- A very good year end, driving an

excellent full-year performance for 2017 and demonstrating the

rationale of the Group’s strategy

- €8,326 million in sales,

up 10.5% on 2016, with 8.9% organic growth

- EBITDA up 17% to €1,391

million, led by strong growth for all three of the Group’s

divisions

- EBITDA margin at 16.7%

(15.8% in 2016)

- Adjusted net income up 42% to

€592 million, representing €7.82 per share (€5.56 per

share in 2016)

- Very strong cash generation, with

€565 million in free cash flow and a significant reduction

in net debt to €1,056 million (versus €1,482 million at 31

December 2016), i.e. 0.8 times 2017 EBITDA

- Proposed dividend increase from

€2.05 to €2.30 per share

Regulatory News:

The Board of Directors of Arkema (Paris:AKE) met on 21 February

2018 to approve the Group's consolidated financial statements for

2017 and the annual financial statements of the parent company. At

the close of the meeting, Chairman and CEO Thierry Le Hénaff

stated:

“Our very good performance in 2017 reflects the quality of our

underlying strategy and the strength of the growth projects for our

specialty businesses. We largely exceeded the medium-term financial

targets we set ourselves in 2014, with close to €1.4 billion in

EBITDA, excellent cash generation and a low level of debt.

The Group is reaping the benefits of its successful innovations

for advanced materials meeting our customers’ high demand for

lighter materials, new energies, 3D printing and consumer goods as

demonstrated by our ranking, for the seventh consecutive year, in

the Top 100 Global Innovators by Clarivate Analytics.

With Bostik, we have created a leading growth platform in

adhesives, which currently represents almost a quarter of our

overall sales. Bostik is proving all its potential, with its EBITDA

up by more than 50% since it joined Arkema three years ago.

Lastly, our intermediate chemical businesses achieved an

excellent performance supported by a very solid environment and the

development and productivity initiatives undertaken since several

years.

Arkema has demonstrated over the past three years and in

different types of operating contexts, the quality of its portfolio

of businesses with one of the best growth rates in its

industry.”

2017 KEY FIGURES

(In millions of euros)

2017

2016

Year-on-yearchange

Sales 8,326 7,535

+10.5% EBITDA

1,391 1,189 +17.0%

EBITDA margin 16.7 %

15.8 % Recurring depreciation and

amortization (449) (455)

-1.3%

Recurring operating income (REBIT)

942 734 +28.3%

REBIT margin 11.3% 9.7%

Depreciation and amortization related to purchase price

allocation* (45) (38) N/A

Other income and expenses* (52) 21

N/A

Operating income 845

717 +17.9% Adjusted

net income 592 418

+41.6% Net income – Group share

576 427 +34.9% Adjusted net income per

share (in €) 7.82 5.56

+40.6% Weighted average number of ordinary shares

75,682,844 75,201,739

* In the consolidated income statement, “Depreciation and

amortization related to the revaluation of tangible and intangible

assets as part of the purchase price allocation process” is now

recognized in “Operating expenses”. For 2016, other income and

expenses were restated to reflect this reclassification.

2017 BUSINESS PERFORMANCE

Sales totaled €8,326 million in 2017, up 10.5% on

2016. At constant exchange rates and business scope, the increase

was 8.9%. Volumes, which were 2.4% higher year on year,

significantly increased in High Performance Materials (+4.4%)

driven by Asia, the Group’s innovation drive and the startup of

new units. The price effect was positive for all three divisions

with a positive 6.5% price effect overall. This reflects the

actions taken by the Group to raise selling prices in specialty

businesses (which accounted for 71% of Group sales for the year)

and positive market conditions in intermediate chemical businesses

(which contributed 29% to the Group’s total sales figure1). The

scope effect added 3.3% to sales and included the contribution of

Den Braven as well as the impact of the divestment of the activated

carbon and filter aid business and the oxo alcohols business. The

currency effect was a negative 1.7%, primarily due to the

appreciation of the euro against the US dollar.

Broken down geographically, North America represented 32% of

Group sales, Europe 38% and Asia and the rest of the world 30%.

At €1,391 million, EBITDA reached an all-time

high, up 17% year on year and largely exceeding the €1.3 billion

target that the Group set itself in 2014 for 2017. All three

divisions reported EBITDA rises despite higher raw materials costs

than in 2016. This performance was led by Bostik’s growth, with in

particular the contribution of Den Braven, the benefits of

sustainability innovations and new manufacturing units for advanced

materials, excellent results from the Industrial Specialties

division, improvements in the acrylic cycle and operational

excellence initiatives.

EBITDA margin increased to16.7% from 15.8% in

2016, in line with the Group’s medium- and long-term targets.

