CORRECT: GE To Buy Mining Supplier Industrea For About A$470 Million

May 16 2012 - 12:53AM

Dow Jones News

General Electric Co. (GE) has moved to bolster its footprint in

the fast-growing mining equipment sector, agreeing to buy

Australia's Industrea Ltd. (IDL.AU) for about A$470 million ($466

million) as well as an independently owned U.S. supplier for an

undisclosed amount.

Industrea's board in a separate statement Wednesday said it is

unanimously recommending the cash offer, although it has negotiated

to sell its mining services division separately in the hope of

attracting a higher price.

GE said the acquisitions will increase its exposure to the $61

billion global mining equipment industry, and it will be able to

expand the two regionally focused companies to reach a global

customer base. Both will benefit from the industrial conglomerate's

lean manufacturing and global supply chain management, it said.

The two companies will become part of GE Transportation's global

mining business.

Industrea, which operates from seven locations in resource-rich

Australia and has a significant presence in China, said the A$1.27

per share bid represented a 48% premium to the last closing price

for the company's shares. New of the offer buoyed the shares, which

at 0210 GMT were trading 44% higher at A$1.235.

Robin Levison, chief executive of the Australian company, told

reporters during a conference call that negotiations with GE had

taken place over the past few weeks before the U.S. company secured

the backing of Industrea's board, in the absence of a higher

offer.

Mr. Levison said GE's focus clearly is on mining equipment, and

Industrea's board believes there may be a suitor willing to pay

more for the services operations. He declined to say whether

Industrea has received any approaches, but added that if a higher

bid for the division is received then the bid amount will be

subtracted from the A$1.27 bid price GE will have to pay and if no

better offer is received then the unit will remain part of

Industrea and join GE.

The value of the services division is included in the A$1.27

offer, but isn't being disclosed, a spokesman for Industrea said.

GE's offer values Industrea at about A$700 million, including

debt.

Lorenzo Simonelli, president and CEO of GE Transportation said:

"We believe that Industrea's business can grow more rapidly by

expanding its product suite and geographic reach combined with GE's

technical expertise and global customer relationship."

Industrea said it is expecting net profit this financial year of

between A$40 million and A$45 million, down from A$47.9 million the

year before.

GE has also signed a binding agreement to buy Virginia-based

Fairchild International, which it said manufactures a range of

underground mining equipment. GE said it will grow the independent

company's focus beyond the U.S.

-By Robb M. Stewart, Dow Jones Newswires; +61 3 9292 2094;

robb.stewart@dowjones.com

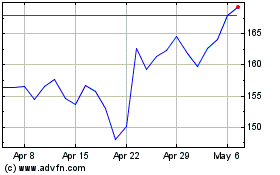

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

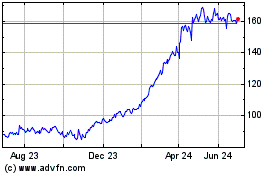

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024