TIDMCCP

RNS Number : 3664E

Celtic PLC

08 February 2018

Celtic plc (the "Company")

INTERIM REPORT FOR THE SIX MONTHS TO 31 DECEMBER 2017

Operational Highlights

-- Currently top of the SPFL Premiership

-- Winners of the Scottish League Cup for the second season in a row

-- 19 home fixtures (2016: 18)

-- Successfully qualified for the Group Stages of UEFA Champions League

-- Secured European football after Christmas by qualifying for

the round of 32 of the Europa League

Financial Highlights

-- Revenue increased by 16.8% to GBP71.5m (2016: GBP61.2m)

-- Profit from trading was GBP23.7m (2016: GBP21.4m)

-- Profit from transfer of player registrations (shown as profit

on disposal of intangible assets) GBP0.5m (2016: GBP2.0m)

-- Profit before taxation of GBP19.5m (2016: GBP18.6m)

-- Profit after taxation of GBP17.4m (2016: GBP18.6m)

-- Period end net cash at bank of GBP30.9m (2016: GBP18.6m)

Celtic plc

CHAIRMAN'S STATEMENT

I am pleased to report on our interim results for the period

ended 31 December 2017. These show revenue of GBP71.5m (2016:

GBP61.2m) and a profit from trading of GBP23.7m (2016: GBP21.4m).

Overall this resulted in a profit before taxation of GBP19.5m

(2016: GBP18.6m) and a period end net cash at bank of GBP30.9m

(2016: GBP18.6m). The introductory page to these interim results

summarises the main highlights.

We are delighted with the sustained period of success on the

pitch, as Brendan Rodgers, his backroom team and the players have

built on their achievements of last season. They are to be

congratulated on qualification for the group stages of the UEFA

Champions League for a second successive season, for retaining the

League Cup and for the record breaking 69 game domestic unbeaten

run. At the time of writing, we sit 8 points clear at the top of

the Scottish Premiership and, as we continue to progress in the

Scottish Cup, we retain the prospect of winning an historic back to

back domestic treble.

During the period we secured the permanent registrations of

Olivier Ntcham and Kundai Benyu, and the temporary registration of

Patrick Roberts. Our profit on disposal of intangible assets of

GBP0.5m (2016: GBP2.0m) largely reflects the transfer of the

registrations of Gary Mackay Steven and Saidy Janko. Subsequently,

during the January 2018 transfer window, we have invested further

by acquiring the permanent registrations of experienced German

Bundesliga defender Marvin Compper, exciting young Scottish talents

Lewis Morgan and Jack Hendry and the temporary registrations of

sought after midfielder Charly Musonda and goalkeeper Scott

Bain.

The Board is committed to a course of investment in the playing

squad so as to be as competitive as we can be within the structure

of Scottish football and on the European stage. With our full

support and encouragement, Brendan seeks to enhance the squad by

the careful acquisition of quality players and the development of

existing players and young talent coming up from our Youth Academy.

Youth Academy graduates James Forrest, Kieran Tierney, Michael

Johnston, Callum McGregor, Calvin Miller and Anthony Ralston have

all contributed to the first team this year. Furthermore, we were

delighted to agree an extended contract with Kieran Tierney, who

has captained Celtic and his country during the season.

The Board is also pursuing initiatives to enhance the Club's

assets at Celtic Park, so as to aid our playing competitiveness, as

in the case of the recent pitch improvements, and to develop and

commercialise the space we occupy, as in the case of our recent

planning application for a hotel, retail store and museum. The

Board's investment policy, nonetheless, recognises the uncertainty

inherent in football, and our long held strategy of operating a

self-sustaining financial model.

Looking forward, and entirely in line with our trading

seasonality, we do not expect the same level of financial

performance in the second half of the year. In this period we will

play fewer home fixtures and revenue from European competition will

be lower. Our key objectives for the remainder of the year are to

win the SPFL Premiership, secure the Scottish Cup and build towards

the European qualifiers in the summer. The Club will also continue

to look at ways in which to develop Celtic Park and the surrounding

area to create a destination and match day experience that all

Celtic fans can be proud of.

