TIDMANTO

RNS Number : 4863H

Antofagasta PLC

13 March 2018

NEWS RELEASE, 13 MARCH 2018

PRELIMINARY RESULTS ANNOUNCEMENT FOR THE YEARED 2017

Strong earnings growth and improved margins

Antofagasta plc CEO Iván Arriagada said: "We have continued to

invest through the cycle while maintaining our focus on cost

discipline and operating performance. As a result, as copper prices

rose in 2017 Antofagasta had another successful year completing the

development of Encuentro Oxides, meeting our safety target of zero

fatalities and achieving both our production and cost guidance.

"EBITDA increased by 59% to $2.6 billion with operating cash

flow rising to $2.5 billion. Testament to the improved copper

market and our continuing cost management programme, our EBITDA

margin rose to 54% - the highest level since 2012 when the copper

price was 30% higher. As a result of this performance the Board has

recommended a final dividend of 40.6 cents per share which,

combined with the interim dividend, brings the total dividend for

the year to 50.9 cents per share, an increase of 177% on 2016, and

represents a cash payout of 67% of earnings.

"Our priorities for 2018 are continued capital discipline and

the next phase of our growth - notably the review and expected

approval of the Los Pelambres Incremental Expansion project and

progressing expansion plans at Centinela."

HIGHLIGHTS

Financial performance

-- EBITDA(1) for the full year was $2,586.6 million, 59.1%

higher than the previous year as revenue increased by 31.1% on

higher realised metal prices

-- EBITDA margin(2) strengthened to 54.5%, the Group's highest margin since 2012

-- Operating cash flow of $2,495.0 million, up 71.2% compared to

the same period last year on the back of stronger margins and

higher sales

-- Free cash flow(3) for the year of $1,199 million

-- Capital expenditure increased to $899.0 million as planned,

$103.9 million higher than in 2016. The increase partly reflected

increased capitalised stripping costs at Centinela and Antucoya,

and higher sustaining capital expenditure

-- Attributable net debt fell by $458 million to $42 million,

reflecting strong operating cash flow and capital discipline

-- Earnings per share from continuing operations and before

exceptional items of 76.1 cents per share, a 119% increase on

2016

-- Final dividend of 40.6 cents per share declared, bringing the

total dividend for the year to 50.9 cents per share, a 177%

increase compared to 2016 and, at 67%, is above the Company's

minimum payout policy of 35% of underlying net earnings per

share.

Operating performance

-- The Group achieved its goal of zero fatalities during 2017.

-- Group copper production for the full year was 704,300 tonnes,

in line with guidance and 0.7% lower than in 2016. This was due to

the impact of the expected lower grades at Los Pelambres and

Centinela, which was offset by Encuentro Oxides coming into

production in October and following the completion of the ramp-up

at Antucoya in 2016

-- Group cash costs before by-product credits(1) for the full

year were $1.60/lb, 6c/lb higher than last year due to the expected

decline in grades at Los Pelambres and Centinela, higher input

prices and a stronger local currency

-- Group net cash costs(1) for 2017 were $1.25/lb, 4.2% higher

than in 2016, but below guidance reflecting higher than expected

by-product revenues.

Outlook for 2018

-- Group production in 2018 is expected to be 705-740,000 tonnes

of copper, 190-210,000 ounces of gold and 11,500-12,500 tonnes of

molybdenum (as previously announced). Copper production is expected

to grow quarter-by-quarter through the year as grades improve, with

approximately 45% of the year's production expected in the first

half of the year

-- Group cash costs in 2018 before and after by-product credits

are expected to be $1.65/lb and $1.35/lb respectively (as

previously announced) and decrease during the year as quarterly

production increases

-- Cost savings of $100 million targeted under the Cost and

Competitiveness Programme which have been included in the unit cost

guidance figures

-- Capital expenditure for 2018 is estimated at $1.0 billion (as previously announced).

Other

-- Labour negotiations at Los Pelambres, Centinela and Zaldívar

successfully completed. The last of the Group's negotiations for

the year, at Los Pelambres, is currently in mediation the union

members having rejected the last offer from the company on 9(th)

March. Mediation is expected to last one to two weeks from this

date

-- Encuentro Oxides project completed some 5% under budget

-- Los Pelambres Incremental Expansion Phase 1 EIA approved and

capital estimate updated. The project's capital estimate has been

updated with current pricing projections, advanced detailed

engineering and a project execution plan to a revised estimate of

$1.3 billion. This figure includes the concentrator plant expansion

and pre-stripping at $780 million and the desalination plant and

water pipeline at $520 million. The desalination plant will serve

as a back-up water supply for the existing operation in conditions

of severe drought and for both phases of the expansion. The project

is expected to be submitted for approval to the Board during the

second half of 2018 once ancillary permits to the approved EIA are

in place and the 2021 start-up of the project remains

unchanged.

YEARING 31 DECEMBER 2017 2016 %

------------------------------------------------- ------- -------- --------- --------

Group revenue $m 4,749.4 3,621.7 31.1%

EBITDA(1) $m 2,586.6 1,626.1 59.1%

EBITDA margin(1, 2) % 54.5 44.9 21.4%

Underlying Earnings per share (continuing

operations, before exceptional items) cents 76.1 34.7 119.3%

Earnings per share (continuing and discontinued

operations, after exceptional items) cents 76.2 16.0 376.3%

Dividend per share cents 50.9 18.4 176.6%

Cash flow from operations (continuing

& discontinued) $m 2,495.0 1,457.3 71.2%

Capital expenditure(4) $m (899.0) (795.1) 13.1%

Attributable net debt at period end(1) $m (41.6) (499.5) (91.7%)

Average realised copper price $/lb 3.00 2.33 28.8%

--------

Copper sales kt 709.0 698.5(5) 1.5%

Gold sales koz 218.2 271.4 (19.6%)

Molybdenum sales kt 9.6 7.2 33.3%

Cash costs before by-product credits(1) $/lb 1.60 1.54 3.9%

Net cash costs(1) $/lb 1.25 1.20 4.2%

------------------------------------------------- ------- -------- --------- --------

Note: The financial results are prepared in accordance with

IFRS, unless otherwise noted below.

(1) Non IFRS measures. Refer to the alternative performance

measures in Note 28 to the preliminary results announcement

(2) Calculated as EBITDA/Group revenue. If Associates and JVs

revenue is included EBITDA margin was 50.1% in 2017 and 41.1% in

2016.

(3) Cash flow from operations less net interest, tax paid and total capital expenditure

(4) On a cash basis

(5) Includes pre-commercial production sales at Antucoya of 11,800 tonnes.

The 2017 Preliminary Results Presentation is available for

download from the website www.antofagasta.co.uk.

Investors - London Media - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Andres Vergara avergara@antofagasta.co.uk Will Medvei antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Investors - Santiago Media - Santiago

Francisco Veloso fveloso@aminerals.cl Pablo Orozco porozco@aminerals.cl

Telephone +56 2 2798 7000 Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

DIRECTORS' COMMENTS FOR THE YEARED 2017

2017 FINANCIAL HIGHLIGHTS

Revenue for the Group in 2017 was $4,749.4 million, 31.1% higher

than in 2016. The increase of $1,127.7 million mainly reflected an

increase in the realised copper price and copper sales volumes, as

well as higher molybdenum revenue offset by lower gold revenue.

EBITDA reflected this increase in revenue, partly offset by the

higher unit cash costs, and increased exploration and evaluation

expenditure and mine closure provision costs. EBITDA increased by

59.1% to $2,586.6 million, at an EBITDA margin of 54.5%.

Earnings per share from continuing operations for the year were

76.1 cents, an increase of 41.4 cents compared with 2016. Cash flow

from operations strengthened by 71.2% to $2,495.0 million, compared

with $1,457.3 million in the previous year.

During the year, copper production decreased by 0.7% to 704,300

tonnes, compared to 2016. This was due to the impact of the

expected lower grades at Los Pelambres and Centinela, which was

offset by Encuentro Oxides coming into production in October and

following the completion of the ramp-up at Antucoya in 2016.

