Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today

announced its financial results for the three and nine months ended

June 30, 2017.

“We were very pleased with our third quarter results, as we

generated growth in EBITDA and earnings per share, driven by

operational improvements across our business,” said Allan Merrill,

Beazer’s President and CEO. “We increased both sales pace and gross

margin during the quarter, improved our backlog conversion and

demonstrated strong overhead cost discipline. With a backlog dollar

value of $860 million, we’re well positioned for a strong finish to

Fiscal 2017.”

Mr. Merrill continued, “Beyond this year, we are poised for

further earnings growth and reductions in leverage, driven by an

improving return on capital and the continued rollout of our

Gatherings business.”

The Company generated net income of $7.1 million for the

quarter, which was up $1.3 million versus the same period last

year. Results for the third quarter of Fiscal 2016 included a $15.5

million benefit related to insurance recoveries and $11.9 million

of impairment and abandonment charges. Adjusting for non-recurring

items, net income would have been up $3.4 million.

Beazer Homes Fiscal Third Quarter 2017

Highlights and Comparison to Fiscal Third Quarter 2016:

- Adjusted EBITDA was $44.3 million. This

was up $6.0 million, excluding the benefit from insurance

recoveries in the prior year

- Homebuilding revenue was $472.4

million, higher by 4.7% due to a 1.7% increase in home closings and

a 3.0% increase in average selling price

- Homebuilding gross margin, excluding

interest, impairments and abandonments and additional insurance

recoveries in the prior year, was 21.3%, up 60 basis points. The

improvement was driven by higher margins on spec home closings and

lower than anticipated warranty costs

Other Operational Highlights:

- Sales per community per month of 3.4,

up 14.2%

- New home orders, net of 1,595, up

7.0%

- Dollar value of homes in backlog of

$859.9 million, up 5.6%, driven by an increase in the average

selling price of homes in backlog of $351.8 thousand, up $16

thousand

- Selling, general and administrative

expenses (SG&A) as a percentage of total revenue was 12.4%, an

improvement of 20 basis points

- Land and land development spending of

$103.8 million, up 43.1%

- Total available liquidity at quarter

end of $308.5 million, including $168.4 million of unrestricted

cash and $140.1 million available on the Company’s revolving credit

facility

Gatherings Update

During the third quarter, the Company started vertical

construction at its first Orlando Gatherings community in the Lake

Nona master-planned development, which will ultimately provide more

than 200 homes. Further, two additional sites, representing more

than 130 future sales, were approved for purchase in Dallas and

Virginia.

So far this fiscal year, the Company has approved four new

communities representing nearly 300 future sales and is currently

reviewing a pipeline of potential communities that exceeds 2,000

homes.

Summary results for the three and nine months ended

June 30, 2017 are as follows:

Three Months Ended June 30, 2017

2016 Change* New home

orders, net of cancellations

1,595 1,490 7.0 % Orders per

community per month

3.4 3.0 14.2 % Average active community

count

155 166 (6.2 )% Actual community count at quarter-end

154 168 (8.3 )% Cancellation rates

16.9 % 19.6

% -270 bps Total home closings

1,387 1,364 1.7 %

Average selling price (ASP) from closings (in thousands)

$

340.6 $ 330.6 3.0 % Homebuilding revenue (in millions)

$ 472.4 $ 451.0 4.7 % Homebuilding gross margin

16.7 % 17.0 % -30 bps Homebuilding gross margin,

excluding impairments and abandonments (I&A)

16.7

% 19.7 % -300 bps Homebuilding gross margin, excluding

I&A and interest amortized to cost of sales

21.3

% 24.1 % -280 bps Homebuilding gross margin, excluding

I&A, interest amortized to cost of sales and additional

insurance recoveries from third-party insurer

21.3 %

20.7 % 60 bps Income from continuing operations before

income taxes (in millions)

$ 12.9 $ 11.5 $ 1.4

Provision for income taxes (in millions)

$ 5.7 $ 5.3

$ 0.4 Income from continuing operations (in millions)*

$

7.1 $ 6.1 $ 1.0 Basic and diluted income per share from

continuing operations

$ 0.22 $ 0.19 $ 0.03

Income from continuing operations before income taxes (in millions)

$ 12.9 $ 11.5 $ 1.4 Gain on debt extinguishment (in

millions)