Celtic plc

CHAIRMAN'S STATEMENT

Celtic FC Foundation, which sits outwith the Group, continues to

develop its reach and to assist more people in our communities, in

line with the Club's founding principles. Most recently, the 2017

Christmas Appeal raised in excess of GBP230,000, which was split

between local families with children, local old age pensioners,

children's charities, women's aid charities and homeless, refugee

and other vulnerable groups. Following the success of the

Foundation's Lions Legacy campaign, these fantastic achievements

are testament to the hard work and generosity of the Celtic

family.

On behalf of the Board, I thank our fans, shareholders and

partners, whose support is vital as we continue to build for the

future.

Ian P Bankier

8 February 2018

Chairman

For further information contact:

Company

Ian Bankier, Celtic plc Tel: 0141 551 4235

Peter Lawwell, Celtic plc Tel: 0141 551 4235

Canaccord Genuity Limited, Nominated Adviser

Bruce Garrow Tel: 020 7523 8350

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Celtic plc

INDEPENT REVIEW REPORT TO CELTIC PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the interim report for the six months

ended 31 December 2017 which comprises the consolidated statement

of comprehensive income, the consolidated balance sheet, the

consolidated statement of changes in equity, the consolidated cash

flow statement and the related notes.

We have read the other information contained in the interim

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the interim report

based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim report for the six months ended 31 December 2017 is

not prepared, in all material respects, in accordance with the

rules of the London Stock Exchange for companies trading securities

on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

Glasgow

United Kingdom

Date 8 February 2018

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Celtic plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTHS TO 31 DECEMBER 2017

2017 2016

Unaudited Unaudited

Note GBP000 GBP000

Revenue 2 71,505 61,229

Operating expenses (before intangible

asset transactions and exceptional

items) 3 (47,815) (39,821)

------------- -------------

Profit from trading before intangible

asset transactions and exceptional

items 23,690 21,408

Exceptional operating expenses - (646)

Amortisation of intangible assets 4 (4,227) (3,849)

Profit on disposal of intangible

assets 482 1,959

Operating profit 19,945 18,872

Finance income 5 47 119

Finance expense 5 (482) (391)

Profit before tax 19,510 18,600

Income tax expense 6 (2,130) -

------------- -------------

Profit and total comprehensive

income for the period 17,380 18,600

------------- -------------

Basic earnings per Ordinary Share 7 18.57p 19.92p

============= =============

Diluted earnings per share 7 12.94p 13.84p

============= =============

Celtic plc

Registered number SC3487

CONSOLIDATED BALANCE SHEET

31 December 31 December

2017 2016

Unaudited Unaudited

Notes GBP000 GBP000

NON-CURRENT ASSETS

Property plant and equipment 56,637 54,998

Intangible assets 8 15,996 13,224

Deferred tax asset 891 -

73,524 68,222

CURRENT ASSETS

Inventories 2,039 1,615

Trade and other receivables 9 15,608 15,972

Cash and cash equivalents 37,410 25,392

--------------- ---------------

55,057 42,979

--------------- ---------------

TOTAL ASSETS 128,581 111,201

=============== ===============

EQUITY

Issued share capital 10 27,123 24,318

Share premium 14,720 14,657

Other reserve 21,222 21,222

Capital reserve - 2,781

Accumulated profits 11,817 6,140

--------------- ---------------

TOTAL EQUITY 74,882 69,118

=============== ===============

LIABILITIES

NON-CURRENT LIABILITIES

Interest bearing loans 6,350 6,550

Debt element of Convertible

Cumulative Preference

Shares 4,216 4,241

Trade and other payables 10,293 -

Provisions 1,082 1,285

Deferred income 86 143

--------------- ---------------

22,027 12,219

--------------- ---------------

CURRENT LIABILITIES

Trade and other payables 17,035 15,930

Current borrowings 304 304

Provisions 709 106

Deferred income 13,624 13,524

--------------- ---------------

31,672 29,864

--------------- ---------------

TOTAL LIABILITIES 53,699 42,083

=============== ===============

TOTAL EQUITY AND LIABILITIES 128,581 111,201

=============== ===============

Approved by the Board on 8 February 2018

Celtic plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Other Capital Retained Total

capital premium reserve reserve earnings

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

EQUITY SHAREHOLDERS'

