TIDMBOOM

RNS Number : 6377I

Boom Pictures Limited

26 July 2012

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY RESTRICTED JURISDICTION (INCLUDING THE

UNITED STATES, AUSTRALIA, CANADA AND JAPAN) OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

26 July 2012

OFFER UPDATE

Recommended cash offer

by Deloitte Corporate Finance

on behalf of Boom Pictures Limited ("Boom Pictures")

for Boomerang Plus plc ("Boomerang")

Offer declared unconditional in all respects

On 4 July 2012, the Independent Directors and board of directors

of Boom Pictures announced that they had reached agreement on the

terms of a recommended cash offer to be made by Deloitte Corporate

Finance on behalf of Boom Pictures for the entire issued and to be

issued share capital of Boomerang, excluding the Roll-over Shares.

The full terms and conditions of the Offer and the procedures for

acceptance are set out in the offer document issued on 4 July 2012

(the "Offer Document").

Terms defined in the Offer Document have the same meaning in

this announcement unless the context requires otherwise.

Boom Pictures is pleased to announce that all of the conditions

of the Offer have now either been satisfied or waived and the Offer

is hereby declared unconditional in all respects.

The Offer will remain open for acceptance until further notice.

At least 14 days' notice will be given in the event that the Offer

is to be closed.

Level of acceptances

As at 1.00 p.m. (London time) on 26 July 2012, Boom Pictures had

received valid acceptances of the Offer in respect of 6,434,730

Offer Shares, representing approximately 97.3 per cent. of the

total Offer Shares, which Boom Pictures may count towards the

satisfaction of the Acceptance Condition of the Offer.

Of this total, Boom Pictures has received acceptances pursuant

to irrevocable undertakings to accept the Offer in respect of a

total of 5,346,477 Boomerang Shares, representing approximately

80.8 per cent. of the Offer Shares. Of this total, valid

acceptances have been received from persons acting or deemed to be

acting in concert with Boom Pictures in respect of a total of

2,182,704 Boomerang Shares, representing approximately 33.0 per

cent. of the Offer Shares. A total of 5,000 Boomerang Shares,

representing 0.1 per cent. of the Offer Shares remain outstanding

under these irrevocable commitments.

Further dealings by Boom Pictures' concert parties

Boomerang had prior to 1.00 p.m. (London time) on 26 July 2012

issued a further 231,321 Boomerang Shares as a result of Boomerang

Options being exercised, all of which have been accepted in

relation to the Offer. Accordingly, the current total issued share

capital of Boomerang is set out below in accordance with Rule 2.10

of the Code.

As a result of the exercise of Boomerang Options, the Management

Team (and their close relatives and related trusts) have had the

following further dealings in the relevant securities of Boomerang

since the Announcement of the Offer:

Boomerang Boomerang Share Number of Date

Director Option Scheme Boomerang

Options exercised

------------------- ----------------------- ------------------- --------------------

Mark Fenwick Boomerang 2005 13,725 26 July 2012 (prior

Enterprise Management to 1.00 p.m.)

Incentive Plan

------------------- ----------------------- ------------------- --------------------

Nia Thomas Boomerang 2005 30,000 26 July 2012 (prior

Enterprise Management to 1.00 p.m.)

Incentive Plan

------------------- ----------------------- ------------------- --------------------

Dylan Davies Boomerang 2005 20,000 26 July 2012 (prior

Enterprise Management to 1.00 p.m.)

Incentive Plan

------------------- ----------------------- ------------------- --------------------

Becca Evans Boomerang 2005 6,398 26 July 2012 (prior

(wife of Enterprise Management to 1.00 p.m.)

Gruffydd Incentive Plan

Davies who

is a member

of the Management

Team)

------------------- ----------------------- ------------------- --------------------

Save as disclosed in this announcement and in paragraph 5 of

Appendix IV of the Offer Document, as at 25 July 2012, the last

practicable Business Day prior to this announcement, neither Boom

Pictures nor, so far as Boom Pictures is aware, any person acting

in concert with Boom Pictures, had an interest in or right to

subscribe for relevant securities of Boomerang or had any short

position in relation to relevant securities of Boomerang (whether

conditional or absolute and whether in the money or otherwise),

including any short position under a derivative, any agreement to

sell or any delivery obligation or right to require another person

to purchase or take delivery of any relevant securities of

Boomerang nor has any such person borrowed or lent therein.

