By Robert Wall and Doug Cameron

Boeing Co. and Airbus SE, swamped with orders for new jets, are

struggling to deliver them all on time -- in some cases angering

customers and delaying payments.

Airbus has missed a number of deadlines for deliveries, forcing

airline customers to find alternatives, change routes or cancel

flights. It has delivered fewer planes than it did by this time

last year, despite promising 80 more this year.

The missed deliveries mean delayed payments, since most cash

changes hands only upon delivery. That has hit Airbus's closely

followed cash flow over the year.

Boeing hasn't missed any deliveries and says it won't. But it is

straining with the same supplier shortfalls as Airbus, particularly

when it comes to engines.

"It is on all of our radars every day," Boeing Chief Executive

Dennis Muilenburg told reporters Sunday at the Farnborough Air

Show, the industry's biggest trade show of the year. The company

has made investments to help manage its suppliers, he said,

including in technology to help monitor their performance.

Those efforts are crucial, he said, with Boeing poised to

deliver more than 800 planes for the first time this year and more

than 900 by the end of the decade.

For years, booming demand for new aircraft has made it more

challenging for jet makers to deliver planes on time to airline

customers. A supply-line crunch for everything from engines to wing

components is now magnifying the strain.

The result: Some airlines have been left waiting for months for

new planes. That has angered executives and, in some cases, even

stranded passengers.

Airbus is late delivering new, A321neo single-aisle jets to

Primera Air, a Scandinavian airline, because of a lack of engines

made by CFM International, a joint venture of General Electric Co.

and Safran SA. The airline has had to suspend plans for some of its

routes, including trans-Atlantic flights from New York and Toronto

to Birmingham, England.

British Airways is waiting for A320neo planes for the same

reason -- no engines. Willie Walsh, chief executive of parent

International Consolidated Airlines Group SA, said he is "clearly

very disappointed with the performance of Airbus." He has had to

rent planes and operate older, less efficient ones from his fleet

as he waits for his new jets to arrive.

CFM, which had fallen behind on deliveries by up to seven weeks,

has started to catch up and will be back on schedule before

year-end, said Sébastien Imbourg, executive vice president for the

engine maker.

Boeing, too, has suffered delays on engines for its 737 Max

planes, though it hasn't yet held up deliveries of planes to

customers. Both jet makers also have been hit by delays for

components used to make wings and fuselages made by Spirit

AeroSystems Holdings Inc., which fell behind because of its own

supply-chain problems.

"The suppliers are saying, 'Houston, we have a problem, we need

to slow down,'" said Eric Bernardini, head of aerospace at

consultant AlixPartners.

Airlines have been left waiting for planes before. Boeing was

late with its then brand new 787 Dreamliner and Airbus with the

A380 superjumbos. But this time it is the scale of production,

rather than issues with assembling new plane designs that is

hobbling the companies.

Boeing, the No. 1 plane maker by deliveries, and No. 2 Airbus

and are on track this year to deliver more than 1,600 airliners in

total, more than double the figure produced in 2000, and both are

expected to add hundreds more to their backlogs this week at the

Farnborough Air Show. The plane makers have been struggling for

years under the surge, and have spent heavily reviewing and

retooling supply lines.

Mr. Muilenburg said the planemaker boosted its 20-year

industrywide demand growth outlook, projecting delivery of 43,000

new commercial planes worth nearly $7 trillion, up from 41,000

aircraft forecast last year. Airbus also recently lifted its

equivalent projection.

The record production pace is due in part to surging demand for

flights. This year is poised to be the ninth in a row of growth in

passenger demand. The International Air Transport Association, an

industry lobby group, forecasts planes will carry 4.4 billion

passengers this year, compared with 2.7 billion in 2010. Amid

higher oil prices, airlines are also eager to update their fleet to

more efficient planes that burn less gas.

Suppliers to Boeing and Airbus have struggled to keep up. Engine

production delays have been among the most painful. At one point

this year, Airbus had more than 100 near-finished planes waiting on

the tarmac for their engines. In the first six months, the company

delivered only 303 jetliners against a full-year target of 800

deliveries, mostly down to late engines.

Airbus Chief Executive Tom Enders this month said meeting the

full-year goal was "doable" but "hard."

Boeing had delivered 378 planes at the midyear point against a

full-year target of between 810 and 815 planes.

Airbus has two engine suppliers for its popular A320neo-family

of new single-aisle planes and both have struggled. CFM remains

behind schedule, Airbus said.

Safran Chief Executive Philippe Petitcolin has blamed the delays

on the joint venture's own supplier issues, particularly with

forgings, often-large metal parts that can be difficult to produce.

The company said it planned to catch up this summer.

Airbus also buys engines from Pratt & Whitney, a unit of

United Technologies Corp. Pratt & Whitney said it held back

deliveries while it fixed design problems that were causing

components to fail early. Pratt & Whitney is now delivering as

planned, according to Airbus.

Pratt & Whitney said it had caught up on delivery

commitments and remained committed to achieving its 2018 goal.

Airbus considered slowing production of single-aisle planes

while the engine makers recovered, but it feared that could disrupt

other parts makers, causing knock-on delays, said Airbus commercial

plane boss Guillaume Faury. Instead, it continued building planes,

Mr. Faury said, gambling engine makers would catch up.

Boeing took a more conservative view on the number of engines

its suppliers could deliver, according to company

representatives.

Spirit AeroSystems, the aircraft fuselage and wing-parts maker,

started sending wing parts for Airbus's long-range A350 jets to its

factory in Scotland via expensive airfreight, to get them there in

time, said Scott McLarty, Spirit's vice president for the U.K. and

Malaysia. After catching up, the parts now are again going by

sea.

Airbus has asked Spirit to keep extra inventory for both A350

and A320 plane parts, Mr. McLarty said. Spirit, to protect its own

production commitments, is asking its suppliers to keep spare

inventory, too. It also has audited vendors to make sure they have

the staff and resources to keep pace, he said, and has started

sourcing parts from more than one supplier.

"The job today is not just about running a factory but running

the entire supply chain," Mr. McLarty said.

The supply-chain woes have trickled down to passengers. Joanna

Barlow and her partner Dan Winyard were due to fly to Boston from

Birmingham, England, next month to visit family on Primera, the

Scandinavian budget carrier. That flight was canceled because

Primera couldn't get its jet on time from Airbus. They rebooked,

but then their return flight was also canceled for lack of

jets.

"You definitely don't expect flights to be canceled," Ms. Barlow

said. "And certainly not because of lack of aircraft."

--Andrew Tangel contributed to this article.

Write to Robert Wall at robert.wall@wsj.com and Doug Cameron at

doug.cameron@wsj.com

(END) Dow Jones Newswires

July 15, 2018 12:44 ET (16:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

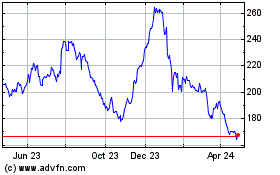

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

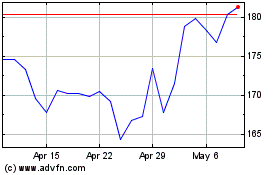

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024