$ — $ 0.4 $ (0.4 ) Inventory impairments

and abandonments (in millions)

$ 0.5 $ 11.9 $ (11.4 )

Additional insurance recoveries from third-party insurer (in

millions)

$ — $ 15.5 $ (15.5 ) Income from continuing

operations excluding gain on debt extinguishment, inventory

impairments and abandonments and additional insurance recoveries

before income taxes (in millions)*

$ 13.3 $ 7.4 $ 5.9

Net income

$ 7.1 $ 5.8 $ 1.3 Net income

excluding gain on debt extinguishment, inventory impairments and

abandonments and additional insurance recoveries (in millions)* +

$ 7.4 $ 4.0 $ 3.4 Land and land development

spending (in millions)

$ 103.8 $ 72.6 $ 31.3

Adjusted EBITDA (in millions)

$ 44.3 $ 53.8 $ (9.5 )

Adjusted EBITDA, excluding additional insurance recoveries from

third-party insurer (in millions)

$ 44.3 $ 38.3 $ 6.0

LTM Adjusted EBITDA, excluding unexpected warranty costs (net of

recoveries), additional insurance recoveries and write-off of

deposit (in millions)

$ 167.9 $ 161.4 $ 6.4

* Change and totals are calculated using

unrounded numbers.

+ Gain on debt extinguishment, inventory

impairments and abandonments and additional insurance recoveries

were tax-effected at annualized effective tax rates of 36.7% and

49.5% for the three months ended June 30, 2017 and

June 30, 2016, respectively.

“LTM” indicates amounts for the trailing

12 months.

Nine Months

Ended June 30, 2017 2016

Change* New home orders, net of cancellations

4,149 3,951 5.0 % LTM orders per community per month

2.9 2.6 11.5 % Cancellation rates

17.9 % 20.4

% -250 bps Total home closings

3,621 3,563 1.6 % ASP

from closings (in thousands)

$ 339.8 $ 326.9 3.9 %

Homebuilding revenue (in millions)

$ 1,230.4 $

1,164.8 5.6 % Homebuilding gross margin

16.2 % 16.6 %

-40 bps Homebuilding gross margin, excluding I&A

16.2

% 17.8 % -160 bps Homebuilding gross margin, excluding

I&A and interest amortized to cost of sales

20.9

% 22.1 % -120 bps Homebuilding gross margin, excluding

I&A, interest amortized to cost of sales, unexpected warranty

costs (net of recoveries) and additional insurance recoveries from

third-party insurer

20.9 % 20.4 % 50 bps

Income (loss) from continuing operations before income taxes (in

millions)

$ (3.0 ) $ 8.1 $ (11.1 ) (Benefit

from) provision for income taxes (in millions)

$ (1.3

) $ 2.1 $ (3.3 ) Income (loss) from continuing operations

(in millions)*

$ (1.7 ) $ 6.0 $ (7.7 ) Basic

and diluted income (loss) per share from continuing operations

$ (0.05 ) $ 0.19 $ (0.24 ) Income

(loss) from continuing operations before income taxes (in millions)

$ (3.0 ) $ 8.1 $ (11.1 ) Loss on debt

extinguishment (in millions)

$ 15.6 $ 2.0 $ 13.5

Inventory impairments and abandonments (in millions)

$

0.8 $ 15.1 $ (14.3 ) Unexpected warranty costs related to

Florida stucco issues, net of recoveries (in millions)

$

— $ 3.6 $ (3.6 ) Additional insurance recoveries from

third-party insurer (in millions)

$ — $ 15.5 $ (15.5

) Write-off of deposit on legacy land investment

$

2.7 $ — $ 2.7 Income from continuing operations excluding

loss on debt extinguishment, inventory impairments and

abandonments, unexpected warranty costs (net of recoveries),

additional insurance recoveries and write-off of deposit before

income taxes (in millions)*

$ 16.0 $ 6.1 $ 9.9

Net income (loss)

$ (1.8 ) $ 5.5 $ (7.4 ) Net

income (loss) excluding loss on debt extinguishment, inventory

impairments and abandonments, unexpected warranty costs (net of

recoveries), additional insurance recoveries and write-off of

deposit (in millions)*+

$ 10.3 $ 4.9 $ 5.4

Land and land development spending (in millions)

$

309.9 $ 267.8 $ 42.1 Adjusted EBITDA (in millions)

$ 99.2 $ 109.4 $ (10.2 ) Adjusted EBITDA, excluding

unexpected warranty costs (net of recoveries), additional insurance

recoveries and write-off of deposit (in millions)

$

101.9 $ 90.3 $ 11.6

* Change and totals are calculated using

unrounded numbers.

