TIDMCNA

RNS Number : 9317J

Centrica PLC

05 April 2018

5 April 2018

Centrica plc (the Company)

Annual Report and Accounts 2017

Further to the release of the Company's preliminary results

announcement on 22 February 2018, the Company announces that it has

today published its Annual Report and Accounts 2017 (Annual Report

2017).

The Company also announces that today, 5 April 2018, it posted

to shareholders the Notice of Annual General Meeting to be held at

2.00pm on Monday 14 May 2018 at the QEII Centre, Broad Sanctuary,

Westminster, London SW1P 3EE.

In accordance with Listing Rule 9.6.1, copies of the following

documents have been submitted to the UK Listing Authority and will

shortly be available for inspection from the National Storage

Mechanism at www.morningstar.co.uk/uk/NSM:

- Annual Report 2017;

- Annual Review 2017;

- Notice of Annual General Meeting 2018; and

- Proxy Form for the 2018 Annual General Meeting.

The above documents are also available at www.centrica.com/ar17

and www.centrica.com/agm18

This information should be read in conjunction with the

Company's preliminary results announcement. A condensed set of the

Company's financial statements and information on important events

that have occurred during the financial year and their impact on

the financial statements, were included in the preliminary results

announcement released on 22 February 2018. That information,

together with the information set out below, which is extracted

from the Annual Report 2017, is provided in accordance with the

Disclosure and Transparency Rule (DTR) 6.3.5R, which requires it to

be communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full Annual Report 2017. Page and note

references in the text below refer to page numbers and note numbers

in the Annual Report 2017.

Our Principal Risks and Uncertainties

Understanding those Risks that impact our Strategy

The fundamental trends outlined in our strategy on pages 10 and

11, including the decentralisation of energy systems, shift of

power to consumers and increasing digitisation, present both

opportunities and threats. Identifying and managing these risks is

critical to delivering our strategy. The Group Priorities, as laid

out below, are the lens through which we assess our risks and drive

discussions around the level of risk we need to take and the

requirements of our System of Risk Management and Internal

Control.

Strengthening our System of Risk Management and Internal

Control

Following our Strategic Review in 2015, we refreshed our

approach to risk

management. In 2017 we focused on embedding this improved

process aligned with the new operating model to ensure it makes a

positive contribution to effective decision-making and business

growth, while ensuring we successfully manage risks. In particular,

as we have moved into new geographies, we have sought to ensure we

are addressing risks associated with operating in those

jurisdictions.

Each business unit and Group function is responsible for

identifying and assessing its significant risks within the context

of our Principal Risks. For each risk, they consider both the

potential impact to the Group and the likelihood of occurrence on

an inherent and residual basis. The Executive Committee then

considers these perspectives alongside broader external and

internal factors to create a Group-wide set of prioritised

risks.

-- We categorise our risks as:

- Risk Requiring Standards (RRS):

Risk with negative impacts that we control through Standards and

Management Systems, for example process safety or data

security.

- Risk Requiring Judgement (RRJ): Risk that we choose to take in

order to execute our business strategy, for example new products or

business improvement opportunities.

- External Risk: Risk that requires a focus on scenario and

contingency planning with little or no ability to reduce

likelihood, for example extreme weather or geopolitical

turbulence.

On an annual basis, we evaluate our System of Risk Management

and Internal Control, learning from any control incidents that have

arisen, to ensure we are mitigating risks in line with our risk

appetite.

Determining the risk we would like to take

The Board approves statements of risk appetite associated with

each Group Priority. These statements provide a framework to guide

our risk mitigation activities and to drive the appropriate level

of risk taking:

-- Safety, compliance and conduct: Our appetite for taking risk

in this area is as low as reasonably practicable in relation to:

ensuring the safety of our people, customers and communities;

conducting our business operations in compliance with laws and

regulations; and managing our financial reporting risks.

-- Customer satisfaction and operational excellence: We have a

moderate risk appetite to allow us to pursue innovative

opportunities. We are driven to satisfy the changing needs of our

customers.

-- Cash flow growth and strategic momentum: We have a moderate to high risk appetite for seeking opportunities to deliver cash flow growth and our target return on capital.

-- Cost efficiency and simplification: We have a low risk

appetite for failing to implement and manage improvements

sustainably and in a rigorous and systematic way.

