beginning of period 5,947 12,184 12,184

------------- ------------- -----------

Cash and cash equivalents

at end of period 6,174 5,753 5,947

------------- ------------- -----------

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 December 2016

Share Capital

Share premium redemption Other Accumulated

capital account reserve reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2015 7,725 90,120 3,449 7,463 (90,076) 18,681

Comprehensive

income

Loss for the

financial

year - - - - (5,488) (5,488)

--------- --------- ------------- --------- ------------ --------

Total comprehensive

loss - - - - (5,488) (5,488)

--------- --------- ------------- --------- ------------ --------

Transactions

with owners

Issue of shares,

net of costs - - - - - -

Share-based

payments charge - - - - 589 589

--------- --------- ------------- --------- ------------ --------

Total transactions

with owners - - - - 589 589

--------- --------- ------------- --------- ------------ --------

At 31 December

2015 7,725 90,120 3,449 7,463 (94,975) 13,782

--------- --------- --------- ------------ --------

Comprehensive

income

Loss for the

financial

year - - - - (4,972) (4,972)

Total comprehensive

loss - - - - (4,972) (4,972)

--------- --------- ------------- --------- ------------ --------

Transactions

with owners

Issue of shares,

net of costs 54 - - - - 54

Share-based

payments charge - - - - 423 423

Total transactions

with owners 54 - - - 423 477

--------- --------- ------------- --------- ------------ --------

At 30 June

2016 7,779 90,120 3,449 7,463 (99,524) 9,287

--------- --------- ------------- --------- ------------ --------

Comprehensive

income

Loss for the

financial

year - - - - (5,168) (5,168)

Total comprehensive

loss - - - - (5,168) (5,168)

Transactions

with owners

Issue of shares,

net of costs 2,301 17,102 - - - 19,403

Share-based

payments charge - - - - 482 482

Total transactions

with owners 2,301 17,102 - - 482 19,885

--------- --------- ------------- --------- ------------ --------

At 31 December

2016 10,080 107,222 3,449 7,463 (104,210) 24,004

--------- --------- ------------- --------- ------------ --------

The accompanying notes are an integral part of these

consolidated financial statements.

Notes to the financial statements for the six months ended 31

December 2016

1. Basis of preparation

This condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU.

The consolidated financial statements of the Group are prepared

on a going concern basis, in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union, the IFRS Interpretations Committee (IFRS-IC) interpretations

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The consolidated financial statements have

been prepared on a historical cost basis except that the following

assets and liabilities are stated at their fair value: derivative

financial instruments and financial instruments classified as fair

value through the profit or loss.

The financial information contained in this interim announcement

is unaudited and does not constitute statutory financial statements

as defined by in Section 434 of the Companies Act 2006. The

financial statements for the year ended 30 June 2016, on which the

auditors gave an unqualified audit opinion, have been filed with

the Registrar of Companies.

The accounting policies adopted are consistent with those of the

financial statements for the year ended 30 June 2016, as described

in those financial statements.

After having made appropriate enquiries and in light of the

placing which raised GBP19.4 million net of expenses in October

2016, the Directors have a reasonable expectation that the Group

and Company have adequate resources to progress their established

strategy for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis in preparing these

financial statements.

2. Operating costs

Operating costs are

split as follows:

Year

ended

30 June

2016

Six months Six months

ended ended

31 December 31 December

2016 (Unaudited) 2015 (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Research and development

costs 5,434 4,905 10,588

Administrative expenses 2,059 1,660 3,714

------------------ ------------------ -----------

7,493 6,565 14,302

Reversal of provision

relating to onerous

lease and property dilapidations (106) - (276)

------------------ ------------------ -----------

7,387 6,565 14,026

================== ================== ===========

3. Loss per share

Six months

ended Year ended

31 December 30 June

2016 (Unaudited) 2016

Six months

ended

31 December

2015 (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Loss for the financial

period attributable

to shareholders (5,168) (5,488) (10,460)

================== ================== ============

Weighted average number

of shares in issue 824,447,210 772,537,841 773,999,046

================== ================== ============

Loss per GBP0.01 ordinary

share (basic & diluted) (0.63)p (0.71)p (1.35)p

================== ================== ============

4. Share capital

Ceres Power Holdings plc has called-up share capital totalling

1,008,040,924 GBP0.01 ordinary shares as at 31 December 2016

(777,857,841 ordinary shares of GBP0.01 each at 30 June 2016).

