Cardinal Health Looks to Scale Back in China -- WSJ

July 22 2017 - 3:02AM

Dow Jones News

By Anne Steele and Joseph Walker

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 22, 2017).

Cardinal Health Inc. is exploring a sale of its China

distribution operations, marking a potential exit from the region's

fast-growing pharmaceuticals market.

In a note to investors Thursday, the company said it was

exploring strategic alternatives for Cardinal Health China.

"The China market clearly has outstanding potential for further

growth," the note said. "The challenge, however, is that to take

full advantage of this growth -- and properly serve the market --

will require continued investments of capital and resources to

build out the business."

The Shanghai-based unit distributes branded and generic drugs

and operates direct-to-patient specialty pharmacies. It employs

about 2,300 across China, and the company said it serves more than

10,000 customers.

Reuters reported earlier about Cardinal Health's plans and that

the company had drawn interest from firms willing to pay up to $1.5

billion in a deal.

In 2010, Cardinal extended its reach in China when it acquired

Zuellig Pharma China, the country's largest drug importer, for $470

million, including debt. Zuellig had annual sales exceeding $1

billion at the time.

If Cardinal does sell the unit, the company would be exiting

China's fast-growing pharmaceuticals market as government

regulators look to exert greater oversight of the industry. In

February, the Chinese government issued its plans for reform of the

industry, including asking state agencies to encourage

consolidation of drug manufacturers and distributors, according to

an article published by corporate law firm Sidley Austin LLP.

A deal could also give Cardinal more leeway to expand its

medical-supplies business overseas. In April, Cardinal agreed to

acquire Medtronic PLC's medical-supplies business for $6.1 billion,

which it plans to finance with $4.5 billion in new debt. The

Medtronic unit's product lines include feeding tubes and

blood-collection devices.

Cardinal Health said other entities, including heart-product

business Cordis, will continue to work in China, and noted it will

build out Asia-Pacific operations following the Medtronic

acquisition.

"We think it makes sense for [Cardinal] to focus its time and

capital on medical," Barclays said in a note to clients on

Thursday.

Cardinal could use proceeds from the sale of its Chinese unit to

pay down some debt from the Medtronic deal and potentially reduce

its annual interest expense by $60 million to $80 million annually,

Barclays said in the note.

Write to Anne Steele at Anne.Steele@wsj.com and Joseph Walker at

joseph.walker@wsj.com

(END) Dow Jones Newswires

July 22, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

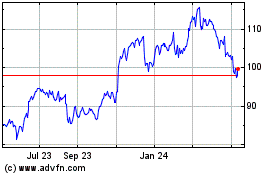

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024