Bank of America Earnings Hurt by Tax-Related Charge -- 3rd Update

January 17 2018 - 8:42AM

Dow Jones News

By Rachel Louise Ensign

Bank of America Corp. said Wednesday that its fourth-quarter

profit fell from a year ago, hurt by a $2.9 billion charge related

to the tax bill, even as the bank ended a year that put its

crisis-era issues firmly in the past.

The Charlotte, N.C.-based bank reported a profit of $2.37

billion, or 20 cents a share. Without the tax charge, the bank's

profit was $5.3 billion, or 47 cents a share.

Analysts polled by Thomson Reuters had expected earnings of 44

cents a share, on an adjusted basis.

Bank of America shares rose 14 cents to $31.38 in premarket

trading.

Investors are expected to look past the one-time charges because

they are likely to be outweighed by the new tax law's longer-term

benefits. Starting this year, a lower corporate tax rate is

expected to boost Bank of America's profit by 16%, according to

Bernstein analysts.

Excluding the tax charges, the bank posted a $21.1 billion

profit for 2017, matching the bank's 2006 all-time profit

record.

Total revenue was $20.4 billion for the fourth quarter, but

$21.4 billion if excluding the tax-bill related items. That

compares to $19.99 billion a year earlier.

While the new tax law hurt Bank of America's results in the

fourth quarter, Chief Financial Officer Paul Donofrio said the

changes will soon turn to a net positive for the bank. In addition

to a lower tax rate that will lead to "significant savings," Mr.

Donofrio says the new law "will level the playing field" for the

U.S. against other countries.

"We benefit when U.S. consumers and corporations can grow and

when there is more economic activity in the U.S.," he said.

As recently as 2014, Bank of America's results were dogged by

tens of billions of dollars in penalties over financial-crisis era

issues. Since then, the company's legal problems have eased, as

Chairman and Chief Executive Brian Moynihan has made a concerted

effort to cut costs and focus on safer businesses such as lending

to consumers with good credit.

The bank also has had the help of rising interest rates, which

are boosting profits. The bank's net-interest income rose to

$11.462 billion from the prior quarter.

It paid slightly higher rates to depositors in the quarter. The

rate the bank paid on U.S. interest-bearing deposits was 0.27%,

compared with 0.24% in the prior quarter.

Trading revenue was a weak spot. Excluding an accounting

adjustment, it fell about 9% to $2.66 billion from $2.91 billion in

last year's fourth quarter.

Another issue was a $292 million charge-off related to "a

single-name non-U.S. commercial" client in the fourth quarter. A

person familiar with the matter said this was the bank's lending

activity involving troubled firm Steinhoff International Holdings

NV. JPMorgan Chase & Co. and Citigroup Inc. both took similar

charges for loans involving the retailer, which is battling a

burgeoning financial crisis after disclosing possible accounting

irregularities

Bank of America's quarterly return on equity was 7.8%, down

slightly from 8.1% the prior quarter and below the bank's 10%

theoretical cost of capital.

However, the bank came relatively close to meeting performance

goals it set for itself in the fourth quarter, including a 1%

return on average assets and a 12% return on average tangible

common equity. Excluding the effect of the tax bill, those metrics

stood at 0.9% and 10.9%.

Loan growth, which has slowed down across the banking industry,

grew 2% from a year earlier. The slowdown in lending across the

industry runs counter to the optimism that bank executives have

said they are hearing from customers. Executives are hoping tax

reform kick-starts borrowing.

Investment banking rose 16% from a year earlier.

Expenses for 2017 were $54.743 billion, just above the $53

billion target the bank has set for 2018.

The lender's overall improving fortunes helped lift its stock

above $30 a share for the first time since 2008 earlier this year.

Shares are up 84% since the 2016 presidential election, when hopes

for deregulation, tax cuts and rate increases sent stocks in the

sector higher.

Still, the bank had to issue so many new shares to deal with its

crisis-era problems that per-share profits remain far below

pre-2008 levels. And the bank still trades at a lower valuation

than some competitors like JPMorgan Chase.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

January 17, 2018 08:27 ET (13:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

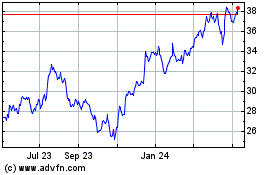

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

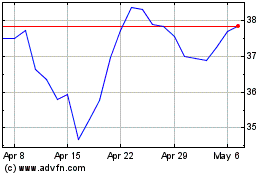

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024