Aon survey finds financial health of defined benefit pension plans ends 2017 near decade-long highs

January 04 2018 - 10:29AM

· Aon’s Median Solvency Ratio at end of Q4 2017 stood at

99.2%

Capping a year that saw the financial health of Canadian defined

benefit pension plans reach levels not seen in more than a decade,

plan solvency in the fourth quarter of 2017 maintained the trend

and remained near the post-recession high set in Q3, according to

Aon’s latest quarterly Median Solvency Ratio survey.

Quotes:“From a financial point of view, 2017

was a very good year for the plans many Canadians will rely on in

retirement, and pension plans are entering 2018 on solid footing,”

said William da Silva, Senior Partner and Retirement Practice

Director at Aon Hewitt. “With solvency near 100%, it seems very

clear that plan sponsors are looking at another manageable year

regarding funding, and 2018 is also shaping up to be a good year

for settlements, as one of the key impediments to fully settling

liabilities – cash outlay – is now less of a concern.”

“Markets and monetary policy got together in 2017 to make

Canadian pension plans healthier than we’ve seen in years,” said

Ian Struthers, Partner and Investment Consulting Practice Director

at Aon Hewitt. “Rising interest rates have decreased plan

liabilities, but also remain low enough to continue to support the

bull market in equities. How long these supportive financial

conditions will last is anyone’s guess, but the good news for

pensions is that they are in a strong position to mitigate risk and

employ smart diversification strategies going forward.”

Key Facts:

- Aon’s median solvency ratio held steady through the fourth

quarter of 2017, standing at 99.2% on Jan. 1, 2018. That compares

with 99.3% for Q3 2017.

- 46% of plans were fully funded as of Jan. 1, down from 48% in

Q3.

- Canadian bond yields fell over the quarter, with Canada 10-year

yields down 9 basis points and Canada long bond yields down 24 bps.

Lower yields increase pension plan liabilities, and negatively

impacted pension plan solvency over the quarter.

- Pension assets returned 3.1% in Q4 2017, in the previous

quarter, asset returns were 0.1%.

- Emerging Market and U.S. equities were the strongest performers

among asset classes in Q4, returning +7.6% and +6.8%, respectively,

through the quarter. International MSCI EAFE (4.4%), global MSCI

World (5.7%) and Canadian equities (4.5%) indices all posted strong

returns in the quarter.

- In Canadian fixed income, falling bond yields bolstered bond

performance in Q4 2017. FTSE TMX Long Term bonds ended the quarter

up 5.2%, while FTSE TMX Universe Bonds were up 2.0%.

- Real asset returns were also strong this quarter, with global

infrastructure up 1.8%, and global real estate up 3.8%, both in

Canadian dollar terms.

A graphic accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/df632699-925d-4241-abb0-f9028bc359ce

About Aon’s median solvency ratio surveyAon’s

median solvency ratio measures the financial health of a defined

benefit plan by comparing total assets to total pension liabilities

on a solvency basis according to the different legislations. It is

the most accurate and timely representation of the financial

condition of Canadian DB plans because it draws on a large database

and reflects each plan’s specific features, investment policy,

contributions and solvency relief steps taken by the plan sponsor.

The analysis of the plans in the database takes into account the

index performance of various asset classes, as well as the

applicable interest rates to value liabilities on a solvency

basis.

ENDS

About AonAon plc (NYSE:AON) is a

leading global professional services firm providing a broad range

of risk, retirement and health solutions. Our 50,000 colleagues in

120 countries empower results for clients by using proprietary data

and analytics to deliver insights that reduce volatility and

improve performance.

Media contactsFor further information please

contact Alexandre Daudelin (+1.514.982.4910)

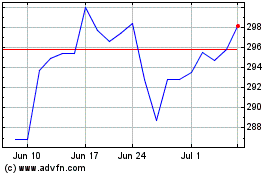

Aon (NYSE:AON)

Historical Stock Chart

From Mar 2024 to Apr 2024

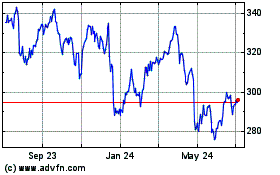

Aon (NYSE:AON)

Historical Stock Chart

From Apr 2023 to Apr 2024