Gold production was 212,400 ounces, 21.6% lower than in 2016,

with lower grades at Los Pelambres and a shift to higher copper

content ores at Centinela. However, molybdenum production was

boosted by 47.9% year on year by higher grades.

The transport division transported 3.5% less tonnage in 2017

than in 2016 following labour disruptions at one of its clients.

This was partially offset by higher road transport volumes and

productivity improvements achieved during the year.

The focus of the Group has been on producing profitable tonnes

by reducing costs, improving productivity and efficiency and

applying innovative solutions to the operating challenges the Group

faces. One of the outcomes of these efforts is more consistent and

reliable delivery, producing 704,300 tonnes of copper at a net cash

cost of $1.25/lb in 2017.

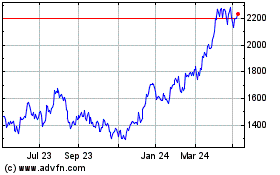

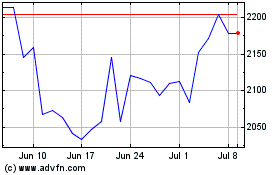

The LME copper price at the beginning of 2017 was $2.51/lb and

rose to end the year at $3.27/lb, averaging $2.80/lb over the whole

year, an increase of 27% compared with 2016. Copper supply came

under pressure during the first half of the year as strikes and

other issues at some of the world's largest mines led to

significant disruptions. However, in the second half of the year

demand was supported by unexpected strength in key markets,

particularly in China. This resulted in the average realised price

of copper being 29.0% higher in 2017 at $3.00/lb. The realised gold

price was $1,280.4/oz in 2017 compared with $1,256.1/oz in 2016,

while the realised molybdenum price increased by 28.3% to

$8.7/lb.

SAFETY

In 2017 Antofagasta achieved its zero fatalities goal and is

determined to continue with this success. It has also continued to

reduce the severity and frequency of accidents and this

demonstrates the value of near-miss reporting, which is one of the

pillars of the Corporate Safety Model which is focused on risk

prevention and operating control.

Focus on Fatal Risks

In line with international best practice, the Group's safety and

health model is based on fatal risk prevention and self-awareness.

This applies to the whole workforce, both employees and

contractors. In 2017 further progress was made in standardising and

simplifying fatal risk prevention and controls. Antofagasta focuses

on 15 fatal risks prevented through 72 critical controls. Employees

and contractors are encouraged to take responsibility for their own

and their colleagues' safety through the continuous verification of

the implementation of critical controls, onsite leadership,

training, awareness initiatives, public recognition of safe conduct

and the use of the best available safety technology.

ENVIRONMENT

Antofagasta seeks to prevent, mitigate and control the impact of

its activities on the environment. The Group remains committed to

achieving sustainable and efficient use of natural resources

throughout the mining cycle, from exploration to site closure and

beyond. The Group had no significant operating incidents with

environmental impact in 2017.

Environmental Management

Antofagasta's mining operations have a total of 54 RCAs listing

some 6,500 environmental commitments. These commitments are now

centrally administered through Antofagasta's updated Environmental

Management System, which is similar to the safety system and

focuses on key risk prevention, specific controls, audits and the

reporting of near-miss incidents. In 2017, Los Pelambres submitted

the Environmental Impact Assessment (EIA) for its Incremental

Expansion project which was approved early in 2018.

COMMUNITIES

Antofagasta contributes to the sustainable development of the

regions and communities in which it operates, creating a shared

vision for development by engaging in effective, participatory and

transparent stakeholder dialogue, as well as recognising

disagreements and opportunities.

During 2017, the Group rolled out engagement programmes at

Centinela and Antucoya based on the Somos Choapa programme that had

been successfully developed for Los Pelambres.

COST CONTROL AND PRODUCTIVITY

The Group achieved mine site savings of $166 million during the

year under its Cost and Competitiveness Programme (CCP), 10% more

than had been targeted and equivalent to $0.11/lb. The target for

2018 is set at an incremental $100 million and the accumulated mine

site saving up to the end of 2017 were $525 million.

Mine site cost savings are being achieved in four areas;

services productivity, operating and maintenance management,

corporate and organisational effectiveness, and energy

efficiency.

FUTURE GROWTH

The Environmental Impact Assessment (EIA) for Phase 1 of the Los

Pelambres Incremental Expansion project was approved in February

2018.

The project's capital estimate has been updated with current

pricing projections, advanced detailed engineering and a project

execution plan to a revised estimate of $1.3 billion. This figure

includes the concentrator plant expansion and pre-stripping at $780

million and the desalination plant and water pipeline at $520

million. The desalination plant will serve as a back-up water

supply for the existing operation in conditions of severe drought

and for both phases of expansion. The project is expected to be

submitted for approval to the Board during the second half of 2018

once ancillary permits to the approved EIA are in place and the

2021 start-up of the project remains unchanged.

The project will increase Los Pelambres' production by 55,000

tonnes of copper a year from 2021. Phase 2 will require further

permitting and will add another 35,000 tonnes of production and

extend the mine life by some 15 years.

The Group is also evaluating two alternatives to expand

production at Centinela. One is to build a new second concentrator

at an estimated cost of $2.7 billion, and the other is to expand

the existing concentrator. Preliminary work has been carried out on

the second option, which has lower capital expenditure and lower

construction and project execution risks than the Second

Concentrator project. More work will be conducted on both options

during 2018 with the intention of the Company being able to select

its preferred alternative by the end of the year. If the expansion

of the existing concentrator is selected a feasibility study will

then need to be completed, which would take some 18 months.

DIVIDS

The Board has recommended a final dividend for the year of 40.6

cents per share, bringing the total dividend for the year to 50.9

cents per share or $502 million. This is an increase of 177% on

last year and represents a total pay-out ratio of 67% of underlying

net earnings, significantly in excess of the Company's policy of

paying out a minimum of 35% of underlying net earnings.

OUTLOOK

Group copper production in 2018 is expected to be in the range

of 705-740,000 tonnes, higher than the 704,300 tonnes produced in

2017 as Encuentro Oxides reaches full capacity during the year.

This will be partially offset by lower mined grades. Production is

expected to grow quarter-by-quarter through the year as grades

improve with approximately 45% of the year's production expected to

be produced in the first half of the year.

Group cash costs before by-product credits for 2018 are expected

to be $1.65/lb reflecting some upward pressure on input costs and a

lower percentage contribution from the lowest cost mine, Los

Pelambres. Net cash costs are expected to increase by some 10c/lb

to $1.35/lb.

The copper market is expected to tighten in the second half of

the year and to be in balance or in a slight deficit for the full

year. From 2019 the likelihood of the market being in deficit is

expected to increase as mine supply continues to be affected by the

long-term trend of grade decline and lack of new investment. Given

the lead time between the decision to proceed with the construction

of a reasonable-sized mining operation and it coming into

production, the few projects that have been approved or are

awaiting the final stages of permitting are only expected to come

on-stream in the next decade. In addition, there are an unusually

large number of labour negotiations taking place in Chile and Peru

during 2018. With the backdrop of stronger copper prices, employee

expectations may be raised which could result in some supply

disruptions in the region.

On the demand side, growth will continue to be driven by Chinese

consumption, but the rise in demand from electric vehicles and

renewables will be significant if they develop at the rates many

analysts are expecting.

REVIEW OF OPERATIONS

LOS PELAMBRES

2017 Performance

Operating Performance

EBITDA at Los Pelambres was $1,428 million in 2017, compared

with $921 million in 2016, reflecting increased realised metal

prices.

Production

Copper production was 343,800 tonnes in 2017, which was 3.3%

lower than in 2016. This decrease was primarily due to lower

grades, which dropped from 0.73% to 0.68%. Molybdenum production

for the year was 10,500 tonnes, 47.9% higher than in 2016, due to

higher grades, recoveries and throughput. Gold production was 4.2%

lower in 2017 at 55,400 ounces, compared with 57,800 ounces in

2016.

