Berkshire Now Has a $4 Billion Stake in Largest U.S. Bank

November 14 2018 - 5:49PM

Dow Jones News

By Nicole Friedman

Warren Buffett's Berkshire Hathaway Inc. is increasing its bet

on the U.S. banking industry.

The Omaha conglomerate took a $4 billion stake in JPMorgan Chase

& Co. in the third quarter, adding to a list of other large

holdings in major American financial institutions. JPMorgan is

currently the largest U.S. bank by assets.

Berkshire also took a new stake during the quarter in Pittsburgh

bank PNC Financial Services Group Inc. and increased its holdings

of Goldman Sachs Group Inc., Bank of America Corp., Bank of New

York Mellon Corp. and U.S. Bancorp. Other banking investments

include Wells Fargo & Co. and M&T Bank Corp.

Berkshire disclosed the new positions as of Sept. 30 in a

securities filing Wednesday.

JPMorgan Chase declined to comment.

The new Berkshire investment in JPMorgan follows a number of

existing ties between the two companies.

Berkshire portfolio manager Todd Combs is on the JPMorgan board

and JPMorgan Chief Executive James Dimon is a longtime personal

friend of Mr. Buffett. In June, they wrote an op-ed piece together

that urged companies to consider ending the practice of providing

quarterly earnings guidance.

Mr. Buffett and Mr. Dimon have also teamed up with Jeff Bezos,

the CEO of Amazon.com Inc., to form a health-care venture aimed at

lowering costs for the hundreds of thousands of employees of the

three companies.

JPMorgan is on track to report a record year: It notched a

profit of $8.38 billion in the third quarter, with strength across

its businesses. The bank's stock has tripled in the past 10 years,

easily outpacing a roughly 65% rise in the KBW Nasdaq bank

index.

(END) Dow Jones Newswires

November 14, 2018 17:34 ET (22:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

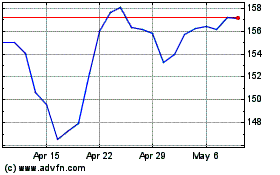

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

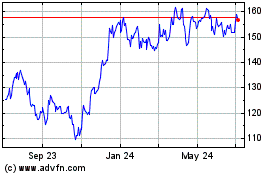

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Apr 2023 to Apr 2024