Carl Icahn to Oppose Dell's Purchase of DVMT Tracking Shares

October 15 2018 - 6:38AM

Dow Jones News

By Cara Lombardo

Carl Icahn is gearing up for another battle with Michael

Dell.

The activist investor, who fought Mr. Dell when he took his

namesake computer company private in 2013, will challenge plans to

take it public again.

Mr. Icahn on Monday disclosed that he has boosted his stake in

shares that track Dell Technologies Inc.'s interest in VMware Inc.

to 8.3%. He said in a letter that he plans to vote against Dell

Technologies' plan to buy the stock -- known by its ticker, DVMT --

and encourage other shareholders to do the same.

The move represents a serious challenge to a deal that is meant

to streamline Dell's complicated ownership structure and return the

company to the public markets. Several other investors are already

unhappy with the proposal, which Dell and investment firm Silver

Lake announced in July, and Mr. Icahn's public opposition lengthens

the odds of winning shareholder approval.

Mr. Icahn argues that the current deal, which would allow

tracking-stock holders to exchange each share for 1.3665 shares of

what will become a newly public Dell, or $109 in cash,

significantly undervalues DVMT stock.

"I firmly believe Dell and Silver Lake are trying to capture $11

billion of value that rightly belongs to us," he said in an open

letter to other shareholders. Mr. Icahn said he believes DVMT is

worth approximately $144 a share, based on recent DVMT and VMware

share prices. It currently trades at about $94.50.

The special committee of Dell's board representing DVMT

shareholders previously said it examined several alternatives and

determined the current offer maximizes value.

The deal has been unpopular with shareholders since it was

announced. Holders of around 20% of DVMT -- including Mr. Icahn,

fellow activist Elliott Management Corp., some teams at BlackRock

Inc. and others -- were already considering rejecting it, The Wall

Street Journal previously reported.

While Mr. Icahn didn't initially intend to challenge the deal,

his plans changed as more investors voiced concerns privately to

him, no other large shareholder came forward and he did more

research, according to people familiar with the matter.

He recently boosted his position from 1.2%.

P. Schoenfeld Asset Management LP, which owns a much smaller

DVMT stake, said in a letter made public Oct. 5 that the

consideration should be increased by 20%. Mr. Icahn would be

unlikely to support a deal even at that price, the people said.

Mr. Icahn also said in his letter he is considering making a

competing partial bid to buy DVMT shares, should some holders want

to cash out at a lower price than he feels is fair.

Dell, which has been meeting with investors in an effort to sell

the deal, has said its offer is final. As shareholder

dissatisfaction simmered, Dell interviewed several banks about the

possibility of a straight initial public offering, which it saw as

a backup option should the current deal fail, the Journal reported

last month. But Mr. Icahn and other DVMT shareholders have

dismissed it as an empty threat.

Once the largest personal-computer maker, Dell is now known as

much for its corporate products such as storage, servers and

security software. Its majority stake in VMware is seen as its most

promising asset.

DVMT was created to help finance Dell's 2016 purchase of storage

pioneer EMC. Dell went private in a roughly $25 billion leveraged

buyout in 2013 by Mr. Dell and Silver Lake.

In Mr. Icahn's several-month clash with Dell at the time, the

buyout group eventually marginally increased the price and added a

dividend, prompting Mr. Icahn to relent.

In his letter Monday, Mr. Icahn said he doesn't expect a fast

resolution. "I intend to do everything in my power to stop this

proposed DVMT merger," he wrote.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

October 15, 2018 06:23 ET (10:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

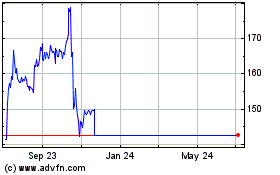

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024