AptarGroup, Inc. (NYSE:ATR) today reported fourth quarter and

annual results for 2017. The Company also announced details of its

business transformation plan and affirmed its long-term financial

targets.

Fourth Quarter Summary

- Reported sales increased 16% driven

by robust core sales growth in each business segment (+ 10%) and

the positive effect of currency rates (+ 6%)

- Core sales increased in each end

market and in each region

- Reported net income (8% of net

sales) was $50 million (equal to the prior year)

- Adjusted EBITDA (19% of net sales)

increased to $118 million (+ 9%)

- Reported earnings per share of $0.77

(equal to the prior year) included negative impacts of recently

enacted tax reform legislation

- Comparable adjusted earnings per

share of $0.81 vs. $0.77 in the prior year (+ 5%)

- Business transformation plan to

drive growth and yield annual recurring incremental EBITDA of

approximately $80 million by the end of 2020 with implementation

costs expected to be approximately $90 million

Annual Summary

- Reported sales increased 6% to $2.5

billion primarily from core sales growth in each business segment

(+ 4%), positive effect of currency rates (+ 1%) and the effects of

an acquisition completed in early 2016 (+ 1%)

- Reported annual net income (9% of

net sales) increased to $220 million (+ 7%)

- Adjusted annual EBITDA (19% of net

sales) of $475 million (slight decrease)

- Reported annual earnings per share

of $3.41 vs. $3.17 in the prior year (+ 8%)

- Comparable adjusted annual earnings

per share of $3.44 vs. $3.26 in the prior year (+ 6%)

- Paid increased annual dividend for

the 24th consecutive year

Fourth Quarter Results

For the quarter ended December 31, 2017, reported sales

increased 16% over the prior year to $626 million. Core sales,

which exclude the positive impact from changes in currency exchange

rates, increased approximately 10%.

Fourth Quarter Segment Sales Analysis

(Change Over Prior Year)

Beauty + Food + Total

Home Pharma Beverage AptarGroup Core

Sales Growth 10% 11% 11% 10% Currency Effects (1) 6% 7%

3% 6% Total Reported Sales Growth 16%

18% 14% 16% (1) - Currency effects are

approximated by translating last year's amounts at this year's

foreign exchange rates.

Commenting on the quarter, Stephan Tanda, President and CEO,

said, “This was a strong quarter with robust and wide-spread demand

for our innovative dispensing and drug delivery systems. Core sales

grew across each business segment, and in each end market and

geographic region. Our Beauty + Home segment built on the momentum

experienced in the third quarter, particularly the recovery in

demand from the beauty market. Our Pharma segment experienced

strong growth in the prescription drug and consumer health care

markets as demand rose for allergy and asthma related devices, as

well as for decongestant nasal sprays and saline systems. Our Food

+ Beverage segment grew sales in each market and continued to

penetrate the vast beverage market with our value-adding dispensing

closures. With the sales growth and our continued drive to capture

value and contain costs, each segment reported adjusted EBITDA

growth over the prior year. Additionally, we recorded several items

during the quarter that are not representative of our ongoing

results — an insurance recovery gain, charges related to our

business transformation plan and certain items impacting our income

tax provision.”

Aptar’s reported earnings per share of $0.77 equaled the prior

year level despite the negative impacts of recently enacted tax

reform legislation. Comparable adjusted earnings per share

increased 5% to $0.81 compared to $0.77 in the prior year.

Annual Results

For the year ended December 31, 2017, reported sales increased

6% to $2.5 billion from $2.3 billion a year ago. Core sales, which

exclude the positive impacts from acquisitions and changes in

currency exchange rates, increased approximately 4%.

Annual Segment Sales Analysis

(Change Over Prior Year)

Beauty + Food + Total

Home Pharma Beverage AptarGroup Core

Sales Growth 2% 8% 6% 4% Acquisitions 1% 0% 0% 1% Currency Effects

(1) 1% 1% 0% 1% Total Reported Sales

Growth 4% 9% 6% 6% (1) -

Currency effects are approximated by translating last year's

amounts at this year's foreign exchange rates.