Recurring operating income amounted to €942

million compared to €734 million in 2016, in line with EBITDA

increase. It includes €449 million in recurring depreciation and

amortization, which was overall stable compared to 2016

(€455 million). REBIT margin, which corresponds to

recurring operating income as a percentage of sales, rose to

11.3% from 9.7% in 2016.

At €845 million, operating income was up 18% year on

year. It included €52 million in net other expenses, roughly half

of which stemmed from the consequences of hurricane Harvey in the

United States and the remaining half from restructuring and

acquisition costs. It also included €45 million in depreciation and

amortization related to the revaluation of assets carried out as

part of the Bostik and Den Braven purchase price allocation

processes.

Financial result represented a net expense of €103

million, unchanged from 2016.

Income taxes represented a net expense of €162

million in 2017 versus a net €193 million expense in 2016.

Excluding exceptional items, the tax rate corresponded to 26% of

recurring operating income, down significantly on the 29% rate for

2016 due to the more balanced geographic split of the Group’s

results in 2017. The income tax expense figure comprises various

exceptional items, including a one-time €36 million gain with no

cash impact arising from the adjustment of deferred taxes following

the decrease in corporate tax rate announced in the United States.

In view of the Group’s strong position that it has built up in the

United States and based on its 2017 results, Arkema will benefit

with the US tax reform from an estimated tax saving representing

around 6% of its adjusted net income, which will reduce its tax

rate to around 23% of recurring operating income. This tax saving

comes at a time when the Group is substantially increasing its

capital expenditure in the United States.

Net income – Group share rose sharply to €576

million from €427 million in 2016. Excluding the post-tax

impact of non-recurring items, adjusted net income came to

€592 million, representing €7.82 per share (up 41% on

2016).

In line with the Group’s dividend policy, the Board of Directors

has decided that at the Annual General Meeting of 18 May 2018 it

will recommend increasing the dividend to be paid entirely in cash

from €2.05 per share to €2.30, representing a payout rate of

almost 30% of the Group’s adjusted net income. Shares will be

traded ex-dividend on 25 May 2018 and the dividend will be paid as

from 29 May 2018.

2017 PERFORMANCE BY DIVISION

HIGH PERFORMANCE MATERIALS (46% OF TOTAL GROUP SALES)

(In millions of euros)

2017

2016

Year-on-yearchange

Sales 3,830 3,422

+11.9% EBITDA 632

570 +10.9% EBITDA

margin 16.5% 16.7%

Recurring operating income (REBIT)

474 416

+13.9% REBIT margin 12.4% 12.2%

Sales generated by the High Performance Materials

division totaled €3,830 million, up 11.9% on 2016. The scope

effect was a positive 8.0%, reflecting the integration of Den

Braven and the CMP business within Bostik as well as the divestment

of the activated carbon and filter aid business. At constant

exchange rates and business scope, year-on-year sales growth was

5.9%, led by a 4.4% increase in volumes. Volumes rose for all the

division’s businesses, driven in particular by very high demand in

Asia for lighter materials, new energies (batteries and

photovoltaics) and consumer goods (sports and consumer electronics)

as well as by the contribution of the new specialty molecular

sieves unit in Honfleur (France). The price effect was a positive

1.5%, reflecting the actions undertaken by the Group to raise its

selling prices. The currency effect was a negative 2.1%.

At €632 million, EBITDA increased 10.9% year on

year, supported by strong volume momentum for advanced materials

(Technical Polymers and Performance Additives), as well as by

Bostik’s growth fueled by the integration of Den Braven and the

benefits of first synergies. This strong rise was achieved despite

the significant impact of higher costs for certain raw materials

and the stronger euro versus the US dollar.

At 16.5%, EBITDA margin held firm compared with the 16.7%

margin for 2016.

INDUSTRIAL SPECIALTIES (31% OF TOTAL GROUP SALES)

(In millions of euros)

2017

2016

Year-on-yearchange

Sales 2,545 2,316

+9.9% EBITDA 585

473 +23.7% EBITDA

margin 23.0% 20.4%

Recurring operating income (REBIT)

411 300

+37.0% REBIT margin 16.1% 13.0%

Industrial Specialties sales were up 9.9% year on year to

€2,545 million. At constant exchange rates and business

scope, sales growth was 11.3%, driven by a 9.6% positive price

effect reflecting higher prices for certain fluorogases

particularly in Europe and Asia, and positive market conditions in

the MMA/PMMA chain. Volumes were 1.7% higher than in 2016, driven

mainly by good demand in Thiochemicals. The currency effect was a

negative 1.4%.

At €585 million, EBITDA increased 23.7% year on

year and EBITDA margin reached 23% in a market

boosted by robust global growth and a more intense environmental

policy in China. Against this backdrop, the division’s results

reflect the return of Fluorogases to a very good level of results,

a tight supply/demand situation in the MMA/PMMA business, and a

solid performance by Thiochemicals and Hydrogen Peroxide.

