TIDMCWR

RNS Number : 6140S

Ceres Power Holdings plc

04 October 2017

4 October 2017

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Ceres Power Holdings plc - Final results for the year ended 30

June 2017

A YEAR OF CONTINUED FINANCIAL & COMMERCIAL PROGRESS

Ceres Power Holdings plc ("Ceres Power", the "Company" or the

"Group") (AIM: CWR.L) announces its final results for the year

ended 30 June 2017.

Phil Caldwell, CEO, commented:

"This has been our most successful year to date. We are ahead of

expectations financially and are on track to meet our commercial

objectives. Our ability to sign new commercial agreements and then

generate revenues working alongside our partners has enabled us to

accelerate the technical development of the SteelCell and explore

new applications, giving Ceres Power's technology access to

opportunities in our target markets including the Residential,

Commercial, Data Centre and Electric Vehicles sectors.

"The global demand for low carbon, flexible, near zero emission

technologies such as ours has never been stronger. Our strategy of

developing partnerships with world-class companies, addressing

multiple growth markets, means the business is well positioned to

further capitalise on opportunities in the coming year and I look

forward to being able to announce further commercial progress."

Highlights:

Strong commercial progress has driven improved financial

performance

-- Revenue(1) and other operating income ahead of expectations,

up 140% to GBP4.1m (2016: GBP1.7m).

-- EBITDA(2) loss down by 11% to GBP10.3m (2016: GBP11.5m) while

continuing to invest in people, technology and operations to

support growth into higher power applications, addressing new

sectors including EVs and Data Centres.

-- Equity free cash outflow(3) reduced 17% to GBP9.4m (2016:

GBP11.3m). As of June 2017, the Company held GBP17.2m in net cash

and short-term investments, ahead of previous forecasts.

-- Growing order book of GBP3.2m (2016: GBP1.7m) positions Ceres

Power for continued commercial growth.

Rapid development towards commercialisation:

-- First significant US commercial success with Cummins & US

Dept. of Energy to develop multi-kW systems for Data Centre and

commercial scale applications.

-- Signing of fourth significant partner and first

'go-to-market' agreement to develop a combined heat and power

("CHP") product for the business sector, adding to agreements with

Cummins, Honda & Nissan.

-- Agreement signed in May 2017 with an existing Global OEM to

develop a residential CHP system.

-- On track to sign fifth partner by the end of 2017.

Further technical progress highlights SteelCell's proven

performance and Ceres Power's manufacturing expertise

-- Successful UK field trial proved SteelCell(TM) is reliable,

highly efficient, and can generate low carbon heat and power that

could save home-owners around GBP400 a year.

-- Formal release of SteelCell(TM) version 4 to customers with

improved performance and manufacturability.

-- Assessing options to increase UK manufacturing capacity to

meet near term customer demand and continuing to explore

manufacturing partner for large scale production.

______________________________________________________________

Financial Highlights:

Year Ended Year Ended

30 June 30 June

2017 2016

GBP'000 GBP'000

----------- -----------

Total revenue and other operating

income, comprising: 4,076 1,668

Revenue (1) 3,119 1,113

Other operating income 957 555

EBITDA(2) (10,263) (11,516)

Equity free cash flow (3) (9,363) (11,291)

Net cash and short-term investments 17,158 6,947

1 Revenue includes the release of GBP0.4 million of deferred

revenue in respect of contracted work completed for British Gas

(2016: GBP0.6million)

2 EBITDA (earnings before interest, depreciation and

amortisation) is calculated as the operating loss (GBP11.5 million)

less depreciation (GBP1.2 million). Management use EBITDA as an

alternative performance measure to operating loss as they believe

that it is a more relevant and comparable measure of the operating

activities of the Group.