Costs

Cash costs before by-product credits at $1.44/lb were 5.9%

higher than in 2016, as grades decreased, partially compensated by

higher throughput. Net cash costs in 2017 were $1.02/lb compared

with $1.06/lb in 2016, due to significantly higher credits from

molybdenum sales.

Capital expenditure

Total capital expenditure in 2017 was $236 million, which

included $89 million on mine development. Capital expenditure is

forecast at approximately $365 million in 2018, reflecting the

expected start of construction of the Incremental Expansion project

and higher sustaining capital expenditure compared to 2017.

Environmental Compliance

In October 2016, the Chilean Environmental Superintendency (the

SMA) raised charges against Los Pelambres for delayed or incomplete

compliance with some of its Environmental Approval Resolutions

(RCA) commitments. The company responded by conducting an in-depth

review of its internal processes to understand how these compliance

gaps had occurred and to accelerate implementation of the new

corporate Environmental Management System. The review found that

some smaller and older commitments had been missed by the original

control system, interpretations of other commitments had evolved

over the years, and audit standards had changed. Towards the end of

2017 the SMA accepted the compliance programme proposed by Los

Pelambres and suspended the charges raised in 2016.

Cerro Amarillo

In November 2017, the San Juan Province accepted a plan

presented by Los Pelambres to remove the Cerro Amarillo waste rock

dump and work commenced in December. The execution of the plan is

subject to certain conditions and the approved time for the removal

of 5.5 years can be extended by one year in certain circumstances.

The company made a provision of $50 million during 2017 for the

removal of the waste rock. The removal plan does not represent any

acknowledgment of responsibility by Los Pelambres nor prejudice any

of its rights, since at the time the company started construction

of the waste rock dump it did so in accordance with valid permits

issued by the responsible Chilean government agencies.

Outlook

Production

The forecast production for 2018 is 345-355,000 tonnes of

payable copper (slightly higher than in 2017), 10-11,000 tonnes of

molybdenum and 60-70,000 ounces of gold.

Costs

Cash costs before by-product credits for 2018 are forecast to

increase to approximately $1.50/lb and net cash costs to increase

to approximately $1.10/lb.

CENTINELA

2017 Performance

Operating Performance

EBITDA at Centinela was $859 million, compared with $562 million

in 2016, despite lower production and higher operating costs as the

realised copper price increased by 28% and the realised gold price

rose by 2.1%.

Production

Copper production for the full year 2017 was 228,300 tonnes,

3.3% lower than in 2016 primarily as a result of lower recoveries

and lower grade at Centinela concentrates. This was partly offset

by higher grades in the oxides line and the start of production at

Encuentro Oxides. Copper in concentrate production for the full

year was 163,900 tonnes, 9.1% lower than 2016 mainly reflecting

slightly lower grades and the consequential drop in recoveries.

Gold production was 157,000 ounces, 26.3% lower than in 2016. This

was mainly due to lower grades and recoveries. Copper cathode

production for the year was 64,500 tonnes, 15.6% higher than the

previous year, as grades increased and Encuentro Oxides came into

production in the last quarter of the year.

Costs

Cash costs before by-product credits for the year were $1.81/lb,

3.4%, higher than in 2016, mainly as a result of lower copper

production, higher input prices and the payment of a one-off

signing bonus following the successful conclusion of labour

negotiations with three unions at the operation. The essential

terms of each of the labour agreements were standardised and

allowing the completion of the operational integration of Esperanza

and El Tesoro, which began in 2014 when they were merged as

Centinela. This completion of the integration will bring further

improvements in operating practices at Centinela and will enable

improvements in productivity. Net cash costs for 2017 were $1.36/lb

compared with $1.19/lb in 2016. This increase is due to the

increase in cash costs before by-product credits and lower gold

production.

Capital expenditure

Capital expenditure was $578 million, including $192 million on

Encuentro Oxides and the molybdenum plant and $264 million on mine

development. Total project expenditure on the Encuentro Oxides

project was $605 million, some $30 million under budget.

Total capital expenditure in 2018 is expected to be $515

million, including $280 million on mine development.

Outlook

Production

Production for 2018 is forecast at 230-245,000 tonnes of payable

copper, 130-140,000 ounces of gold and 1,500 tonnes of molybdenum

following the commissioning of the molybdenum plant early in 2018.

While the grade at Centinela Concentrates will be lower than in

2017, Encuentro Oxides will reach full capacity during the year

contributing approximately 50,000 tonnes of payable copper.

Costs

Cash costs before by-products for 2018 are forecast at

approximately $1.90/lb and net cash costs at approximately

$1.50/lb.

ANTUCOYA

2017 Performance

Operating Performance

EBITDA at Antucoya was $207 million compared with $65 million in

2016, reflecting Antucoya's first year of operation at full

capacity.

Production

Production was 80,500 tonnes of copper, 21.6% higher than in

2016, following the completion of the ramp-up in late 2016.

Costs

Cash costs for the year were $1.68/lb, 8.2% lower than in 2016

mainly because of higher production.

Capital expenditure

Capital expenditure was $44 million, including $17 million on

mine development.

Outlook

Production in 2018 is forecast to be approximately 75-80,000

tonnes and cash costs are expected to increase to $1.75/lb. Total

capital expenditure is expected to be approximately $55 million,

which includes $22 million of mine development costs.

ZALDÍVAR

2017 Performance

Operational Performance

Attributable EBITDA was $134 million compared with $85 million

in 2016. During 2017 the company successfully concluded labour

negotiations with the workers union.

Production

Total attributable production in 2017 was 51,700 tonnes of

copper cathodes unchanged from 2016 as, although the grade

increased, recoveries were lower due to the significantly higher

proportion of sulphide ores being processed compared to 2016.

Costs

Cash costs for 2017 were $1.62/lb, 5.2% higher than previous

year mainly because of the impact of the one-off signing bonuses

following the conclusion of the labour negotiations and higher

input prices.

Capital expenditure

Attributable capital expenditure for 2017 was $51 million, which

includes approximately $25 million with respect to mine

development. These amounts are not included in the Group capital

expenditure figures.

Outlook

Attributable copper production in 2018 is forecast to be

approximately 55-60,000 tonnes at a cash cost of $1.70/lb.

Attributable capital expenditure in 2018 is expected to be

approximately $60 million, of which $10 million will be spent on

mine development.

GROWTH PROJECTS AND OPPORTUNITIES

Encuentro Oxides

The Encuentro Oxides deposit is in the Centinela Mining

District. It is expected to produce an average of approximately

43,000 tonnes of copper cathode per year over an eight-year period,

offsetting a natural decline in production due to falling mined

grades at Centinela's existing oxide pits.

The project was completed during 2017 and first production was

in September with full production expected in 2018.

This deposit is important for the Group's long-term development,

as Encuentro Oxides sits on top of the much larger Encuentro

Sulphide deposit. The Encuentro Oxides project therefore acts as a

funded pre-strip for the sulphide deposit, opening up the latter

for development as part of the Centinela expansion project.

During 2017, total expenditure incurred was $153 million

bringing total expenditure on the project to $605 million, some $30

million under budget.

Molybdenum Plant

This project will allow Centinela to produce an average of 2,400

tonnes of molybdenum per year. Completion is expected in early

2018, and the addition of another by-product credit will lower

Centinela's unit net cash costs.

At the end of December 2017, the project achieved 98% progress

(including design, engineering, procurement and construction).

During 2017, total expenditure incurred was $40 million.

Los Pelambres Incremental Expansion

This expansion project is being carried out in two phases in

order to simplify the permitting application process and spread the

cost over a longer period.

Phase 1

This phase is designed to optimise throughput within the limits

of the existing operating, environmental and water extraction

permits, with only relatively simple updates required and an EIA

for the new desalination plant. During this phase, Los Pelambres

will operate at an average throughput of 190,000 tonnes of ore per

day, with the addition of a new grinding and flotation circuit to

mitigate the impact of the harder ore currently being mined, and a

400 litres per second desalination plant and associated pipeline.

Desalinated water will be pumped from the coast to the Mauro

tailings storage facility, where it will connect with the recycling

circuit returning water to the Los Pelambres concentrator

plant.