-- People and building capability: We accept a moderate level of

risk in finding ways to attract, develop and reward people with the

diverse capabilities needed to deliver our ambitions. However, we

have a low risk appetite for rewarding and retaining people who

fail to demonstrate our Values.

Evaluating Risks through our Enterprise Risk Framework

Our Enterprise Risk Framework is designed to enable us to

identify, evaluate and mitigate our risks appropriately. It

comprises of six steps:

1. Identify

-- Identify significant risks to achieving business unit and/or function objectives

2. Assess & Analyse

-- Assess inherent impact and likelihood using Centrica risk assessment matrix

-- Identify risk type (RRS, RRJ or External Risk) and determine target risk rating

-- Identify mitigating activity and key risk indicators and assess current risk exposure

3. Design & Implement Controls

-- Design and implement controls and actions to mitigate the

potential impact and likelihood of risks

4. Manage & Monitor

-- Management of risks and controls to deliver target risk level

-- Monitor through inspection, performance reviews and regular reporting

-- Identify and implement specific remediation actions

5. Calibrate & Assure

-- Group Functions calibrate submitted risks to ensure

consistency and prioritise their responses

-- Functional assurance and internal audit activity

-- Assess impact of assurance findings

6. Report, Evaluate & Improve

-- Report consolidated risk, assurance and control position to

the Group Risk, Assurance and Control Committee, Audit Committee

and Safety, Health, Environment, Security and Ethics Committee

-- Evaluate priority risks within the Group risk profile to identify any corrective actions

-- Evaluate Group-wide severe, but plausible risks and implications

-- Drive continuous improvement through reviewing the Risk Universe and Group risk appetite

Mitigating risks through the System of Risk Management and

Internal Control

Risk management is a key pillar of the overall governance and

management framework for the Group. Our system of Risk Management

and Internal Control comprises the following elements that are

assessed annually for effectiveness:

-- What we stand for:

- Our Purpose: We are an energy and services company. Everything

we do is focused on satisfying the changing needs of our

customers.

- Our Values: The new values were rolled out globally in

September 2017 to underpin our strategy and Priorities.

- Our Code: This was launched in early 2018 to replace our

Business Principles and provides the foundation for how we

operate.

-- Our strategic framework:

- Strategy: Set out in July 2015 and aligned throughout the

organization by the five Group Priorities.

- Financial framework: Sets out parameters and targets within

which we operate to guide our strategic planning and financial

decision making.

- Enterprise risk framework: Incorporates the Principal Risks

within the Group Risk Universe, as outlined on pages 55 to 60.

-- Our governance:

- Board and committees: Structured to effectively dispense with

required duties and through which our Principal Risks are

monitored.

- Legal entities: Subsidiary company legal entities with Boards

of Directors required to meet legal and regulatory obligations.

- Delegations of authority: Accountability is delegated through

the organisation to individuals in accordance with risk

appetite.

- Executive and committees: Oversight to ensure appropriate

planning and performance management.

-- How we are organised and managed:

- Management systems: The detailed policies, standards and

processes establishing the mandatory requirements and which are

required for the systematic management of related risks.

-- How we provide assurance:

- Functional assurance: Ensuring policies and standards are

complied with through monitoring and testing activities performed

by individuals who are not directly responsible for the operation

of the controls.

- Internal Audit: Providing confidence to the Board, via the

Audit Committee, that Centrica has appropriate risk management

procedures and effective controls in place.

- External assurance: Auditing of the Group's Annual Report and

Accounts prior to reporting, which includes assessment of internal

controls relevant to financial reporting.

Principal Risks

The Group Risk Universe is made up of a holistic framework of

Principal Risks, laid out below. The Board makes a robust

assessment of these Principal Risks, considering future performance

and our ability to deliver the strategy, including solvency and

liquidity risks. For each Principal Risk, we discuss the nature of

the risk, the risk climate and the impact on our Group Priorities.

Each Principal Risk is overseen directly by the Board or one of its

Committees, with the Board retaining overall responsibility for

risk across the Group.

Description Potential Mitigation

impacts

--- ---------------------- ---------------------- -----------------------------------------------------------------

1 Political Changes in

and Regulatory government * We are active in contributing our views on the

Intervention and regulatory development of the markets in which we operate and in

Risk of political oversight, discussions with political parties, regulatory

or regulatory specifically authorities and other influencers.

intervention relating to

such as the the Consumer

adoption Divisions * We are committed to an open, transparent and

of blanket markets in competitive UK energy market that provides choice for

price caps the UK and consumers. In November, we announced seven unilateral

in the UK North America, steps we would take and recommended a series of

energy supply such as the broader market reforms (as detailed on page 18).

market, changes developments

to the political in UK market

or regulatory regulation * The UK is due to exit the European Union within two

landscape, during 2017, years of Article 50 being triggered in March 2017. We

or failure could erode have a dedicated Brexit project group which is

to influence our profit working to understand and assess the many

that change. margins through Brexit-related issues which could impact the Group

External price caps, and our customers.

