Beazer Homes Announces Results of Tender Offer for 7.500% Senior Notes Due 2021

March 13 2017 - 7:35PM

Business Wire

Beazer Homes USA, Inc. (NYSE: BZH) (the “Company”) announced

today the results of its previously announced cash tender offer for

any and all of its 7.500% Senior Notes due 2021 (the “Notes”), upon

the terms and conditions included in the Offer to Purchase, dated

March 7, 2017.

As of the Expiration Time, which was 5:00 p.m., New York City

time, on March 13, 2017, the aggregate principal amount of the

Notes that have been validly tendered and not validly withdrawn was

$175,399,000, representing 88.59% of the $198,000,000 aggregate

outstanding principal amount of the Notes.

The tender offer is subject to the satisfaction or waiver of

certain conditions as described in the Offer to Purchase, including

(1) the receipt of at least $250 million in gross proceeds from one

or more offerings of senior notes on terms reasonably acceptable to

the Company, and (2) certain general conditions, in each case as

described in more detail in the Offer to Purchase. If any of the

conditions are not satisfied, the Company may terminate the tender

offer and return tendered Notes, may waive unsatisfied conditions

and accept for payment and purchase all validly tendered Notes, may

extend the tender offer or may otherwise amend the tender

offer.

Subject to the terms and conditions of the tender offer being

satisfied or waived, holders who validly tendered and did not

withdraw Notes prior to the Expiration Time will, if their Notes

are accepted for purchase, receive the “Tender Offer Consideration”

equal to $1,060.25 per $1,000 principal amount of Notes. In

addition to the Tender Offer Consideration, holders will receive

accrued and unpaid interest on the Notes from the most recent

payment of semi-annual interest preceding the Settlement Date to,

but not including, the Settlement Date. The Settlement Date is

expected to be March 14, 2017.

The Company currently intends to redeem, as soon as practical

after the Settlement Date, any Notes that remain outstanding

following the tender offer in accordance with the terms of the

indenture governing the Notes. However, there is no requirement in

the Indenture or otherwise that the Company redeem any Notes, and

unless redeemed, such Notes will continue to remain

outstanding.

The complete terms and conditions of the tender offer are set

forth in the Offer to Purchase, the Letter of Transmittal and the

Notice of Guaranteed Delivery that have been sent to holders of the

Notes. Holders are urged to read the Offer to Purchase, the Letter

of Transmittal and the Notice of Guaranteed Delivery carefully.

The Company has engaged Credit Suisse Securities (USA) LLC to

act as Dealer Manager for the tender offer. Persons with questions

regarding the tender offer should contact Credit Suisse Securities

(USA) LLC toll-free at (800) 820-1653 or collect at (212) 325-2476.

Requests for documents should be directed to D.F. King & Co.,

Inc., the Tender and Information Agent for the tender offer, at

(212) 269-5550 (for banks and brokers) or (800) 290-6427 (for

noteholders).

This press release is for informational purposes only and is not

an offer to purchase or a solicitation of an offer to purchase with

respect to any of the Notes. The tender offer is being made

pursuant to the tender offer documents, including the Offer to

Purchase that the Company distributed to holders of the Notes. The

tender offer is not being made to holders of Notes in any

jurisdiction in which the making or acceptance thereof would not be

in compliance with the securities or other laws of such

jurisdiction. None of the Company, the Dealer Manager, the Tender

and Information Agent or their respective affiliates is making any

recommendation as to whether or not holders should tender all or

any portion of their Notes in the tender offer.

About Beazer Homes USA, Inc.

Headquartered in Atlanta, Beazer Homes is a geographically

diversified homebuilder with active operations in 13 states

within three geographic regions in the United States. The

Company's homes meet or exceed the benchmark for energy-efficient

home construction as established by ENERGY STAR® and are designed

with Choice Plans to meet the personal preferences and lifestyles

of its buyers. In addition, the Company is committed to providing a

range of preferred lender choices to facilitate transparent

competition between lenders and enhanced customer service. The

Company's active operations are in the following states: Arizona,

California, Delaware, Florida, Georgia, Indiana, Maryland, Nevada,

North Carolina, South Carolina, Tennessee, Texas and Virginia.

Beazer Homes is listed on the New York Stock Exchange under the

ticker symbol “BZH.”

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170313006452/en/

Beazer Homes USA, Inc.David I. Goldberg, 770-829-3700Vice

President of Treasury and Investor

Relationsinvestor.relations@beazer.com

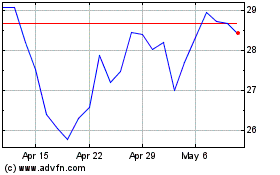

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Mar 2024 to Apr 2024

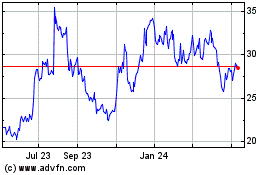

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Apr 2023 to Apr 2024