Save for the irrevocable undertakings described above and

pursuant to the Share Exchange Deed and the Subscription and

Shareholders' Agreement, neither Boom Pictures nor any person

acting in concert with Boom Pictures has any arrangement in

relation to Boomerang Shares, or any securities convertible or

exchangeable into Boomerang Shares or options (including traded

options) in respect of, or derivatives referenced to, Boomerang

Shares. For these purposes, "arrangement" includes any indemnity or

option arrangement, any agreement or understanding, formal or

informal, of whatever nature, relating to relevant securities which

is, or may be, an inducement to deal or refrain from dealing in

such securities.

Settlement of consideration

Settlement of the cash consideration due under the Offer in

respect of acceptances which have been received and are valid and

complete in all respects will be despatched by first class post (in

the case of certificated holders) or credited to the relevant CREST

account (in the case of uncertificated holders) on or before 9

August 2012. Settlement of the consideration in respect of further

acceptances which are valid and complete in all respects will be

despatched as soon as practicable and in any event within 14 days

of receipt of such acceptances.

Cancellation of trading on AIM, re-registration as a private

company and intention to compulsorily purchase Offer Shares

As Boom Pictures has received acceptances under the Offer in

respect of 90 per cent. or more of the Offer Shares, Boom Pictures

intends to exercise its rights pursuant to sections 974 to 991 of

the Companies Act 2006 to acquire compulsorily the remaining Offer

Shares in respect of which the Offer has not been accepted. A

further announcement will be made in due course.

As Boom Pictures is now interested in more than 75 per cent. of

the issued share capital of Boomerang, it is also intended that,

subject to any applicable regulatory requirements, Boom Pictures

will procure that Boomerang applies to the London Stock Exchange

for the cancellation of trading in Boomerang's Shares on AIM. It is

anticipated that cancellation of trading on AIM will take place

approximately 20 Business Days from today. Such cancellation would

significantly reduce the liquidity and marketability of any Offer

Shares not acquired by Boom Pictures. A further announcement is

expected to be made in due course regarding the proposed date for

cancellation of trading on AIM. Following such cancellation, Boom

Pictures intends to seek to procure the re-registration of

Boomerang as a private company.

Shareholders of Boomerang who have not yet accepted the Offer

are, therefore, encouraged to do so without delay. Acceptances of

the Offer should be received in accordance with the instructions

contained in the Offer Document. In the case of Boomerang Shares

held in certificated form, the Form of Acceptance should be

completed and returned. If you are a holder of Boomerang Shares in

uncertificated form (that is in CREST), you should ensure that your

TTE Instruction is settled.

If you are in any doubt about the Offer or as to the action you

should take, you are recommended to seek your own independent

financial advice from a stockbroker, solicitor, accountant or other

independent financial adviser authorised under the Financial

Services and Markets Act 2000. If you are outside the UK, you

should immediately consult an appropriately authorised independent

financial adviser.

Enquiries:

For further information, please contact:

Boom Pictures

Lorraine Heggessey 020 8995 3936

Huw Eurig Davies 029 2067 1505

Deloitte Corporate Finance 020 7936 3000

(financial adviser to Lorraine Heggessey & Boom

Pictures)

Jon Hinton

James Lewis

Stuart Sparkes

Plank PR 020 8995 3936

(public relations adviser to Boom Pictures)

Louise Plank

Boomerang 07802 793 444

Richard Huntingford, Chairman

finnCap 020 7220 0500

(financial adviser to Boomerang)

Geoff Nash

Charlotte Stranner

Walbrook PR 020 7933 8780

(PR adviser to Boomerang)

Paul McManus

Paul Cornelius

Further information

This announcement is for information purposes only and is not

intended and does not constitute or form part of an offer or

invitation to sell or purchase any securities or the solicitation

of an offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, pursuant to the Offer or

otherwise. The Offer is being made solely by the Offer Document and

the accompanying Form of Acceptance, which contains the full terms

and conditions of the Offer, including details of how the Offer may

be accepted.

