Vaxart Merger is the Result of an Extensive

Review of Strategic Alternatives and is in the Best Interest of ALL

Stockholders

Aviragen Therapeutics, Inc. (NASDAQ:AVIR) today issued the

following statement in response to a report by Institutional

Shareholder Services (“ISS”) regarding the Company’s proposed

merger with Vaxart, Inc.:

“ISS’s report contains numerous factual errors and we strongly

believe that ISS has reached the wrong conclusion in failing to

recommend that Aviragen stockholders vote FOR our

proposed merger with Vaxart.

ISS’s recommendation relies on “the hope that the board finds

another transaction that adequately compensates shareholders for

Aviragen's assets (cash, a public listing, and a royalty stream).”i

However, ISS itself notes that voting against the transaction

carries significant risk “as the board appears to have already run

an extensive process before selecting Vaxart as a merger

candidate.”i

- Since the announcement on April 4, 2017, Aviragen conducted a

public seven-month review of strategic alternatives; having

considered 167 parties for strategic transactions, Aviragen sent

non-confidential materials to 65 parties and received indications

of interest from 16 parties, including numerous unsolicited inbound

inquiries. No other parties have expressed interest in a

transaction with Aviragen since the proposed merger with Vaxart was

announced three months ago. Given the public nature of this review,

Aviragen does not understand how ISS can conclude that a more

attractive candidate than Vaxart may emerge. Should Aviragen

stockholders vote against the transaction, it is unlikely that

another strategic option will emerge.

- Aviragen notes that after the merger closes, there will only be

$5 million of debt outstanding. In its analysis, ISS incorrectly

states that following the merger, the combined company may have to

address its high leverage based on Vaxart’s $33.1 million in net

debt. In fact, nearly all of Vaxart’s debt will convert to equity

as part of the transaction – and it will convert at $1.44 per

share, a substantial premium over the current share price of

$0.60.

- ISS asserts that stockholders would benefit from preserving

their liquidation option, but in its analysis fails to indicate

that the liquidation value of $22.4 million in the proxy was

calculated as of October 31, 2017. Given the passage of time and

the costs of the Company’s ongoing clinical trial and the pending

proxy contest with the group led by Digirad, the Company expects to

spend approximately $8 million between last October and June 30,

2018, at which point the Company expects to obtain topline data

from the ongoing trial. Given the timing of topline data, Aviragen

notes that June 30, 2018 is the earliest it could consider

liquidating the Company.

- By voting down the proposed merger with Vaxart, stockholders

leave open the possibility that the group led by Digirad – with no

alternative plans for growing the Company, a proposed Board slate

with no experience in the biotechnology industry to evaluate the

Company’s assets, and a chairman found to have violated securities

law – could still take control of the Board.

- ISS has understated the chance of success for Vaxart’s

products. Vaxart has recently completed a successful Phase 2

clinical trial in which its influenza tablet vaccine performed very

well against the market-leading injectable flu

vaccine, proving that its oral tablet vaccine delivery

technology works in humans. Vaxart’s second program, a novel oral

vaccine for norovirus, has already demonstrated robust immune

responses in human clinical trials. The proposed merger with Vaxart

will create a leading vaccine company with multiple opportunities

for value creation. Importantly, the combined company will be

well-financed with little debt and a cash runway through the second

quarter of 2019. The combined company will be led by an experienced

biotechnology management and directorial team, maximizing the

likelihood of success.

Aviragen’s Board and management team continue to believe

approving the proposed merger with Vaxart represents the best path

forward for Aviragen and its stockholders. Accordingly, Aviragen

strongly recommends stockholders vote FOR the

proposed merger with Vaxart.”

EACH VOTE IS IMPORTANT – PLEASE VOTE FOR

THE PROPOSED MERGER WITH VAXART TODAY - EACH VOTE

IS IMPORTANT

The Aviragen Board unanimously recommends that stockholders vote

FOR the proposed merger. Each vote is extremely

important, no matter how many or how few shares are owned. The

affirmative vote of the holders of a majority of the shares of

Aviragen common stock properly cast at the Aviragen Special

Meeting, presuming a quorum is present, is required to approve the

proposed merger. Aviragen stockholders of record at the close of

business on January 2, 2018 are entitled to vote at the Special

Meeting. Please take a moment to vote FOR the

proposals necessary to approve the proposed merger today – by

telephone, by Internet or by signing, dating and returning the

proxy card received with the proxy statement.

If you have any questions or need assistance voting your shares,

please contact our proxy solicitor, D.F. King & Co., Inc.,

toll-free at (800) 967-5074.

About Aviragen Therapeutics

Aviragen Therapeutics is focused on the discovery and

development of the next generation of direct-acting antivirals to

treat infections that have limited therapeutic options and affect a

significant number of patients globally. It has three Phase 2

clinical stage compounds: BTA074 (teslexivir), an antiviral

treatment for condyloma caused by human papillomavirus types 6 and

11; vapendavir, a capsid inhibitor for the prevention or treatment

of rhinovirus (RV) upper respiratory infections; and BTA585

(enzaplatovir), a fusion protein inhibitor in development for the

treatment of respiratory syncytial virus infections. Aviragen also

receives royalties from marketed influenza products, Relenza® and

Inavir®. For additional information, please visit

www.aviragentherapeutics.com.

