Buffett May Unveil Heir Soon - Analyst Blog

April 18 2012 - 9:48AM

Zacks

Warren Buffett, the Chairman and CEO of Berkshire

Hathaway Inc. (BRK.A) (BRK.B), has had no intention till

now to step down from his post, but now it seems that the

octogenarian will soon have to do some rethinking in this regard as

there has been an unprecedented development in Buffett’s health. On

Tuesday, he announced that he has been diagnosed with Stage 1

prostate cancer.

Despite an early diagnosis, the side effects of the impending

treatment of the 81-year-old could be a concern. Warren Buffett has

decided to undergo radiation treatment. Given his age, the

radiation treatment may have a negative effect on his

health.

Nevertheless, Buffett sounded optimistic in his letter to

shareholders saying that he was feeling normal and his energy level

continued to be 100%.

This sudden announcement has once again raised a question about

Berkshire’s succession plans in the minds of its shareholders.

Buffett had already announced during the last shareholder’s meet

that the prospective candidates have been finalized for the higher

ranks. However, the names have been kept under wraps.

The shareholders will continue to feel anxious until they get to

know the names or get more clarity on the company’s succession

plans. Buffett plans to split up his single job into three parts

that of a CEO, Chairman and investment management for the smooth

functioning of the organization. We also believe that it is

extremely difficult for any new management or individual of this

behemoth conglomerate to ably fill in his shoes.

As far as the operations of Berkshire Hathaway is considered,

sans Buffett, we believe the conglomerate will continue to run

swiftly, with most of its businesses performing exceptionally well.

Though some of its businesses have been affected in the recent

years due to the U.S. downturn, they are slowly recovering with the

gradual recovery of the economy.

Moreover, Buffett’s practice of letting the units’ managers

handle their own operations independently, without his significant

interference, is expected to keep the wheels of the business

running smoothly even if he is not around.

Though Buffett has streamlined operations to run on their own,

greater concerns surround the investment role played by Buffett

along with the company’s Vice-Chairman Charlie Munger, who is

already 88 years old. Buffett is known as a value-investor

worldwide. While he has picked up hedge fund manager Todd Combs and

Ted Weschler to manage the company’s investments, utilizing the

vast amount of cash that the company generates quarter after

quarter is a mammoth task.

Though Berkshire has to run without Buffett someday, the two are

so closely interlinked that any news relating to Buffett’s

retirement from the job is bound to make headlines and spark

investors’ concerns.

BERKSHIRE HTH-A (BRK.A): Free Stock Analysis Report

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

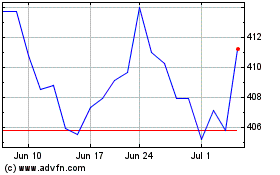

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

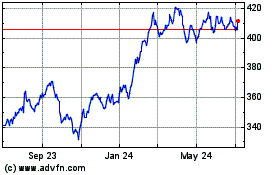

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024