By Adrienne Roberts and AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 2, 2018).

Auto sales slumped in February as tightening credit conditions,

higher interest rates and stingy discounts drove up monthly

payments and slowed the U.S. car business even as the broader

economy rolled along.

During the sales boom of past years, automobiles got more

expensive due to the introduction of new technology and a migration

to heftier trucks and SUVs, but consumers could afford them with

the help of easy credit and a flood of incentives. Now dealers say

they face a tougher sell.

"I can't match previous payments," Ali Reda, a salesman at Les

Stanford Chevrolet in Dearborn, Mich., said. "Buying power is more

limited."

Mr. Reda set the all-time individual sales record for a salesman

in 2017, but keeping that pace this year will be tough, he said.

Customers are being more heavily scrutinized, with banks turning

cautious about giving loans to buyers with balances on their credit

cards, for instance.

Overall U.S. vehicle sales dropped 2.4% in February, to 1.3

million, according to Autodata Corp. Of the major auto makers, only

Toyota Motor Corp. registered an increase for the month.

Brian Allan, a senior director at the Southern California

dealership group Galpin Motors, said he is seeing some credit

tightening, but considers it appropriate.

"I would call it a little bit more responsible, but it's

subtle," Mr. Allan said. The problem of a higher monthly payment

can be "cured with a little bit more down payment," he said

Mr. Allan said he explains to customers that most cars have

improved fuel economy and more infotainment offerings.

"Your payment may be up $50, but you'll save in fuel," he said.

"We sell the whole expense structure."

Mr. Allan said he has also seen an increase in leasing.

General Motors Co.'s chief economist, Mustafa Mohatarem, said

the broader economy could lend the industry a hand as the year

rolls on. "The impact of tax reform and tax refunds aren't being

felt fully by consumers yet. We expect consumer spending to pick up

as tax cuts are reflected in pay checks."

Buyers, however, may not find the kind of deals they are looking

for.

Auto lenders have been tightening underwriting standards over

the past year in an attempt to shield themselves from loan losses.

One reason for the shift: Used-car values, which were strong for

several years following the financial crisis, have sagged as more

preowned inventory hits the market. Those used cars are collateral

for the loans and leases that buyers need to finance a $30,000

automobile.

Although modest, recent interest-rate increases present another

headwind for buyers. And sales incentives that dealers long used to

bridge the gap between a sticker price and what a customer could

really afford aren't keeping pace.

Nissan Motor Co.'s compact car Sentra, which starts at $17,000,

saw sales jump 7% in February at a time when most consumers prefer

higher-price SUVs and trucks. Judy Wheeler, Nissan's U.S. sales

chief, attributes the sales increase for a vehicle that is aimed at

price-sensitive customers to higher interest rates, while other

shoppers wait for their tax returns to decide if they can afford to

a higher-price vehicle.

"As interest rate go up, and credit tightens down a bit, I think

you will see more buyers go to used cars and certified preowned

vehicles," Ms. Wheeler said. "Other indicators are positive...but I

go back to how important tax cuts are. People are taking the safe

approach."

J.D. Power estimates incentive spending in February -- averaging

$3,850 per vehicle -- was down slightly from the same month in

2017. Discounts on pickups and SUVs, Detroit auto makers' most

popular models, fell by an average of $450 per unit over the

period, however.

"At a certain point, auto makers have to pull back," Thomas

King, a J.D. Power analyst, said. He said the decline in incentive

spending was the first in more than four years.

GM and Ford Motor Co., the top two sellers in the U.S., both

reported 7% sales declines. Fiat Chrysler Automobiles NV, Honda

Motor Co. and Nissan also posted declines, while Toyota recorded a

4.5% increase.

The seasonally adjusted sales pace for the market slipped to

17.1 million on an annualized basis, from 17.5 million a year

earlier, according to Autodata. February's decline followed a

slight increase in January that was driven by an additional selling

day compared with the first month of 2017.

Average monthly payments now exceed $525 a month, according to

Edmunds.com, with the online-shopping company estimating that

interest rates on new-vehicle loans hit an eight-year high in

February.

Average credit scores for consumers buying and leasing new cars

rose to 716 in the fourth quarter on a scale that tops out at 850,

according to new data from credit-reporting firm Experian PLC. That

is up from 714 a year prior and 712 in 2015.

Credit scores on average are higher among borrowers signing up

for leases than among those signing up for purchase loans. Leases

are generally arranged by manufacturers' captive finance arms.

Subprime borrowers, who helped fuel the U.S. auto market to

record levels in 2015 and 2016, are accounting for a smaller share

of auto loan volume.

"There are still loans out there for subprime borrowers...what

has changed will be the lenders making the offers," said Melinda

Zabritski, Experian's automotive-finance senior director. "Or if

they make an offer, there will likely need to be more money down,

shorter terms, etc."

--John D. Stoll contributed to this article.

Write to Adrienne Roberts at Adrienne.Roberts@wsj.com and

AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

March 02, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

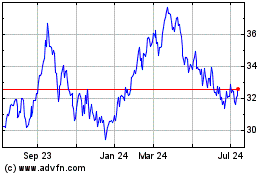

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

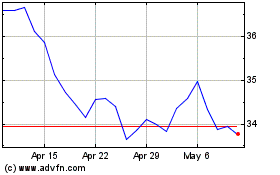

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024