COATING SOLUTIONS (23% OF TOTAL GROUP SALES)

(In millions of euros)

2017

2016

Year-on-yearchange

Sales 1,924 1,771

+8.6% EBITDA 244

208 +17.3% EBITDA

margin 12.7% 11.7%

Recurring operating income (REBIT)

135 83

+62.7% REBIT margin 7.0% 4.7%

At €1,924 million, sales for the Coating Solutions

division rose 8.6% on 2016, led by a 12.1% positive price effect

thanks to a better acrylic cycle as well as measures taken to raise

selling prices across the entire chain. Volumes were generally

stable year on year (edging down just 0.4%), as higher volumes in

the division’s downstream businesses offset the impact in the

Acrylics business of maintenance turnarounds. The divestment of the

oxo-alcohol business resulted in a 1.5% negative scope effect and

the currency effect was a negative 1.5%.

The division’s EBITDA amounted to €244 million, up

17.3% year on year, and EBITDA margin rose to 12.7%

from 11.7% in 2016. As the Group expected, unit margins for acrylic

monomers gradually improved from the low points seen in 2016, and

were positioned in 2017 between the low and mid point of the cycle.

This more than offset the impact of higher input costs on

downstream businesses.

CASH FLOW AND NET DEBT AT 31 DECEMBER 2017

In 2017, Arkema generated a high level of free cash flow

(which corresponds to net cash flow excluding the impact of

portfolio management), with a year-on-year increase of €139 million

to €565 million (€426 million in 2016). This increase

reflects the significant rise in EBITDA and tight control of

working capital despite a context of rising raw materials costs. At

31 December 2017, the ratio of working capital to annual sales

reached a record low at 13.1% compared with 14.5% at 31 December

2016 (excluding Den Braven which was acquired in late 2016). This

ratio, which was positively impacted by the appreciation of the

euro, mainly reflects the continuing implementation of a strict

operational discipline and the optimization drive conducted in

several businesses.

The free cash flow also includes €431 million in recurring

capital expenditure 2 (representing 5.2% of Group sales) as

well as €10 million in exceptional investments for the initial work

undertaken as part of the project to double thiochemical production

capacity in Malaysia.

In 2018 Arkema expects capital expenditure to amount to around

€550 million, corresponding to recurring capital expenditure

representing around 5.5% of sales and to exceptional investments

for the specialty polyamides project in Asia and the thiochemicals

project in Malaysia presented at Arkema’s Capital Markets Day in

July 2017.

Finally, free cash flow also included €54 million in

non-recurring expenses, primarily relating to the consequences of

hurricane Harvey in the United States and restructuring costs.

Free cash flow excluding exceptional investments represented 41%

of EBITDA for 2017, thus exceeding the Group’s target of a 35%

EBITDA conversion rate into cash. This performance is in the top

range for the industry as a whole.

Portfolio management operations represented a net cash outflow

of just €5 million in 2017, with the impact of the purchase of the

assets of CMP Specialty Products in the adhesives business almost

entirely offsetting the effect of the divestment of the oxo

alcohols business.

Cash flow from financing activities totaled €192

million in 2017 and included a bond issue for a total net

amount of €891 million, the repayment of a bond that had reached

maturity for a net amount of €494 million, the payment of a €2.05

per-share dividend totalling €155 million and a €33 million

coupon paid on a hybrid bond.

At 31 December 2017 net debt stood at €1,056

million, down significantly on the €1,482 million net debt

figure at 31 December 2016. The Group’s gearing decreased to

24% from 35% at end-December 2016 and net debt represented 0.8

times EBITDA for the year. In accordance with IFRS standards, these

figures exclude the hybrid bond.

KEY FIGURES FOR FOURTH-QUARTER 2017

(In millions of euros)

Q4 2017

Q4 2016

Year-on-yearchange

Sales 1,957 1,852

+5.7% EBITDA 283

243 +16.5% High

Performance Materials 131 116 +12.9% Industrial Specialties 120 87

+37.9% Coating Solutions 44 41

+7.3%

EBITDA margin 14.5% 13.1%

High Performance Materials

14.4%

13.8%

Industrial Specialties

19.8%

15.3%

Coating Solutions

10.1%

9.3%

Depreciation, amortization and impairment

(118) (119) -0.8%

Recurring operating income (REBIT) 165

124 +33.1% REBIT margin

8.4% 6.7%

Adjusted net income 115

68 +69.1% Net income – Group share

137 86 +59.3% Adjusted

net income per share (in €) 1.52 0.90

+68.9%

In the fourth quarter of 2017, sales rose 6.7% year on

year to €1,957 million at constant exchange rates and

business scope. The price effect was positive for all three

divisions with a positive 6.7% price effect overall. This reflects

the actions taken by the Group to raise its selling prices for

specialty businesses as well as continuously positive market

conditions for intermediate chemical businesses. Despite a 4%

increase in volumes for advanced materials, volumes for the Group

as a whole remained overall stable against the high basis of

comparison of the fourth quarter of 2016, particularly in the

Coating Solutions division. The scope effect was a positive 3.7%

and included the contribution of Den Braven as well as the impact

of the divestment of the oxo alcohols business. The currency effect

was a negative 4.7%, primarily attributable to the stronger euro

versus the US dollar.

