BHP Billiton Upbeat on Iron Ore, Coal -- Commodity Comment

February 20 2018 - 1:55AM

Dow Jones News

BHP Billiton Ltd., the world's largest listed miner by market

value, released its fiscal first-half results on Tuesday.

Underlying profit rose 25% to $4.05 billion, and said it will lift

its interim dividend by 38% to 55 cents a share.

Here are remarks from the company's report:

On its balance sheet:

"Higher commodity prices and a solid operating performance

delivered free cash flow of US$4.9 billion. We used this cash to

further reduce net debt and increase returns to shareholders

through higher dividends...Our capital-expenditure program remains

focused on high-return, low-risk development opportunities in

commodities where we see greatest potential. We remain firm in our

resolve to maximize cash flow, maintain discipline and increase

shareholder value and returns."

On China's outlook:

"Economic growth is expected to slow modestly" this year toward

the lower end of the 6.5-7.0% "official GDP target range...as

continued strength in infrastructure and resilience in external

trade is offset by a cooling of growth rates in the housing and

automobile markets."

On world growth:

Global GDP should match the 3.5-3.7% range seen last year in

2018 as "the U.S. economy should see a near-term boost to growth"

following the recent tax cuts. "In Europe and Japan, where the

limits of monetary-policy effectiveness may have been reached, any

upside on growth in the medium term will have to come from

external-demand sources. India's economy is on a healthy growth

trajectory, supported by positive reform sign posts."

On iron ore:

The overall price gains seen in the last half of 2017 came as

"demand for high-grade products remained firm on the back of high

steel margins" as Chinese production slowed. "This has resulted in

an elevated price differential between high- and low-grade-ore

price indexes. In the medium to longer term, ongoing Chinese

supply-side reforms, the shift of steel capacity to coastal regions

and more-stringent environmental policies are expected to underpin

demand for high-quality seaborne iron ore."

On copper:

Its prices also rose into 2018, helped by "continued strength in

China [demand], in particular from consumer durables. On the supply

side, the announcement that China would ban lower-grade copper

scrap imports and the potential for supply disruptions due to the

large number of upcoming labor negotiations in South America drove

sentiment. Over the next few years, the global copper market is

expected to remain finely balanced and vulnerable to supply shocks,

particularly in the concentrate segment."

On coal:

After 2H gains in metallurgical prices amid still-strong Chinese

demand and constrained domestic supplies, "high prices have

incentivized additional seaborne supply from the U.S. and

Mozambique. In the medium term, China's coal supply-side reforms

and environmental considerations will support demand for

higher-quality metallurgical coal."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 20, 2018 01:40 ET (06:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

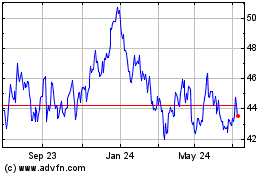

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024