+ Loss on debt extinguishment,inventory

impairments and abandonments, unexpected warranty costs (net of

recoveries) and additional insurance recoveries were tax-effected

at annualized tax effective rates of 36.7% and 49.5% for the nine

months ended June 30, 2017 and June 30, 2016,

respectively.

“LTM” indicates amounts for the trailing

12 months.

As of June 30,

2017

As of

June 30, 2017 2016

Change Backlog units

2,444 2,426 0.7 % Dollar value

of backlog (in millions)

$ 859.9 $ 814.6 5.6 % ASP in

backlog (in thousands)

$ 351.8 $ 335.8 4.8 % Land and

lots controlled

22,481 24,317 (7.6 )%

Conference Call

The Company will hold a conference call on August 1, 2017

at 5:00 p.m. ET to discuss these results. Interested parties may

listen to the conference call and view the Company’s slide

presentation over the Internet by visiting the “Investor Relations”

section of the Company’s website at www.beazer.com. To access the conference call by

telephone, listeners should dial 800-619-8639 (for international

callers, dial 312-470-7002). To be admitted to the call, verbally

supply the passcode “BZH.” A replay of the call will be available

shortly after the conclusion of the live call. To directly access

the replay, dial 866-479-8684 (for international callers, dial

203-369-1544) and enter the passcode “3740” (available until 5:59

a.m. ET on August 9, 2017), or visit www.beazer.com. A replay of the webcast will be

available at www.beazer.com for at

least 30 days.

Headquartered in Atlanta, Beazer Homes is a geographically

diversified homebuilder with active operations in 13 states

within three geographic regions in the United States. The

Company’s homes meet or exceed the benchmark for energy-efficient

home construction as established by ENERGY STAR® and are designed

with Choice Plans to meet the personal preferences and lifestyles

of its buyers. In addition, the Company is committed to providing a

range of preferred lender choices to facilitate transparent

competition among lenders and enhanced customer service. The

Company’s active operations are in the following states: Arizona,

California, Delaware, Florida, Georgia, Indiana, Maryland, Nevada,

North Carolina, South Carolina, Tennessee, Texas and Virginia.

Beazer Homes is listed on the New York Stock Exchange under the

ticker symbol “BZH.” For more info visit Beazer.com, or check out

Beazer on Facebook and Twitter.

This press release contains forward-looking statements. These

forward-looking statements represent our expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of our control, that could

cause actual results to differ materially from the results

discussed in the forward-looking statements, including, among other

things: (i) economic changes nationally or in local markets,

changes in consumer confidence, declines in employment levels,

inflation or increases in the quantity and decreases in the price

of new homes and resale homes on the market; (ii) the cyclical

nature of the homebuilding industry and a potential deterioration

in homebuilding industry conditions; (iii) factors affecting

margins, such as decreased land values underlying land option

agreements, increased land development costs on communities under

development or delays or difficulties in implementing initiatives

to reduce our production and overhead cost structure; (iv) the

availability and cost of land and the risks associated with the

future value of our inventory, such as additional asset impairment

charges or writedowns; (v) shortages of or increased prices for

labor, land or raw materials used in housing production, and the

level of quality and craftsmanship provided by our subcontractors;

(vi) estimates related to homes to be delivered in the future

(backlog) are imprecise, as they are subject to various

cancellation risks that cannot be fully controlled; (vii) a

substantial increase in mortgage interest rates, increased

disruption in the availability of mortgage financing, a change in

tax laws regarding the deductibility of mortgage interest for tax

purposes or an increased number of foreclosures; (viii) our cost of

and ability to access capital, due to factors such as limitations

in the capital markets or adverse credit market conditions, and

otherwise meet our ongoing liquidity needs, including the impact of

any downgrades of our credit ratings or reductions in our tangible

net worth or liquidity levels; (ix) our ability to reduce our

outstanding indebtedness and to comply with covenants in our debt

agreements or satisfy such obligations through repayment or

refinancing; (x) increased competition or delays in reacting to

changing consumer preferences in home design; (xi) continuing

severe weather conditions or other related events that could result

in delays in land development or home construction, increase our

costs or decrease demand in the impacted areas; (xii) estimates

related to the potential recoverability of our deferred tax assets,

and a potential reduction in corporate tax rates that could reduce

the usefulness of our existing deferred tax assets; (xiii)