Against this backdrop EBITDA was up 16.5% to

€283 million and EBITDA margin reached 14.5%

compared to 13.1% in fourth-quarter 2016, despite much higher raw

materials costs in fourth-quarter 2017 and the stronger euro versus

the US dollar. This performance was led by higher volumes for

advanced materials, the benefits from Den Braven’s integration and

first synergies, as well as a very good performance from the

Industrial Specialties division.

The High Performance Materials division delivered a good

performance in spite of higher raw materials costs and the stronger

euro. At €909 million, the division’s sales rose 8.3% on

fourth-quarter 2016, led by a 9.3% positive scope effect, mainly

related to the integration of Den Braven and CMP. At constant

exchange rates and business scope, year-on-year sales growth came

to 3.5%, driven by a 4% increase in volumes for advanced materials

driven by Asia and innovation. EBITDA came to €131 million, up

12.9% on fourth-quarter 2016, reflecting the strong sales rise.

The Industrial Specialties division achieved another very

good quarter, with sales up 6.7% year on year to €606 million.

At constant exchange rates and business scope, the increase was

11.7% led by a 13.3% positive price effect, with a positive price

effect for all of the division’s businesses. At €120 million, the

division’s EBITDA surged 37.9%, supported by increases across all

of the division’s businesses and reflecting the continuing tight

market conditions for the MAM/PMMA chain as well as good results

from the Fluorogases business despite the usual year-end

seasonality.

The Coating Solutions division reported a slight increase

against a high basis of comparison in the fourth quarter of 2016,

especially for Asia. At €437 million, Coating Solutions sales were

generally stable versus fourth-quarter 2016, edging down just 0.7%,

with a 2.1% negative scope effect following the divestment of the

oxo alcohols business. At constant exchange rates and business

scope, sales rose 6.3% on the fourth quarter of 2016, thanks to a

9.0% positive price effect. EBITDA increased by 7.3% to €44

million, with better margins for acrylic monomers in Europe and the

United States more than offsetting the impact in downstream

businesses of higher input costs.

POST BALANCE SHEET EVENTS

In line with its strategy of continuing to expand in adhesives,

on 2 January 2018 Bostik acquired the assets of XL Brands, a

leader in floor covering adhesives in the United States. This

transaction, based on a US$205 million enterprise value, will

enable Bostik to offer a full range of solutions for this growing

high added-value market. The Group aims to reduce the EV/EBITDA

multiple paid from 11 times to 7 times within four to five years

and after implementing synergies.

In February 2018, Arkema announced a 25% increase of its global

polyamide 12 production capacities. This new capacity will be added

at Arkema’s Changshu platform in China and is expected to come on

stream by mid-2020. This investment of a few tens of millions of

euros will support the strong demand in growing applications such

as cable protection, lighter materials in automobiles, high

performance sports shoes and consumer electronics.

OUTLOOK FOR 2018

In 2018, demand in the three main geographic regions should

remain well oriented and the environment characterized by a marked

strengthening of the euro versus the US dollar 3 and higher

and volatile raw materials costs.

Against this backdrop, the Group will benefit from its strong

innovation drive in advanced materials, from Bostik’s growth

with the integration of XL Brands and from a market environment

expected to remain globally robust for its intermediate chemical

businesses. It will continue to implement its major manufacturing

projects, as presented during its Capital Markets Day, for

thiochemicals, specialty polyamides, fluoropolymers and

Sartomer.

Lastly, the Group will continue its actions to pass on in its

selling prices the continuous rises in raw materials costs as well

as the rollout of its operational excellence initiatives to partly

offset inflation on its fixed costs.

Supported by a good start of the year and this strong internal

momentum and despite the euro’s current strength, Arkema is

confident in its ability to increase its EBITDA in 2018 compared to

the excellent performance achieved in 2017.