Tanda commented on the year, “It was both a challenging and

rewarding year. To address changing conditions with certain

customers and markets we needed to adapt and embarked upon a

journey to reignite our entrepreneurial spirit and improve our

performance. Specifically, we developed a strategy to address the

challenges faced by our Beauty + Home segment and began

implementing company-wide operating, commercial and innovation

excellence initiatives. With some of these initiatives taking root,

and with the strong finish to the year, our Beauty + Home segment

achieved core sales growth for 2017. Our Pharma segment delivered

another excellent year with core sales growth in each end market,

and we invested in additional capacity to better serve our

customers in the U.S. injectables market. Our Food + Beverage

segment also grew core sales in each end market, primarily driven

by strong demand for our innovative dispensing closures in the

infant nutrition and bottled water categories. We also broke ground

in the second half of the year on a new facility in southern China

to position us for growth in this critical country and across Asia.

For the year, we are pleased to report annual core sales growth of

four percent with growth in each business segment, each geographic

region and in each end market with the exception of the home care

market.”

For the year 2017, Aptar reported earnings per share of $3.41,

an increase of 8% over $3.17 reported a year ago. Comparable

adjusted earnings per share increased 6% to $3.44 compared to $3.26

a year ago.

Business Transformation Plan

In late 2017, Aptar began a business transformation plan to

become a more agile, competitive and customer-centric business. The

plan includes a wide range of initiatives to drive profitable sales

growth, increase operational excellence, enhance our approach to

innovation and improve organizational health and effectiveness. The

primary focus of the plan will be the Beauty + Home segment and

certain global G&A functions, as we work to improve efficiency

and attain our long-term financial objectives.

- Growth:

Our transformation initiatives are intended to enable leaner,

focused, agile teams that will use unique local market insights to

provide our customers with even greater service and innovative

solutions. The Beauty + Home segment has already seen top line

improvements in the fourth quarter and has achieved core sales

growth of 2% for 2017.

- Incremental

EBITDA: We expect the business transformation to yield

annual recurring incremental EBITDA of approximately $80 million by

the end of 2020, principally within the Beauty + Home segment. The

initial focus is on executing commercial growth initiatives,

procurement savings, improvements in operating efficiencies and

better leveraging our G&A functions.

- Implementation

& Investment Costs: We expect to incur implementation

costs of approximately $90 million over the next three years

(including $2 million recognized in the fourth quarter of 2017)

with the costs being reported in the quarter in which they are

recognized for accounting purposes. We also anticipate making

capital investments related to the business transformation plan of

approximately $45 million, the majority of which will occur in

2018. We expect nearly all the cash needed to fund these capital

expenditures will come from improvements in working capital.

- Organizational

Health & Effectiveness: We are undertaking steps to

improve the safety performance, health and effectiveness of our

organization, including fostering an entrepreneurial spirit with a

culture of accountability, leadership development programs, greater

employee engagement and improved communication at all levels. We

believe our healthy, empowered and committed organization will

generate value for all stakeholders for years to come.

Tanda added, “I feel fortunate to have taken the helm of a

strong organization with a deeply-rooted, entrepreneurial history,

a commitment to innovation and strong core values. This

transformation will reignite the entrepreneurial spirit across our

company, re-energize our customer-centric approach and sharpen our

talent and competitiveness. Through a combination of

value-capturing strategies and efficiency initiatives, we are

positioning Aptar for continued long-term, sustainable profitable

growth.”

Outlook

Commenting on Aptar’s outlook, Tanda stated, “I am excited about

the energy and dedication within our company toward the successful

execution of our growth strategies and I am encouraged by our

near-term outlook. We expect momentum from the fourth quarter to

carry over into the first quarter as we continue to help our

customers grow and win in their markets while we improve

efficiencies and further develop our talented organization. We

currently expect each segment to report increased first quarter

revenues over the prior year. Despite a lot of expectation around

tax rate reductions stemming from the recent U.S. tax reform, we

expect little benefit to our near-term overall effective tax rate

given the nature of our international business and the related tax

consequences of the new legislation.”

Aptar expects earnings per share for the first quarter to be in

the range of $0.90 to $0.95, excluding any costs related to our

business transformation plan, compared to $0.81 per share reported

in the prior year. Our guidance range is based on an effective tax

rate range of 27% to 29%, which includes estimated effects of the

recent tax reform legislation. Adjusting for changes in currency

translation rates, comparable earnings per share for the prior year

were approximately $0.91 which included an effective tax rate of

26%.

Aptar also affirmed its long-term financial targets as

follows:

Core Sales Growth (excluding acquisitions

and changes in currency rates):

Beauty + Home 3-6% Pharma 6-10% Food +

Beverage 6-10% Total Aptar 4-7%

Adjusted EBITDA Margins:

Beauty + Home 15-17% Pharma 32-36% Food

+ Beverage 18-21% Total Aptar 20-22%

Cash Dividend

The year 2017 marked Aptar’s 24th consecutive year of paying an

increased annual dividend. As previously reported on January 18,

2018, the Board declared a quarterly cash dividend of $0.32 per

share, payable February 21, 2018, to stockholders of record as of

January 31, 2018.