3 Equity free cash outflow (EFCF) is the net change in cash and

cash equivalents in the year (-GBP2.8 million) less net cash

generated from financing activities (GBP19.6 million) plus the

movement in short term investments (GBP13.0 million). Management

use EFCF as an alternative performance measure to the net change in

cash and cash equivalents as they believe that it is a more

relevant and comparable measure of the overall cash flows of the

Group as it excludes any funding activities or changes in

investments.

Enquiries:

Ceres Power Holdings plc

Phil Caldwell, CEO 01403 273

Richard Preston, CFO 463

020 3829

www.cerespower.com 5000

Zeus Capital - Nominated Adviser and 020 3207

Joint Broker 7800

Giles Balleny / Andrew Jones / Hugh Kingsmill

Moore

www.zeuscapital.co.uk

Berenberg - Joint Broker

Ben Wright / Mark Whitmore / Laure Fine

www.berenberg.com

Powerscourt

Peter Ogden / Andy Jones 020 7250

www.powerscourt-group.com 1446

About Ceres Power

Ceres Power (http://www.cerespower.com/) is a world leader in

low cost, next generation fuel cell technology for use in

distributed power products that reduce operating costs, lower CO2,

SOx and NOx emissions, increase efficiency and improve energy

security. The Ceres Power unique patented SteelCell technology

generates power from widely available fuels at high efficiency and

is manufactured using standard processing equipment and

conventional materials such as steel, meaning that it can be mass

produced at an affordable price for domestic and business use.

Ceres Power offers its partners the opportunity to develop power

systems and products using its unique SteelCell technology and

know-how, combined with the opportunity to supply the SteelCell in

volume through its manufacturing partners.

Chairman's statement

Major disruptions in the power generation and automotive sectors

are providing exciting new opportunities for Ceres Power.

Driven by international commitment to achieve COP21

decarbonisation targets, legislative action to reduce carbon

emissions and more recently action on air pollution, major changes

have been set in motion around the world.

The first major disruption is to conventional power generation.

The cost of renewables has fallen to levels at which integrating

them into the energy system has become financially credible and

centralised power plants are increasingly undercut by the

ever-decreasing cost of renewables. However, intermittent renewable

power needs to be balanced out with flexible power generation and,

as a result, in countries like Japan and Germany there are active

programmes to promote the deployment of distributed generation

technologies including fuel cells.

The second major disruption is the rise of electric vehicles.

While decarbonisation continues to be the focus of international

efforts, the importance of improving air quality has risen rapidly

up the legislative agenda. This has led to clear commitments to ban

combustion engines by governments and cities around the world

including by 2025 in Norway, through to 2040 in France and the

United Kingdom.

Though 2040 still seems relatively distant, electric vehicles

are predicted to match the cost of, and become cheaper than,

conventional vehicles by 2020. This disruption is driving the major

engine manufacturers to switch their R&D and product

development away from combustion engines to electrochemical power

generation technologies including fuel cells.

With more demand for power (a major driver being the exponential

rise in demand for power-hungry data centres, a new market for

Ceres), there is increasing tension on existing, centralised

systems which are, in many cases, already struggling to keep pace

with current consumption levels.

Distributed generation technologies, like the SteelCell(TM),

avoid expensive grid reinforcement, as they can use the existing

gas infrastructure. Established providers of conventional systems

to the power generation and transportation sectors, such as Ceres

Power's world-class partners Honda and Nissan, are turning to us to

develop our robust, highly-efficient, low-carbon technology that

operates on existing fuels such as natural gas and biofuels.

Ceres Power had traditionally been focused on micro combined

heat and power (Micro-CHP) in the residential market, however

significant progress in the last year has enabled us to rapidly

establish ourselves in markets where higher power output is

required, expanding our ability to address the enormous

opportunities that the global energy transition is enabling.

Indeed, the majority of our customer demand is now for larger power

systems.

Ceres Power's partnerships with leading global OEMs positions us

well as we continue to work to achieve our vision of embedding the

SteelCell(TM) technology into world-leading products within the

home, business, data centre and electric vehicle markets.

