TIDMAGQ

Trading Symbols

AIM: AGQ

FWB: I3A

ARIAN

SILVER

29 September 2017

Interim results for the six months ended 30 June 2017

Arian Silver Corporation ("Arian" or the "Company") is pleased to announce its

financial results for the six months ended 30 June 2017.

Jim Williams, Chief Executive of Arian, commented: "Our strategy is to create a

portfolio of primarily lithium, silver and gold exploration projects,

principally in Mexico.

The investment case for lithium is well understood given the expected demand

for energy storage in the automotive and housing sectors. This demand for the

metal is expected to grow and be sustained, which makes this an ideal time to

have moved into the sector.

The region in Mexico in which Arian has been operating for many years is

already known to host some large lithium deposits, and we are presently seeking

out similar prospective mining concessions. As announced earlier today, we have

withdrawn from exploring a group of projects under option, which although they

confirmed consistency of lithium grades, did not contain the higher grades

known to be attainable in the region.

With regards to Arian's portfolio of silver projects, these contain some very

promising targets which we are keen to retain and explore further once the

silver price has demonstrated sustainability at higher levels."

Strategy

Arian's objective is to create a portfolio of primarily lithium, silver and

gold exploration projects, principally in Mexico.

The group has operated in Mexico for over ten years during which time it has

established long-term relationships with local government, communities, and key

stakeholders. Arian's geological experts assess and identify projects for

potential mineralisation. Wherever possible, the Company will seek to enter

into agreements whereby Arian has the option to acquire projects, allowing

preliminary exploration work to be undertaken whilst minimising any financial

commitment.

Where preliminary studies evidence sufficient mineralisation, increasingly

comprehensive studies will be undertaken with a view to delineating a compliant

mineral resource estimate in readiness of potential sale of the asset to a

producing mining company, at which time a significant premium over its

acquisition and development cost may be justified.

Financial highlights

As at 30 June 2017, the Company had total assets of US$1.5 million (2016:

US$2.2 million) of which US$0.9 million (2016: US$1.2 million) was cash. The

Company had total liabilities of US$0.1 million (2016: US$0.1 million) of which

US$0.1 million were current liabilities (2016: US$0.1 million).

In the six months ended 30 June 2017 the Company made an operating loss of

US$0.7 million (2016: US$0.9 million) and a loss per share of US$0.003 (2016:

US$0.006). The Company raised proceeds by way of private placings of shares of

US$0.8 million before costs and expenses, to further its strategy.

Overview of operations

During the six months ended 30 June 2017, the Company carried out a high level

exploration programme over its portfolio of silver mining concessions covering

an area of over approximately 1,500 hectares, to develop and direct future

exploration work, the findings of which are set out in more detail below.

Properties

As at 30 June 2017, the Company fully owned 12 silver mining concessions

covering an area of approximately 1,500 hectares. During the six months ended

30 June 2017, Arian acquired an option over three lithium mining concessions

covering approximately 1,600 hectares for consideration of US$200,000, payable

in instalments up to March 2018.

In light of assay results from the initial auger drill programme received after

the period end, in September 2017, the Company will not undertake any further

exploration work on these projects and will seek to negotiate an extension to

the option agreement.

Silver projects

Los Campos project

The Los Campos project comprises four concessions covering an area of

approximately 500 hectares, located on the south side of the city of Zacatecas.

The property is easily accessible and is only a 15-minute drive from the centre

of the City of Zacatecas and from the Calicanto project.

San Celso project

San Celso consists of three contiguous mining concessions totalling 88

hectares. The concessions are located in the historic mining district of

Pánfilo Natera-Ojocaliente and are surrounded by other concessions to the south

and west.

Calicanto project

The Calicanto property, the sale of which was completed in February 2017,

consists of seven contiguous mining concessions totalling approximately 75

hectares. The property is located in the heart of the Zacatecas mining

district, adjacent and partly contiguous to Capstone Mining's Cozamin mine, and

covers four known main vein systems.

