Becton Dickinson Remains Neutral - Analyst Blog

May 21 2012 - 10:45AM

Zacks

We reiterate our Neutral

recommendation on Becton, Dickinson and

Company (BDX). Earnings for the second quarter matched the

Zacks Consensus Estimate of $1.38. Becton, Dickinson recorded

second quarter revenues of $1,991 million, up 3.6% (or 4.6% in

constant currency) year over year, surpassing the Zacks Consensus

Estimate of $1,942 million.

The company is pursuing a number of

key product initiatives. It will launch several products before the

end of fiscal 2013.

Besides, Becton, Dickinson

favorably tweaked its guidance for the fiscal year on a currency

neutral basis. The prospects for safety needles are more upbeat in

Europe, than in the U.S. market, following the adoption of safety

standards. Next generation safety needles were recently

launched.

Becton, Dickinson maintains a focus

on geographical expansion into overseas markets, in particular the

emerging markets, which accounted for about 21.4% of revenues in

the second quarter of 2012 (growing at 10% year over year). Growth

in safety needles in emerging markets was a bright spot, which rose

26% year over year.

Cash flows, including fresh debt,

are being utilized for large stock repurchases. Moreover, the

company is engaged in operational enhancement and cost containment.

However, it suffers from a lack of near-term catalysts even though

it has undertaken several initiatives to bolster product

pipeline.

We remain cautious about Becton,

Dickinson due to the lack of major short-term catalysts. The rising

demand for safety-needle products (with higher price points and

margins) was the primary driver of the company’s past growth, which

is not expected to continue, given that the U.S. market is already

largely penetrated.

On the positive side, Becton,

Dickinson’s preeminent global healthcare products franchise is

partly insulated from volatile macroeconomic conditions and

structural deficiencies elsewhere in the healthcare delivery

field.

Becton, Dickinson faces a wide

range of competitors, including Baxter

International (BAX) in certain niches, in each of its

three business segments. We currently have a long-term Neutral

recommendation on the stock. The stock currently retains a Zacks #3

Rank, which translates into a short-term “Hold” recommendation.

BAXTER INTL (BAX): Free Stock Analysis Report

BECTON DICKINSO (BDX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

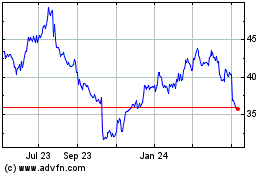

Baxter (NYSE:BAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

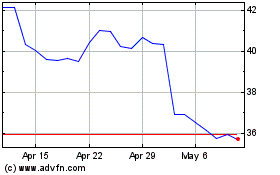

Baxter (NYSE:BAX)

Historical Stock Chart

From Apr 2023 to Apr 2024