AMERICAN SHARED HOSPITAL SERVICES (NYSE AMERICAN: AMS)

(the "Company"), a leading provider of turnkey technology solutions

for advanced radiosurgical and radiation therapy services, today

announced financial results for the second quarter and first six

months of 2017.

Second Quarter Results

For the three months ended June 30, 2017, medical services

revenue increased 9.5% to $4,945,000 compared to medical services

revenue of $4,518,000 for the second quarter of 2016. Net income

attributable to the Company for the second quarter of 2017 was

$113,000, or $0.02 per share. This compares to net income

attributable to the Company for the second quarter of 2016 of

$93,000, or $0.02 per share.

This year's second quarter net income reflected unusually high

selling and administrative expenses, consisting primarily of

certain one-time legal and consulting fees and non-recurring costs

associated with the start-up of AMS' Gamma Knife center in Lima,

Peru, which began treating patients in July. Income tax expense

also was unusually high in the second quarter, relative to pre-tax

income, as the start-up losses associated with the Peru Gamma Knife

project could not be included in the Company's income tax

computation for financial reporting purposes. These non-recurring

transactions amounted to approximately $0.02 per share, after

taxes.

Second quarter revenue for the Company's initial proton therapy

system installed at The Marjorie and Leonard Williams Center for

Proton Therapy at Orlando Health – UF Health Cancer Center in

Florida was $862,000. This center, which began treating patients in

April 2016, generated revenue for the second quarter of 2016 of

$446,000.

Revenue for the Company's Gamma Knife operations increased to

$3,968,000 for the second quarter of 2017 compared to $3,962,000

for the second quarter of 2016. As previously announced, AMS lost

one of its Gamma Knife units due to the expiration of its contract

term at the end of April 2017. Excluding this site, Gamma Knife

revenue increased 6% for this year's second quarter compared to the

second quarter of 2016.

Medical services gross margin for the second quarter of 2017

increased to 45.5% of revenue, compared to medical services gross

margin of 40.7% of revenue for the second quarter of 2016. The

positive impact on gross margin from the increase in proton therapy

revenue in this year's second quarter versus prior year was

partially offset by higher depreciation expense associated with

Cobalt-60 reloads at two Gamma Knife centers in this year's first

quarter and depreciation expense for the proton system.

Operating income increased 51.0% to $669,000 for the second

quarter of 2017 compared to operating income of $443,000 for the

same period a year earlier. Income before income taxes increased

48.9% to $664,000 for the second quarter of 2017 compared to

$446,000 for the second quarter of 2016. Non-GAAP pre-tax income,

net of income attributable to non-controlling interest, was

$333,000 for the second quarter of 2017. This compares to non-GAAP

pre-tax income, net of income attributable to non-controlling

interest, of $186,000 for the second quarter of 2016. Please refer

to the financial statements included with this press release for a

reconciliation of GAAP to non-GAAP financial measures.

Adjusted EBITDA, a non-GAAP financial measure, was $2,549,000

for the second quarter of 2017, compared to $2,328,000 for the

second quarter of 2016.

Six Months Results

For the six months ended June 30, 2017, medical services revenue

increased 12.6% to $9,859,000 compared to medical services revenue

of $8,756,000 for the first six months of 2016.

Excluding treatments at a customer site lost due to the

expiration of its contract term in April 2017, Gamma Knife revenue

decreased 3.5% for the first half of 2017 compared to the first

half of 2016.

Proton therapy revenue increased to $2,017,000 for the first

half of 2017 compared to $446,000 for the first half of 2016.

Net income attributable to the Company for the first six months

of 2017 was $406,000, or $0.07 per share. This compares to net

income attributable to the Company for the first six months of 2016

of $144,000, or $0.03 per share.

Adjusted EBITDA, a non-GAAP financial measure, was $5,165,000

for the first six months of 2017, compared to $4,457,000 for the

first six months of 2016.

Balance Sheet Highlights

At June 30, 2017, cash and cash equivalents was $2,851,000,

compared to $3,121,000 at December 31, 2016. Shareholders' equity

at June 30, 2017 was $28,083,000, or $4.92 per outstanding share.

This compares to shareholders' equity at December 31, 2016 of

$27,173,000, or $4.97 per outstanding share.