Other silver projects

Arian Silver holds five additional silver mining concessions covering over 900

hectares. These concessions were acquired in 2006 because of their strategic

position to the San Celso project. These concessions too require further

exploratory work to fully assess their economic potential.

Lithium projects

Initial sampling at the three lithium projects held under option evidenced

lithium grades of up to 0.016% (160 parts per million).

Pozo Hondo

The Pozo Hondo project is the largest of the projects at almost 1,100 hectares

in size and covers one salar, the Laguna El Salado.

Columpio

The Columpio project is almost 400 hectares in size, encompassing two salars,

Laguna Tenango and Laguna La Virgen, approximately 24km from the town of Villa

de Cos.

Abundancia

The Abundancia project is 150 hectares in size and encompasses the Laguna Noria

del Burro salar, approximately 40km from the town of Villa de Cos.

Post balance sheet events

On 13 July 2017, the Company announced a fundraise of GBP600,000 before expenses

through the private placing for 0.5p each, of 120 million units, each

comprising one Common share in the capital of the Company and one warrant

exercisable to receive one Common share in the capital of the Company at 0.6p

each. Admission of the Placing Shares became effective at 8:00am on 27 July

2017.

Future outlook

The expected increase in demand for lithium has significantly improved the

economic potential for mining companies with access to good quality lithium

assets. Arian is focussed on identifying new lithium prospects predominantly

within the Zacatecas region of Mexico.

The review of the Company's silver mining concessions resulted in the

identification of good opportunities for the future exploration of those assets

once the silver price has demonstrated sustainability at higher levels, the

disposal of one silver project, and the absence of a need for any impairment.

Management continue to work towards the identification of additional

opportunities to expand and develop the Company's mining assets, with a

particular focus on assets giving access to near-term revenues.

Notice of no auditor review of interim financial information

The interim unaudited consolidated financial information for the six month

period ended 30 June 2017 have been prepared by and are the responsibility of

the Company's management, in accordance with International Accounting Standards

("IAS") 34 Interim Financial Reporting.

Arian Silver Corporation

Consolidated statement of comprehensive income

For the six months ended 30 June 2017

(tabular amounts expressed in thousands of US dollars unless otherwise stated)

Unaudited As restated Audited

six months unaudited year ended

ended six months 31 December

30 June ended 2016

2017 30 June

2016

Continuing operations

Administrative expenses (653) (663) (1,366)

Impairment - (202) (202)

Operating loss (653) (865) (1,568)

Net investment income 5 60 20

Loss from continuing operations (648) (805) (1,548)

Profit/(loss) for the period (648) (805) (1,548)

attributable to equity shareholders of

the parent

Other comprehensive income

Foreign exchange translation 41 (145) (263)

differences recognised directly in

equity

Other comprehensive income for the year 41 (145) (263)

Total comprehensive income for the year (607) (950) (1,811)

attributable to equity shareholders of

the parent

Basic and diluted loss per share ($/ (0.003) (0.006) (0.010)

share)

The accompanying notes are an integral part of these consolidated financial

information.

These consolidated financial information have been approved by the Company's

directors.

Arian Silver Corporation

Consolidated statement of financial position

For the six months ended 30 June 2017

(tabular amounts expressed in thousands of US dollars)

Note Unaudited As restated Audited

30 June unaudited 31 December

2017 30 June 2016

2016

Assets

Non-current assets

Intangible assets 2 233 662 173

Property, plant and equipment 3 6 10 7

Available-for-sale investment 272 - -

Total non-current assets 511 672 180

Current assets

Trade and other receivables 66 351 309

Cash and cash equivalents 891 1,169 416

Total current assets 957 1,520 725

Asset held for sale - - 400

Total assets 1,468 2,192 1,305

Equity attributable to equity

shareholders of the parent

Share capital 4 52,559 52,396 52,396

Warrant reserve 4 1,867 1,333 1,333

Share-based payment reserve 4 1,389 1,417 1,417

Foreign exchange translation 4 1,869 1,946 1,828

reserve

Accumulated losses (56,328) (55,021) (55,764)

Total equity 1,356 2,071 1,210

Liabilities

Trade and other payables 112 121 95

Total current liabilities 112 121 95

Total equity and liabilities 1,468 2,192 1,305

The accompanying notes are an integral part of these consolidated financial

information.