Risk or through

Governance additional

oversight: obligations * We accept that we may be the subject of regulatory

Board that increase scrutiny that could result in stakeholder concerns.

Risk Climate: operating We co-operate fully with any enquiry or investigation

Increased costs. The and take measures to react as quickly as possible.

Priority: UK's decision

Cash flow to exit the

growth and European Union

strategic and wider

momentum political

changes in

the markets

we operate

in present

risks relating

to changing

policies in

relation to

the energy

market change

and carbon

emissions.

--- ---------------------- ---------------------- -----------------------------------------------------------------

2 Financial Our exposure

Market to adverse * We have hedging strategies in place to mitigate

Risk of financial price movements exposure to

loss due in commodity

to our exposure markets, due

to market to our large commodity and financial

movements, upstream and market volatility.

including downstream * Financial risk is reviewed regularly by the Group

commodity positions, Finance Function and the Group Risk Assurance and

prices and could impact Control

volumes, profitability

inflation, and cash flow

interest generation Committee to assess

rates and across the financial exposures

currency business. and compliance with

fluctuations. Financial risk limits. Regular

External market risk review is also undertaken

Risk with is taken on by the Audit Committee.

elements by Energy * As we move into new trading arrangements, including

that are Marketing the continued expansion of our LNG business, we are

Risks Requiring & Trading focused on ensuring that our financial risk policies

Judgement (EM&T) as remain appropriate to the risks we face.

Governance part of the

oversight: proprietary

Board and trading business. * Our business units have risk measures, policies and

Audit Committee Increased monitoring commensurate with the activities and risks

Risk climate: volatility that they manage, and we invest in our systems to

at a similar in commodity further automate our control environment.

level prices could

Priority: provide more

Cash flow opportunities

growth and but also give

strategic rise to higher

momentum collateral

costs and/or

additional

credit risk

for both EM&T

and

North America

Business.

--- ---------------------- ---------------------- -----------------------------------------------------------------

3 Health, Safety, Our operations

Environment have the potential * We undertake regular reviews and have assurance

and Security to result processes in place with reporting to the HSES

(HSES) in personal Subcommittee on a quarterly basis and full discussion

Risk of failure or environmental of all issues arising.

to protect harm, or operational

the health, loss. Significant

safety and HSES events * The HSES management system is used to manage our

security could also controls, focusing on areas of concern including

of customers, have regulatory, process safety, driving and working at heights.

employees legal, financial

and third and reputational

parties or impacts that * We continue to invest in training to ensure we

to take appropriate would adversely maintain safe operating practices. During 2017 all

measures affect some senior leaders took part in a HSES leadership event.

to protect or all of

our environment our brands

and in response and businesses. * Security intelligence and operating procedures, as

to climate well as crisis management and business continuity

change. plans, are regularly evaluated and tested.

Risk Requiring

Standards

Governance * Significant Centrica representation on Board

oversight: Committees and establishment of a Shareholder Office

Board and to ensure that mitigation of HSES risks remains a

Safety, Health priority within the new joint venture organisation,

Environment, Spirit Energy.

Security

and Ethics

Committee * We actively engage with climate change bodies and

Risk climate: NGOs to offer our perspective, understand the

at a similar direction of potential future actions, and assess our

level readiness to manage through change.

Priority:

Safety, compliance

and conduct * A description of how we manage our environmental risk

is described on page 36.

--- ---------------------- ---------------------- -----------------------------------------------------------------

4 Strategy Successful

Delivery delivery of * The Board sets and approves the Group's strategy,

Risk that our strategy setting the strategic direction and confirming the

we do not requires delivering strategic choices made by the business. Regular

deliver our the energy reviews are conducted on changes in market trends and

strategy and services the competitive environment, and the business

due to insufficient our customers response.

capability desire in

to execute a way that

it in line satisfies * We have a clear financial framework to ensure capital

with plan their needs is allocated in line with the strategy and that

or failure in a competitive balance sheet strength and return on capital boundary

to adapt market place. conditions are met.

quickly enough Failure to

to respond identify changing

to changes trends in * The Board and Executive Committee regularly review

in the external customers' the capabilities required to deliver on the strategy

environment. needs, adapt and address gaps as they arise.