FUNDS AS AT 1 JULY

2016 (Audited) 24,316 14,611 21,222 2,781 (12,460) 50,470

Share capital issued 1 46 - - - 47

Reduction in debt

element of

convertible cumulative

preference shares 1 - - - - 1

Profit and total

comprehensive income

for the period - - - - 18,600 18,600

EQUITY SHAREHOLDERS'

FUNDS AS AT 31

DECEMBER 2016 (Unaudited) 24,318 14,657 21,222 2,781 6,140 69,118

EQUITY SHAREHOLDERS'

FUNDS AS AT 1 JULY

2017 (Audited) 27,107 14,657 21,222 - (5,563) 57,423

Share capital issued 1 63 - - - 64

Reduction in debt

element of convertible

cumulative preference

shares 15 - - - - 15

Profit and total

comprehensive income

for the period - - - - 17,380 17,380

EQUITY SHAREHOLDERS'

FUNDS AS AT 31

DECEMBER 2017 (Unaudited) 27,123 14,720 21,222 - 11,817 74,882

========== =========== =========== =========== ============ ==========

Celtic plc

CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to to

31 December 31 December

2017 2016

Note Unaudited Unaudited

GBP000 GBP000

Cash flows from operating activities

Profit before tax 19,510 18,600

Depreciation 881 820

Amortisation 4,227 3,849

Impairment of intangible

assets - 358

Profit on disposal of intangible

assets (482) (1,959)

Net finance costs 435 272

-------------- --------------

24,571 21,940

Decrease in inventories 375 274

(Increase) in receivables (7,028) (5,178)

(Decrease) in payables and

deferred income (364) (5,540)

-------------- --------------

Cash generated from operations 17,554 11,496

Net interest paid (25) (42)

-------------- --------------

Net cash flow from operating

activities 17,529 11,454

-------------- --------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (946) (540)

Purchase of intangible assets (8,874) (5,218)

Proceeds from sale of intangible

assets 5,769 9,833

-------------- --------------

Net cash (used in) / generated

from investing activities (4,051) 4,075

-------------- --------------

Cash flows from financing

activities

Repayment of debt (100) (100)

Dividend on Convertible Cumulative

Preference Shares (473) (487)

-------------- --------------

Net cash used in financing

activities (573) (587)

-------------- --------------

Net increase in cash equivalents 12,905 14,942

Cash and cash equivalents

at 1 July 24,505 10,450

-------------- --------------

Cash and cash equivalents

at period end 11 37,410 25,392

============== ==============

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

1. BASIS OF PREPARATION

The financial information in this interim report comprises the

Consolidated Statement of Comprehensive Income, Consolidated

Balance Sheet, Consolidated Statement of Changes in Equity,

Consolidated Cash Flow Statement and accompanying notes. The

financial information in this interim report has been prepared

under the recognition and measurement requirements of IFRSs as

adopted for use in the European Union but does not include all of

the disclosures that would be required under those accounting

standards. The accounting policies adopted in the financial

information are consistent with those expected to be adopted in the

Company's financial statements for the year ended 30 June 2018 and

are unchanged from those used in the Company's annual report for

the year ended 30 June 2017.

The financial information in this interim report for the six

months to 31 December 2017 and to 31 December 2016 has not been

audited, but it has been reviewed by the Company's auditor, whose

report is set out on page 4. Any comparative figures for the year

ended 30 June 2017 are extracted from the Group's audited financial

statements for that period as filed with the Registrar of

Companies. The financial information for the year ended 30 June

2017 does not constitute the Company's financial statements for

that period but is derived from them. The Company's statutory

financial statements for the year ended 30 June 2017 have been

filed with the Registrar of Companies. The auditor's report on

those statutory financial statements was unqualified.

Assessment on adoption of standards not yet effective

At the date of authorisation of this interim report the

following standards were not effective however will be adopted in

accordance with their effective dates. An update as to the Group's

assessment of the impact of each standard is provided below.