These consolidated financial information have been approved by the Company's

directors.

Arian Silver Corporation

Consolidated statement of cash flows

For the and six months ended 30 June 2017

(tabular amounts expressed in thousands of US dollars)

Unaudited As restated Audited

six months unaudited year ended

ended six months 31 December

30 June ended 2016

2017 30 June

2016

Cash flows from operating activities

(Loss)/profit before tax from continuing (648) (805) (1,548)

operations

Adjustments for non-cash items:

Depreciation and amortisation 2 1 3

Exchange difference 55 (105) (69)

Net interest receivable (6) (1) (20)

Proceeds from Quintana for working - (50) -

capital

Impairment of intangible assets - 202 202

Equity-settled share-based payment 56 - -

transactions

Operating cash flows before movements in (541) (758) (1,432)

working capital

Increase in trade and other receivables (38) (120) (48)

Increase/(decrease) in trade and other 11 (362) (433)

payables

Cash used in operating activities (568) (1,240) (1,913)

Cash flows from investing activities

Interest received 1 1 1

Proceeds from Quintana for working - 50 50

capital 400

Proceeds from asset held for sale

Purchase of intangible assets (34) (52) (84)

Acquisition of property, plant and - (7) (7)

equipment

Cash used in investing activities 367 (8) (40)

Cash flows from financing activities

Proceeds from issue of share capital 775 2,157 2,157

Issue costs (77) (210) (209)

Cash from financing activities 698 1,947 1,948

Net increase/(decrease) in cash and cash 497 699 (5)

equivalents

Cash and cash equivalents at beginning 416 474 474

of period/year

Effect of exchange rate fluctuations on (22) (4) (53)

cash held

Cash and cash equivalents at end of 891 1,169 416

period/year

The accompanying notes are an integral part of these consolidated financial

information.

These consolidated financial information have been approved by the Company's

directors.

Arian Silver Corporation

Consolidated statement of changes in equity

For the six months ended 30 June 2017

(tabular amounts expressed in thousands of US dollars)

For the six months ended 30 June 2017

Unaudited Share Warrant Share Foreign Accumulated Total

capital reserve based exchange losses

payment translation

reserve reserve

Balance: 1 January 2017 52,396 1,333 1,417 1,828 (55,764) 1,210

Loss for the period - - - - (648) (648)

Foreign exchange - - - 41 - 41

Total comprehensive - - - 41 (648) (607)

income

Shares issued for cash 775 - - - - 775

Share issue costs (78) - - - - (78)

Share options lapsed - - (84) - 84 -

Share options issued - - 56 - - 56

Cancellation of warrants - - - - - -

Fair value of warrants (534) 534 - - - -

issued

Balance: 30 June 2017 52,559 1,867 1,389 1,869 (56,328) 1,356

For the six months ended 30 June 2016

Unaudited As Share Foreign As restated Total

restated As based exchange Accumulated

Share restated payment translation losses

capital Warrant reserve reserve

reserve

Balance: 1 January 2016 51,781 3,455 7,701 2,091 (63,955) 1,073

Profit for the period - - - - (805) (805)

Foreign exchange - - - (145) - (145)

Total comprehensive - - - (145) (805) (948)

income

Share options lapsed - - (6,284) - 6,284 -

Fair value of warrants - 1,333 - - - 1,333

Share issued 825 - - - - 825

Share issue costs (210) - - - - (210)