This strategy of developing partnerships with world-class

companies, addressing multiple growth markets, means that the

business is well positioned to further capitalise on opportunities

in the coming year.

The Company strengthened its balance sheet by raising GBP20m

from new and existing institutional investors in October 2016,

which enables us to secure key commercialisation agreements by the

end of 2018. The growing appetite for investment in the energy

sector and the Company's strong existing financial backing gives us

confidence that we can access future growth capital as we continue

to deliver against our strategy.

The Board has continued to strengthen its governance structure

to ensure it provides effective control and oversight of the

business as it grows and is very clear and focused on its

priorities. The Governance Report in the Annual Report sets out in

detail how the Board embeds Ceres Power's culture and values in

everything we do.

I would like to offer my thanks to the Board and all our

employees for their efforts to achieve our targets over the past

year.

We look forward to demonstrating further progress in the next 12

months, both with existing and new partners as Ceres Power

reinforces its reputation as a world-leader in the fast-growing

clean energy sectors.

Alan Aubrey

Chairman

Chief Executive's statement

Overview of performance

This has been Ceres Power's most successful year to date with

significant commercial, operational and technological progress,

further establishing our world-leading position in metal-supported

Solid Oxide Fuel Cells (SOFC). Our total revenue and other

operating income grew by 140% to GBP4.1m. We have secured two

further world-class customers including Cummins and an OEM who

remains confidential at this point, both of whom are focused on our

5 to 10 kW platform. This is in addition to the ongoing

partnerships with Honda and Nissan, which are progressing well.

This progress with partners represents 4 out of the 5 joint

development agreements which is our stated end-of-2017 target,

additionally we have signed our 1st 'go-to-market' agreement which

includes technology transfer and a license to our system

architecture. We have also further demonstrated the growing

maturity of the SteelCell(TM) platform by successfully completing

field trials of 1kW home systems in the UK as part of the ene.field

programme, as well as developing larger 5kW stacks to open up new

markets.

Commercial Progress

In September 2016, we signed a Joint Development Agreement with

Cummins Inc., a global leader in power systems, as part of a

consortium backed by the US Department of Energy (US DoE) to

develop a multi kW power system for use in data centres and other

commercial and industrial applications. This was our first

significant entry into the US market and our first development of a

modular multi kW system. Together, Ceres Power and Cummins will

work closely with consortium partners to develop an innovative,

modular 10kW Solid Oxide Fuel Cell system which will target high

electrical efficiency of 60% and be inherently scalable to meet

multiple distributed power applications.

The initial target application will be the fast-growing data

centre market which currently accounts for 3% of global electricity

consumption. Cummins are a global leader in supplying back up and

temporary power systems to this market and are an ideal partner for

us. I am pleased to say in the first year of this collaboration we

have achieved all key milestones.

In December 2016 we announced our first 'go-to-market'

partnership with a Joint Development License Agreement for a

multi-kW combined heat and power (CHP) product targeting

applications in the business sector with an OEM who is a market

leader in this field. This was our fourth partnership and most

notably the first agreement which includes technology transfer and

a license to scale up our 1kW system architecture to a multi-kW

scale, which leads to future Steel Cell(TM) stack supply. Details

of this relationship are commercially confidential, but I'm pleased

to report the technology transfer of our system architecture has

been completed on time and the programme is proceeding to plan.

Commercialisation should lead to further revenues for the Company

in the form of future royalty payments and SteelCell(TM) stack

supply.

As the majority of our partners are based in Asia or the US it

was pleasing to have the opportunity to join the European-wide

field testing programme of residential micro-CHP units (ene.field)

supported by British Gas. We entered this programme in September

last year and while we have now successfully completed the formal

programme which finished at the end of August 2017, we intend to

run on a number of units to continue to gather real-world lifetime

and durability data.