IFRS 9: Financial Instruments - A detailed review of the impact

of this standard is in progress and will be completed by the end of

the current financial year, the conclusion of which will be

disclosed in the annual report.

IFRS 15: Revenue from Contracts with Customers - we have

performed a review of the Group's revenue recognition policy for

each activity type and our initial assessment is that on full year

basis any impact on revenue will be immaterial. With regards to

interim reporting, the impact of applying this standard has yet to

be concluded however the assessment will be completed by the end of

the current financial year and disclosure will be made in the

annual report.

IFRS 16: Leases - Based on our assessment, the net impact to the

Group's financial statements is not considered to be material, but

we will recognise the asset value of the operating leases within

assets and a liability reflecting the associated future

obligations. There will also be a reallocation in the Statement of

Comprehensive Income from rental costs to depreciation within

Operating Expenses and to the unwinding of discount charge within

Finance Expense. As this stage the value associated with the above

adjustments has yet to be quantified.

Going concern

The Company has considerable financial resources available to

it, together with established contracts with a number of customers

and suppliers. As a consequence, the Directors believe that the

Company is well placed to continue managing its business risks

successfully and they have a reasonable expectation that the

Company has adequate resources to continue in operational existence

for the foreseeable future. Thus, they continue to adopt the going

concern basis of accounting in preparing the financial information

in this interim report.

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

2. REVENUE

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

GBP000 GBP000

Football and stadium operations 26,802 22,583

Multimedia & other commercial

activities 34,011 29,917

Merchandising 10,692 8,729

71,505 61,229

============== ==============

Number of home games 19 18

============== ==============

3. TOTAL OPERATING EXPENSES

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

GBP000 GBP000

Football and stadium operations

(excluding exceptional items

and asset transactions) 40,677 33,682

Merchandising 5,923 4,968

Multimedia & other commercial

activities 1,215 1,171

--------------

47,815 39,821

============== ==============

4. EXCEPTIONAL OPERATING EXPENSES

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

GBP000 GBP000

Impairment of intangible

assets - 358

Compromise payments on

contract termination - 288

---------------- --------------

- 646

================ ==============

5. FINANCE INCOME AND EXPENSE

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

Finance income: GBP000 GBP000

Interest receivable on

bank deposits 35 19

Notional interest income

on deferred consideration 12 100

-------------- --------------

47 119

============== ==============

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

5 FINANCE INCOME AND EXPENSE (CONTINUED)

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

GBP000 GBP000

Finance expense:

Interest payable on bank

and other loans (61) (62)

Notional interest expense

on deferred consideration (134) (40)

Dividend on Convertible

Cumulative Preference

Shares (287) (289)

-------------- --------------

(482) (391)

============== ==============

6. TAXATION

Tax has been charged at 19% for the six months ended 31 December

2017 (2016: 19.75%) representing the best estimate of the average

annual effective tax rate expected to apply for the full year,

applied to the pre-tax income of the six month period. A deferred

tax asset of GBP0.6m has been reversed due to the utilisation of

tax losses. A deferred tax asset of GBP1.5m has been recognised in

respect of short term timing differences and is offset by an

existing deferred tax liability of GBP0.6m relating to accelerated

capital allowances.

7. EARNINGS PER SHARE

Basic earnings per share has been calculated by dividing the

profit for the period of GBP17.4m (2016: GBP18.6m) by the weighted

average number of Ordinary Shares in issue 93,591,020 (2016:

93,374,010). Diluted earnings per share as at 31 December 2017 has

been calculated by dividing the profit for the period by the

weighted average number of Ordinary Shares, Convertible Cumulative

Preference Shares and Convertible Preferred Ordinary Shares in

issue, assuming conversion at the balance sheet date if

dilutive.