Cancellation of warrants - (3,455) - - 3,455 -

Balance: 30 June 2016 52,396 1,333 1,417 1,946 (55,021) 2,071

For the year ended 31 December 2016

Audited Share Warrant Share Foreign Accumulated Total

capital reserve based exchange losses

payment translation

reserve reserve

Balance: 1 January 2016 51,781 3,455 7,701 2,091 (63,955) 1,073

Loss for the year - - - - (1,548) (1,548)

Foreign exchange - - - (263) - (263)

Total comprehensive - - - (263) (1,548) (1,811)

income

Share issued for cash 824 - - - - 824

Share issue costs (209) - - - - (209)

Fair value of warrants - 1,333 - - - 1,333

issued - - (6,284) - 6,284 -

Share options lapsed - (3,455) - - 3,455 -

Cancellation of warrants

Balance: 31 December 2016 52,396 1,333 1,417 1,828 (55,764) 1,210

The accompanying notes are an integral part of these consolidated financial

information.

These consolidated financial information have been approved by the Company's

directors.

Arian Silver Corporation

Notes to Consolidated Financial Information (Unaudited)

For the six months ended 30 June 2017

(tabular amounts expressed in thousands of US dollars unless otherwise stated)

1. Basis of preparation, going concern and adequacy of project finance

These interim unaudited consolidated financial information for Arian Silver

Corporation ("ASC" or the "Company") have been prepared in accordance with

International Financial Reporting Standards.

ASC is a company domiciled in the British Virgin Islands. The consolidated

financial information of the Company comprise financial information of the

Company and its subsidiaries (together referred to as the "Group"). The Group

is primarily involved in the exploration and development of mineral resource

assets.

The accounting policies and methods of computation used in the preparation of

the interim unaudited consolidated financial information are the same as those

described in the Company's audited consolidated financial information and notes

thereto for the year ended 31 December 2016. In the opinion of the management,

the interim unaudited consolidated financial information include all

adjustments considered necessary for fair and consistent presentation of

financial information. These interim unaudited consolidated financial

information should be read in conjunction with the Company's audited financial

statements and notes for the year ended 31 December 2016.

These consolidated financial information are presented in United States dollars

as the Company believes it to be the most appropriate and meaningful currency

for investors. The functional currencies of the Company and its subsidiaries

are pounds sterling, Mexican peso and United States dollars.

The financial Information have been prepared on a going concern basis. The

directors regularly review cash flow forecasts to determine whether the Group

has sufficient cash reserves to meet future working capital requirements and

discretionary business development opportunities including exploration

activities.

On 8 June 2017, the Company successfully raised gross proceeds of US$775,000 (GBP

600,000) by issuing 120,000,000 common shares at 0.5 pence each.

The Group's assets are at an early stage and in order to meet financing

requirements for their development previously the Company has raised equity

funds in several discrete share placements, which is a common practice for

junior mineral exploration companies. Although the Company has been successful

in the past in raising equity finance, there can be no assurance that the

funding required by the Group will be made available to it when needed or, if

such funding were to be available, that it would be offered on reasonable

terms. The terms of such financing might not be favourable to the Group and

might involve substantial dilution to existing shareholders.

The directors currently believe that the Group has adequate resources for the

foreseeable future or access to such resources in order to continue to prepare

the Company's financial information on a going concern basis. In reaching this

conclusion, the directors have reviewed cash flow forecasts to the end of July

2018 and considered their ability to reduce expenditure in the event that

further fundraisings are not completed within that timeframe, and have

concluded they can make such savings as may be necessary in order to operate

within the funds currently available to them.

2. Intangible assets - deferred exploration and evaluation costs

The Group's deferred exploration and evaluation costs comprise costs directly

incurred in exploration and evaluation as well as the cost of maintaining

mineral licences. They are capitalised as intangible assets pending the

determination of the feasibility of the project. When the decision is taken to

develop a mine, the related intangible assets are transferred to property,

plant and equipment. Where a project is abandoned or is determined not

economically viable, the related costs are written off.