The field trial programme here in the UK has successfully

demonstrated the robustness of the technology to our OEM partners

around the world and was a contributory factor in the signing in

May of this year of a new two-year agreement with an existing OEM

partner to jointly develop power systems for residential

applications. Recognising decarbonisation of residential heating as

a critical success factor for meeting CO2 reduction targets, the UK

Government is supporting our technology through the provision of

GBP0.7 million of funding from BEIS (Department of Business, Energy

and Industrial Strategy) and Innovate UK.

In addition to developing new partnerships we have deepened our

existing customer relationships with partners like Honda and

Nissan. We are now in the second year of our two-year joint stack

development with Honda R&D and have hit key deliverables to

date. Furthermore, we are working with Nissan UK to develop a 5kW

stack which runs on biofuels. This would extend the range of

electric vehicles, enabling drivers to experience the same range

and refuelling time as a conventional combustion engine vehicle,

but with significantly lower carbon and emissions. I'm pleased to

say we have met all of the performance targets set by Nissan and

are on track to put on test our first 5kW stack by the end of

2017.

Over the past year we have also carried out a series of new

Technology Evaluation Agreements with prospective OEMs in Asia and

Europe which have advanced to the point of negotiating potential

new partnerships. The order book(4) at the date of this report

stands at GBP3.2m and we are confident of continued success in

2017/18.

(4) Order book is the contracted commercial and grant revenue

scheduled to be realised in future years. There is no comparable

figure disclosed in the "financial statements" as this figure

represents future anticipated revenue and other operating income in

the form of grants. Management use order book as a performance

measure as they believe that it is a useful measure to demonstrate

the Group's progress towards commercialisation.

Technology Update

An important focus for our Engineering Department this year has

been the development of larger 5kW stacks and modular multi-kW

systems to support our customer programmes with Nissan and Cummins

and includes data centre, commercial-scale CHP and power-only

applications. We have demonstrated a number of firsts, including

rapid start-up times, over 3000 repeated cycles and Ceres Power now

has two stack configurations to address the 1kW and 5kW+

markets.

Our Version 4 (V4) technology was officially released to

customers in the summer of 2016 and has performed well with the

longest running stacks now in operation for more than 18 months.

The next generation R&D cells are showing higher efficiency,

lower degradation and increased power density. Our core fuel cell

R&D team has a continued focus on improving lifetime and

performance and this year has delivered a number of exciting

developments around degradation. By unlocking a significant

reduction in underlying degradation rate the programme has

demonstrated a potential 10-year life. Degradation is not the only

factor that is important for lifetime and we have several projects

looking at increasing lifetime and reliability at the cell and

stack level. Some of these improvements will be brought forward to

customers in our V5 platform release next year, as we look to

maintain our leadership position in metal-supported solid oxide

fuel cells.

The technology team has enabled rapid progress with our first

'go-to-market' customer by completing a successful technology

transfer. The customer has designed and built its first prototype

multi-kW commercial CHP in less than 9 months, after a successful

transfer of our 1kW SteelGen design.

Furthermore, in support of customer programmes Ceres Power has

underscored the fuel flexible potential of the SteelCell(TM)

technology in multiple projects including running Solid Oxide Fuel

Cell stacks on fuels as diverse as diesel - without generating SOx,

NOx or particulates - and pure hydrogen.

Operations Update

In 2016/17 we manufactured a record number of cells, having

invested in manufacturing processes and new equipment during the

year and added a third shift to give us additional capacity. The

new process technology not only reduces material usage but also

increases yield levels.

We are now at a stage where we need to invest in additional

manufacturing capacity, particularly for higher power applications,

due to a significant increase in customer demand. As such, we are

currently evaluating options to invest in further capacity in the

UK to ensure the Company can deliver against customer demand for

the next few years, as well as demonstrating the scalability of our

manufacturing to potential partners.

In addition to this investment in near-term additional capacity

in the UK and consistent with our long-term strategy we are

continuing to discuss potential manufacturing partnerships for high

volumes to meet our customer needs locally in different parts of

the world.