In our bottom-up to

process of changing market

risk reporting, and competitive

this is a environments,

key area deliver major

of focus transformation

for our business programmes

units and to be an efficient

functions. supplier,

Risk Requiring and build

Judgement the necessary

Governance capabilities

oversight: to compete,

Board have the potential

Risk climate: to impact

increased our cash flow

Priority: growth and

Cash flow value creation

growth and goals.

strategic

momentum

--- ---------------------- ---------------------- -----------------------------------------------------------------

5 External We operate

Market Environment in highly * We focus on understanding customer segments and their

Risk that competitive needs, aiming to design products and offerings that

events in and changing are attractive and competitive.

the external markets, where

market or customer behaviour,

environment needs and * We are increasing our investment in areas like

could affect demands are Connected Home and Distributed Energy & Power that

the delivery evolving due represent emerging customer needs and reinforce our

of our to digitisation, existing energy supply and services offerings,

strategy. energy efficiency, putting customers more in control of their energy use

External climate change, as described on page 33.

Risk government

Governance initiatives,

oversight: and the general * Regular analysis is undertaken of commodity price

Board economic outlook. fundamentals and their potential impact on our

Risk Climate: In addition, business plans and forecasts.

at a similar we are subject

level to global

Priority: market

Cash flow volatility

growth and in our upstream

strategic businesses

momentum in commodity

markets.

--- ---------------------- ---------------------- -----------------------------------------------------------------

6 Brand, Trust Failure to

and Reputation appropriately * We regularly monitor and review our level of customer

Risk that manage brand service, aiming to deliver a fair, simplified and

our competitive perception, transparent offering to all of our consumers.

position media attention Operational processes are in place to address failure

is compromised and campaign in service and customer complaints.

by poor standards or pressure

of fairness groups could

and transparency have a negative * We engage with NGOs, consumer and customer groups,

and by failing impact on political parties, regulators, charities and other

to protect consumer sentiment stakeholders to identify solutions to help reduce

our brands. and contribute bills and improve trust in the industry.

Risk Requiring to a fall

Judgement in overall

Governance customer numbers. * We review and monitor changes in our customer brand

oversight: Failure to position through net promoter score (NPS) and other

Board be fair and metrics as described on page 31.

Risk climate: transparent

increased in all our

Priority: operations * We consider our impact on society as part of being a

Customer could cause good corporate citizen. This is set out in the

satisfaction reputational Building strong communities section on pages 37 to

and operational damage and 38.

excellence if standards

are particularly

low, lead

to legal action.

--- ---------------------- ---------------------- -----------------------------------------------------------------

7 Change Management If change

Risk of failure projects are * Significant change management programmes are reviewed

in the not aligned as a regular aspect of Group and business unit

identification, to strategic performance reviews, and are regular agenda items of

alignment objectives Executive Committee meetings.

and execution or not implemented

of change appropriately,

programmes the expected * Change activity is managed through a network of

and business benefits may programme offices providing oversight and governance

restructuring. not be realised. at the appropriate level.

Risk Requiring If acquisitions

Judgement are not integrated

Governance effectively * We have dedicated change capability at Group and

oversight: the business business unit level to monitor the realisation of

Board benefits may benefits, the prioritisation of efforts and to share

Risk climate: not be realised. best practice.

at a similar

level

Priority: * Our people capability is continually reviewed and

Cost efficiency developed to ensure we have the right skills to

and simplification deliver our plans.

* We have post-merger integration guidelines in place

to integrate acquired businesses.

--- ---------------------- ---------------------- -----------------------------------------------------------------

8 Legal, Regulatory Our operations

and Ethical are the subject * Regulatory compliance monitoring activities are

Standards of intense performed by a single Group-wide function to drive

Compliance regulatory consistency and quality.

Risk of failure focus and

to comply we seek to

with laws deliver the * Control frameworks are in place in the UK and in

and regulations highest standards development in other markets to ensure that the

and behave in compliance. customer experience is delivered in line with our

ethically We recognise Customer Conduct guidelines. This is managed through

in line with any real or a Group-wide practice group.