The recoverability of deferred exploration and evaluation costs is dependent

upon a number of factors common to the natural resource sector. These include

the extent to which the Group can establish economically recoverable reserves

on its properties, the ability of the Group to obtain necessary financing to

complete the development of such reserves and future profitable production or

proceeds from the disposition thereof.

Intangible assets for the six months ended 30 June 2017 are detailed in the

following table and relate entirely to deferred exploration and development

costs:

Unaudited As Audited

30 Jun restated 31 Dec

2017 unaudited 2016

$ 30 Jun $

2016

$

Cost

Opening balance 1 January 173 812 812

Additions for the period 33 52 84

Transferred to investments held for sale - - (400)

Impairment - (202) (202)

Foreign exchange 27 - (121)

Closing balance 233 662 173

The opening balance for 30 June 2016 has been restated because upon review of

licences in prior year, directors identified 4 licences relating to the San

Jose project, which were discontinued in 2015. Therefore, the loss on

discontinued operations in 2015 was restated, increasing by $69,000, with

intangible assets and equity decreasing by the same amount.

3. Available-for-sale investment

Investments classified as available-for-sale comprise the Group's investments

in entities not qualifying as subsidiaries, associates or jointly controlled

entities. They are carried at fair value with changes in fair value, other than

those arising due to exchange rate fluctuations and interest calculated using

the effective interest rate, recognised in other comprehensive income and

accumulated in the available-for-sale reserve. Exchange differences on

investments denominated in a foreign currency and interest calculated using the

effective interest rate method are recognised in profit or loss. The

available-for-sale investments held at period end are held at cost as

management consider it representative of fair value.

4. Share capital and reserves

Share capital

The Company is authorised to issue an unlimited number of common shares of no

par value.

Changes in share capital for the six months ended 30 June 2017 are as follows:

Number of Amount

Shares US$

'000

Opening balance 1 January 2016 33,907 51,781

Closing balance 30 June 2016 (unaudited) - as 183,695 52,396

restated

Closing balance 31 December 2016 (audited) 183,695 52,396

Shares issued 120,000 775

Share issue costs - (78)

Fair value of share warrants issued - (534)

Closing balance 30 June 2017 (unaudited) 303,695 52,559

2016

· On 27 January 2016, 79,787,493 common shares were issued at GBP0.01 each,

GBP797,875 (US$1,137,419).

· On 13 May 2016, 70,000,000 common shares were issued at GBP0.01 each, GBP

700,000 (US$1,019,970).

Six months ended 30 June 2017

· On 8 June 2017, 120,000,000 common shares were issued at 0.5 pence each,

GBP600,000 (US$775,110).

Six months ended 30 June 2016

· Upon review, it was determined that the fair value of the warrants

issued during the period was incorrectly charged to the income statement,

instead of being charged to share capital. Accordingly share capital was

restated to include a charge of $1.3m.

Warrant reserve

The number and weighted average exercise price for the period ended 30 June

2017 are set out in the table below:

Outstanding Weighted

(000's) average

exercise

price

US$

Opening balance 1 January 2016 12,152 0.88

Closing balance 30 June 2016 (unaudited) 114,787 0.02

Closing balance 31 December 2016 (audited) 114,787 0.02

Issued 132,000 0.01

Cancelled - -

Closing balance 30 June 2017 (unaudited) 246,787 0.01

On 9 June 2017 132,000,000 common share purchase warrants were issued,

exercisable at 0.76 US cents (0.6p) per common share, until 8 June 2019.

Upon review, it was determined that the fair value of the warrants issued

during the period was incorrectly calculated as US$2.8m and should have been

US$1.3m. Accordingly the balance of the warrant reserve for the six-month

period ended 30 June 2016 has been restated.

Fair value of Warrants and assumptions

The estimate of the fair value of the Warrants is measured based on the

Black-Scholes model. The following inputs were used in the calculation of the

fair value of the warrants granted.