Financial

This commercial success has put us in a strong financial

position. Revenue and other operating income grew 140% to GBP4.1m

(2015/16 - GBP1.7m), which was split GBP3.1m revenue from customers

and GBP1.0 million from grants and other income. This progress led

to a reduction of EBITDA loss of 11% to GBP10.3m (2015/16 -

GBP11.5m) despite the Company investing significantly in people,

technology and operations to support the strategic growth into

higher power applications. Equity free cash flow reduced 17% from

GBP11.3m in 2016 to GBP9.4m in 2017.

We have had a strong start to the 2017/18 year and our order

book is currently GBP3.2m, up from GBP1.7m at this time last year.

We expect to continue to grow top line revenue as we increase our

number of new customers and as existing customers progress through

from evaluation to product development and to commercial launch.

Subject to any investment to increase manufacturing capacity we

expect this will translate to a continued improvement in our

financial results.

In October 2016 we raised GBP20 million to fund the next stage

of the Company's growth through a placing with approximately GBP10

million from existing institutional investors holding or increasing

their position in the Company as well as further new institutional

investors. As of June 2017 we held GBP17.2 million cash, cash

equivalents and short-term investments, which puts us in a strong

position as we look to secure key commercialisation agreements by

the end of 2018.

People

Once again we have been able to attract talented people to join

the team at Ceres Power. The growth in the team this year has added

to the commercial, engineering and programme delivery side of the

business to support our growing number of customer programmes.

I would personally like to thank everyone within the business

for their continued contribution towards what has been a very

successful year and I am looking forward with confidence to next

year.

Outlook

Ceres Power is making good progress against our aim of securing

our fifth global engineering company as a customer in a Joint

Development Agreement by the end of 2017, with the intent to be in

two launch programmes with OEM partners by the end of 2018.

We intend to maintain our technology leadership position through

continually advancing the performance and maturity of the

SteelCell(TM) and by advancing manufacturing readiness levels and

scaling up supply of our core technology to meet customer

demand.

The Company's reputation continues to grow within the industry

and the demand for low carbon, flexible, near zero emission

technologies such as ours has never been stronger. This is an

exciting stage in the Company's growth and I look forward to being

able to announce further commercial progress against these

objectives in the year ahead.

Phil Caldwell

Chief Executive Officer

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME

For the year ended 30 June 2017

Year Year

ended ended

30 June 30 June

2017 2016

Note GBP'000 GBP'000

Revenue 3,119 1,113

Cost of sales (1,334) (336)

Gross profit 1,785 777

Other operating income 957 555

Operating costs 2 (14,264) (14,026)

Operating loss (11,522) (12,694)

Finance income 89 77

Loss before taxation (11,433) (12,617)

Taxation credit 2,025 2,157

Loss for the financial year

and total comprehensive

loss (9,408) (10,460)

========= =========

Losses per GBP0.01 ordinary

share expressed in pence

per share:

Basic and diluted loss per

share 3 (1.00)p (1.35)p

All activities relate to the Group's continuing operations and

the loss for the financial year is fully attributable to the owners

of the parent.

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2017

30 June 30 June

2017 2016

Note GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 1,913 2,309

Total non-current assets 1,913 2,309

Current assets

Inventories 595 -

Trade and other receivables 1,339 497

Other assets 1,123 612

Derivative financial instrument 8 28

Current tax receivable 1,805 1,997

Short-term investments 6 14,000 1,000

Cash and cash equivalents 6 3,158 5,947

---------- ---------

Total current assets 22,028 10,081

Liabilities

Current liabilities

Trade and other payables (2,654) (2,121)

Derivative financial instrument (8) (7)

Provisions - (78)

---------- ---------

Total current liabilities (2,662) (2,206)

---------- ---------

Net current assets 19,366 7,875

Non-current liabilities

Accruals and deferred income - (31)

Provisions (828) (866)

---------- ---------

Total non-current liabilities (828) (897)

