Ampco-Pittsburgh Corporation (NYSE: AP) reported sales for the

three and nine months ended September 30, 2018, of $112.2 million

and $354.7 million, respectively, compared to $103.9 million and

$318.0 million, respectively, for the three and nine months ended

September 30, 2017. The increase is principally attributable to the

Forged and Cast Engineered Products segment.

Loss from operations for the three and nine months ended

September 30, 2018, was $6.7 million and $9.4 million,

respectively. This compares to a loss from operations of $3.2

million and $8.0 million, respectively, for the comparable prior

year periods.

Net loss for the three and nine months ended September 30, 2018,

was $7.0 million or $0.56 per common share, and $9.1 million or

$0.73 per common share, respectively. This compares to net loss for

the comparable prior year periods of $2.2 million or $0.18 per

common share, and $8.9 million or $0.72 per common share,

respectively.

Sales for the Forged and Cast Engineered Products segment for

the three and nine months ended September 30, 2018, increased 8%

and 13%, respectively, compared to the same periods of the prior

year. The current year periods benefited from higher sales of mill

rolls and forged engineered products. While sales of frac blocks

have declined for each of the periods, sales of other forged

engineered products, primarily within Canada, more than

compensated. Operating results for the three and nine months ended

September 30, 2018, declined compared to the same periods of the

prior year, principally due to results of the Corporation’s

Canadian subsidiary, ASW Steel Inc. (“ASW”). Despite a higher

overall volume of shipments and higher pricing, the segment

experienced the full-quarter effect of tariffs imposed by the

United States, effective June 1, 2018, on U.S. imports of steel

products from Canada. ASW further experienced the effect of

significantly lower contribution margin and higher unabsorbed costs

given the contraction in demand for ingot feedstock used in the

manufacture of frac blocks in the current quarter compared to prior

year quarter. In addition, segment results for the quarter were

negatively impacted by higher operating costs, including the impact

of equipment maintenance issues.

Sales and operating income for the Air and Liquid Processing

segment for the three and nine months ended September 30, 2018,

improved when compared to the same periods of the prior year due to

a higher volume of shipments and product mix.

Commenting on the quarter’s results, Brett McBrayer,

Ampco-Pittsburgh’s Chief Executive Officer said, “Sales for the

quarter hit the top end of our guidance and operating loss near the

middle of the range. The combined full-quarter effects of both the

tariffs on steel imports from our Canadian subsidiary and the

decline in the frac block market were major negative factors for us

in the quarter. Equipment reliability was also an issue, but now

that we have secured more than sufficient liquidity to prepare for

the early 2019 debt maturity, we are presently addressing certain

key equipment needs.

“As expressed in our November 1, 2018 press release, we have

begun a series of restructuring actions to realign our

manufacturing footprint and reduce cost. The magnitude of these

actions is expected to be significant. Our first round of

initiatives will continue throughout 2019; however, we anticipate

incremental improvements as each action unfolds.”

Teleconference Access

Ampco-Pittsburgh Corporation (NYSE: AP) will hold a conference

call on Thursday November 8, 2018, at 10:30 a.m. Eastern Time (ET)

to discuss its financial results for the third quarter ended

September 30, 2018. If you would like to participate in the

conference call, please register using the link below or by dialing

1-844-308-3408 at least five minutes before the 10:30 a.m. ET start

time.

We encourage participants to pre-register for the conference

call using the following link. Callers who pre-register will be

given a conference passcode and unique PIN to gain immediate access

to the call and bypass the live operator. Participants may

pre-register at any time, including up to and after the call start

time. To pre-register, please go to:

http://dpregister.com/10125436

Those without internet access or unable to pre-register may dial

in by calling:

- Participant Dial-in (Toll Free):

1-844-308-3408

- Participant International Dial-in:

1-412-317-5408

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on our website

under the Investors menu at www.ampcopgh.com.

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by or on

our behalf. This news release may contain forward-looking

statements that reflect our current views with respect to future

events and financial performance. All statements in this document

other than statements of historical fact are statements that are,

or could be, deemed forward-looking statements within the meaning

of the Act. In this document, statements regarding future financial

position, sales, costs, earnings, cash flows, other measures of

results of operations, capital expenditures or debt levels and

plans, objectives, outlook, targets, guidance or goals are

forward-looking statements. Words such as “may,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future

events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For Ampco-Pittsburgh, these risks and

uncertainties include, but are not limited to, those described

under Item 1A, Risk Factors, of Ampco-Pittsburgh’s Annual Report on

Form 10-K. In addition, there may be events in the future that we

are not able to predict accurately or control which may cause

actual results to differ materially from expectations expressed or

implied by forward-looking statements. Except as required by

applicable law, we assume no obligation, and disclaim any

obligation, to update forward-looking statements whether as a

result of new information, events or otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

(In thousands except per share amounts)

Three Months

Ended

Nine Months

Ended

September

30,

September

30,

2018

2017

2018

2017

Sales

$ 112,216

$ 103,886 $

354,720 $ 317,952

Cost of products sold (excl depreciation

and amortization)

98,408 87,346 301,741 264,179 Selling and administrative 14,512

14,218 44,799 44,648 Depreciation and amortization 5,683 5,451

17,357 17,019 Loss on disposal of assets

298

110 237

109 Total operating expense

118,901 107,125

364,134

325,955 Loss from operations (6,685 )

(3,239 ) (9,414 ) (8,003 ) Other income (expense) – net

1,029 (468 )

2,554 (2,617

) Loss before income taxes (5,656 ) (3,707 )

(6,860 ) (10,620 ) Income tax (provision) benefit (800 ) 1,804 (907

) 1,771 Equity income in joint venture

0

0 0

535 Net loss before non-controlling

interest (6,456 ) (1,903 ) (7,767 ) (8,314 )

Net income attributable to non-controlling

interest

583 299

1,325 584 Net

loss

$ (7,039 )

$ (2,202 ) $

(9,092 ) $

(8,898 ) Loss per common share:

Basic

$ (0.56 )

$ (0.18 ) $

(0.73 ) $ (0.72

) Diluted

$ (0.56

) $ (0.18 )

$ (0.73 ) $

(0.72 )

Weighted-average number of common shares

outstanding:

Basic

12,494 12,361

12,432 12,320

Diluted

12,494

12,361 12,432

12,320

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181108005509/en/

Ampco-Pittsburgh CorporationMichael G. McAuley,

412-429-2472Senior Vice President, Chief Financial Officer and

Treasurermmcauley@ampcopgh.com

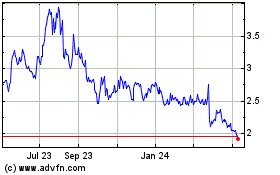

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024