Our Code, perceived

resulting failure to

in reputational follow Our * The Market Conduct practice group shares best

or financial Code or comply practice with standardised controls and processes and

damage. This with legal aligns mitigation activities where possible.

includes or regulatory

market conduct, obligations

customer would undermine * Data is a strategic asset and its protection is a

conduct, trust in our priority under a Steering Group led by the Executive

data protection business. Director, Centrica Consumer.

and financial Non-compliance

crime risk. could also

Risk Requiring result in * Our Code was launched globally in January 2018 to

Standards fines, penalties underpin the new values introduced in 2017. This sets

Governance or other the standard for behaviour across the Group.

oversight: interventions.

Board and

Safety, Health, * Where we enter new territories via acquisition or

Environment, organic growth we ensure country risks are identified

Security and managed appropriately, including anti-bribery and

and Ethics corruption risk and compliance with local

Committee legislation.

Risk climate:

at a similar

level

Priority:

Safety, compliance

and conduct

--- ---------------------- ---------------------- -----------------------------------------------------------------

9 Asset Development, Failure to

Availability invest in * Capital allocation and investment decisions are

and Performance the maintenance governed through the Investment Committee, the final

Risk that and development decision resting with the Group Chief Executive

failures of our assets Officer and/or Board of Directors.

in the development could result

or integrity in significant

of our investments safety issues * Group-wide minimum standards are applied to all

in operated or asset assets, whether operated or non-operated to give

and non-operated underperformance. confidence in their integrity.

assets could Operational

compromise integrity

performance is critical * Maintenance activity and improvement programmes are

delivery. to our ability conducted in all asset-based businesses to maximise

Risk Requiring to deliver effectiveness and production levels.

Judgement performance

Governance in line with

oversight: the strategic

Board objectives.

Risk climate:

decreased

Priority:

Customer

satisfaction

and operational

excellence

--- ---------------------- ---------------------- -----------------------------------------------------------------

10 Information Our substantial

Systems and customer base * Our information security strategy seeks to integrate

Security and strategic information systems, personnel and physical aspects

Risk of reduced requirement in order to prevent, detect and investigate threats

effectiveness, to be at the and incidents.

availability, forefront

integrity of technology

or security development, * We engage with key technology partners and suppliers,

of IT systems means that to ensure potentially vulnerable systems are

and data it is critical identified.

essential our technology

for Centrica's is robust,

operations. our systems * Regular controls testing and security patching around

Risk Requiring are secure our core systems is undertaken and our controls are

Standards and our data further tested periodically by outside experts.

with elements protected.

that are Sensitive

Risks Requiring data faces * Strengthening of the Chief Information Security

Judgement the threat Officer (CISO) role to oversee the development of

Governance of misappropriation, standards, controls and assurance across the Centrica

oversight: leading to estate.

Board and potential

Safety, Health, financial

Environment, loss and/or * We regularly evaluate the adequacy of our

Security reputational infrastructure and IT security controls, undertake

and Ethics damage to employee awareness and training and test our

Committee the Group. contingency and recovery processes, recognising the

Risk climate: Failure to evolving nature and pace of the threat landscape.

at a similar deliver IT

level solutions

Priority: in support * Established governance bodies to oversee plans to

Safety, compliance of the prioritised comply with new requirements including the European

and conduct objectives General Data Protection Regulation (GDPR).

and change

programmes

in the business

would have

consequences

both for our

organisational

transformation

and in some

cases, our

compliance

obligations.

--- ---------------------- ---------------------- -----------------------------------------------------------------

11 Financial The increasingly

Processing complex financial * Our financial control framework incorporates our

and Reporting accounting financial controls and management self-assessment

Risk of errors landscape, compliance, with progress being made to improve the

or losses including use of systems and reduce the reliance on manual

arising from new financial controls.

the processing reporting

and reporting standards,

of financial increases * We have implemented a revised balance sheet review

transactions the likelihood and reconciliation procedure to target minimising

for internal of errors control gaps arising in our underlying systems and

and external being made ensure that issues are detected on a timely basis.

purposes. in the application

This includes of accounting

potential judgements. * We undertake detailed testing and evaluation of the

errors such The potential effectiveness of our controls in response to critical

as the reassessment for failures financial risks and report to the Financial Risk,

of unbilled in core controls Assurance and Controls Committee quarterly.

power revenues around critical

in our North processes

America Business increases * Controls improvement is a key objective of the

Unit of GBP46m, in a period Finance transformation programme, with oversight of

reported of significant delivery of this objective provided by the Audit

in our November change. As Committee.