potential delays or increased costs in obtaining necessary permits

as a result of changes to, or complying with, laws, regulations or

governmental policies, and possible penalties for failure to comply

with such laws, regulations or governmental policies, including

those related to the environment; (xiv) the results of litigation

or government proceedings and fulfillment of any related

obligations; (xv) the impact of construction defect and home

warranty claims, including water intrusion issues in Florida; (xvi)

the cost and availability of insurance and surety bonds, as well as

the sufficiency of these instruments to cover potential losses

incurred; (xvii) the performance of our unconsolidated entities and

our unconsolidated entity partners; (xviii) the impact of

information technology failures or data security breaches; (xix)

terrorist acts, natural disasters, acts of war or other factors

over which the Company has little or no control; or (xx) the impact

on homebuilding in key markets of governmental regulations limiting

the availability of water.

Any forward-looking statement speaks only as of the date on

which such statement is made and, except as required by law, we

undertake no obligation to update any forward-looking statement to

reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of unanticipated

events. New factors emerge from time-to-time, and it is not

possible for management to predict all such factors.

-Tables Follow-

BEAZER HOMES USA, INC.UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND

UNAUDITEDCOMPREHENSIVE INCOME (LOSS)(In thousands,

except per share data)

Three Months Ended

Nine Months Ended June 30, June 30,

2017 2016

2017 2016 Total

revenue

$ 478,588 $ 459,937

$ 1,243,297

$ 1,189,993 Home construction and land sales expenses

399,675 370,367

1,043,041 980,094 Inventory

impairments and abandonments

470 11,917

752 15,098 Gross profit

78,443 77,653

199,504 194,801 Commissions

18,773 17,500

48,728 45,856 General and

administrative expenses

40,794 40,457

117,282 111,024

Depreciation and amortization

3,307

3,387

9,139 9,434

Operating income

15,569 16,309

24,355 28,487 Equity

in income of unconsolidated entities

158 62

213 71

Gain (loss) on extinguishment of debt

— 429

(15,563

) (2,030 ) Other expense, net

(2,871 )

(5,344 )

(12,007 ) (18,467 )

Income (loss) from continuing operations before income taxes

12,856 11,456

(3,002 ) 8,061 Expense (benefit)

from income taxes

5,742 5,349

(1,262 ) 2,067 Income (loss)

from continuing operations

7,114 6,107

(1,740

) 5,994 Income (loss) from discontinued operations, net of

tax

9 (325 )

(101

) (447 ) Net income (loss) and comprehensive income

(loss)

$ 7,123 $ 5,782

$

(1,841 ) $ 5,547 Weighted average number of

shares: Basic

31,971 31,813

31,944 31,793 Diluted

32,375 31,820

31,944 31,797 Basic income (loss) per

share: Continuing operations

$ 0.22 $ 0.19

$

(0.05 ) $ 0.19 Discontinued operations

— (0.01 )

— (0.01

) Total

$ 0.22 $ 0.18

$

(0.05 ) $ 0.18 Diluted income (loss) per

share: Continuing operations

$ 0.22 $ 0.19

$

(0.05 ) $ 0.19 Discontinued operations

— (0.01 )

— (0.01

) Total

$ 0.22 $ 0.18

$

(0.05 ) $ 0.18

Three Months Ended Nine Months Ended June 30,

June 30, Capitalized Interest in Inventory

2017 2016

2017 2016 Capitalized interest in

inventory, beginning of period

$ 146,916 $ 140,139

$ 138,108 $ 123,457 Interest incurred

26,243

28,758

79,812 89,313 Capitalized interest impaired

—

(626 )

— (710 ) Interest expense not qualified for

capitalization and included as other expense

(2,934 )

(5,406 )

(12,232 ) (19,471 ) Capitalized interest

amortized to home construction and land sales expenses

(21,895 ) (20,467 )

(57,358

) (50,191 ) Capitalized interest in inventory, end of

period

$ 148,330 $ 142,398

$

148,330 $ 142,398

BEAZER HOMES USA, INC.UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS(In thousands, except

share and per share data)

