Australian Dollar Advances As Asian Stock Markets Trade Higher

July 10 2017 - 11:17PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Tuesday, as Asian stock markets

traded higher following the mostly positive cues overnight from

Wall Street.

Investors are awaiting the start of the U.S. corporate earnings

season and Federal Reserve Chair Janet Yellen's semi-annual

testimony before Congress later in the week. The testimony will be

closely scrutinized for clues about when the Fed will again raise

interest rates.

Crude oil delivery for August is currently up by 0.11 percent or

$44.51 per barrel. The crude oil prices rose as traders bet

significant recent losses were overdone in the aftermath of last

week's U.S. stockpiles drawdown.

There are some indications that U.S. production has slowed after

robust output earlier in the year. The U.S. rig count fell slightly

two weeks ago, and inventories at the Cushing facilities have

dwindled from record highs.

On the economic front, the Australian Bureau of Statistics said

that the total number of home loans in Australia gained a

seasonally adjusted 1.0 percent on month in May, standing at

54,061. That missed forecasts for 1.5 percent following the 1.9

percent decline in April.

The latest survey from the National Australia Bank revealed that

business confidence in Australia saw a marginal improvement in

June, with an index score of +9. That's up from +8 in May, and it

moves further into positive territory and the realm of

optimism.

Monday, the Australian dollar showed mixed trading against its

major rivals. While the aussie rose against the yen and the NZ

dollar, it held steady against the U.S. dollar, the euro and the

Canadian dollar.

In the Asian trading, the Australian dollar rose to nearly a

4-month high of 87.13 against the yen and a 5-day high of 1.4949

against the euro, from yesterday's closing quotes of 86.74 and

1.4984, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 88.00 against the yen and 1.47

against the euro.

Against the U.S. and the Canadian dollars, the aussie advanced

to 4-day highs of 0.7621 and 0.9829 from yesterday's closing quotes

of 0.7607 and 0.9804, respectively. The aussie may test resistance

near 0.78 against the greenback and 1.00 against the loonie.

The aussie climbed to a 1-week high of 1.0537 against the NZ

dollar, from yesterday's closing value of 1.0454. On the upside,

1.06 is seen as the next resistance level for the aussie.

Looking ahead, Bank of England Chief Economist Andy Haldane is

expected to participate in a panel discussion at the 'Essentials of

Numeracy' launch event, in London at 6:00 am ET.

At 7:00 am ET, Bank of England Deputy Governor Ben Broadbent is

expected to speak at the Scottish Council for Development and

Industry, in Aberdeen, Scotland.

At 8:00 am ET, European Central Bank Board member Benoit Coeure

gives opening remarks at the FX Contact Group meeting in

Frankfurt.

In the New York session, U.S. NFIB small business index, Canada

housing starts and U.S. wholesale inventories, all for June, are

slated for release.

At 12:20 pm ET, Federal Reserve Bank of Minneapolis President

Neel Kashkari will participate in a Town Hall question-and-answer

session moderated by Bremer Bank CEO Jeanne Crain in

Minneapolis.

At 12:30 pm ET, Federal Reserve Governor Lael Brainard is

expected to speak about normalizing central banks' balance sheets

at a conference jointly sponsored by Columbia University and the

Federal Reserve Bank of New York.

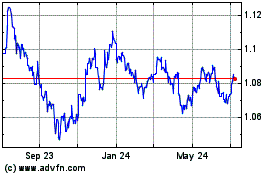

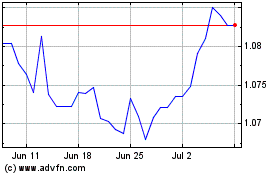

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024