2017 trading Finance continues

update. to implement

Risk Requiring the functional

Standards transformation

Governance programme,

oversight: the risk of

Board control degradation

Risk climate: could increase

increased and this is

Priority: an area of

Safety, compliance significant

and conduct focus.

--- ---------------------- ---------------------- -----------------------------------------------------------------

12 Business We prioritise

Planning, how we use * Annual planning processes are subject to scrutiny and

Forecasting our resources challenge with respect to underlying market trends,

and Performance based on our competitive threats and organisational capability and

Management business plans delivery from the Executive Committee and the Board.

Risk that and forecasts.

plans and Failure to

forecasts accurately * Group Functions have adopted standardised planning

may not be plan and forecast, processes in support of the business priorities,

deliverable taking into driving improved integration of plans.

or may fail account the

to drive changing business

efficient environment, * Quarterly performance review meetings involving the

and effective could result Executive Committee enable the review of performance

performance in sub-optimal against forecasts, ensuring that mitigating actions

and the risk decisions or revisions are developed and implemented.

of failures and failure

in performance to realise

reporting. anticipated

This includes benefits.

the risk

that we do

not quickly

respond to

and reflect

performance

management

issues in

any of the

Business

Units as

and when

they arise.

Risk Requiring

Judgement

with elements

that are

Risks Requiring

Standards

Governance

oversight:

Board

Risk climate:

at a similar

level

Priority:

Cash flow

growth and

strategic

momentum

--- ---------------------- ---------------------- -----------------------------------------------------------------

13 People In challenging

Risk that conditions, * We continue to evolve a clearly defined people

we cannot it is critical strategy based on culture and engagement, equality

attract or that we attract and wellbeing, talent development, training and

retain employees and retain reward and recognition.

to ensure key capabilities

we have the across the

appropriate business. * We regularly review organisational capability in

capabilities The consequence critical business areas, reward strategies for key

to deliver of not being skills, talent management and learning and

our strategy. able to fulfil development programmes through external benchmarking.

There is key roles

also the could have

potential a detrimental * We conduct an annual survey of employee engagement

risk of industrial impact on and take seriously the messages arising with a plan

action in our ability of actions.

our Consumer to meet our

businesses. strategic

Risk Requiring objectives. * The Executive Committee has clear oversight through

Judgement The risk of regular discussions of the people related challenges

with elements industrial inherent in our transformation programme.

that are action in

Risks Requiring our businesses

Standards. would have * We engage with trade unions on restructuring and

Governance a potential issues that could impact terms and conditions with

oversight: impact on clear and open processes to promote an environment of

Board customer service trust and honesty.

Risk climate: levels and

increased retention.

Priority: We require * Our Code was launched in early 2018. This sets the

People and the right expectations for all employees, replacing the

building behaviours Business Principles.

capability from our leaders

and employees

to deliver

our business

strategy in

accordance

with our Values

and Our Code.

--- ---------------------- ---------------------- -----------------------------------------------------------------

14 Customer The delivery

Service of high quality * Customer and Field Operations teams monitor customer

Risk of failure customer service service levels, ensuring enquiries are answered in a

to consistently is central timescale and manner acceptable to the customer,

meet the to our business complaint levels are minimised, and that customer

expectations strategy. satisfaction is reviewed at all stages of the

of our customers With the entry customer journey.

through the of new competitors

customer to the market,

lifecycle. customers * Leadership teams in our front-line businesses

Risk Requiring are increasingly establish accountability for specific aspects of the

Judgement likely to customer journey and assess performance against

Governance switch if agreed metrics weekly.

oversight: they face

Board an unacceptable

Risk climate: customer experience. * Performance parameters are monitored on a weekly

at a similar Remaining basis for all third-party service providers involved

level at the forefront in the front-line and back office customer service

Priority: of digital process.

Customer developments

satisfaction and innovating

and operational to provide * Customer service agents are quality assessed for

excellence choice and consistency with a rigorous training and performance

control for management programme, and a structured performance

our customers management process is in place for field teams.

is critical.

This risk

faces increased * We operate an environment of continuous improvement,

scrutiny as incorporating an accredited programme (STAR), and use

political root cause analysis of complaint and NPS insight to

and regulatory continuously improve our service delivery.

attention

focuses on

introducing

competition

by applying

pressure over

pricing strategies.