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

8. INTANGIBLE ASSETS

6 months 6 months

to to

31 December 31 December

2017 2016

Unaudited Unaudited

Cost GBP000 GBP000

At 1 July 34,335 28,244

Additions 6,634 9,497

Disposals (2,591) (5,167)

-------------- --------------

At period end 38,378 32,574

============== ==============

Amortisation

At 1 July 20,408 18,446

Charge for the period 4,227 3,849

Provision for impairment - 358

Disposals (2,253) (3,303)

-------------- --------------

At period end 22,382 19,350

============== ==============

Net Book Value at period

end 15,996 13,224

============== ==============

9. TRADE AND OTHER RECEIVABLES

The decrease of GBP0.4m in receivables from 31 December 2016 to

GBP15.6m is primarily due to the receipt of player receivables

offset

by the value of UEFA receivables and increase in prepaid

costs.

10. SHARE CAPITAL

Authorised Allotted, called

up and fully paid

31 December 31 December

2017 2016 2017 2017 2016 2016

Unaudited Unaudited Unaudited

No No No GBP000 No GBP000

000 000 000 000

Equity

Ordinary Shares of

1p each 223,101 222,869 93,696 937 93,403 934

Deferred Shares of

1p each 647,036 635,145 647,036 6,470 635,145 6,351

Convertible Preferred

Ordinary Shares of

GBP1 each 14,923 14,994 12,936 12,936 13,007 13,007

Non-equity

Convertible Cumulative

Preference Shares of

60p each 18,459 18,543 15,959 9,576 16,043 9,626

Less reallocated to

debt:

Initial debt - - - (2,796) - (2,819)

Capital reserve - - - - - (2,781)

---------- ----------

903,519 891,551 769,627 27,123 757,598 24,318

========== ========== ========== ========== ========== ===========

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

11. ANALYSIS OF NET CASH AT BANK

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net cash is as follows:

31 December 31 December

2017 2016

Unaudited Unaudited

GBP000 GBP000

Bank Loans due after more

than one year (6,350) (6,550)

Bank Loans due within one

year (200) (200)

Cash and cash equivalents:

Cash at bank and on hand 37,410 25,392

------------- -------------

Net cash at bank at period

end 30,860 18,642

============= =============

Total net cash, deducting other loans of GBP0.1m (2016: GBP0.1m)

and that arising from the reclassification of equity to debt of

GBP4.2m (2016: GBP4.2m) amounted to GBP26.5m (2016: GBP14.3m).

12. POST BALANCE SHEET EVENTS

Since the balance sheet date, we have secured the permanent

registrations of Marvin Compper from RB Leipzig, Lewis Morgan from

St Mirren and Jack Hendry from Dundee, and the temporary

registrations of Charly Musonda from Chelsea and Scott Bain from

Dundee. We have also permanently transferred the registration of

Liam Henderson to Bari and temporarily transferred the

registrations of first team players Nadir Ciftci to Motherwell,

Lewis Morgan to St Mirren, Kundai Benyu to Oldham Athletic, Erik

Sviatchenko to FC Midtjylland, Scott Allan to Hibernian and Conor

Hazard to Falkirk.

We also temporarily transferred the registrations of development

squad players, Regan Hendry to Raith Rovers, Jamie McCart to Alloa

Athletic, Mark Hill to St Mirren and Joe Thomson to Queen of the

South.

Celtic plc

Directors

Ian P Bankier (Chairman)

Peter T Lawwell (Chief Executive)

Chris McKay (Finance Director)

Thomas E Allison

Dermot F Desmond

Brian D H Wilson

Sharon Brown

Company Secretary

Michael Nicholson

Registered Office

Celtic Park

Glasgow

G40 3RE

Registered Number

SC3487

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDDBGGBGII

(END) Dow Jones Newswires

February 08, 2018 11:05 ET (16:05 GMT)

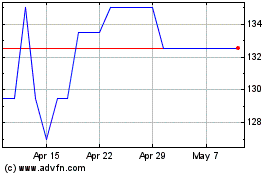

Celtic (LSE:CCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

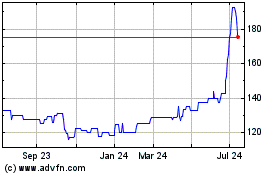

Celtic (LSE:CCP)

Historical Stock Chart

From Apr 2023 to Apr 2024