Net assets 20,451 9,287

========== =========

Equity

Share capital 4 10,124 7,779

Share premium account 107,349 90,120

Capital redemption reserve 3,449 3,449

Merger reserve 7,463 7,463

Accumulated losses (107,934) (99,524)

Total equity 20,451 9,287

========== =========

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2017

Year Year

ended ended

30 June 30 June

2017 2016

Note GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 5 (10,822) (11,773)

Taxation received 2,217 1,679

--------- ---------

Net cash used in operating

activities (8,605) (10,094)

--------- ---------

Cash flows from investing

activities

Purchase of property, plant

and equipment (863) (1,302)

Movement in short-term investments (13,000) 5,000

Finance income received 89 77

--------- ---------

Net cash (used in) / generated

from investing activities (13,774) 3,775

--------- ---------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 20,209 54

Expenses from of issuance

of ordinary shares (635) -

--------- ---------

Net cash generated from financing

activities 19,574 54

--------- ---------

Net decrease in cash and

cash equivalents (2,805) (6,265)

Exchange gains on cash and

cash equivalents 16 28

--------- ---------

(2,789) (6,237)

Cash and cash equivalents

at beginning of year 5,947 12,184

--------- ---------

Cash and cash equivalents

at end of year 3,158 5,947

--------- ---------

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2017

Share Capital

Share premium redemption Merger Accumulated

capital account reserve reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2015 7,725 90,120 3,449 7,463 (90,076) 18,681

Comprehensive

income

Loss for the

financial

year - - - - (10,460) (10,460)

--------- --------- ------------- --------- ------------ ---------

Total comprehensive

loss - - - - (10,460) (10,460)

--------- --------- ------------- --------- ------------ ---------

Transactions

with owners

Issue of shares,

net of costs 54 - - - - 54

Share-based

payments charge - - - - 1,012 1,012

--------- --------- ------------- --------- ------------ ---------

Total transactions

with owners 54 - - - 1,012 1,066

--------- --------- ------------- --------- ------------ ---------

At 30 June

2016 7,779 90,120 3,449 7,463 (99,524) 9,287

--------- --------- --------- ------------ ---------

Comprehensive

income

Loss for the

financial

year - - - - (9,408) (9,408)

Total comprehensive

loss - - - - (9,408) (9,408)

--------- --------- ------------- --------- ------------ ---------

Transactions

with owners

Issue of shares,

net of costs 2,345 17,229 - - - 19,574

Share-based

payments charge - - - - 998 998

Total transactions

with owners 2,345 17,229 - - 998 20,572

--------- --------- ------------- --------- ------------ ---------

At 30 June

2017 10,124 107,349 3,449 7,463 (107,934) 20,451

--------- --------- ------------- --------- ------------ ---------

The accompanying notes are an integral part of these

consolidated financial statements.

Notes to the financial statements for the year ended 30 June

2017

1. Basis of preparation

The consolidated financial statements of the Group have been

prepared on a going concern basis, in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union, the IFRS Interpretations Committee (IFRS-IC) interpretations

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The consolidated financial statements have

been prepared on a historical cost basis except that the following

assets and liabilities are stated at their fair value: derivative

financial instruments and financial instruments classified as fair

value through the profit or loss.

The financial information contained in this final announcement

does not constitute statutory financial statements as defined by in

Section 434 of the Companies Act 2006. The financial information

has been extracted from the financial statements for the year ended

30 June 2017 which have been approved by the Board of Directors,

and the comparative figures for the year ended 30 June 2016 are

based on the financial statements for that year.

The financial statements for 2016 have been delivered to the

Registrar of Companies and the 2017 financial statements will be

delivered after the Annual General Meeting on the 6 December

2017.

The Auditor has reported on both sets of accounts without

qualification, did not draw attention to any matters by way of

emphasis without qualifying their report, and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

The accounting policies adopted are consistent with those of the

financial statements for the year ended 30 June 2017, as described

in those financial statements.