During 2017 the Group progressed the EIA for the project with

the authorities and provided various submissions associated with

the permitting process. The EIA was approved in February 2018.

The project's capital estimate has been updated with current

pricing projections, advanced detailed engineering and a project

execution plan to a revised estimate of $1.3 billion. This figure

includes the concentrator plant expansion and pre-stripping at $780

million and the desalination plant and water pipeline at $520

million. The desalination plant will serve as a back-up water

supply for the existing operation in conditions of severe drought

and for both Phase and Phase 2 of the expansion. The project is

expected to be submitted for approval to the Board during the

second half of 2018 once ancillary permits to the approved EIA are

in place and the 2021 start-up of the project remains

unchanged.

The project will increase Los Pelambres' production by 55,000

tonnes of copper a year from 2021.

Phase 2

In this phase the Group will seek to increase throughput to

205,000 tonnes of ore per day and to extend the mine's life by 15

years beyond the currently approved 20 years. As part of this

development the Group will submit a new EIA to increase the

capacity of the mine's Mauro tailings storage facility and mine

waste dumps. Work on the environmental baseline study for the new

EIA started in 2017 and the results will be reviewed in late

2018.

Capital expenditure for this phase was estimated in the

pre-feasibility study at approximately $500 million, the majority

being on mining equipment, additional crushing and grinding

capacity and flotation cells. The conveyors from the primary

crusher to the concentrator plant will also have to be repowered to

support the additional throughput. Critical studies on tailings and

waste storage capacity are underway and should be completed in

2018. However, the project will only proceed following a decision

on Phase 1 and will require the submission of extensive permit

applications, including the new EIA. First production from this

phase would be in 2022 at the earliest and is expected to increase

copper production by 35,000 tonnes per year.

Centinela Expansion

At Centinela the expansion of the existing concentrator and

using its infrastructure (power lines, pipelines, port and other

facilities) is being considered as an alternative to building a new

concentrator.

Centinela Second Concentrator

One alternative under consideration for the expansion of

Centinela is the construction of a second concentrator some 7 km

from Centinela's current concentrator. It is expected to have an

ore throughput capacity of approximately 90,000 tonnes per day,

with annual production of approximately 180,000 tonnes of copper

equivalent, which includes gold and molybdenum as by-products.

Ore will be sourced initially from the Esperanza Sur deposit

and, once mining is completed at Encuentro Oxides, additionally

from Encuentro Sulphides.

The EIA for the project was approved in 2016 and the Group has

commenced applications for the additional permits required for the

project following certain design modifications made during the

year. The feasibility study for this $2.7 billion project is due

for completion by the end of 2018, when a decision will be made on

whether to proceed with this project or the expansion of the

existing plant. If approval is given in 2018 first production is

expected in 2022.

However, if the expansion of the existing concentrator is

approved it is likely that the second concentrator will proceed at

a later date.

There is also scope to increase the plant capacity further once

the second concentrator is completed, which could bring throughput

capacity to approximately 150,000 tonnes per day and increase the

plant's production to approximately 250,000 tonnes of copper

equivalent.

Alternative Development Option

As an alternative to the construction of a second concentrator,

the Group is evaluating expanding the existing concentrator and

tailings storage facilities as a lower capital expenditure and

lower construction and project execution risk alternative.

Technical viability, capital cost and financial returns will be

assessed before the completion of the feasibility study for the

second concentrator. The expansion of the existing concentrator

will not preclude the later construction of the second

concentrator.

More work will be conducted on both expansion options during

2018 with the intention of the Company being able to select its

preferred alternative by the end of the year. If the alternative of

expanding the existing concentrator is selected then a full

feasibility study would be required before it is taken to the Board

for approval. This work would delay the date for final project

approval by approximately 18 months.

Twin Metals Minnesota (Twin Metals)

Twin Metals is a wholly-owned copper, nickel and platinum group

metals (PGM) underground mining project in north-eastern Minnesota,

US.

During 2017 the Group commenced preparation of the Mine Plan of

Operations, a pre-requisite for permitting applications. The Group

also undertook further evaluation and optimisation exercises on the

pre-feasibility study completed in 2014, with the aim of completing

an updated pre-feasibility study by the end of 2018.

In December 2017, the US Department of the Interior reaffirmed

Twin Metals' right to renew two federal mineral leases, a right

denied in December 2016 by the Bureau of Land Management (BLM) and

the US Forest Service (USFS). These mineral leases cover part of

the project's mineral resources.

TRANSPORT DIVISION

2017 Performance

During the year, the transport division further optimised its

business under the FCAB Management Model based on the three key

areas of sustainability, productivity and cost management. Tonnage

transported continued in line with the previous year and the

railway renewed an acid transport contract with one of its largest

customers. Seven new locomotives purchased during the year are

scheduled to begin operating in the first half of 2018, and another

five locomotives have been ordered, optimising the fleet and

increasing asset productivity.

Operational performance

The division's EBITDA was $98 million in 2017, compared to $88

million in 2016, reflecting tight cost management and higher sales

from the water business.

Transport tonnage

During 2017 the division transported 6.3 million tonnes,

compared to 6.5 million tonnes in 2016, 3.5% lower mainly due to

labour disruptions at one of the division's clients, partially

offset by higher road transport volumes and productivity

improvements achieved during the year.

Costs

Cost management was focused on optimising the division's

business processes to ensure the lasting competitiveness of its

services through better utilisation of the fleet, organisational

changes and cost savings.

Outlook

The division will continue to develop new business opportunities

and optimise the use of rolling stock and utilisation of the fleet.

Improvements are expected in maintenance, using knowledge gained

from the mining division and best practices from the railway

industry, and benefitting from the seven new locomotives and higher

fleet availability. The implementation of the Competitiveness and

Costs Programme will further keep costs under control.

FINANCIAL REVIEW FOR THE YEARED 31 DECEMBER 2017

Results

Year ended Year ended

31.12.2017 31.12.2016

---------------------------------------

Exceptional

Before items

exceptional (Note

Total items 3) Total

$m $m $m $m

Revenue 4,749.4 3,621.7 - 3,621.7

---------------------------------------- ------------ ------------- ------------ ----------

EBITDA (including results from

associates and joint ventures) 2,586.6 1,626.1 - 1,626.1

---------------------------------------- ------------ ------------- ------------ ----------

Operating costs excluding depreciation (2,318.9) (2,100.0) (241.0) (2,341.0)

Depreciation, loss on disposals

and impairments (589.4) (598.1) (215.6) (813.7)

------------- ------------ ----------

Operating profit from subsidiaries 1,841.1 923.6 (456.6) 467.0

Net share of results from associates

and joint ventures 59.7 23.4 (134.7) (111.3)

Total profit from operations,

associates and joint ventures 1,900.8 947.0 (591.3) 355.7

Net finance expense (70.0) (71.1) - (71.1)

Profit before tax 1,830.8 875.9 (591.3) 284.6

Income tax expense (633.6) (313.5) 204.9 (108.6)

------------- ------------ ----------

Profit from continuing operations 1,197.2 562.4 (386.4) 176.0

============= ============ ==========

Discontinued operations 0.5 38.3 - 38.3

------------- ------------ ----------

Profit for the year 1,197.7 600.7 (386.4) 214.3

============= ============ ==========

Basic earnings per share US cents US cents US cents US cents

From continuing operations 76.1 34.7 (22.6) 12.1

From discontinued operations 0.1 3.9 - 3.9

------------- ------------ ----------

Total continuing and discontinued

operations 76.2 38.6 (22.6) 16.0

============= ============ ==========

At 31 December 2017, the Group had commenced a process to

dispose of Centinela Transmission, the electricity transmission

line supplying Centinela and other external parties. As a result of

this, its net results are shown as a discontinued operation in the

income statement. In the 2016 comparatives the net results of the

Group's former Michilla operation were shown as a discontinued

operation.

A detailed segmental analysis of the components of the income

statement is contained in Note 4 to the preliminary results

announcement.