Further details on the 2017 results and outlook are provided in

the "Full year 2017 results" presentation available on Arkema’s

website at www.finance.arkema.com

The consolidated financial statements at 31 December 2017 have

been audited, and an unqualified certification report has been

issued by the Company's statutory auditors. These accounts and the

statutory auditors’ report will be available at end-March in the

Company’s reference document which will be posted online on

Arkema’s website at www.finance.arkema.com

FINANCIAL CALENDAR

3 May 2018

Publication of 1st quarter 2018

results

18 May 2018 Annual General Meeting 1 August 2018

Publication of 1st half 2018 results

6 November 2018

Publication of 3rd quarter 2018

results

A designer of materials and innovative solutions, Arkema

shapes materials and creates new uses that accelerate customer

performance. Our balanced business portfolio spans High Performance

Materials, Industrial Specialties and Coating Solutions. Our

globally recognized brands are ranked among the leaders in the

markets we serve. Reporting annual sales of €8.3 billion in 2017,

we employ around 20,000 people worldwide and operate in some 50

countries. We are committed to active engagement with all our

stakeholders. Our research centers in North America, France and

Asia concentrate on advances in bio-based products, new energies,

water management, electronic solutions, lightweight materials and

design, home efficiency and insulation. www.arkema.com

DISCLAIMER

The information disclosed in this press release may contain

forward-looking statements with respect to the financial position,

results of operations, business and strategy of Arkema. Such

statements are based on management's current views and assumptions

that could ultimately prove inaccurate and are subject to risk

factors such as (but not limited to) changes in raw materials

prices, currency fluctuations, the pace at which cost-reduction

projects are implemented and changes in general economic and

financial conditions. Arkema does not assume any liability to

update such forward-looking statements whether as a result of any

new information or any unexpected event or otherwise. Further

information on factors which could affect Arkema's financial

results is provided in the documents filed with the French Autorité

des marchés financiers.

Balance sheet, income statement and cash flow statement data as

well as data relating to the statement of changes in shareholders'

equity and information by business division included in this press

release are extracted from the consolidated financial statements at

31 December 2017 as reviewed by Arkema’s Board of Directors on 21

February 2018. Quarterly financial information is not audited.

Information by business division is presented in accordance with

Arkema's internal reporting system used by management.

Details of the main alternative performance indicators used by

the Group are provided in the tables appended to this press

release.

For the purpose of analyzing its results and defining its

targets, the Group also uses the following indicators:

• REBIT margin: recurring operating income (REBIT)

as a percentage of sales.

• free cash flow: net cash flow from operating and

investing activities excluding the impact of portfolio

management.

For the purpose of tracking changes in its results, and

particularly its sales figures, the Group analyzes the following

effects (unaudited analyses):

• business scope effect: the impact of changes in

the Group’s scope of consolidation, which arise from acquisitions

and divestments of entire businesses or as a result of the

first-time consolidation or deconsolidation of entities. Increases

or reductions in capacity are not included in the scope effect.

• currency effect: the mechanical impact of

consolidating accounts denominated in currencies other than the

euro at different exchange rates from one period to another. The

currency effect is calculated by applying the foreign exchange

rates of the prior period to the figures for the period under

review.

• price effect: the impact of changes in average

selling prices is estimated by comparing the weighted average net

unit selling price of a range of related products in the period

under review with their weighted average net unit selling price in

the prior period, multiplied, in both cases, by the volumes sold in

the period under review.

• volume effect: the impact of changes in volumes

is estimated by comparing the quantities delivered in the period

under review with the quantities delivered in the prior period,

multiplied, in both cases, by the weighted average net unit selling

price in the prior period.

1 Acrylics, Fluorogases and PMMA.2 Excluding exceptional capex

and capex relating to portfolio management.3 10% increase in euro /

US dollar exchange rate has a €(50) m EBITDA impact

(translation).

ARKEMA Financial Statements

Consolidated financial statements - At the

end of December 2017

CONSOLIDATED INCOME STATEMENT

4th quarter

2017

End of December

2017

3rd

quarter 2016

End of December

2016

(In millions of euros) (non audited)

(audited) (non audited) (audited)

Sales

1,957

8,326

1,852

7,535

Operating expenses*

(1,559)

(6,467)

(1,504)

(5,926)

Research and development expenses (59) (235) (57) (222) Selling and

administrative expenses (185) (727) (177) (691) Other income and

expenses* (32) (52) 13

21

Operating income 122

845 127

717 Equity in income of affiliates 1 1 1 8 Financial result

(25) (103) (28) (103) Income taxes 40

(162) (16) (193)

Net income

138 581

84 429 Of which non-controlling

interests 1 5 (2)

2

Net income - Group share 137

576 86

427 Earnings per share (amount in euros)** 1.37 7.17 0.7

5.24 Diluted earnings per share (amount in euros)**

1.36 7.15 0.69 5.22

* Depreciation and amortization associated with revaluation of

tangible and intangible assets for allocation of the purchase price

of businesses previously included in “Other income and expenses”

(see note C4 “Other income and expenses”) have been reclassified as

“Operating expenses”.** From 2017, in accordance with

IAS 33, the earnings per share and diluted earnings per share

are calculated based on net income (Group share) less the

net-of-tax interest paid to bearers of subordinated perpetual notes

(hybrid bonds). The 2016 figures have been restated

accordingly.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

4th quarter

2017

End of December

2017

3rd

quarter 2016

End of December

2016

(In millions of euros) (non audited)