June 30, 2017

September 30, 2016

ASSETS Cash and cash equivalents

$

168,381 $ 228,871 Restricted cash

12,735 14,405

Accounts receivable (net of allowance of $176 and $354,

respectively)

39,816 53,226 Income tax receivable

380

292 Owned Inventory

1,655,853 1,569,279 Investments in

unconsolidated entities

3,850 10,470 Deferred tax assets,

net

312,370 309,955 Property and equipment, net

18,658 19,138 Other assets

9,582

7,522 Total assets

$ 2,221,625 $

2,213,158

LIABILITIES AND STOCKHOLDERS’ EQUITY Trade

accounts payable

$ 119,408 $ 104,174 Other

liabilities

119,654 134,253 Total debt (net of premium of

$3,606 and $1,482, respectively, and debt issuance costs of $14,908

and $15,514, respectively)

1,334,623

1,331,878 Total liabilities

$ 1,573,685

$ 1,570,305 Stockholders’ equity: Preferred stock (par value

$.01 per share, 5,000,000 shares authorized, no shares issued)

$ — $ — Common stock (par value $0.001 per share,

63,000,000 shares authorized, 33,545,740 issued and outstanding and

33,071,331 issued and outstanding, respectively)

34 33

Paid-in capital

872,217 865,290 Accumulated deficit

(224,311 ) (222,470 ) Total stockholders’

equity

647,940 642,853 Total

liabilities and stockholders’ equity

$ 2,221,625

$ 2,213,158

Inventory Breakdown Homes

under construction

$ 558,533 $ 377,191 Development

projects in progress

706,134 742,417 Land held for future

development

152,959 213,006 Land held for sale

20,182

29,696 Capitalized interest

148,330 138,108 Model homes

69,715 68,861 Total owned

inventory

$ 1,655,853 $ 1,569,279

BEAZER HOMES USA,

INC.CONSOLIDATED OPERATING AND FINANCIAL DATA –

CONTINUING OPERATIONS($ in thousands, except otherwise

noted)

Three Months Ended June 30,

Nine Months Ended June 30, SELECTED

OPERATING DATA 2017 2016

2017

2016

Closings: West region

624 620

1,695 1,666 East region

346 373

849 907

Southeast region

417 371

1,077 990 Total closings

1,387

1,364

3,621 3,563

New orders,

net of cancellations: West region

791 661

1,941

1,820 East region

385 343

1,027 982 Southeast region

419 486

1,181

1,149 Total new orders, net

1,595 1,490

4,149 3,951

As of June

30, Backlog units at end of period: 2017 2016

West region

1,074 1,109 East region

622 562 Southeast

region

748 755 Total backlog units

2,444 2,426 Dollar value of backlog at end of period

(in millions)

$ 859.9 $ 814.6

Three Months Ended June 30, Nine Months Ended June

30, SUPPLEMENTAL FINANCIAL DATA 2017 2016

2017 2016

Homebuilding revenue: West region

$

208,004 $ 201,848

$ 564,908 $ 535,984 East

region

129,755 136,204

324,284 332,411 Southeast

region

134,637 112,925

341,204 296,430 Total homebuilding revenue

$

472,396 $ 450,977

$ 1,230,396 $

1,164,825

Revenues: Homebuilding

$

472,396 $ 450,977

$ 1,230,396 $ 1,164,825 Land

sales and other

6,192 8,960

12,901 25,168 Total revenues

$ 478,588

$ 459,937

$ 1,243,297 $ 1,189,993

Gross profit: Homebuilding

$ 78,662 $ 76,803

$ 199,190 $ 193,141 Land sales and other

(219 ) 850

314 1,660

Total gross profit

$ 78,443 $ 77,653

$

199,504 $ 194,801

Reconciliation of homebuilding gross profit and the related

gross margin before impairments and abandonments and interest

amortized to cost of sales to homebuilding gross profit and gross

margin, the most directly comparable GAAP measure, is provided for

each period discussed below. Management believes that this

information assists investors in comparing the operating

characteristics of homebuilding activities by eliminating many of

the differences in companies’ respective level of impairments and

level of debt.

In addition, given the unusual size and nature of the charges

related to the Florida stucco issues, net of insurance recoveries,

and the additional insurance recoveries from third-party insurer,

homebuilding gross profit is also shown excluding these charges.

