Aon Beats Estimates While Expenses Rise

October 27 2017 - 12:38PM

Dow Jones News

By Allison Prang

Net income fell at Aon plc as the company reported rising costs

partly tied to restructing that outpaced sales growth.

The company reported profit attributable to shareholders of $185

million, down 42% from this time last year. On an adjusted basis,

earnings were $1.29 per share, slightly beating analysts' estimates

of $1.28.

Operating margin expanded 170 basis points to 20.3%, helped by

restructuring initiatives that saved the company $55 million.

Overall sales rose 6% to $2.34 billion, while expenses at the

company grew 13% driven by both amortization and impairment of

intangible assets and restructuring costs.

Organic revenue rose by 2%, largely helped by higher revenue

from Aon's reinsurance and retirement solutions businesses. Organic

revenue from commercial risk solutions, the company's biggest

revenue pool by dollars, declined by 1%.

The company also entered into agreements during the past quarter

to buy both the Townsend Group, a real-estate investment management

firm, and Unirobe Meeus Groep, a Netherlands-based insurance and

real-eastate brokerage company. Aon also repurchased $750 million

worth of its shares.

Shares of Aon were down 3.6% in morning trading.

Write to Allison Prang at allison.prang@wsj.com.

(END) Dow Jones Newswires

October 27, 2017 12:23 ET (16:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

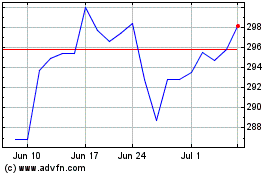

Aon (NYSE:AON)

Historical Stock Chart

From Mar 2024 to Apr 2024

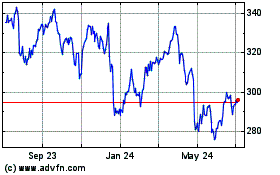

Aon (NYSE:AON)

Historical Stock Chart

From Apr 2023 to Apr 2024