BRT Apartments Corp. Acquires 281-Unit Value Add Property in Dallas/Ft. Worth, Texas

May 21 2018 - 6:00AM

BRT Apartments Corp. (NYSE:BRT) announced that an entity in which

it has a 50% equity interest acquired Landings of Carrier Parkway,

a 281-unit multi-family property located in Grand Prairie, Texas,

midway between Dallas and Ft. Worth, for $30.8 million, including

$19.0 million of mortgage debt obtained in connection with the

acquisition. The mortgage debt matures in 2028, carries an

interest rate of 4.37% and is interest only until 2023. BRT

contributed $7.3 million of equity in connection with the

acquisition and anticipated improvements to the property.

“Landings of Carrier Parkway presents BRT with a unique

opportunity to reposition a property located in a submarket

undergoing strong economic growth,” stated Jeffrey A. Gould,

President and CEO. “Grand Prairie is equidistant to both

Dallas and Fort Worth, making it an attractive location to live; it

is also well located near major employers, including Lockheed

Martin, Textron and General Motors, which is projected to add new

jobs to a near-by logistics center it is constructing.

Landings is yet another example of investing in multi-family

communities that we believe will contribute to BRT’s growth in the

coming years.”

BRT’s investment in Landings of Carrier Parkway represents the

fourth investment with this equity partner. The prior

investments are also located in Texas, which allows BRT and this

partner to leverage local market knowledge in their efforts to

reposition and add value to enhance the project’s economic

potential. In fiscal 2018, the Company has acquired six

multi-family properties for a total purchase price in excess of

$230 million.

Forward Looking

Statements:

Certain information contained herein is forward looking within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. BRT intends such forward looking statements to be

covered by the safe harbor provisions for forward looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and includes this statement for purposes of complying

with these safe harbor provisions. Forward-looking

statements, which are based on certain assumptions and describe our

future plans, strategies and expectations, are generally

identifiable by use of the words “may,” “will,” “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “project,” or similar

expressions or variations thereof. Forward looking

statements, including statements with respect to BRT’s multi-family

property acquisition, development and ownership activities, involve

known and unknown risks, uncertainties and other factors, which, in

some cases, are beyond BRT’s control and could materially affect

actual results, performance or achievements. Investors are

cautioned not to place undue reliance on any forward-looking

statements and to carefully review the section entitled “Item 1A. -

Risk Factors” in BRT’s Annual Report on Form 10-K for the year

ended September 30, 2017 and in the Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K filed thereafter.

About BRT Apartments Corp.:

BRT is a real estate investment trust that either directly, or

through joint ventures, owns and operates multi-family properties

and other real estate assets. Additional financial and

descriptive information on BRT, its operations and its portfolio,

is available at BRT’s website at:

http://BRTapartments.com. Interested parties are encouraged to

review BRT’s Annual Report on Form 10-K for the year ended

September 30, 2017, and the other reports filed thereafter with the

Securities and Exchange Commission for additional

information.

Contact: Investor RelationsBRT Apartments

Corp.60 Cutter Mill RoadSuite 303Great Neck, New York

11021Telephone (516) 466-3100Telecopier (516)

466-3132http://BRTapartments.com

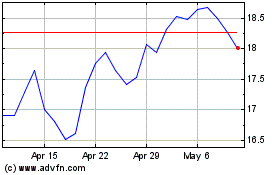

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

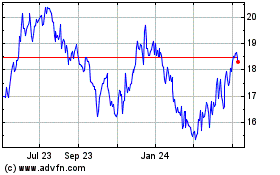

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Apr 2023 to Apr 2024