The following table reconciles the change in EBITDA between 2016

and 2017:

$m

EBITDA in 2016 1,626.1

Revenue

Increase in copper volumes sold 122.0

Increase in realised copper price 966.4

Decrease in treatment and refining

charges 23.3

--------

Increase in revenue from copper sales 1,111.7

--------

Decrease in gold revenue (61.1)

Decrease in silver revenue (8.3)

Increase in molybdenum revenue 74.5

--------

Increase in revenue from by-products 5.1

--------

Increase in transport division revenue 10.9

--------

Increase in Group revenue 1,127.7

========

Operating costs

Increase in mine operating costs (175.0)

Increase in closure provisions (30.5)

Increase in exploration and evaluation

costs (24.5)

Increase in corporate costs (15.2)

Decrease in other mining division

costs 35.2

--------

Increase in operating costs for mining

division (210.0)

========

Increase in transport division operating

costs (8.9)

Increase in attributable EBITDA relating

to associates and in joint ventures 51.7

--------

Total EBITDA in 2017 2,586.6

========

Revenue

Revenue for the Group in 2017 was $4,749.4 million, 31.1% higher

than in 2016. The increase of $1,127.7 million mainly reflected an

increase in the realised copper price and copper sales volumes, as

well as higher molybdenum revenue offset by lower gold and silver

revenue.

Revenue from the mining division

Revenue from copper sales

Revenue from copper concentrate and copper cathode sales

increased by $1,111.7 million, or 32.3%, to $4,578.3 million,

compared with $3,461.5 million in 2016. The increase reflected the

impact of higher realised prices and increased sales volumes.

(i) Realised copper price

The higher average realised copper price resulted in a $966.4

million increase in revenue. The average realised price increased

by 28.5% to $3.00/lb in 2017 (2016 - $2.33/lb), largely reflecting

the 26.7% increase in the LME average market price to $2.80/lb

(2016 - $2.21/lb). In addition, there was a significant positive

provisional pricing adjustment of $309.5 million, mainly reflecting

the increase in the year-end copper price to approximately $3.25/lb

at 31 December 2017, compared with around $2.50/lb at 31 December

2015.

In 2017 revenue also includes a loss of $17.1 million (2016 -

loss of $2.2 million) relating to commodity derivatives which

matured during the year. Further details of hedging activity in the

period are given in Note 6(c) to the preliminary results

announcement.

Realised copper prices are determined by comparing revenue

(gross of treatment and refining charges for concentrate sales)

with sales volumes in the period. Realised copper prices differ

from market prices mainly because, in line with industry practice,

concentrate and cathode sales agreements generally provide for

provisional pricing at the time of shipment with final pricing

based on the average market price for future periods (normally

around one month after delivery to the customer in the case of

cathode sales and normally four months after delivery to the

customer in the case of concentrate sales). Realised copper prices

also reflect the impact of realised gains or losses on commodity

derivative instruments hedge accounted for in accordance with IAS

39 "Financial Instruments: Recognition and Measurements".

Further details of provisional pricing adjustments are given in

Note 5 to the preliminary results announcement.

(ii) Copper volumes

Copper sales volumes reflected within revenue increased from

634,100 tonnes in 2016 to 657,700 tonnes in 2017 increasing revenue

by $122.0 million. This increase was mainly due to Antucoya which

achieved commercial production on 1 April 2016, and which therefore

recorded a full 12 months' of sales volumes within revenue in 2017

(80,800 tonnes), compared to only nine months' 2016 (54,900

tonnes).

(iii) Treatment and refining charges

Treatment and refining (TCs/RCs) charges for copper concentrate

decreased by $23.3 million to $277.7 million in 2017 from $301.0

million in 2016, mainly due a decrease in the average TCs/RCs.

Treatment and refining charges are deducted from concentrate sales

when reporting revenue and hence the decrease in these charges has

had a positive impact on revenue.

Revenue from molybdenum, gold and other by-product sales

Revenue from by-product sales at Los Pelambres and Centinela

relate mainly to molybdenum and gold and, to a lesser extent,

silver. Revenue from by-products increased by $5.1 million or 1.0%

to $505 million in 2017, compared with $499.9 million in 2016. This

overall slight increase reflects higher molybdenum revenue largely

offset by lower gold sales.

Revenue from molybdenum sales (net of roasting charges) was

$168.5 million (2016 - $94.0 million), an increase of $74.5

million. The increase was due to higher sales volumes of 9,600

tonnes (2016 - 7,200 tonnes) and an increased realised price of

$8.7/lb (2016 - $6.8/lb).

Revenue from gold sales (net of treatment and refining charges)

was $278.6 million (2016 - $339.7 million), a decrease of $61.1

million which mainly reflected a decrease in volumes, partly offset

by a higher realised price. Gold sales volumes decreased by 19.6%

from 271,400 ounces in 2016 to 218,200 ounces in 2017, mainly due

to lower grades and recoveries at Centinela. The realised gold

price was $1,280.4/oz in 2017 compared with $1,256.1/oz in 2016,

with the increase reflecting slightly higher market prices.

Revenue from silver sales decreased by $8.3 million to $58.2

million (2016 - $66.2 million). The decrease was due to lower sales

volumes of 3.5 million ounces (2016 - 3.7 million ounces) as well

as a decrease in the realised silver price to $16.8/oz (2016 -

$17.5/oz).

Revenue from the transport division

Revenue from the transport division (FCAB) increased by $10.9

million or 6.8% to $171.1 million, mainly due to increased average

rail tariffs and higher road tonnages.

Operating costs (excluding depreciation, loss on disposals and

impairments)

Operating costs (excluding depreciation, loss on disposals and

impairments) are considered to provide a useful and comparable

indication of the current operational performance of the Group's

businesses, excluding the depreciation of the historic cost of

property, plant & equipment.

The Group's total operating costs (excluding depreciation, loss

on disposals and impairments) amounted to $2,318.9 million (2016 -

$2,100.0 million), an increase of $218.9 million mainly due to

increased costs at the mining division.

Operating costs (excluding depreciation, loss on disposals and

impairments) at the mining division

Operating costs (excluding depreciation, loss on disposals and

impairments) at the mining division increased by $210.0 million to

$2,223.1 million in 2017, an increase of 10.4%. Of this increase,

$175.0 million is attributable to higher mine-site operating costs.

This increase in mine-site costs reflected the higher production

volumes in the year, the one-off signing bonus payable following

the successful completion of labour negotiations at Centinela, the

stronger Chilean peso and higher key input prices, partly offset by

cost savings from the Group's Cost and Competitiveness Programme.

As a result, weighted average unit cash costs excluding by-product

credits (which are reported as part of revenue) and refining

charges for concentrates (which are deducted from revenue)

increased from $1.33/lb in 2016 to $1.41/lb in 2017.

The Cost and Competitiveness Programme has been designed to

achieve permanent savings through the application of a structured

process. During the year, $166 million of savings were achieved,

bringing total savings since the start of the programme to $525

million. These permanent savings have been achieved through

organizational simplification, improved productivity of services

and operations, tightened maintenance management and greater energy

efficiency.

Exploration and evaluation costs increased by $24.5 million to

$68.8 million (2016 - $44.3 million). This reflected a general

increase in activity, including with early-stage generative

exploration activity in Chile and drilling work at Los Pelambres.

Costs relating to the mine closure provisions increased by $30.5

million compared with 2016 and corporate costs increased by $15.2

million. These increases were partly offset by a $35.2 million

decrease in other expenses, largely relating to decreased community

expenditure at Los Pelambres.

Operating costs (excluding depreciation and loss on disposals)

at the transport division

Operating costs (excluding depreciation and loss on disposals)

at the transport division increased by $8.9 million to $95.8

million, mainly reflecting higher diesel prices due to the stronger

Chilean peso and an increase in services provided by third

parties.

EBITDA

EBITDA (earnings before interest, tax, depreciation,

amortisation) increased by $960.5 million or 59.1% to $2,586.6

million (2016 - $1,626.1 million). EBITDA includes the Group's

proportional share of EBITDA from associates and joint

ventures.