During the period 228,603,083 ordinary shares of GBP0.01 each

were issued through a placing on AIM for cash consideration of

GBP20 million. In addition, 1,580,000 ordinary shares of GBP0.01

each were issued on the exercise of employee share options.

5. Cash used in operations

Year ended

30 June

2016

Six months Six months

ended ended

31 December 31 December

2016 (Unaudited) 2015 (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Loss before taxation (6,212) (6,186) (12,617)

Adjustments for:

Other finance income (30) (49) (77)

Depreciation of property,

plant and equipment 589 534 1,178

Share-based payments 482 589 1,012

Net foreign exchange gains/(losses) 7 - (49)

Operating cash flows before

movements in working capital (5,164) (5,112) (10,553)

(Increase)/decrease in

trade and other receivables (948) 227 (134)

Increase/(decrease) in

trade and other payables 168 (112) (775)

Decrease in provisions (138) (313) (311)

------------------ ------------------ -----------

Increase in working capital (918) (198) (1,220)

Cash used in operations (6,082) (5,310) (11,773)

================== ================== ===========

6. Net cash, short-term investments and financial assets

Year

ended

Six months Six months

ended ended

31 December 31 December 30 June

2016 2015 2016

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 3,716 1,577 805

Money market funds 2,458 4,176 5,142

-------------

Cash and cash equivalents 6,174 5,753 5,947

-------------

Short-term investments

(bank deposits > 3 months) 16,000 7,000 1,000

------------- ------------- -----------

Net cash and short term

investments 22,174 12,753 6,947

------------- ------------- -----------

The Group typically places surplus funds into pooled money

market funds and bank deposits with durations of up to 12 months.

The Group's treasury policy restricts investments in short-term

sterling money market funds to those which carry short-term credit

ratings of at least two of AAAm (Standard & Poor's), Aaa/MR1+

(Moody's) and AAA V1+ (Fitch) and deposits with banks with minimum

long-term rating of A/A-/A3 and short-term rating of F-1/A-2/P-2

for banks which the UK Government holds less than 10% ordinary

equity.

INDEPENT REVIEW REPORT TO CERES POWER HOLDINGS PLC

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly report for the six

months ended 31 December 2016 which comprises Consolidated

statement of profit and loss and other comprehensive income,

Consolidated statement of financial position, Consolidated cash

flow statement, Consolidated statements of changes in equity and

the related explanatory notes. We have read the other information

contained in the half-yearly report and considered whether it

contains any apparent misstatements or material inconsistencies

with the information in the condensed set of financial

statements.

This report is made solely to the company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company for our review work, for this

report, or for the conclusions we have reached.

Directors' responsibilities

The half-yearly report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the half-yearly report in accordance with the AIM

Rules.

The annual financial statements of the group are prepared in

accordance with IFRSs as adopted by the EU. The condensed set of

financial statements included in this half-yearly report has been

prepared in accordance with the recognition and measurement

requirements of IFRSs as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly report for the six months ended 31 December 2016

is not prepared, in all material respects, in accordance with the

recognition and measurement requirements of IFRSs as adopted by the

EU and the AIM Rules.

James Ledward

for and on behalf of KPMG LLP

Chartered Accountants

1 Forest Gate,

Brighton Road, Crawley

RH11 9PT

8 March 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDXCBGBGRR

(END) Dow Jones Newswires

March 08, 2017 02:00 ET (07:00 GMT)

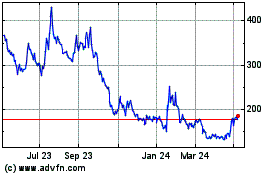

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

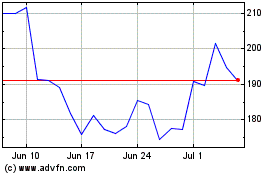

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024