Open Conference Call

There will be a conference call on Tuesday, February 13, 2018,

at 8:00 a.m. Central Time to discuss the Company’s fourth quarter

and year-end results for 2017. The call will last approximately

one-hour. Interested parties are invited to listen to a live

webcast by visiting the Investor Relations page at www.aptar.com.

Replay of the conference call can also be accessed for a limited

time on the Investor Relations page of the website.

Aptar is a leading global supplier of a broad range of

innovative dispensing and sealing solutions for the beauty,

personal care, home care, prescription drug, consumer health care,

injectables, food, and beverage markets. AptarGroup is

headquartered in Crystal Lake, Illinois, with manufacturing

facilities in North America, Europe, Asia and South America. For

more information, visit www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including current and prior year adjusted earnings per

share and adjusted EBITDA, which exclude the impact of a gain from

an insurance recovery, business transformation plan charges, items

impacting the income tax provision including recent tax reforms

recorded in the fourth quarter of 2017, transaction costs and

purchase accounting adjustments related to an acquisition recorded

in the first quarter of 2016 and certain tax settlements recorded

in the fourth quarter of 2016. Adjusted earnings per share also

exclude the impact of currency translation effects, and core sales

excludes both the impact of currency translation effects and

acquisitions. Aptar’s non-GAAP financial measures may not be

comparable to similarly titled financial measures provided by other

companies. Aptar’s management believes these non-GAAP financial

measures are useful to our investors because they allow for a

better period over period comparison of operating results by

removing the impact of items that, in management’s view, do not

reflect our core operating performance. These non-GAAP financial

measures also provide investors with certain information used by

our management when making financial and operational decisions.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for GAAP financial results, but should

be read in conjunction with the unaudited condensed consolidated

statements of income and other information presented herein. A

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP measures is included in the accompanying tables.

Our long-term financial targets are provided on a non-GAAP basis

because certain reconciling items are dependent on future events

that either cannot be controlled, such as the impact of currency

translation effects, or reliably predicted because they are not

part of Aptar’s routine activities, such as acquisitions and

business transformation plan charges.

This press release contains forward-looking statements,

including certain statements set forth under the “Outlook” and

“Business Transformation Plan” sections of this press release.

Words such as “expects,” “anticipates,” “believes,” “estimates,”

“future,” “potential” and other similar expressions or future or

conditional verbs such as “will,” “should,” “would” and “could” are

intended to identify such forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and are based on our

beliefs as well as assumptions made by and information currently

available to us. Accordingly, our actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist in our operations and business environment including, but not

limited to, the impact of tax reform legislation; the execution of

the business transformation plan; the impact and extent of

contamination found at the Company’s facility in Brazil; economic

conditions worldwide including potential deflationary conditions in

regions we rely on for growth; political conditions worldwide;

significant fluctuations in foreign currency exchange rates or our

effective tax rate; changes in customer and/or consumer spending

levels; financial conditions of customers and suppliers;

consolidations within our customer or supplier bases; fluctuations

in the cost of materials, components and other input costs; the

availability of raw materials and components; our ability to

successfully implement facility expansions and new facility

projects; our ability to increase prices, contain costs and improve

productivity; changes in capital availability or cost, including

interest rate fluctuations; volatility of global credit markets;

cybersecurity threats that could impact our networks and reporting

systems; fiscal and monetary policies and other regulations,

including changes in tax rates; direct or indirect consequences of

acts of war or terrorism; work stoppages due to labor disputes; and

competition, including technological advances. For additional

information on these and other risks and uncertainties, please see

our filings with the Securities and Exchange Commission, including

the discussion under “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in

our Form 10-Ks and Form 10-Qs. We undertake no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise.