Deloitte Corporate Finance is acting only for Lorraine Heggessey

and Boom Pictures and no one else in connection with the Offer and

will not regard any other person as its client nor be responsible

to anyone other than those persons for providing the protections

afforded to clients of Deloitte Corporate Finance nor for providing

advice in relation to the Offer, the contents of this announcement

or any other matters referred to in this announcement. Deloitte

Corporate Finance is a division of Deloitte LLP, which is

authorised and regulated by the Financial Services Authority in

respect of regulated activities.

finnCap Ltd, which is authorised and regulated in the United

Kingdom by the Financial Services Authority, is acting only for

Boomerang and no one else in connection with the Offer and will not

be responsible to anyone other than Boomerang for providing the

protections afforded to clients of finnCap Ltd or for providing

advice in relation to the Offer, the contents of this announcement

or any other matters referred to in this announcement.

This announcement has been prepared for the purposes of

complying with English law and the Code and the information

disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with

the laws and regulations of any jurisdiction outside of

England.

Rule 2.10 Disclosure

In accordance with Rule 2.10 of the Code, Boomerang confirms

that, at the date of this announcement, there are 9,163,548

Boomerang Shares in issue and admitted to trading on AIM. The ISIN

of the Boomerang Shares is GB00B23VYZ68.

Overseas Shareholders

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by the laws of those

jurisdictions and therefore persons into whose possession this

announcement comes should inform themselves about and observe any

such restrictions. Failure to comply with any such restrictions may

constitute a violation of the securities laws of any such

jurisdiction. To the fullest extent permitted by applicable law,

the companies involved in the Offer disclaim any responsibility or

liability for the violation of such restrictions by any person.

Unless otherwise determined by Boom Pictures and permitted by

applicable law and regulation, subject to certain exemptions, the

Offer is not being, made, directly or indirectly, in or into and is

not capable of acceptance from or within a Restricted Jurisdiction.

Accordingly, unless otherwise determined by Boom Pictures, copies

of this announcement and any other documentation relating to the

Offer are not being and must not be, directly or indirectly, mailed

or otherwise forwarded, distributed or sent in, into or from a

Restricted Jurisdiction and persons receiving this announcement and

any other documentation relating to the Offer (including

custodians, nominees and trustees) must not mail or otherwise

distribute or send them in, into or from such jurisdictions as

doing so may be a breach of applicable law and regulation in that

jurisdiction and may invalidate any purported acceptance of the

Offer. The availability of the Offer to persons who are not

resident in the United Kingdom may be affected by the laws of their

relevant jurisdiction. Such persons should inform themselves about

and observe any applicable legal or regulatory requirements of

their jurisdiction.

Any person (including nominees, trustees and custodians) who

would, or otherwise intends to, or may have a legal or contractual

obligation to, forward this announcement and/or any documentation

relating to the Offer to any jurisdiction outside the United

Kingdom, should inform themselves of, and observe, any applicable

legal or regulatory requirements of any relevant jurisdiction and

seek appropriate advice before taking any action.

Publication on websites and availability of hard copies

A copy of this announcement will be made available free of

charge, at www.boomerang.co.uk and www.boombid.co.uk by no later

than 12 noon on 27 July 2012 and will be available during the

course of the Offer. You may request a hard copy of this

announcement, free of charge, by contacting Mark Fenwick, the

Company Secretary of Boomerang, on +44 (0) 29 2067 1500 or Jenny

Stephenson of CMS Cameron McKenna LLP on +44 (0) 207 367 3000. It

is important that you note that unless you make such a request, a

hard copy of this announcement and any information incorporated by

reference in it will not be sent to you. You may also request that

all future documents, announcements and information sent to you in

relation to the Offer should be in hard copy form. For the

avoidance of doubt, the content of the websites referred to above

is not incorporated into and does not form part of this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OUPUNUNRUUABUAR

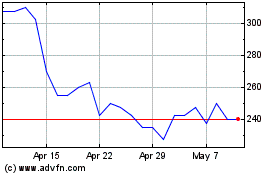

Audioboom (LSE:BOOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

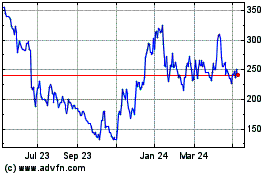

Audioboom (LSE:BOOM)

Historical Stock Chart

From Apr 2023 to Apr 2024