--- ---------------------- ---------------------- -----------------------------------------------------------------

15 Balance Sheet Failure to

Strength operate within * We assess available resources on a regular basis and

and Credit the Group's this analysis underpins our going concern assumption

Position financial and viability analysis as described on pages 61 and

Risk that framework 62.

the balance resulting

sheet may in risk to

not be resilient maintaining * Significant committed facilities are maintained with

with implications our target sufficient cash held on deposit to meet working

for our credit credit rating, capital fluctuations as they arise.

rating, liquidity impacting

risk and our access

long-term to cost effective * Counterparty exposures are restricted through a Group

financial capital and Credit Limit policy which is regularly reviewed and

obligations. trading arrangements. adjusted as necessary.

Risk Requiring Long term

Judgement financial

Governance obligations * Wholesale credit risks associated with commodity

oversight: may increase trading and treasury positions are managed in

Board and in value due accordance with Group policy.

Audit Committee to factors

Risk climate: both inside

at a similar and outside * We consider accounting assumptions impacting on our

level of our control, balance sheet carefully, including decommissioning

Priority: for example and impairment, as described as part of the Group

Cash flow pension schemes, Financial Review on pages 48 to 51 and in note 3(b)

growth and resulting to the Financial Statements.

strategic in additional

momentum funding required

to meet our

obligations.

--- ---------------------- ---------------------- -----------------------------------------------------------------

16 Procurement Our business

and Supplier operations * All suppliers are required to sign up to our 'Ethical

Management rely on products Procurement' policies and procedures.

Risk of failure and services

to source provided through

responsibly third parties, * Financial health, risk and anti-bribery and

and to co-ordinate including corruption due diligence and monitoring is

and collaborate outsourced implemented in supplier selection and contract

with supply activities, renewal processes.

chain partners infrastructure

to ensure and operating

value delivery responsibility * Audits are conducted in relation to third-party

and continuity. for some assets. operation of jointly operated Exploration &

Risk Requiring We rely on Production assets.

Judgement these parties

with elements to comply

that are not only with * We review the ethical conduct of our suppliers

Risks Requiring contractual including a programme of supplier visits to provide

Standards terms, but additional assurance over practices employed,

Governance also legal, including respect for human rights, as part of being

oversight: regulatory a good corporate citizen as laid out on page 38.

Board and ethical

Risk climate: business

at a similar requirements. * Procurement practices have been reviewed across the

level Group and a global Procurement Policy and Standard

Priority: was implemented from 1 January 2018.

Customer

satisfaction

and operational

excellence

--- ---------------------- ---------------------- -----------------------------------------------------------------

Related Party Transactions

The Group's principal related party is its investment in Lake

Acquisitions Limited, which owns the existing EDF UK nuclear fleet.

The disclosures below, including comparatives, only refer to

related parties that were related in the current reporting

period.

During the year, the Group entered into the following arm's

length transactions with related parties who are not members of the

Group, and had the following associated balances:

2017 2016

Sale Purchase Sale Purchase Amounts

of goods of goods Amounts Amounts of goods of goods owed Amounts

and and owed owed and and from owed

services services from to services services (i) to

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- --------- --------- ------- ------- --------- --------- ------- -------

Joint ventures:

Wind farms (i) 1 (10) - - 7 (80) 120 (43)

Associates:

Nuclear - (527) - (40) - (617) - (57)

Other - - - - 4 (5) - -

----------------- --------- --------- ------- ------- --------- --------- ------- -------

1 (537) - (40) 11 (702) 120 (100)

----------------- --------- --------- ------- ------- --------- --------- ------- -------

(i) Disposed on 17 February 2017. See note 12(d) for further

details. Transactions have only been included above up to this

disposal date.

During the year, there were no material changes to commitments

in relation to joint ventures and associates. During the year a

provision against a receivable from one of the Group's joint

ventures was charged to the Group Income Statement amounting to

GBP1 million. No other provision for bad or doubtful debts relating

to amounts owed from related parties was recognised during the year

through the Group Income Statement (2016: nil). The balance of the

provision at 31 December 2017 was nil (2016: nil)

At the balance sheet date, the Group committed facilities to the

Lake Acquisition Group totalling GBP120 million, although nothing

has been drawn at 31 December 2017.

Key management personnel comprise members of the Board and

Executive Committee, a total of 18 individuals at 31 December 2017

(2016: 18).