AptarGroup, Inc. Condensed Consolidated Financial

Statements (Unaudited) (In Thousands, Except Per Share Data)

Consolidated Statements of Income

Three Months Ended Year Ended December 31, December 31,

2017

2016

2017

2016

Net Sales $ 625,895 $ 538,868 $ 2,469,283 $ 2,330,934 Cost

of Sales (exclusive of depreciation and amortization shown below)

(1) 411,214 352,963 1,604,181 1,498,070 Selling, Research &

Development and Administrative (2) 95,358 81,721 388,281 367,562

Depreciation and Amortization 38,434 38,858 153,094 154,802

Restructuring Initiatives

2,208

- 2,208

- Operating Income 78,681 65,326 321,519

310,500 Other Income/(Expense): Interest Expense (14,890 ) (8,690 )

(40,597 ) (35,237 ) Interest Income 3,384 884 5,470 2,643 Equity in

Results of Affiliates (87 ) (4 ) (229 ) (191 ) Miscellaneous, net

(3)

9,171 3,777

8,662 2,782

Income before Income Taxes 76,259 61,293 294,825 280,497

Provision for Income Taxes

26,753

11,706 74,796

74,893 Net Income $ 49,506 $ 49,587 $ 220,029 $

205,604 Net Income Attributable to Noncontrolling Interests

7 (6 )

1 (14 )

Net Income Attributable to AptarGroup, Inc.

$

49,513 $ 49,581

$ 220,030 $

205,590 Net Income Attributable to

AptarGroup, Inc. per Common Share: Basic

$

0.80 $ 0.79

$ 3.52 $

3.27 Diluted

$ 0.77

$ 0.77 $

3.41 $ 3.17

Average Numbers of Shares Outstanding: Basic 61,944 62,586

62,435 62,804 Diluted 64,528 64,220 64,596 64,849 Notes to

the Condensed Consolidated Financial Statements: (1) For the

year ended December 31, 2016, Cost of Sales included the effect of

approximately $2.6 million of purchase accounting adjustments to

inventory related to the Mega Airless acquisition. (2) For

the year ended December 31, 2016, Selling, Research &

Development and Administrative included approximately $5.6 million

of costs related to the Mega Airless acquisition. (3) For

the quarter and year ended December 31, 2017, Miscellaneous, net

included approximately $10.6 million of gain on an insurance

recovery.

AptarGroup, Inc. Condensed Consolidated

Financial Statements (Unaudited) (continued) (In Thousands)

Consolidated Balance Sheets December 31,

2017 December 31, 2016 ASSETS Cash and

Equivalents $ 714,393 $ 466,287 Receivables, net 510,426 433,127

Inventories 337,216 296,914 Other Current Assets

109,792 73,842 Total Current

Assets 1,671,827 1,270,170 Net Property, Plant and Equipment

867,906 784,321 Goodwill 443,887 407,522 Other Assets

155,957 144,772 Total Assets

$ 3,139,577 $

2,606,785 LIABILITIES AND EQUITY

Short-Term Obligations $ 66,169 $ 173,816 Accounts Payable and

Accrued Liabilities

463,333

369,139 Total Current Liabilities 529,502 542,955

Long-Term Obligations 1,191,146 772,737 Deferred Liabilities

106,881 116,851 Total Liabilities

1,827,529 1,432,543 AptarGroup, Inc. Stockholders' Equity

1,311,738 1,173,950 Noncontrolling Interests in Subsidiaries

310 292 Total Equity

1,312,048 1,174,242 Total

Liabilities and Equity

$ 3,139,577

$ 2,606,785 AptarGroup,

Inc. Reconciliation of EBIT, Adjusted EBIT, EBITDA and

Adjusted EBITDA to Net Income (Unaudited) (In Thousands)

Three Months Ended December 31,

2017 Consolidated Beauty + Home Pharma

Food + Beverage Corporate & Other Net Interest

Net Sales $ 625,895 335,473 207,719 82,703 - -

Reported net income $ 49,506

Reported income taxes 26,753

Reported income before income taxes 76,259

24,028 60,502 5,119 (1,884 )

(11,506 ) Adjustments: Restructuring initiatives

2,208 529 1,679 Gain on insurance recovery (10,648 )

(10,648 )

Adjusted earnings before income taxes 67,819 24,557 60,502

6,798 (12,532 ) (11,506 ) Interest expense 14,890 14,890 Interest

income (3,384 )

(3,384 ) Adjusted earnings before net

interest and taxes (Adjusted EBIT) 79,325 24,557 60,502 6,798

(12,532 ) - Depreciation and amortization 38,434

19,405 10,681

6,349 1,999 -

Adjusted earnings before net interest, taxes, depreciation

and amortization (Adjusted EBITDA) $ 117,759 $ 43,962

$ 71,183 $ 13,147 $

(10,533 ) $ - Segment income margins (Income

before income taxes / Reported Net Sales) 7.2 % 29.1 % 6.2 %

Adjusted EBITDA margins (Adjusted EBITDA / Reported Net Sales) 18.8

% 13.1 % 34.3 % 15.9 % Three Months Ended December 31, 2016

Consolidated Beauty + Home Pharma Food

+ Beverage Corporate & Other Net Interest

Net

Sales $ 538,868 290,399 176,110 72,359 - -

Reported net income $ 49,587 Reported

income taxes 11,706

Reported income

before income taxes 61,293 21,114 52,169

4,720 (8,904 ) (7,806 )