9 June 2017

Fair value (US$ 000s) 534

Share price (GBP) 0.007

Weighted average exercise price (GBP) 0.006

Expected volatility 68.29%

Expected warrants life 2 years

Expected dividend yield 0%

Risk-free interest rate 0.12%

Share based payment reserve

The share based payment reserve arises on the grant of share options to

directors, employees and other eligible persons under the share option plan.

A summary of the changes in the Group's contributed surplus for the six months

ended 30 June 2017 is set out below:

Unaudited Unaudited Audited

30 Jun 30 Jun 31 Dec

2017 2016 2016

US$ US$ US$

Opening balance 1 January 1,417 7,701 7,701

Fair value of share options 56 - -

Incentive stock options lapsed (84) (6,284) (6,284)

Closing balance 1,389 1,417 1,417

Foreign exchange translation reserve

The translation reserve comprises foreign exchange differences arising from the

translation of the financial statements of operations that do not have a US

dollar functional currency. Exchange differences arising are classified as

equity and transferred to the Group's translation reserve. Such translation

differences are recognised in profit or loss in the period in which the

operation is disposed of.

Accumulated losses

Accumulated losses contain losses incurred in the current and prior years.

5. Incentive stock options

A summary of the Company's stock options as at 30 June 2017 is set out below:

Outstanding shares Exercise price Expiry

725,000 GBP0.70 29 May 2018

50,000 GBP0.44 5 January 2020

6,250,000 GBP0.01 2 February 2022

2,250,000 GBP0.01 9 February 2022

6. Related party transactions

These unaudited interim consolidated financial information include balances and

transactions with directors and officers of the Company and/or corporations

related to them. All transactions have been recorded at the exchange amount

which is the consideration established and agreed to between the related

parties.

Control of the Company

In the opinion of the Board, at 30 June 2017 there was no ultimate controlling

party of the Company.

Identity of related parties

The Company and its subsidiaries have a related party relationship, with its

Directors and executive officers.

Siberian Goldfields Ltd ("SGL")

On 24 September 2013 the Company acquired an option for US$200,000 to conduct

due diligence on SGL and its mineral properties, with a view to ASC undertaking

a potential equity transaction or other corporate transaction or investment

with SGL ("Transaction"). On 27 November 2013, ASC gave notice to SGL of its

election not to proceed with a Transaction.

The option grant fee was repayable by SGL to ASC together with interest payable

at a rate of 10% per annum in the event that ASC elects not to proceed with a

Transaction. On 21 April 2017 the outstanding debt owed by SGL was settled

through the issue of 2 million SGL shares representing 0.70% of the issued

share capital of SGL. These were subsequently exchanged for 881,077 ordinary

shares (representing 0.35% of the issued share capital) of Siberian Goldfields

Ltd ("SGL UK"), a UK registered company. The Company's interest in the

underlying Siberian Goldfields project remains unchanged as a consequence of

the restructuring from SGL to SGL UK.

As at 30 June 2017 the investment in SGL UK is shown as an investment held for

sale in the statement of financial position.

As at 21 April 2017, interest accrued during the period ended 30 June 2017

amounted to US$6,000 (30 June 2016: US$10,000, 31 December 2016: US$20,000). As

at 21 April 2017, total amount owed to ASC by SGL was US$272,000 (30 June 2016:

US$255,000, 31 December 2016: US$265,000).

A.J. Williams is a director and shareholder of SGL.

Directors' interests in shares of the Company

At 30 June 2017 the Directors of the Company and their immediate relatives

controlled approximately 1.7% (30 June 2016: 2.8%, 31 December 2016: 2.8%) of

the voting shares of the Company.

Directors' interests in the common shares of the Company as at 30 June 2017 are

set out below.