CEO Comments

Chairman and Chief Executive Officer Ernest A. Bates, M.D.,

said, "Treatment volume at our proton therapy center at UF Health

Cancer Center-Orlando Health increased to 1,189 fractions in this

year's second quarter, compared to 442 fractions during the

center's initial quarter of operations last year. Treatment volume

for this year's second quarter decreased slightly compared to this

year's first quarter, however, which we attribute to random

variation in patient flow that we also have experienced from time

to time in our Gamma Knife business. We expect treatment volume to

resume its upward trend in the second half of 2017. The MEVION S250

proton system we supplied Orlando Health continues to perform

admirably, and we continue to believe there is room for further

growth in treatment volume.

"We had anticipated relatively flat revenue in our Gamma Knife

business in this year's first half versus prior year, the result of

routine Cobalt-60 reload at two of our centers in the first

quarter, as well as the loss of one of our sites due to the

expiration of its contract term in this year's second quarter.

Looking ahead, we expect the performance of our Gamma Knife

business to improve as AMS' Gamma Knife del Pacífico Institute at

the Air Force Hospital in Lima, Peru ramps up patient treatments

that began last month, and the Gamma Knife® Perfexion™ system we

contracted to supply to Bryan Medical Center in Lincoln,

Nebraska begins treating patients in August. Volume at these new

centers should more than offset a Gamma Knife customer contract

that will end in fourth quarter of 2017.

"With start-up costs for our Gamma Knife center in Peru now

behind us, and renewed growth in treatment volume anticipated at

our proton therapy center in Orlando as well as in our Gamma Knife

business, we expect substantially improved financial performance

beginning in the current quarter."

Earnings Conference Call

American Shared has scheduled a conference call at 12: 00 p.m.

PDT (3:00 p.m. EDT) today. To participate in the live call, dial

(800) 588-4973 at least 5 minutes prior to the scheduled start

time, and mention confirmation number 4543 5421. A simultaneous

WebCast of the call may be accessed through the Company's website,

www.ashs.com, or www.streetevents.com (institutional investors). A

replay will be available for 30 days at these same internet

addresses, or by dialing (888) 843-7419 and entering 4543 5421#

when prompted.

About AMS

American Shared Hospital Services provides turnkey technology

solutions for advanced radiosurgical and radiation therapy

services. AMS is the world leader in providing Gamma Knife

radiosurgery equipment, a non-invasive treatment for malignant and

benign brain tumors, vascular malformations and trigeminal

neuralgia (facial pain). The Company also offers proton therapy,

and the latest IGRT and IMRT systems. AMS owns a common stock

investment in Mevion Medical Systems, Inc., developer of the

compact MEVION S250 Proton Therapy System.

Safe Harbor Statement

This press release may be deemed to contain certain

forward-looking statements with respect to the financial condition,

results of operations and future plans of American Shared Hospital

Services (including statements regarding the expected continued

growth in volume of the MEVION S250 system, the expansion of the

Company's proton therapy business, and the timing of treatments by

new Gamma Knife systems) which involve risks and uncertainties

including, but not limited to, the risks of variability of

financial results between quarters, the risks of the Gamma Knife

and radiation therapy businesses, the risks of developing The

Operating Room for the 21st Century program, the risks of investing

in Mevion Medical Systems, Inc., and the risks of the timing,

financing, and operations of the Company’s proton therapy business.

Further information on potential factors that could affect the

financial condition, results of operations and future plans of

American Shared Hospital Services is included in the filings of the

Company with the Securities and Exchange Commission, including the

Company's Annual Report on Form 10-K for the year ended December

31, 2016, its Quarterly Report on Form 10-Q for the three months

ended March 31, 2017, and the definitive Proxy Statement for the

Annual Meeting of Shareholders held on June 27, 2017.

Non-GAAP Financial Measure

Neither Adjusted EBITDA nor non-GAAP pre-tax income, the

non-GAAP measures presented in this press release and supplementary

information, is a measure of performance under the accounting

principles generally accepted in the United States ("GAAP"). These

non-GAAP financial measures should not be considered as substitute

for, and investors should also consider, income before income

taxes, income from operations, net income attributable to the

Company, earnings per share and other measures of performance as

defined by GAAP as indicators of the Company's performance or

profitability. We use these non-GAAP financial measures as a means

to evaluate period-to-period comparisons. Our management believes

that these non-GAAP financial measures provide meaningful

supplemental information regarding our performance by excluding

certain expenses and charges that may not be indicative of the

operating results of our recurring core business, such as the loss

on early extinguishment of debt. We believe that both management

and investors benefit from referring to these non-GAAP financial

measures in assessing our performance.

