By Maureen Farrell in New York, Benoit Faucon in London and Summer Said in Dubai

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 2, 2018).

Saudi Arabia's state-owned oil giant and Google parent Alphabet

Inc., two of the world's biggest companies, are in talks about

jointly building a large technology hub inside the kingdom, people

familiar with the potential deal said.

As part of the potential joint venture, Alphabet would help

Saudi Arabian Oil Co., known as Aramco, build data centers around

Saudi Arabia, the people said. It isn't clear specifically whose

data the centers would house or who would control them.

Senior executives at Aramco and Alphabet have been in talks for

months on the potential joint venture, these people said. The talks

have included Alphabet Chief Executive Larry Page and have been

encouraged by Crown Prince Mohammed bin Salman, who is enamored

with Silicon Valley and wants to bring more tech expertise to the

kingdom, some of the people said. Prince Mohammed has been leading

the kingdom's plan to take Aramco public.

Still, there are many details to work out, and it is unclear

when -- or whether -- such a deal will be finalized, the people

said.

The size of the potential joint venture is unclear, although it

could be big enough to become listed on Saudi Arabia's stock

exchange, one of the people said.

An alliance would help bolster the development of the technology

sector in Saudi Arabia, a goal Prince Mohammed has pointed to as a

key part of his plan, known as Vision 2030, to wean the kingdom off

its reliance on oil.

Alphabet's Google is chasing both Amazon.com Inc. and Microsoft

Corp. in the business of renting computing power and storage

online, and a joint venture with Aramco would give it a key

foothold in Saudi Arabia as it rushes to develop its tech sector.

None of the three companies have massive data-center complexes,

known as "regions" in industry parlance, in the area, though Amazon

has plans to open one in Bahrain and Microsoft has announced it

will open two data-center operations in South Africa this year.

Amazon is also close to finalizing a $1 billion deal to build

three data centers in Saudi Arabia, people familiar with that deal

said. The deal is expected to be announced during a trip to the

U.S. by Prince Mohammed early this year.

A data-center region in Saudi Arabia could potentially help

Google win business from oil-industry customers that are looking to

shift their computing operations to the cloud. The costs for such

centers can run into the hundreds of millions of dollars.

Most data for the Middle East is piped from Europe, slowing

surfing to the most-trafficked websites, which are accessed via

long-distance undersea cables, according to a person familiar with

the Alphabet-Aramco talks. Local data servers -- which would store

content but also cached memory of personal-navigation data or

social-media content -- would speed up access and help the country

be more competitive in the digital economy.

Alphabet and other digital giants have been reluctant to set up

physical data centers in the Middle East, Africa and most of Asia

because of data-protection concerns -- unlike in the U.S., police

generally don't need a court order to access private data, the

person said.

Internet experts say a lack of protection for online data users

in Saudi Arabia and other Gulf countries remains an obstacle for

the establishment of mass storage by U.S. internet giants and, more

broadly, the region's competitiveness in the internet economy.

"Data servers located geographically close to customers means the

speed of access is much higher," said Emily Taylor, an associate

fellow researching internet governance and privacy at British

institute Chatham House.

Aramco is in the middle of planning for an initial public

offering that the government has pegged for this year, though it is

unclear whether it will get done in that time frame.

Prince Mohammed has said the proceeds from the IPO would be used

to invest outside of the oil industry.

"The future business case for oil is slowly shifting from energy

to how much technology can boost the oil sector's productivity,"

said Sam Blatteis, chief executive of MENA Catalysts Inc., a Middle

East public-policy advisory and research firm, and who was Google's

head of Gulf government relations until July of last year.

"Technology is driving a dramatic reordering of the oil arena,

becoming the single most important driver of innovation,

competitiveness and growth."

While a potential joint venture between Alphabet and Aramco

isn't necessarily connected to the latter company's IPO, if a deal

is struck before the offering, advisers to the company could pitch

the pact as a way for investors to bake in technology

valuations.

Because of the outperformance of the technology sector and tech

companies' massive growth potential, investors have often been

willing to value firms higher if they can successfully pitch

themselves as technology companies. It is unclear whether Aramco

would seek to do this in its IPO.

Since Prince Mohammed announced the stock-offering plan and his

$2 trillion estimate for the company's total valuation in early

2016, insiders and outsiders have questioned how he arrived at that

number. Advisers on the deal have said that even with a rebound in

oil prices, investors will struggle to value the company in excess

of $1.5 trillion.

--Jay Greene and Nicolas Parasie contributed to this

article.

Write to Maureen Farrell at maureen.farrell@wsj.com, Benoit

Faucon at benoit.faucon@wsj.com and Summer Said at

summer.said@wsj.com

(END) Dow Jones Newswires

February 02, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

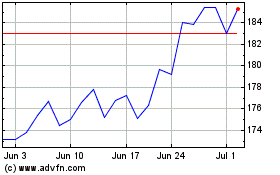

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

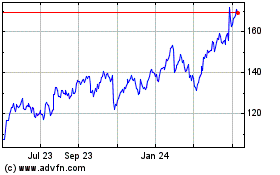

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024