Canadian Dollar Climbs After Better Than Expected GDP Data

June 29 2018 - 5:46AM

RTTF2

The Canadian dollar strengthened against its major opponents in

the European session on Friday, as a data showed that Canadian

economy expanded more than forecast in April.

Data from Statistics Canada showed that Canada's gross domestic

product edged up 0.1 percent on a seasonally adjusted monthly basis

in April, following a 0.3 percent increase in March.

Economists were looking for a flat reading.

Separate data showed that Canadian industrial product price

index rose more than forecast in May, mainly due to higher prices

for energy and petroleum products.

The Industrial Product Price Index increased 1.0 percent in

May, up from a 0.5 percent gain in April.

The index was forecast to rise to 0.9 percent.

The Raw Materials Price Index rose 3.8 percent, beating

forecasts of 2.7 percent.

This follows a 0.7 percent increase in April.

Oil prices rose following an official data showing a larger than

expected draw in crude stockpiles last week.

The Energy Information Administration said U.S. oil inventories

plunged 9.9 million barrels last week, compared to a 3

million-barrel decline expected by economists.

Crude for August delivery rose $0.06 to $73.51 per barrel.

The loonie traded mixed against its major counterparts in the

Asian session. While it fell against the euro and the aussie, it

rose against the yen and the greenback.

The loonie climbed to an 11-day peak of 83.87 against the yen,

up from a low of 83.25 hit at 8:45 pm ET. If the loonie continues

its rise, 85.00 is possibly seen as its next resistance level. Data

from the Ministry of Land, Infrastructure, Transport and Tourism

showed that Japan's housing starts grew unexpectedly in May.

Housing starts advanced 1.3 percent annually, faster than the

0.3 percent increase seen in April. Housing starts were forecast to

drop 5.7 percent in May.

Extending early rally, the loonie spiked up to an 11-day high of

1.3191 against the greenback. The loonie is seen challenging

resistance around the 1.30 area.

The loonie bounced off to 0.9743 against the aussie, heading to

pierce more than a 4-week high of 0.9731 seen at 9:15 pm ET. On the

upside, 0.96 is likely seen as the next resistance level for the

loonie.

The loonie recovered to 1.5352 against the euro, off an early

2-day low of 1.5458.This may be compared to a 10-day peak of 1.5320

seen at 5:30 pm ET. Next key resistance for the loonie is likely

seen around the 1.52 level.

Flash data from Eurostat showed that Eurozone inflation

increased in June on food and energy prices.

Inflation rose to 2 percent in June, in line with forecast, from

1.9 percent in May. The European Central Bank's targets 'below, but

close to 2 percent'.

Looking ahead, U.S. final consumer sentiment index for June is

scheduled for release shortly.

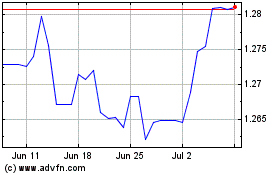

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024