Carrefour to Cut Jobs, Enter Tencent Partnership in Reorganization -- Update

January 23 2018 - 4:25AM

Dow Jones News

(Adds share price, dividend detail, analyst comments.)

By Anthony Shevlin

French retailer Carrefour SA (CA.FR) on Tuesday said that it

intends to cut jobs, form new partnerships and reduce costs as part

of a new strategic plan aimed at shoring up its faltering

performance.

Among the measures are a partnership with China's Tencent

Holdings Ltd (0700.HK) and the offer of voluntary-redundancy

packages for thousands of employees in France.

Carrefour, Europe's biggest retailer by revenue, last week cut

its earnings outlook as it continues to struggle with eroding

domestic-market share. It faces challenges outside France and from

digital competitors.

Investors seemed to welcome the plan. At 0849 GMT, Carrefour

shares were trading 5.7% higher at EUR19.51.

"[The] transformation plan ticks all the right boxes," analysts

at Bernstein said, citing measures focused on productivity and

competitiveness gains, investment and a simpler organization.

The retailer plans investments of 2 billion euros ($2.44

billion) annually as of this year, with EUR2.8 billion over the

next five years set to be channeled into enhancing its digital

offering.

As part of its digital plan, Carrefour said it aims to become a

key player in food e-commerce with a market share of at least 20%

in France by 2022 and sales of EUR5 billion.

Carrefour said will offer about 2,400 employees a

voluntary-redundancy package at its French headquarters in the

Ile-de-France region. The company said it will close the

headquarters in Boulogne and scrap plans to build new headquarters

in Essonne. Carrefour currently employs 10,500 people at its head

office.

Meanwhile, Carrefour said it plans to divest 273 former Dia

stores. If a buyer isn't found, they will be closed, the company

said.

Carrefour said it has also made agreements for new partnerships,

including a strategic cooperation with Tencent in China aimed at

improving Carrefour's online visibility, increasing traffic both

offline and online and using Tencent's expertise to develop retail

initiatives. The deal is subject to further diligence.

Tencent and Yonghui Superstores Co. Ltd (601933.SH) have shown

interest in making a potential investment in Carrefour China,

though Carrefour would remain the largest shareholder in the

operation, it said.

"While some will be disappointed not to see an outright sale of

China, these are both strong strategic partners and we would argue

give the group the best possible ability to turn the business

around," Bernstein said.

Elsewhere, Carrefour entered a partnership with Stuart, a

subsidiary of the La Poste (PST.YY) group, aimed at improving

deliveries. Carrefour said it had formed another partnership with

Sapient, a division of the Publicis Groupe SA (PUB.FR), to

implement the transformation of its e-commerce offer.

Carrefour said it plans to cut costs by EUR2 billion annually by

2020. It said measures to achieve this aim will include the

optimization of direct purchasing, the rationalization of indirect

purchasing and the reduction of logistics costs.

The retailer said it aims to maintain its dividend policy, with

a payout of between 45% and 50% of adjusted net profit.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com

(END) Dow Jones Newswires

January 23, 2018 04:10 ET (09:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

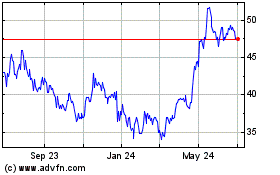

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

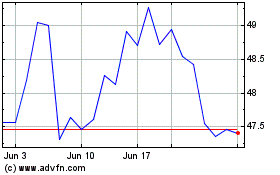

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024