Adjustments: None

Earnings before income taxes 61,293

21,114 52,169 4,720 (8,904 ) (7,806 ) Interest expense 8,690 8,690

Interest income (884 )

(884 ) Earnings before net

interest and taxes (EBIT) 69,099 21,114 52,169 4,720 (8,904 ) -

Depreciation and amortization 38,858

21,123 9,974 5,931

1,830 - Earnings before

net interest, taxes, depreciation and amortization (EBITDA) $

107,957 $ 42,237 $ 62,143

$ 10,651 $ (7,074 ) $ - Segment

income margins (Income before income taxes / Reported Net Sales)

7.3 % 29.6 % 6.5 % EBITDA margins (EBITDA / Reported Net Sales)

20.0 % 14.5 % 35.3 % 14.7 %

AptarGroup, Inc.

Reconciliation of Adjusted EBIT and Adjusted EBITDA to Net

Income (Unaudited) (In Thousands)

Year Ended December 31, 2017 Consolidated

Beauty + Home Pharma Food + Beverage

Corporate & Other Net Interest

Net Sales $

2,469,283 1,313,786 805,880 349,617 - -

Reported

net income $ 220,029 Reported income taxes

74,796

Reported income before income

taxes 294,825 93,276 234,790 36,504

(34,618 ) (35,127 ) Adjustments:

Restructuring initiatives 2,208 529 1,679 Gain on insurance

recovery (10,648 )

(10,648 ) Adjusted earnings before

income taxes 286,385 93,805 234,790 38,183 (45,266 ) (35,127 )

Interest expense 40,597 40,597 Interest income (5,470 )

(5,470 ) Adjusted earnings before net interest and taxes

(Adjusted EBIT) 321,512 93,805 234,790 38,183 (45,266 ) -

Depreciation and amortization 153,094

79,422 41,143 24,720

7,809 - Adjusted

earnings before net interest, taxes, depreciation and amortization

(Adjusted EBITDA) $ 474,606 $ 173,227 $

275,933 $ 62,903 $ (37,457 ) $ -

Segment income margins (Income before income taxes /

Reported Net Sales) 7.1 % 29.1 % 10.4 % Adjusted EBITDA margins

(Adjusted EBITDA / Reported Net Sales) 19.2 % 13.2 % 34.2 % 18.0 %

Year Ended December 31, 2016 Consolidated

Beauty + Home Pharma Food + Beverage Corporate

& Other Net Interest

Net Sales $

2,330,934 1,261,086 741,473 328,375 - -

Reported

net income $ 205,604 Reported income taxes

74,893

Reported income before income

taxes 280,497 100,569 219,039

37,697 (44,214 ) (32,594 )

Adjustments: Transaction costs related to the Mega Airless

acquisition 5,640 5,640 Purchase accounting adjustments related to

Mega Airless inventory 2,577 2,151

426

Adjusted earnings before income taxes 288,714 102,720

219,465 37,697 (38,574 ) (32,594 ) Interest expense 35,237 35,237

Interest income (2,643 )

(2,643 ) Adjusted earnings

before net interest and taxes (Adjusted EBIT) 321,308 102,720

219,465 37,697 (38,574 ) - Depreciation and amortization

154,802 84,273 39,776

23,891 6,862

- Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA) $ 476,110

$ 186,993 $ 259,241 $

61,588 $ (31,712 ) $ - Segment

income margins (Income before income taxes / Reported Net Sales)

8.0 % 29.5 % 11.5 % Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales) 20.4 % 14.8 % 35.0 % 18.8 %

AptarGroup, Inc. Reconciliation of Adjusted Earnings Per

Diluted Share (Unaudited) ($ in thousands, except per share

information) Three Months Ended Year Ended

December 31, December 31,

2017

2016

2017

2016

Income before Income Taxes $ 76,259

$ 61,293 $ 294,825 $

280,497

Adjustments:

Restructuring initiatives 2,208 2,208 Gain on insurance recovery

(10,648 ) (10,648 ) Transaction costs related to the Mega Airless

acquisition 5,640 Purchase accounting adjustments related to Mega

Airless inventory 2,577 Foreign currency effects (1)