Aviragen Therapeutics® is a registered trademark. Relenza® is a

registered trademark of GlaxoSmithKline Pharmaceuticals, Ltd., and

Inavir® is a registered trademark of Daiichi Sankyo Company,

Ltd.

Forward Looking Statements

This press release contains forward-looking statements about

Aviragen Therapeutics, Inc. and Vaxart Inc., and their respective

businesses, business prospects, strategy and plans, including but

not limited to statements regarding anticipated preclinical and

clinical drug development activities, timelines and market

opportunities; the combined company being well-funded to advance

its programs; the potential of Vaxart’s flu vaccine to produce

better efficacy and in a timely manner; and the combined company’s

ability to accelerate development of Vaxart’s vaccine candidates

and generate near and long term value for stockholders. All

statements other than statements of historical facts included in

this press release are forward looking statements. The words

“anticipates,” “may,” “can,” “plans,” “believes,” “estimates,”

“expects,” “projects,” “intends,” “likely,” “will,” “should,” “to

be,” and any similar expressions or other words of similar meaning

are intended to identify those assertions as forward looking

statements. These forward looking statements involve

substantial risks and uncertainties that could cause actual results

to differ materially from those anticipated, including, without

limitation: the risk that the conditions to the closing of the

merger are not satisfied, the failure to timely or at all obtain

stockholder approval for the merger; uncertainties as to the timing

of the consummation of the merger and the ability of each of

Aviragen and Vaxart to consummate the merger; risks related to

Aviragen’s ability to correctly estimate its operating expenses and

its expenses associated with the merger; risks related to the

market price of Aviragen’s common stock relative to the exchange

ratio; the ability of Aviragen or Vaxart to protect their

respective intellectual property rights; competitive responses to

the merger; unexpected costs, charges or expenses resulting from

the merger; and potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

merger. The vaccine candidates that Vaxart develops may not

progress through clinical development or receive required

regulatory approvals within expected timelines or at all. In

addition, future clinical trials may not confirm any safety,

potency or other product characteristics described or assumed in

this press release and such vaccine candidates may not successfully

commercialized. Additional factors that may cause actual

results to differ materially from such forward looking statements

include those identified under the caption “Risk Factors” in the

documents filed by Aviragen with the Securities and Exchange

Commission from time to time, including its Proxy/Prospectus on

Form S-4, Annual Reports on Form 10-K, Quarterly Reports on Form

10-Q, and Current Reports on Form 8-K. You are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. Except to the

extent required by applicable law or regulation, neither Aviragen

nor Vaxart undertakes any obligation to update the forward-looking

statements included in this press release to reflect subsequent

events or circumstances.

Additional Information About the Merger and Where to

Find It

In connection with the proposed strategic merger, Aviragen and

Vaxart have filed relevant materials with the Securities and

Exchange Commission, or the SEC, including a registration statement

on Form S-4, as amended, that contains a prospectus and a joint

proxy statement. Investors may obtain the proxy

statement/prospectus, as well as other filings containing important

information about Aviragen, Vaxart and the merger, free of charge

at the SEC’s web site (www.sec.gov). In addition, investors and

security holders may obtain free copies of the documents filed with

the SEC by Aviragen by directing a written request to: Aviragen

Therapeutics, Inc. 2500 Northwinds Parkway, Suite 100, Alpharetta,

GA 30009, Attention: Corporate Secretary or delivered via email to

investors@aviragentherapeutics.com. Investors and security holders

are urged to read the proxy statement/prospectus and the other

relevant materials before making any voting or investment decision

with respect to the merger.

This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Participants in the Solicitation Aviragen and

Vaxart and their respective directors and officers and certain of

their other members of management and employees may be deemed to be

participants in the solicitation of proxies from the stockholders

of Aviragen in connection with the proposed transaction.

Information regarding the special interests of these directors and

executive officers in the merger are included in the proxy

statement/prospectus referred to above. Additional information

regarding the directors and executive officers of Aviragen is also

included in Aviragen’s Annual Report on Forms 10-K for the year

ended June 30, 2017, filed with the SEC on September 1, 2017, and

the Form 10-K/A filed with the SEC on October 20, 2017. These

documents are available free of charge from the sources indicated

above.

Contacts Mark ColonneseExecutive Vice President

and Chief Financial OfficerAviragen Therapeutics, Inc.(678)

221-3381

mcolonnese@aviragentherapeutics.com

Beth DelGiaccoStern Investor Relations, Inc.(212)

362-1200beth@sternir.com

Kristian KleinD.F. King & Co., Inc.(212) 232-2247

Winnie Lerner / Nick LeasureFinsbury(646) 805-2855

i Permission to use quotations neither sought nor obtained

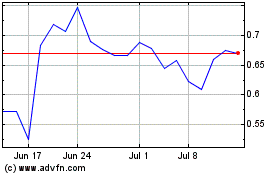

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

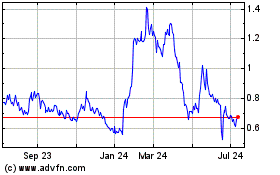

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Apr 2023 to Apr 2024