Unaudited Unaudited Audited

30 Jun 30 Jun 31 Dec

2017 2016 2016

A J Williams 1,688,702 1,688,702 1,688,702

J T Williams 1,500,000 1,500,000 1,500,000

T A Bailey 1,314,226 1,314,226 1,314,226

J A Crombie 566,665 566,665 566,665

Transactions with key management personnel

During the period ended 30 June 2017 the Company entered into the following

transactions involving key management personnel:

Dragon Group Ltd charged the Company a total of US$65,832 (30 June 2016:

US$67,834, 31 December 2016: US$122,266). This relates to the reimbursement of

A.J. Williams' remuneration paid on behalf of the Company. A.J. Williams,

Chairman and a director of the Company, beneficially owns Dragon Group Ltd. At

30 June 2017, US$21,944 (30 June 2016: US$11,306, 31 December 2016: US$10,413)

was outstanding.

Key management personnel also participate in the Group's share option

programme.

JS Cable consulting fees

During the period JS Cable charged the Company a total of nil (30 June 2016:

nil, 31 December 2016: US$10,141) in respect of consulting fees. There was no

outstanding balance at 30 June 2017 (30 June 2016: nil, 2016: nil).

TA Bailey consulting fees

During the period TA Bailey charged the Company a total of nil (30 June 2016:

nil, 2016: US$9,395) in respect of consulting fees. There was no outstanding

balance at 30 June 2017 (30 June 2016: nil, 2016: nil).

7. Post balance sheet events

On 13 July 2017, the Company announced a fundraise of GBP600,000 before expenses

through the private placing for 0.5p each, of 120 million units each comprising

one Common share in the capital of the Company and one warrant exercisable to

receive one Common share in the capital of the Company at 0.6p each. The

placing was conditional on the shares being admitted to trading on AIM

("Admission"). Admission of 120 million shares became effective at 8:00am on 27

July 2017.

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) 596/2014.

For further information please contact:

Arian Silver Corporation Northland Capital Partners Limited

Jim Williams, CEO Gerry Beaney / David Hignell / Jamie

David Taylor, Company Secretary Spotswood

Tel: +44 (0)20 7887 6599 Tel: +44 (0)203 861 6625

OR OR

Beaufort Securities Limited Yellow Jersey

Jon Belliss Charles Goodwin / Harriet Jackson

Tel: +44 (0)20 7382 8300 Tel: +44 (0)7747 788 221

Forward-Looking Information

This press release contains certain "forward-looking information". All

statements, other than statements of historical fact that address activities,

events or developments that the Company believes, expects or anticipates will

or may occur in the future are deemed forward-looking information.

This forward-looking information reflects the current expectations or beliefs

of the Company based on information currently available to the Company as well

as certain assumptions. Forward-looking information is subject to a number of

significant risks and uncertainties and other factors that may cause the actual

results of the Company to differ materially from those discussed in the

forward-looking information, and even if such actual results are realised or

substantially realised, there can be no assurance that they will have the

expected consequences to, or effects on the Company.

Any forward-looking information speaks only as of the date on which it is made

and, except as may be required by applicable securities laws, the Company

disclaims any intent or obligation to update any forward-looking information,

whether as a result of new information, future events or results or otherwise.

Although the Company believes that the assumptions inherent in the

forward-looking information are reasonable, forward-looking information is not

a guarantee of future performance and accordingly undue reliance should not be

put on such information due to the inherent uncertainty therein.

END

(END) Dow Jones Newswires

September 29, 2017 02:01 ET (06:01 GMT)

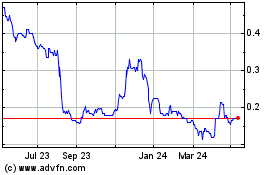

Alien Metals (LSE:UFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

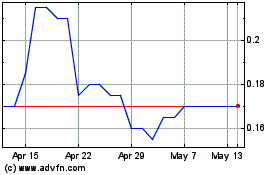

Alien Metals (LSE:UFO)

Historical Stock Chart

From Apr 2023 to Apr 2024