4,093 4,372

Adjusted Income before Income Taxes $ 67,819 $ 65,386

$ 286,385 $ 293,086

Provision for Income Taxes $ 26,753

$ 11,706 $ 74,796 $

74,893

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

(7,900 ) 3,295 (7,900 ) 3,295 Restructuring initiatives 642 642

Gain on insurance recovery (3,666 ) (3,666 ) Transaction costs

related to the Mega Airless acquisition 1,483 Purchase accounting

adjustments related to Mega Airless inventory 859 Foreign currency

effects (1) 851

974 Adjusted Provision for Income Taxes $ 15,829

$ 15,852 $ 63,872 $

81,504

Net Income Attributable to

Noncontrolling Interests $ 7 $ (6

) $ 1 $ (14 )

Net Income Attributable to AptarGroup, Inc. $

49,513 $ 49,581 $ 220,030

$ 205,590

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

7,900 (3,295 ) 7,900 (3,295 ) Restructuring initiatives 1,566 1,566

Gain on insurance recovery (6,982 ) (6,982 ) Transaction costs

related to the Mega Airless acquisition 4,157 Purchase accounting

adjustments related to Mega Airless inventory 1,718 Foreign

currency effects (1) 3,242

3,398 Adjusted Net Income Attributable

to AptarGroup, Inc. $ 51,997 $ 49,528 $

222,514 $ 211,568

Average Number of

Diluted Shares Outstanding 64,528 64,220

64,596 64,849 Net Income Attributable to

AptarGroup, Inc. Per Diluted Share $ 0.77

$ 0.77 $ 3.41 $ 3.17

Adjustments:

Net effect of items included in the Provision for Income Taxes (2)

0.12 (0.05 ) 0.12 (0.05 ) Restructuring initiatives 0.03 0.02 Gain

on insurance recovery (0.11 ) (0.11 ) Transaction costs related to

the Mega Airless acquisition 0.06 Purchase accounting adjustments

related to Mega Airless inventory 0.03 Foreign currency effects (1)

0.05 0.05

Adjusted Net Income Attributable to AptarGroup, Inc. Per

Diluted Share $ 0.81 $ 0.77 $ 3.44

$ 3.26 (1) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings and earnings per share using current period foreign

currency exchange rates. (2) Items included in the Provision

for Income Taxes primarily reflect the impact of recent tax reform

legislation enacted in the fourth quarter of 2017 and certain

settlements for 2016.

AptarGroup, Inc.

Reconciliation of Adjusted Earnings Per Diluted Share

(Unaudited) ($ in thousands, except per share

information) Three Months Ended March 31,

Expected

2018

2017

Income before Income Taxes $ 69,480

Adjustments:

Foreign currency effects (1) 9,106 Adjusted Income before

Income Taxes $ 78,586

Provision for Income

Taxes $ 17,675

Adjustments:

Foreign currency effects (1) 2,566 Adjusted Provision for

Income Taxes $ 20,241

Net Loss Attributable to

Noncontrolling Interests $ 15 Net

Income Attributable to AptarGroup, Inc. $ 51,820

Adjustments:

Foreign currency effects (1) 6,540 Adjusted Net Income

Attributable to AptarGroup, Inc. $ 58,360

Average Number

of Diluted Shares Outstanding 64,234 Net

Income Attributable to AptarGroup, Inc. Per Diluted Share (2) $

0.90 - $0.95

$ 0.81

Adjustments:

Foreign currency effects (1) 0.10 Adjusted Net Income

Attributable to AptarGroup, Inc. Per Diluted Share (2) $ 0.90 -

$0.95 $ 0.91 (1) Foreign currency effects are approximations of the

adjustment necessary to state the prior year earnings per share

using foreign currency exchange rates as of January 31, 2018.

(2) AptarGroup’s expected earnings per share range for the

first quarter of 2018 is based on an effective tax rate range of

27% to 29%, which includes estimated effects of the recent tax

reform legislation.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180212006376/en/

Investor Relations & Media

Contact:AptarGroup, Inc.Matthew

DellaMaria815-477-0424matt.dellamaria@aptar.com

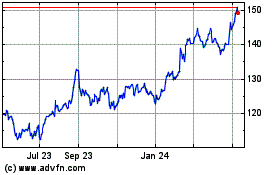

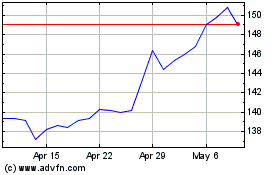

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024