Top regulator raises possibility of breakup in light of

wildfires; accountability faulted

By Russell Gold and Katherine Blunt

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 16, 2018).

A California regulator said late Thursday that it was expanding

a probe of PG&E Corp.'s safety practices to explore the way the

company is managed and run, including whether it should be broken

up.

"I will open a new phase examining the corporate governance,

structure, and operation of PG&E, including in light of the

recent wildfires, to determine the best path forward for Northern

Californians to receive safe electrical and gas service in the

future," Michael Picker, the president of the California Public

Utilities Commission, said in a statement.

Later, in an interview with The Wall Street Journal, he said was

concerned about how PG&E handled safety operations, including

its transmission lines that have sparked wildfires in recent years.

He said the company's decision to compensate its former chief

executive after PG&E was found negligent for a large 2010 gas

explosion that killed eight people as well as its failure to

replace its board "left us wondering is anyone ever accountable for

failing to provide safety at PG&E."

He added: "I am very concerned that they don't have

accountability in place."

He said his expanded review of the company could include whether

to break it up into smaller utilities. "We will put all these

things on the table," Mr. Picker said.

The commission had begun a review of whether PG&E's

"organizational culture and governance prioritize safety" in

2015.

Meanwhile, Moody's Investors Service on Thursday evening

downgraded the ratings of PG&E Corp.'s debt, as well as the

long-term ratings of the company's main utility subsidiary, Pacific

Gas & Electric Co, and said all of the ratings for both are on

review, which could result in a multi-notch ratings downgrade.

The developments capped a wild trading day in which shares of

PG&E fell for the sixth straight day, then rebounded in

after-hours trading, as investors grappled with the volatility that

now comes with owning California's largest utility.

PG&E shares fell more than 30% to close at $17.74 on

Thursday amid investor concerns that the utility, already facing

huge potential liability costs from 2017 wildfires, could be hit

with even more costs related to a current fire in Northern

California that has become the deadliest in state history, killing

more than 50 people.

But the shares then shot up and recovered after hours in a

roller-coaster ride for investors.

PG&E has disclosed that a problem occurred on one of its

high-voltage power lines in Northern California 15 minutes before

the start of the Camp Fire was reported in the area Nov. 8. No

definitive connection between the line outage and the fire has been

made, and California fire investigators will likely take months to

make a final determination.

"It's important to remember that the cause of the fire has not

been determined," PG&E spokeswoman Lynsey Paulo said in a

statement. "We will cooperate with any investigations, and support

the development of best practices and new policies to help prevent

wildfires and protect the public."

The company's stock has been on a downward trajectory over the

past six days as concerned investors confront yet another

fire-related risk for the company, which is already grappling with

more than 800 civil lawsuits from the 2017 fires. State

investigators have concluded that PG&E equipment helped spark

at least 16 of those fires last year.

PG&E said it "wasn't going to speculate or comment on what

factors may or may not be impacting the stock market."

"This is the new normal," said Michael Wara, head of the climate

and energy policy program at Stanford University's Woods Institute.

"Investors believe and are pricing in and acting as if PG&E

will lose a few billion every year because of wildfire

liability."

Equity analysts estimate PG&E could face more than $10

billion in lawsuits and fines from fires in 2017 and from the Camp

Fire this year. The company only has about $1.4 billion in

insurance coverage for fires and about $13.2 billion in annual

revenue from electricity sales.

Thursday's drop was the worst in the S&P 500, and the

preliminary trading volume was the highest on record for the

company. The steep fall in PG&E shares suggests investors

believe the company may be forced to file for bankruptcy

protection, a move that would almost certainly wipe out

shareholders.

The outlook for bond investors is more complicated. Many

PG&E bonds were trading at discounts to their par value,

indicating some concern about the company's prospects. But, in

general, the selling was less intense in the bond market, as many

bond investors expect the company to be able to largely pay its

debts regardless of what happens with wildfire-liability

claims.

The price of PG&E's most active issue, some $3 billion in

6.05% bonds which mature in 2034, gained more than 3 cents Thursday

to 92.5 cents on the dollar, according to MarketAxess. Other

PG&E bonds, which had been trading at distressed levels, also

saw gains. The company's 4% bonds due in 2046 were up almost 4

points to 77.25 cents on the dollar.

Earlier this week, PG&E drew down its full bank line of

credit, a move many analysts saw as a sign its access to debt and

equity markets might be limited. "It's unclear whether the company

will have access to the capital markets at this time," said Jeffrey

Cassella, an analyst with Moody's Investors Service.

Despite the uptick in its bond prices Thursday, PG&E Corp.,

the parent of the utility, will be shut out of the market for bonds

because it is now clear that highly destructive wildfires may be an

annual event, said Andrew DeVries, a high-yield bond analyst at

CreditSights. That raises the risk that lawsuits related to the

wildfires would become a regular occurrence, he added.

The company's financial situation has led to speculation that it

might need a bailout of some sort from the state of California. "As

the company's cash position diminishes, the risk of bankruptcy

could increase unless politicians intervene," wrote Mizuho

Securities USA LLC analyst Paul Fremont.

Earlier this year, California passed legislation that would

allow utilities to securitize wildfire liability by floating bonds

and passing on the costs to ratepayers under certain circumstances.

But the law takes effect in January, leaving utilities exposed to

liabilities that could occur as a result of fires in 2018.

Citi analyst Praful Mehta said the stock selloff reflects

investors' concerns that California might not act to help PG&E

offset potential liability costs arising this year if the move is

viewed as a bailout. "Politically, it could be very challenging,"

he said. "If the political will isn't there, the only way this

could get resolved is to push it into restructuring."

Utility stocks are usually seen as somewhat boring investments

that deliver predictable dividends. But PG&E has become a stock

without a dividend or the prospect of one for the foreseeable

future. The company cut the dividend earlier this year to preserve

cash in anticipation of mounting liability costs after the 2017

fires.

"It's usually considered a safe investment," said David Spence,

a professor who teaches energy law at the University of Texas,

referring to PG&E stock, "but it's not looking very safe right

now."

--Sam Goldfarb,

Patrick Thomas

and Soma Biswas contributed to this article.

Corrections & Amplifications An earlier version of this

article incorrectly referred to PG&E Corp. as PGE Corp. in one

instance. (Nov. 15, 2018)

Write to Russell Gold at russell.gold@wsj.com

(END) Dow Jones Newswires

November 16, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

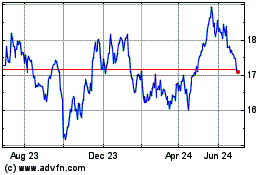

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

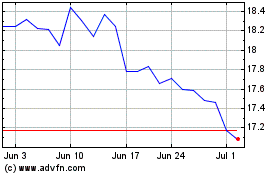

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024