Having reviewed the Group's forecast income and expenditure,

performing appropriate sensitivity and scenario analyses, and after

making appropriate enquiries, the Directors have a reasonable

expectation that the Group and Company have adequate resources to

progress their established strategy and to secure the commercial

agreements expected by the end of the 2018 financial year.

Accordingly, they continue to adopt the going concern basis in

preparing these financial statements.

2. Operating costs

Operating costs are split

as follows:

Year

Year ended ended

30 June 30 June

2017 2016

GBP'000 GBP'000

Research and development costs 10,516 10,588

Administrative expenses 3,907 3,714

----------- ---------

14,423 14,302

Reversal of provision relating

to onerous lease and property

dilapidations (159) (276)

----------- ---------

14,264 14,026

=========== =========

3. Loss per share

Year ended Year ended

30 June 30 June

2017 2016

GBP'000 GBP'000

Loss for the financial year

attributable to shareholders (9,408) (10,460)

============ ============

Weighted average number of

shares in issue 939,762,048 773,999,046

============ ============

Loss per GBP0.01 ordinary share

(basic & diluted) (1.00)p (1.35)p

============ ============

4. Share capital

Ceres Power Holdings plc has called-up share capital totalling

1,012,419,929 ordinary shares of GBP0.01 each as at 30 June 2017

(777,857,841 ordinary shares of GBP0.01 each at 30 June 2016).

During the period 5,959,005 ordinary shares of GBP0.01 each were

issued on the exercise of employee share options for cash

consideration of GBP206,000 (2016: 5,320,000 for cash consideration

of GBP54,000). During the year the Company completed a placing of

228,603,083 ordinary shares of GBP0.01 each for cash consideration

of GBP20,003,000.

5. Cash used in operations

Year ended Year ended

30 June 30 June

2017 2016

GBP'000 GBP'000

Loss before taxation (11,433) (12,617)

Adjustments for:

Other finance income (89) (77)

Depreciation of property, plant

and equipment 1,259 1,178

Share-based payments 998 1,012

Net foreign exchange gains (16) (49)

Net change in fair value of

financial instruments at fair

value through profit and loss 21 -

Operating cash flows before

movements in working capital (9,260) (10,553)

(Increase)/decrease in trade

and other receivables (842) 166

Increase in other assets (511) (300)

Increase in inventories (595) -

Increase/(decrease) in trade

and other payables 502 (775)

Decrease in provisions (116) (311)

----------- -----------

Increase in working capital (1,562) (1,220)

Cash used in operations (10,822) (11,773)

=========== ===========

6. Net cash, short-term investments and financial assets

Year

Year ended ended

30 June 30 June

2017 2016

GBP'000 GBP'000

Cash at bank and in hand 1,354 805

Money market funds 1,804 5,142

Cash and cash equivalents 3,158 5,947

Short-term investments (bank

deposits between 1 and 12 months) 14,000 1,000

----------- ---------

17,158 6,947

----------- ---------

The Group typically places surplus funds into pooled money

market funds and bank deposits with durations of up to 12 months.

The Group's treasury policy restricts investments in short-term

sterling money market funds to those which carry short-term credit

ratings of at least two of AAAm (Standard & Poor's), Aaa/MR1+

(Moody's) and AAA V1+ (Fitch) and deposits with banks with minimum

long-term rating of A/A-/A3 and short-term rating of F-1/A-2/P-2

for banks which the UK Government holds less than 10% ordinary

equity.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FSLFMDFWSEIS

(END) Dow Jones Newswires

October 04, 2017 02:00 ET (06:00 GMT)

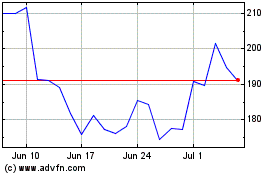

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

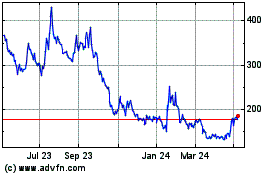

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024