EBITDA from the Group's mining increased by 61.8% from $1,538.4

million in 2016 to $2,488.5 million in this year. As explained

above, this was mainly due to the significant increase in revenue,

partly offset by the higher unit cash costs and increased

exploration and evaluation expenditure and mine closure provision

costs.

EBITDA at the transport division increased by $10.4 million to

$98.1 million in 2017, reflecting the increased revenue offset by

higher operating costs explained above.

Depreciation, amortisation and disposals

The depreciation and amortisation charge was largely in-line

with the prior year at $581.1 million (2016 - $578.4 million). In

addition, there were losses on disposals of assets of $8.3 million

(2016 - loss of $19.7 million).

Prior year exceptional impairment provisions

In the 2016, the Group recognised exceptional impairment

provisions with a total impact of $591.3 million before tax. After

a corresponding tax credit of $204.9 million the after tax impact

was $386.4 million.

Operating profit from subsidiaries

As a result of the above factors, operating profit from

subsidiaries increased in 2017 by 294.2% to $1,841.1 million (2016

- $467.0 million). Of the prior year exceptional impairment

provisions outlined above $456.6 million were recorded within

operating expenses, and therefore excluding the exceptional items

from the prior year figures, the year-on-year increase in operating

profit was $917.5 million or 99.3%.

Share of results from associates and joint ventures

The Group's share of results from associates and joint ventures

was a gain of $59.7 million in 2017, compared with a loss of $111.3

million in 2016. The prior year loss was largely a reflection of

the exceptional impairment provisions. Of the total prior year

impairment provision outlined above, $134.7 million were recorded

within the share of results from associates and joint ventures.

Excluding the impact of the exceptional impairment provisions from

the prior year results, the year-on-year increase in the share of

results from associates and joint ventures was $36.3 million or

55.1%. The improvement compared with the prior year mainly

reflected a higher contribution from Zaldívar due to increase in

the profit after tax (on a 50% attributable basis) to $58.5 million

(2016 - $29.5 million).

Net finance expense

Net finance expense in 2017 was $70.0 million, compared with

$71.1 million in 2016.

Year

Year ended ended

31.12.17 31.12.16

$m $m

Investment income 23.8 26.9

Interest expense (91.5) (86.1)

Other finance items (2.3) (11.9)

----------- ----------

Net finance expense (70.0) (71.1)

=========== ==========

Interest income decreased slightly from $26.9 million in 2016 to

$23.8 million in 2017.

Interest expense increased from $86.1 million in 2016 to $91.5

million in 2017. This was mainly due to a full year of interest

charges being expensed at Antucoya this year, compared with only

nine months in 2016 following the achievement of commercial

production on 1 April 2016.This factor was partly offset by the

higher capitalisation of interest cost during this year.

The other finance items were an expense of $2.3 million (2016 -

expense of $11.9 million). This reflected an expense of $11.6

million for the unwinding of the discounting of provisions (2016 -

$10.0 million) and an expense of $7.8 million relating to the time

value element of changes in the fair value of derivative options

(2016 - gain of $1.0 million), largely offset by a $17.1 million

foreign exchange gain (2016 - expense of $2.9 million).

Profit before tax

As a result of the factors set out above, profit before tax

increased by 543.3% to $1,830.8 million (2016 - $284.6 million).

Excluding exceptional items in 2016, profit before tax increased by

$954.8 million or 109.0%

Income tax expense

The tax charge for 2017 was $633.6 million and the effective tax

rate was 34.6%. Excluding the impact of exceptional items in the

prior year, the 2016 tax charge was $313.5 million and the

effective tax rate was 35.8%.

Year-ended Year-ended Year-ended

31.12.2017 31.12.2016 31.12.2016

BEFORE AFTER EXCEPTIONAL

ITEMS EXCEPTIONAL ITEMS

ITEMS

$m % $m % $m %

Profit before tax 1,830.8 875.9 284.6

Tax at the Chilean corporate

rate tax of 25.5% (2016 - 24.0%) (466.9) 25.5 (210.2) 24.0 (68.3) 24.0

Provision against carrying value

of assets (exceptional items) - - - - 63.0 (22.1)

Effect of increase in future

first category tax rates on deferred

tax balances (0.6) - (24.6) 2.8 (24.6) 8.6

Adjustment in respect of prior

years (35.4) 1.9 - - - -

Items not deductible from first

category tax (26.7) 1.5 (23.7) 2.7 (23.7) 8.3

Deduction of mining royalty as

an allowable expense in determination

of first category tax 17.4 (1.0) 8.5 (1.0) 8.5 (2.9)

Credit of tax losses absorbed

from dividends of the year (4.3) 0.2 - - - -

Carry-back tax losses resulting

in credits at historic tax rates - - (5.4) 0.6 (5.4) 1.8

Mining tax (royalty) (78.3) 4.3 (60.1) 6.9 (60.1) 21.1

Withholding taxes (64.8) 3.5 - - - -

Withholding taxes - adjustment

to previous year - - (3.8) 0.4 (3.8) 1.3

Tax effect of share of results

of associates and joint ventures 15.2 (0.8) 5.6 (0.6) 5.6 (1.9)

Reversal of previously unrecognised

tax losses 9.9 (0.5) - - - -

Net other items 0.9 - 0.2 (0.0) 0.2 (0.0)

------------ ------ -------- ------ ---------- --------

Tax expense and effective tax

rate for the year (633.6) 34.6 (313.5) 35.8 (108.6) 38.2

------------ ------ ======== ====== ========== ========

The effective tax rate varied from the statutory rate

principally due to the mining royalty tax (impact of $78.3 million

/ 4.3%), the withholding tax due on remittances of profits from

Chile (impact of $64.8 million / 3.5%), adjustments in respect of

prior years, which relate to adjustments made during the year in

the deferred tax asset base (impact of $35.4 million / 1.9%) and

items not deductible for Chilean corporate tax purposes,

principally the funding of expenses outside of Chile (impact of

$26.7 million / 1.5%), partly offset by the deduction of the mining

royalty tax which is an allowable expense when determining the

Chilean corporate tax charge (impact of $17.4 million / 1.0%) and

the impact of the recognition of the Group's share of profit from

associates and joint ventures, which are included in the Group's

profit before tax net of their respective tax charges (impact of

$15.2 million / 0.8%).

Further details are given in Note 8 to the preliminary results

announcement.

Profit from discontinued operations

At 31 December 2017, the Group had commenced a process to

dispose of Centinela Transmission, the electricity transmission

line supplying Centinela and other external parties. As a result of

this, its net results (a gain of $0.5 million) are shown as a

discontinued operation in the income statement. In the 2016

comparatives the net results of the Group's former Michilla

operation (a gain of $38.3 million) were shown as a discontinued

operation.

Non-controlling interests

Profit for 2017 attributable to non-controlling interests was

$447.0 million (2016 - $56.3 million). Excluding the prior year

exceptional items the profit attributable to non-controlling

interests in 2016 was $220.9 million.

Earnings per share

Year ended Year ended

31.12.17 31.12.16

$ cents $ cents

Including exceptional items

Earnings per share from continuing

operations 76.1 12.1

Earnings per share from discontinued

operations 0.1 3.9

----------- -----------

Earnings per share from continuing

and discontinued operations 76.2 16.0

=========== ===========

Excluding exceptional items

Earnings per share from continuing

operations 76.1 34.7

Earnings per share from discontinued

operations 0.1 3.9

----------- -----------

Earnings per share from continuing

and discontinued operations 76.2 38.6

=========== ===========

Earnings per share calculations are based on 985,856,695

ordinary shares.

As a result of the factors set out above, profit attributable to

equity shareholders of the Company was $750.7 million compared with

$158.0 million in 2016, and total earnings per share from

continuing and discontinued operations was 76.2 cents per share

(2016 - 16.0 cents per share).

Profit from continuing operations and excluding exceptional

items attributable to equity shareholders of the Company was $750.2

million compared with a profit of $341.5 million in 2016, and

earnings per share from continuing operations excluding exceptional

items was 76.1 cents per share (2016 -34.7 cents per share).