(audited) (non audited) (audited)

Net income 138 581

84 429 Hedging

adjustments (5) 20 (20) (6) Other items (4) (4) 1 (6) Deferred

taxes on hedging adjustments and other items - - (1) (2) Change in

translation adjustments (17) (200)

68 7

Other recyclable comprehensive

income (26) (184)

48 (7) Actuarial gains

and losses 16 32 16 13 Deferred taxes on actuarial gains and losses

(6) (11) (10)

(12)

Other non-recyclable comprehensive income

10 21 6

1 Total income and expenses recognized

directly in equity (16)

(163) 54 (6)

Comprehensive income 122

418 138 423 Of

which: non-controlling interest 4 5

(1) -

Comprehensive income - Group

share 118 413

139 423 INFORMATION BY

BUSINESS SEGMENT

4th quarter 2017

(In millions of euros)

HighPerformanceMaterials

IndustrialSpecialties

CoatingSolutions

Corporate Total Non-Group sales 909 606 437 5

1,957

Inter segment sales 2 34 17 -

Total sales

911 640 454

5 EBITDA

131 120 44

(12) 283 Recurring depreciation

and amortization (42) (42)

(28) (6) (118)

Recurring

operating income (REBIT) 89

78 16 (18)

165 Depreciation and amortization associated with

revaluation of tangible and intangible assets for allocation of the

purchase price of businesses

(11) - - -

(11) Other income and expenses (5) (7) (7) (13) (32)

Operating income 73

71 9 (31)

122 Equity in income of affiliates 0 1 - - 1

Intangible assets and property, plant and equipment

additions 74 79 43 11 207 Of

which Recurring capital expenditure 74 73 43 11 201

4th quarter 2016 (In millions of euros)

HighPerformanceMaterials

IndustrialSpecialties

CoatingSolutions

Corporate Total Non-Group sales 839 568 440 5

1,852

Inter segment sales 2 25 14 -

Total sales

841 593 454

5 EBITDA

116 87 41

(1) 243 Recurring depreciation

and amortization (39) (44)

(35) (1) (119)

Recurring

operating income 77

43 6 (2)

124 Depreciation and amortization associated with

revaluation of tangible and intangible assets for allocation of the

purchase price of businesses (10) - - - (10) Other income and

expenses 65 (48) - (4) 13

Operating income

132 (5) 6

(6) 127 Equity in income of

affiliates - 1 - - 1

Intangible assets and property,

plant and equipment additions 75 64 38

5 182 Of which Recurring capital expenditure 73 65 38

5 181

INFORMATION BY BUSINESS SEGMENT (audited)

End of December 2017 (In millions of euros)

HighPerformanceMaterials

IndustrialSpecialties

CoatingSolutions

Corporate Total Non-Group sales

3,830

2,545

1,924

27

8,326

Inter segment sales 7 141 72 -

Total sales

3,837

2,686

1,996

27 EBITDA

632 585 244

(70)

1,391

Recurring depreciation and amortization (158)

(174) (109) (8)

(449)

Recurring operating income (REBIT)

474 411 135

(78) 942 Depreciation and

amortization associated with revaluation of tangible and intangible

assets for allocation of the purchase price of businesses

(45) - - - (45) Other income and

expenses (19) (9) (8) (16) (52)

Operating income

410 402 127

(94) 845 Equity in income

of affiliates 1 0 - - 1

Intangible assets and property,

plant and equipment additions 186 165 88

20 459 Of which Recurring capital expenditure 168 155

88 20 431

End of December 2016 (In millions of

euros)

HighPerformanceMaterials

IndustrialSpecialties

CoatingSolutions

Corporate Total Non-Group sales

3,422

2,316

1,771

26

7,535

Inter segment sales 14 109 56 -

Total sales

3,436

2,425

1,827

26 EBITDA

570 473 208

(62)

1,189

Recurring depreciation and amortization (154)

(173) (125) (3)

(455)

Recurring operating income 416

300 83

(65) 734 Depreciation and amortization

associated with revaluation of tangible and intangible assets for

allocation of the purchase price of businesses

(38) -

- - (38) Other income and expenses 60 (61) 2

20 21

Operating income 438

239 85 (45)

717 Equity in income of affiliates 1 7 - - 8

Intangible assets and property, plant and equipment

additions 175 175 82 13 445

Of which Recurring capital expenditure 173 155 82 13 423

CONSOLIDATED BALANCE SHEET

End of December

2017

End of December

2016

(In millions of euros) (audited) (audited)