Remuneration of key management personnel 2017 2016

Year ended 31 December GBPm GBPm

----------------------------------------- ----- -----

Short-term benefits 9.8 15.8

Post employment benefits 1.3 1.1

Share-based payments 4.8 7.8

----------------------------------------- ----- -----

15.9 24.7

----------------------------------------- ----- -----

Remuneration of the Directors of Centrica

plc 2017 2016

Year ended 31 December GBPm GBPm

--------------------------------------------- ----- -----

Total emoluments (i) 4.0 9.8

Amounts receivable under long-term incentive

schemes 1.9 -

Contributions into pension schemes 0.8 0.8

--------------------------------------------- ----- -----

(ii) These emoluments were paid for services performed on behalf

of the Group. No emoluments related specifically to services

performed for the Company. 2016 comparatives have been restated.

Further detail is provided in the Remuneration Report on pages 78

to 89.

Directors' responsibilities statement

In compliance with DTR 4.1.12R, the Annual Report 2017 contains

a Directors' responsibilities statement. This is reproduced below,

in line with DTR 6.3.5R. The statement relates to and is extracted

from the Annual Report 2017 and does not attach to the extracted

information presented in this announcement or the preliminary

results announcement released on 22 February 2018.

The Directors, who are named on pages 64 and 65, are responsible

for preparing the Annual Report, the Remuneration Report, the

Strategic Report and the Financial Statements in accordance with

applicable law and regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Accordingly, the Directors have

prepared the Group Financial Statements in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU) and have elected to prepare the Company

Financial Statements in accordance with United Kingdom Generally

Accepted Accounting Practice including FRS 101 'Reduced Disclosure

Framework' (United Kingdom Accounting Standards and applicable

law). Under company law, the Directors must not approve the

Financial Statements unless they are satisfied that they give a

true and fair view of the state of affairs of the Group and the

Company and of the profit or loss of the Group for that period. In

preparing these Financial Statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether IFRS as adopted by the EU and applicable UK

Accounting Standards have been followed, subject to any material

departures disclosed and explained in the Group and Company

Financial Statements respectively; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and the Group and enable them to

ensure that the Financial Statements and the Remuneration Report

comply with the Act and, as regards the Group Financial Statements,

Article 4 of the IAS Regulation. They are also responsible for

safeguarding the assets of the Company and the Group and hence for

taking reasonable steps for the prevention and detection of fraud

and other irregularities.

Furthermore, the Directors are responsible for the maintenance

and integrity of the Company's website. Legislation in the UK

governing the preparation and dissemination of Financial Statements

may differ from legislation in other jurisdictions.

The Directors consider that the Annual Report and Accounts 2017,

when taken as a whole, is fair, balanced and understandable and

provides the information necessary for shareholders to assess the

Group's performance, business model and strategy.

Each of the Directors confirm that to the best of their

knowledge:

-- the Group Financial Statements, which have been prepared in

accordance with IFRS as adopted by the EU, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Group;

-- the Strategic Report contained on pages 2 to 62 together with

the Directors' and Corporate Governance Report on pages 63 to 100,

includes a fair review of the development and performance of the

business and the position of the Group, together with a description

of the principal risks and uncertainties that it faces;

-- as outlined on page 73, there is no relevant audit

information of which Deloitte LLP are unaware; and

-- they have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

ENDS

Enquiries:

Investors and Analysts:

Tel: +44 (0)1753 494900

Email: ir@centrica.com

Media:

Tel: +44 (0)1784 843000

Email: media@centrica.com

Centrica plc is listed on the London Stock Exchange (CNA)

Registered Office: Millstream, Maidenhead Road, Windsor,

Berkshire SL4 5GD

Registered in England & Wales number: 3033654

Legal Entity Identifier number: E26EDV109X6EEPBKVH76

ISIN number: GB00B033F229

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSVELBBVZFLBBX

(END) Dow Jones Newswires

April 05, 2018 06:00 ET (10:00 GMT)

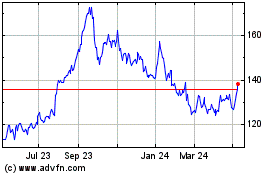

Centrica (LSE:CNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

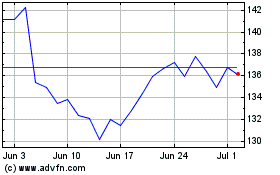

Centrica (LSE:CNA)

Historical Stock Chart

From Apr 2023 to Apr 2024