Dividends

Dividends per share declared in relation to the period are as

follows:

Year ended Year ended

31.12.17 31.12.16

$ cents $ cents

------------------------------------------ ----------- -----------

Ordinary

------------------------------------------ ----------- -----------

Interim 10.3 3.1

------------------------------------------- ----------- -----------

Final 40.6 15.3

------------------------------------------- ----------- -----------

Total dividends to ordinary shareholders 50.9 18.4

------------------------------------------- ----------- -----------

The Board determines the appropriate dividend each year based on

consideration of the Group's cash balance, the level of free cash

flow and underlying earnings generated during the year and

significant known or expected funding commitments. It is expected

that the total annual dividend for each year would represent a

payout ratio based on underlying net earnings for that year of at

least 35%.

The Board has declared a final dividend of 2017 of 40.6 cents

per ordinary share, which amounts to $400.3 million and will be

paid on 25 May 2018 to shareholders on the share register at the

close of business on 27 April 2018.

The Board declared an interim dividend for the first half of

2017 of 10.3 cents per ordinary share, which amounted to $101.5

million and was paid on 6 October 2017 to shareholders on the share

register at the close of business on 8 September 2017.

This gives total dividends proposed in relation to 2017

(including the interim dividend) of 50.9 cents per share or $501.8

million in total, an increase of 176.6% (2016 - 18.4 cents per

ordinary share or $181.4 million in total).

The distributable reserves of Antofagasta plc approximate to the

balance of its retained earnings reserve and can be increased, as

required, by the receipt of dividends from its subsidiaries.

Capital expenditure

Capital expenditure increased by $103.9 million from $795.1

million in 2016 to $899.0 million. The increase partly reflected

increased capitalised stripping costs at Centinela and Antucoya,

and higher capital expenditure at the transport division on

locomotives and rolling stock.

NB: capital expenditure figures quoted in this report are on a

cash flow basis, unless stated otherwise.

Derivative financial instruments

The Group periodically uses derivative financial instruments to

reduce exposure to commodity price movements. At 31 December 2017

the Group had entered into min/max contracts at Centinela and

Antucoya for a notional amount of 30,000 tonnes of copper

production at each operation, covering a period up to 31 December

2018, with an average minimum price of $2.50/lb and an average

maximum price of $3.60/lb.

The Group also periodically uses interest rate swaps to swap

floating rate interest for fixed rate interest. At 31 December 2017

the Group had entered into interest rate swaps at Centinela for a

maximum notional amount of $35 million at a weighted average fixed

rate of 3.372% maturing in August 2018. The Group had also entered

into interest rate swaps in relation to a financing loan at the

FCAB for a maximum notional amount of $60 million at a weighted

average fixed rate of 1.634% maturing in August 2019.

Cash flows

The key features of the Group cash flow statement are summarised

in the following table.

Year ended Year ended

31.12.17 31.12.16

$m $m

Cash flows from continuing and discontinued

operations 2,495.0 1,457.3

Income tax paid (338.4) (272.6)

Net interest paid (44.8) (31.9)

Capital contributions and loans to

associates (45.4) (10.1)

Acquisition of joint ventures - 20.0

Disposal of subsidiaries and joint

ventures 3.1 10.0

Acquisition of mining properties (2.3) (7.0)

Purchases of property, plant and equipment (899.0) (795.1)

Dividends paid to equity holders of

the Company (252.3) (30.6)

Dividends paid to non-controlling

interests (320.0) (260.0)

Dividends from associates 81.8 10.2

Other items 4.3 0.4

------------- -------------

Changes in net debt relating to cash

flows 682.0 90.6

Other non-cash movements (72.2) (149.0)

Exchange 5.5 10.2

------------- -------------

Movement in net debt in the period 615.3 (48.2)

Net debt at the beginning of the year (1,071.7) (1,023.5)

------------- -------------

Net debt at the end of the year (456.4) (1,071.7)

============= =============

Cash flows from continuing and discontinued operations were

$2,495.0 million in 2017 compared with $1,457.3 million in 2016.

This reflected EBITDA from subsidiaries for the year of $2,430.5

million1 (2016 - $1,521.7 million) adjusted for the positive impact

of a net working capital decrease of $12.5 million (2016 - working

capital increase of $73.3 million) and a non-cash increase in

provisions of $52.0 million (2016 - increase of $8.9 million).

The net cash outflow in respect of tax in 2017 was $338.4

million (2016 - $272.6 million). This amount differs from the

current tax charge in the consolidated income statement of $509.8

million because the cash tax payments comprise payments on account

for the current year of $294.0 million based on the prior year's

profit levels, the settlement of outstanding balances in respect of

the previous year's tax charge of $113.7 million and withholding

tax due on remittances of profits from Chile of $62.1 million,

partly offset by the recovery of $131.4 million relating to prior

years.

In 2017 the cash inflow from the disposal of subsidiaries and

joint ventures of $3.1 million related to the disposal of Energia

Andina (2016 - $10.0 million related to the disposal of Minera

Michilla).

Contributions and loans to associates and joint ventures of

$45.4 million relate to the Group's funding of Alto Maipo ($36.0

million accrued at December 2016 and paid in 2017), Tethyan Copper

Company ($9.3 million) and Energia Andina ($0.1 million).

Cash disbursements relating to capital expenditure in 2017 were

$899.0 million compared with $795.1 million in 2016. This included

expenditure of $578.3 million at Centinela (2016 - $534.7 million),

$237.8 million at Los Pelambres (2016 - $215.3 million) and $43.6

million at Antucoya (2016 - $9.4 million).

At 31 December 2017 dividends paid to equity holders of the

Company were $252.3 million (2016 - $30.6 million), which related

to the payment of $101.5 million as the interim dividend declared

in respect of the current year (2016 - $30.6 million) and the final

element of the previous year's dividend of $150.8 million.

Dividends paid by subsidiaries to non-controlling shareholders

were $320.0 million (2016 - $260.0 million).

Financial position

At 31.12.17 At 31.12.16

$m $m

Cash, cash equivalents

and liquid investments 2,252.3 2,048.5

Total borrowings (2,708.7) (3,120.2)

------------ ------------

Net debt at the end

of the period (456.4) (1,071.7)

============ ============

At 31 December 2017 the Group had combined cash, cash

equivalents and liquid investments of $2,252.3 million (31 December

2016 - $2,048.5 million). Excluding the non-controlling interest

share in each partly-owned operation, the Group's attributable

share of cash, cash equivalents and liquid investments was $2,002.0

million (31 December 2016 - $1,830.2 million).

New borrowings in 2017 were $272.0 million (2016 - $938.8

million), including new short-term borrowings at Los Pelambres of

$242.0 million and Antucoya of $30.0 million. Repayments of

borrowings and finance leasing obligations in 2017 were $759.0

million, relating mainly to repayments at Los Pelambres of $350.7

million, Centinela $150.0 million, Antucoya $223.1 million, the

corporate centre of $3.9 million and the transport division of

$31.3 million.

Total Group borrowings at 31 December 2017 were $2,708.7 million

(at 31 December 2016 - $3,120.2 million). Of this, $2,043.6 million

(at 31 December 2016 - $2,329.7 million) is proportionally

attributable to the Group after excluding the non-controlling

interest shareholdings in partly-owned operations.

Cautionary statement about forward-looking statements

This preliminary results announcement contains certain

forward-looking statements. All statements other than historical

facts are forward-looking statements. Examples of forward-looking

statements include those regarding the Group's strategy, plans,

objectives or future operating or financial performance, reserve

and resource estimates, commodity demand and trends in commodity

prices, growth opportunities, and any assumptions underlying or

relating to any of the foregoing. Words such as "intend", "aim",

"project", "anticipate", "estimate", "plan", "believe", "expect",

"may", "should", "will", "continue" and similar expressions

identify forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors that are beyond the

Group's control. Given these risks, uncertainties and assumptions,

actual results could differ materially from any future results

expressed or implied by these forward-looking statements, which

speak only as at the date of this report. Important factors that

could cause actual results to differ from those in the

forward-looking statements include: global economic conditions,

demand, supply and prices for copper and other long-term commodity

price assumptions (as they materially affect the timing and

feasibility of future projects and developments), trends in the

copper mining industry and conditions of the international copper

markets, the effect of currency exchange rates on commodity prices

and operating costs, the availability and costs associated with

mining inputs and labour, operating or technical difficulties in

connection with mining or development activities, employee

relations, litigation, and actions and activities of governmental

authorities, including changes in laws, regulations or taxation.