ASSETS Intangible assets, net 2,706 2,777 Property,

plant and equipment, net 2,464 2,652 Equity affiliates :

investments and loans 30 35 Other investments 30 33 Deferred tax

assets 150 171 Other non-current assets 230 227

TOTAL

NON-CURRENT ASSETS 5,610

5,895 Inventories 1,145 1,111 Accounts receivable

1,115 1,150 Other receivables and prepaid expenses 181 197 Income

taxes recoverable 70 64 Other current financial assets 17 10 Cash

and cash equivalents 1,438 623

TOTAL CURRENT ASSETS

3,966 3,155 TOTAL ASSETS

9,576 9,050 LIABILITIES AND

SHAREHOLDERS' EQUITY Share capital 759 757 Paid-in

surplus and retained earnings 3,575 3,150 Treasury shares (2) (4)

Translation adjustments 101 301

SHAREHOLDERS' EQUITY - GROUP

SHARE 4,433 4,204

Non-controlling interests 41 45

TOTAL SHAREHOLDERS' EQUITY 4,474

4,249 Deferred tax liabilities 271 285

Provisions for pensions and other employee benefits 460 520 Other

provisions and non-current liabilities 443 464 Non-current debt

2,250 1,377

TOTAL NON-CURRENT LIABILITIES

3,424 2,646 Accounts payable 965

932 Other creditors and accrued liabilities 377 402 Income taxes

payable 82 62 Other current financial liabilities 10 31 Current

debt 244 728

TOTAL CURRENT LIABILITIES

1,678 2,155 TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY 9,576 9,050

CONSOLIDATED CASH FLOW STATEMENT

End of December

2017

End of December

2016

(In millions of euros) (audited) (audited)

Cash flow - operating activities Net income 581 429

Depreciation, amortization and impairment of assets 501 530

Provisions, valuation allowances and deferred taxes (41) (56)

(Gains)/losses on sales of assets (2) (106) Undistributed affiliate

equity earnings 2 (5) Change in working capital (41) 11 Other

changes 8 18

Cash flow from operating activities

1,008 821 Cash flow -

investing activities Intangible assets and property,

plant, and equipment additions (459) (445) Change in fixed asset

payables 6 (37) Acquisitions of operations, net of cash acquired

(1) (338) Increase in long-term loans (60) (62)

Total

expenditures (514) (882) Proceeds from

sale of intangible assets and property, plant and equipment 10 118

Change in fixed asset receivables 0 0 Proceeds from sale of

operations, net of cash sold 11 43 Proceeds from sale of

unconsolidated investments 0 19 Repayment of long-term loans 45 38

Total divestitures 66 218

Cash flow from investing

activities (448)

(664) Cash flow - financing activities

Issuance (repayment) of shares and other equity 3 51 Purchase of

treasury shares (17) (6) Dividends paid to parent company

shareholders (188) (176) Dividends paid to non-controlling

interests (4) (4) Increase/ decrease in long-term debt 870 (38)

Increase/ decrease in short-term borrowings and bank overdrafts

(472) (83)

Cash flow from financing

activities 192 (256)

Net increase/(decrease) in cash and cash equivalents 752

(99) Effect of exchange rates and changes in scope 63 11

Cash and cash equivalents at beginning of period 623

711

Cash and cash equivalents at end of period

1,438 623

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(audited)

Shares

issued Treasury

shares

Shareholders'equity -

Groupshare

Non-controllinginterests

Shareholders'equity

(In millions of euros)

Number Amount

Paid-insurplus

Hybridbonds

Retainedearnings

Translationadjustments

Number Amount

At January 1, 2017 75,717,947

757 1,211 689

1,250 301 (65,823)

(4) 4,204 45 4,249

Cash dividend - - - - (188) - - - (188) (4) (192)

Issuance of share capital 152,559 2 5 - - - - - 7 - 7 Purchase of

treasury shares - - - - - - (180,000) (17) (17) - (17) Grants of

treasury shares to employees - - - - (19) - 212,598 19 - - -

Share-based payments - - - - 13 - - - 13 - 13 Other -

- - - 1 - - - 1

(5) (4)

Transactions with shareholders

152,559 2 5 -

(193) - 32,598

2 (184) (9) (193)

Net income - - - - 576 - - - 576 5 581 Total income and expense

recognized directly through equity - - -

- 37 (200) - - (163)

- (163)

Comprehensive income -

- - - 613

(200) - -

413 5 418 At December 31,

2017 75,870,506 759

1,216 689 1,670

101 (33,225) (2)

4,433 41 4,474

ALTERNATIVE PERFORMANCE INDICATORS

To monitor and analyse the financial performance of the Group

and its activities, the Group management uses alternative

performance indicators. These are financial indicators that are not

defined by the IFRS. A reconciliation of these indicators and the

aggregates from the consolidated financial statements under IFRS is

presented below.