Management believes that this representation best reflects the

operating characteristics of the Company.

Three Months Ended June 30,

Nine Months Ended June 30, 2017

2016

2017 2016

Homebuilding gross profit/margin

$ 78,662

16.7 % $ 76,803 17.0 %

$

199,190 16.2 % $ 193,141

16.6 % Inventory impairments and abandonments (I&A)

— 11,899

188 14,512

Homebuilding gross profit/margin before I&A

78,662 16.7 % 88,702 19.7 %

199,378

16.2 % 207,653 17.8 % Interest amortized to cost of

sales

21,895 20,080

57,358 49,520 Homebuilding gross profit/margin

before I&A and interest amortized to cost of sales

100,557 21.3 % 108,782 24.1 %

256,736

20.9 % 257,173 22.1 % Unexpected warranty costs

related to Florida stucco issues (net of expected insurance

recoveries)

— —

— (3,612 ) Additional insurance

recoveries from third-party insurer

— (15,500

)

— (15,500 ) Homebuilding gross profit/margin

before I&A, interest amortized to cost of sales and unexpected

warranty costs (net of recoveries)

$ 100,557

21.3 % $ 93,282 20.7 %

$ 256,736

20.9 % $ 238,061 20.4 %

Reconciliation of Adjusted EBITDA (earnings before interest,

taxes, depreciation, amortization, debt extinguishment, impairments

and abandonments) to total Company net income (loss), the most

directly comparable GAAP measure, is provided for each period

discussed below. Management believes that Adjusted EBITDA assists

investors in understanding and comparing the operating

characteristics of homebuilding activities by eliminating many of

the differences in companies’ respective capitalization, tax

position and level of impairments.

In addition, given the unusual size and nature of certain

amounts recorded during the periods presented, Adjusted EBITDA is

also shown excluding these amounts. Management believes that this

representation best reflects the operating characteristics of the

Company.

Three Months Ended

June 30,

Nine Months Ended

June 30,

LTM Ended June 30,(a) (In thousands)

2017 2016

2017 2016

2017 2016 Net income (loss)

$

7,123 $ 5,782

$ (1,841 ) $ 5,547

$ (2,695 ) $ 361,802 Expense (benefit) from

income taxes

5,740 5,168

(1,332 ) 1,809

13,083 (323,387 ) Interest amortized to home construction

and land sales expenses, capitalized interest impaired and interest

expense not qualified for capitalization

24,829 26,499

69,590 70,372

103,928 101,161 Depreciation and

amortization and stock-based compensation amortization

6,117

5,444

16,471 15,278

22,945 21,586 Inventory

impairments and abandonments (b)

470 11,291

752

14,388

936 17,248 (Gain) loss on extinguishment of debt

— (429 )

15,563

2,030

26,956 2,110

Adjusted EBITDA

$ 44,279 $ 53,755

$

99,203 $ 109,424

$ 165,153 $ 180,520

Unexpected warranty costs related to Florida stucco issues (net of

expected insurance recoveries)

— —

— (3,612 )

— (3,612 ) Additional insurance recoveries from third-party

insurer

— (15,500 )

— (15,500 )

— (15,500 )

Write-off of deposit on legacy land investment

—

—

2,700 —

2,700 — Adjusted EBITDA excluding

unexpected warranty costs (net of recoveries), additional insurance

recoveries and write-off of deposit

$ 44,279 $ 38,255

$ 101,903 $ 90,312

$

167,853 $ 161,408

(a) “LTM” indicates amounts for the

trailing 12 months.

(b) In periods during which we impaired

certain of our inventory assets, capitalized interest that is

impaired is included in the line above titled “Interest amortized

to home construction and land sales expenses, capitalized interest

impaired and interest expense not qualified for

capitalization.”

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170801006413/en/

Beazer Homes USA, Inc.David I. Goldberg, 770-829-3700Vice

President of Treasury and Investor Relationsinvestor.relations@beazer.com

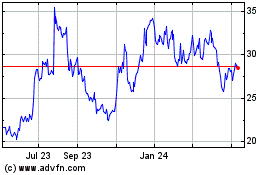

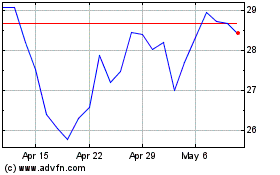

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Apr 2023 to Apr 2024