AMERICAN SHARED HOSPITAL

SERVICES

Selected Financial Data

(unaudited) Summary of Operations Data

Three months ended June 30, Six months ended June 30, 2017

2016 2017 2016 Revenue $ 4,945,000 $ 4,518,000 $ 9,859,000 $

8,756,000 Costs of revenue 2,694,000 2,679,000

5,262,000 5,184,000 Gross margin

2,251,000 1,839,000 4,597,000 3,572,000 Selling &

administrative expense 1,138,000 963,000 2,277,000 1,912,000

Interest expense 444,000 433,000

897,000 718,000 Operating income 669,000

443,000 1,423,000 942,000 (Loss) on early extinguishment of debt --

-- --

(108,000

)

Interest & Other (loss) income

(5,000

)

3,000

(1,000

)

8,000 Income before income taxes 664,000 446,000

1,422,000 842,000 Income tax expense 220,000

93,000 436,000 157,000 Net

income $ 444,000 $ 353,000 $ 986,000 $ 685,000

Less: Net (income) attributable to

non-controlling interest

(331,000

)

(260,000

)

(580,000

)

(541,000

)

Net income attributable to American Shared

Hospital Services

$ 113,000 $ 93,000 $ 406,000 $ 144,000

Income per common share: Basic $ 0.02 $ 0.02 $

0.07 $ 0.03 Diluted $ 0.02 $ 0.02 $

0.07 $ 0.03

Balance Sheet Data June 30,

December 31, 2017 2016 Cash and cash equivalents $

2,851,000 $ 3,121,000 Current assets $ 8,845,000 $ 8,388,000

Investment in equity securities $ 579,000 $ 579,000 Total assets $

58,994,000 $ 60,598,000 Current liabilities $ 8,447,000 $

8,681,000 Shareholders' equity $ 28,083,000 $ 27,173,000

AMERICAN SHARED HOSPITAL SERVICES Selected

Financial Data (unaudited)

Adjusted EBITDA

Three months ended

Six months ended

June 30,

June 30,

2017

2016

2017

2016

Net Income

$

113,000

$

93,000

$

406,000

$

144,000

Plus:

Income Tax Expense

$

220,000

$

93,000

$

436,000

$

157,000

Interest Expense

$

444,000

$

433,000

$

897,000

$

718,000

Depreciation and Amortization Expense

$

1,722,000

$

1,649,000

$

3,326,000

$

3,211,000

Stock-Based Compensation Expense

$

50,000

$

60,000

$

100,000

$

119,000

Early Extinguishment of Debt

$

--

$

--

$

--

$

108,000

Adjusted EBITDA

$ 2,549,000

$

2,328,000

$

5,165,000

$

4,457,000

AMERICAN SHARED HOSPITAL SERVICES Selected

Financial Data (unaudited) Non-GAAP Pre-tax Income

Three months ended Six months ended June 30,

June 30, 2017 2016 2017 2016 Income before

income taxes $ 664,000 $ 446,000 $ 1,422,000 $ 842,000

Less: Net (income) attributable to

non-controlling interest

$ (331,000 ) $ (260,000 ) $ (580,000 ) $ (541,000 )

Non-GAAP Pre-tax Income

$ 333,000

$

186,000

$

842,000

$

301,000

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170810005291/en/

American Shared Hospital ServicesErnest A. Bates, M.D., (415)

788-5300Chairman and Chief Executive

Officereabates@ashs.comorBerkman AssociatesNeil Berkman, (310)

477-3118Presidentinfo@berkmanassociates.com

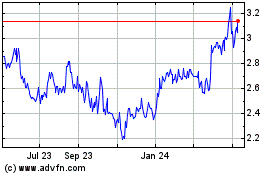

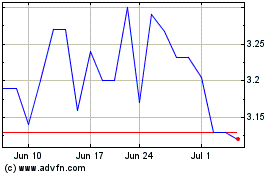

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024