RECURRING OPERATING INCOME (REBIT) AND EBITDA

(In millions of

euros)

End of December

2017

End of December

2016

4th quarter

2017

4th quarter

2016

OPERATING INCOME 845 717 122 127

- Depreciation and amortization associated with revaluation of

tangible and intangible assets for allocation of the purchase price

of businesses (45) (38) (11) (10) - Other income and expenses (52)

21 (32) 13

RECURRING OPERATING INCOME (REBIT)

942 734 165 124 -

Recurring depreciation and amortization (449) (455) (118) (119)

EBITDA 1,391 1,189

283 243

Details of

depreciation and amortizations:

(In

millions of euros)

End of December

2017

End of December

2016

4th quarter

2017

4th quarter

2016

Depreciation and amortization (501)

(530) (136) (162) Of which:

Impairment included in other income and expenses (449) (455) (118)

(119) Of which: Recurring depreciation and amortization (45) (38)

(11) (10) Of which: Depreciation and amortization associated with

revaluation of assets for allocation of the purchase price of

businesses (7) (37) (7) (33)

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE

(In

millions of euros)

End of December

2017

End of December

2016

4th quarter

2017

4th quarter

2016

NET INCOME - GROUP SHARE 576 427 137

86 - Depreciation and amortization associated with

revaluation of assets for allocation of the purchase price of

businesses (45) (38) (11) (10) - Other income and expenses (52) 21

(32) 13 - Other income and expenses - Non-controlling interests - 3

- 3 - Taxes on depreciation and amortization associated with

revaluation of assets for allocation of the purchase price of

businesses 12 10 2 1 - Taxes on other income and expenses 14 4 8 2

- One-time tax-effects 55 9 55 9

ADJUSTED NET INCOME

592 418 115 68 -

Weighted average number of ordinary shares 75,682,844 75,201,739 -

Weighted average number of potential ordinary shares 75,895,729

75,429,599

ADJUSTED EARNINGS PER SHARE (€)

7,82 5,56 1,52

0,90 DILUTED ADJUSTED EARNINGS PER SHARE (€)

7,80 5,54 1,52

0,89 FREE CASH FLOW

(In millions of

euros)

End of December

2017

End of December

2016

4th quarter

2017

4th quarter

2016

Cash

flow from operating activities 1,008 821 350 246 + Cash flow from

investing activities (448) (664) (174)

(327)

NET CASH FLOW 560 157

176 (81) - Net cash flow from portfolio

management operations (5) (269) (1)

(220)

FREE CASH FLOW 565 426

177 139 RECURRING

INVESTMENTS

(In millions of euros)

End of December

2017

End of December

2016

4th quarter

2017

4th quarter

2016

INTANGIBLE ASSETS AND PROPERTY, PLANT, AND EQUIPMENT

ADDITIONS 459 445* 207 182 -

Exceptional investments 10 - 6 - - Investments relating to

portfolio management operations 18 - - - - Investments with no

impact on net debt - 22 - 1

RECURRING INVESTMENTS

431 423 201 181

* The 2016 figures have been corrected by €2 million,

in coherence with the cash flow statement.

NET DEBT (In millions of

euros)

End of December

2017

End of December

2016

Non-current debt 2,250 1,377 Current debt 244 728 Cash and

cash equivalents 1,438 623

NET DEBT 1,056

1,482 WORKING CAPITAL

(In millions of euros)

End of December

2017

End of December

2016

Inventories 1,145 1,111 Accounts receivable 1,115 1,150

Other receivables including income taxes 251 261 Accounts payable

(965) (932) Other liabilities including income taxes (459) (464)

Derivatives 7 (21)

WORKING CAPITAL 1,094

1,105 CAPITAL EMPLOYED

(In millions of euros)

End of December

2017

End of December

2016

Goodwill, net 1,525 1,703

Intangible assets other than goodwill, and property, plant and

equipment, net 3,645 3,726 Investments in equity affiliates 30 35

Other investments and other non-current assets 260 260 Working

capital 1,094 1,105

CAPITAL EMPLOYED

6,554 6,829

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180221006329/en/

INVESTOR RELATIONS CONTACTSSophie Fouillat+33 1 49 00 86

37sophie.fouillat@arkema.comFrançois Ruas+33 1 49 00 72

07francois.ruas@arkema.comorMEDIA CONTACTGilles Galinier+33

1 49 00 70 07gilles.galinier@arkema.com

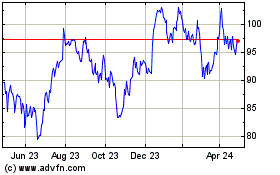

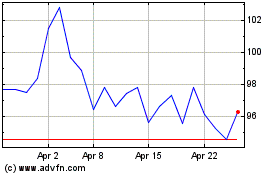

Arkema (EU:AKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arkema (EU:AKE)

Historical Stock Chart

From Apr 2023 to Apr 2024