Except as required by applicable law, rule or regulation, the Group

does not undertake any obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Past performance cannot be relied on as a guide to future

performance.

Consolidated Income Statement

Year ended Year ended 31.12.2016

31.12.2017

----------------------------------------

Notes Before Exceptional Total

exceptional items (Note

items 3)

$m $m $m $m

Revenue 2,5 4,749.4 3,621.7 - 3,621.7

Total operating costs (2,908.3) (2,698.1) (456.6) (3,154.7)

------------ ------------- ------------- ----------

Operating profit from

subsidiaries 2,4 1,841.1 923.6 (456.6) 467.0

Net share of profit/(loss)

from associates and

joint ventures 2,4 59.7 23.4 (134.7) (111.3)

------------ ------------- ------------- ----------

Total profit/(loss)

from operations, associates

and joint ventures 1,900.8 947.0 (591.3) 355.7

Investment income 23.8 26.9 - 26.9

Interest expense (91.5) (86.1) - (86.1)

Other finance items (2.3) (11.9) - (11.9)

------------ ------------- ------------- ----------

Net finance expense 7 (70.0) (71.1) - (71.1)

------------ ------------- ------------- ----------

Profit before tax 1,830.8 875.9 (591.3) 284.6

Income tax expense 8 (633.6) (313.5) 204.9 (108.6)

------------ ------------- ------------- ----------

Profit/(Loss) for the

financial year from

continuing operations 1,197.2 562.4 (386.4) 176.0

============ ============= ============= ==========

Discontinued operations

Profit for the financial

year from discontinued

operations 9 0.5 38.3 - 38.3

------------ ------------- ------------- ----------

Profit/(Loss) for the

year 1,197.7 600.7 (386.4) 214.3

============ ============= ============= ==========

Attributable to:

Non-controlling interests 447.1 220.9 (164.6) 56.3

Profit/(Loss) for the

financial year attributable

to the owners of the

parent 750.6 379.8 (221.8) 158.0

------------ ------------- ------------- ----------

US cents US cents US cents

Basic earnings per

share

From continuing operations 10 76.1 34.7 (22.6) 12.1

From discontinued operations 10 0.1 3.9 - 3.9

------------ ------------- ------------- ----------

Total continuing and

discontinued operations 76.2 38.6 (22.6) 16.0

Consolidated Statement of Comprehensive Income

Year ended Year

ended

31.12.2017 31.12.2016

Notes $m $m

Profit for the financial year 1,197.7 214.3

Items that may be or were subsequently

reclassified to profit or loss:

(Losses) in fair value of cash flow hedges

deferred in reserves (16.8) (3.5)

Share of other comprehensive income of

equity accounted units, net of tax 14 - 4.4

Gains in fair value of available-for-sale

investments 15 1.4 1.7

Tax effects arising on cash flow hedges

deferred in reserves (1.0) 0.6

Losses in fair value of cash flow hedges 6 c)

transferred to the income statement i) 18.0 5.8

Share of other comprehensive income of

equity accounted units transferred to

the income statement - 52.6

Tax effects arising on amounts transferred

to the income statement 0.3 (1.4)

----------- -----------

Total items that may be or were subsequently

reclassified to profit or loss 1.9 60.2

Items that will not be subsequently reclassified

to profit or loss:

Actuarial gains on defined benefit plans 5.7 7.8

Tax on items recognised through OCI which

will not be reclassified to profit or

loss in the future (1.0) (1.3)

----------- -----------

Total Items that will not be subsequently

reclassified to profit or loss 4.7 6.5

Total other comprehensive income 6.6 66.7

Total comprehensive income for the year

period 1,204.3 281.0

=========== ===========

Attributable to:

Non-controlling interests 448.8 24.9

Equity holders of the Company 755.5 256.1

----------- -----------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2017

Other Retained

reserves earnings Non-

Share Share (note (note Net controlling

capital premium 22) 22) equity interests Total

$m $m $m $m $m $m $m

Balance at 1 January

2017 89.8 199.2 (22.3) 6,548.6 6,815.3 1,694.4 8,509.7

Profit for the year - - - 750.6 750.6 447.1 1,197.7

Other comprehensive

income for the year - - 9.8 (4.9) 4.9 1.7 6.6

Dividends - - - (252.4) (252.4) (320.0) (572.4)

Balance at 31 December

2017 89.8 199.2 (12.5) 7,041.9 7,318.4 1,823.2 9,141.6

========= ========= ========== ========== ======== ============= ========

For the year ended 31 December 2016

Other Retained

reserves earnings Non-

Share Share (note (note Net controlling

capital premium 22) 22) equity interests Total

$m $m $m $m $m $m $m

Balance at 1 January

2016 89.8 199.2 (59.3) 6,416.4 6,646.1 1,873.2 8,519.3

Profit for the year - - - 158.0 158.0 56.3 214.3

Other comprehensive

income for the year - - 37.0 4.8 41.8 24.9 66.7

Dividends - - - (30.6) (30.6) (260.0) (290.6)

Balance at 31 December

2016 89.8 199.2 (22.3) 6,548.6 6,815.3 1,694.4 8,509.7

========= ========= ========== ========== ======== ============= ========

Consolidated Balance Sheet

At 31.12.2017 At 31.12.2016

Non-current assets Notes $m $m

Intangible asset 12 150.1 150.1

Property, plant and equipment 13 9,064.3 8,737.5

Other non-current assets 3.5 2.6

Inventories 16 111.1 157.3

Investment in associates and joint

ventures 14 1,069.7 1,086.6

Trade and other receivables 67.0 66.7

Derivative financial instruments 0.2 0.2

Available-for-sale investments 15 6.5 4.6

Deferred tax assets 69.1 82.8

10,541.5 10,288.4

-------------- --------------

Current assets

Inventories 16 483.6 393.4

Trade and other receivables 739.2 735.5

Current tax assets 155.2 255.2

Derivative financial instruments 6 0.1 2.2

Liquid investments 24 1,168.7 1,332.2

Cash and cash equivalents 24 1,083.6 716.3

-------------- --------------

3,630.4 3,434.8

Assets of disposal group classified

as held for sale 9 37.8 -

Total assets 14,209.7 13,723.2

============== ==============

Current liabilities

Short-term borrowings and leases 17 (753.6) (836.8)

Derivative financial instruments 6 (7.1) (2.0)

Trade and other payables (609.0) (595.2)

Current tax liabilities (192.4) (119.4)

(1,562.1) (1,553.4)

-------------- --------------

Non-current liabilities

Medium and long-term borrowings and

leases 17 (1,955.1) (2,283.4)

Derivative financial instruments 6 - (0.5)

Trade and other payables (7.4) (7.9)

Liabilities in relation to joint

ventures 14 (2.0) (3.1)

Post-employment benefit obligations (114.0) (92.2)

Decommissioning & restoration provisions (433.0) (392.1)

Deferred tax liabilities (994.1) (880.9)

-------------- --------------

(3,505.6) (3,660.1)

Liabilities of disposal group classified (0.4) -

as held for sale

-------------- --------------

Total liabilities (5,068.1) (5,213.5)

============== ==============

Net assets 9,141.6 8,509.7

Equity

Share capital 21 89.8 89.8

Share premium 21 199.2 199.2

Other reserves 22 (12.5) (22.3)

Retained earnings 22 7,041.9 6,548.6

Equity attributable to equity holders

of the Company 7,318.4 6,815.3

Non-controlling interests 1,823.2 1,694.4