American National Bankshares Inc. (“American National”)

(NASDAQ:AMNB), parent company of American National Bank and Trust

Company, today announced net income for the first quarter of 2018

of $5,812,000 compared to $4,063,000 for the first quarter of 2017,

a $1,749,000 or 43.0% increase. Basic and diluted net income per

common share was $0.67 for the first quarter of 2018 compared to

$0.47 for the 2017 quarter. Net income for the first quarter of

2018 produced a return on average assets of 1.28%, a return on

average equity of 11.10%, and a return on average tangible equity

of 14.29%.

Financial Performance and OverviewJeffrey V. Haley, President

and Chief Executive Officer, reported, “We were pleased with our

earnings for the first quarter of 2018. Earnings were strong, $5.8

million compared to $4.1 million for the comparable quarter of

2017, a 43.0% increase. There were two major causes of the

increase: greater interest income and lower corporate taxes.

“The main driver was higher net interest income, resulting

mostly from greater interest income on the loan portfolio. Net

interest income increased, resulting from higher yields and higher

loan volume. Average loan volume for the 2018 quarter was up $142.5

million or 11.9% compared to the first quarter of 2017. First

quarter of 2018 compared to first quarter of 2017, loans are up

$101.3 million or 8.3%.

“In the first quarter of 2018, our balance sheet experienced $24

million in payoffs associated with several large multifamily loans

moving into the permanent, non-recourse market. Most of these

projects started as construction loans on our balance sheet and

achieved their projected occupancy and overall performance levels,

allowing them to move off our balance sheet, as we anticipated.

Overall, our loans outstanding declined on a net basis by $14.9

million, or 1.1% from year end because of these payoffs. Of these

payoffs, $20 million was received on the last business day of the

quarter.

“We expect loan growth to continue in the remainder of 2018,

though likely at a reduced pace compared to the past record

year.

“Deposits have grown substantially. Average deposits for the

2018 quarter were $165.0 million or 11.9% greater than the

comparable quarter of 2017. Year over year deposits are up $143.1

million or 10.1%.

“In this rising interest rate environment, our continuing

challenge will be to maintain quality growth in assets and deposits

and, at the same time, maintain and improve our net interest

margin. Our margin for the 2018 quarter was 3.46%, a two basis

point increase from the 2017 quarter.

“The other driver on the earnings increase was a substantial

decrease in our corporate tax rate. The tax cut, enacted in

December 2017, reduced our statutory rate to 21% from 35% and our

effective rate to 19.5% from 28.3%.”

Haley concluded, “American National reports results on a

quarterly basis, like most publicly traded companies. This

inherently results in some volatility in the reporting process. We

manage the Bank for the long term, and we believe this reflects the

underlying strength of our balance sheet and franchise. We continue

to be optimistic about our markets, our industry, and our community

bank.”

CapitalAmerican National’s capital ratios remain strong and

exceed all regulatory requirements.

Average shareholders’ equity was 11.52% of average assets for

the quarter ended March 31, 2018, compared to 11.97% for the

quarter ended March 31, 2017.

Book value per common share was $24.19 at March 31, 2018,

compared to $23.64 at March 31, 2017.

Tangible book value per common share was $19.00 at March 31,

2018, compared to $18.38 at March 31, 2017.

Credit Quality MeasurementsNon-performing assets ($273,000 of 90

day past due loans, $1,598,000 of non-accrual loans and $1,716,000

of other real estate owned) represented 0.20% of total assets at

March 31, 2018, compared to 0.30% at March 31, 2017.

Annualized net charge offs to average loans were zero basis

points (0.00%) for the 2018 first quarter, unchanged from the same

quarter in 2017.

Other real estate owned was $1,716,000 at March 31, 2018,

compared to $1,664,000 at March 31, 2017, an increase of $52,000 or

3.1%.

Acquisition related financial impactThe acquisition accounting

adjustments related to our two most recent acquisitions have had

and continue to have a positive impact on net interest income and

income before income tax. The impact of these adjustments is

summarized below (dollars in thousands):

| |

|

|

|

|

|

|

| For the

quarter ended March 31, |

|

2018 |

|

2017 |

| Net Interest

Income |

|

$ |

427 |

|

$ |

434 |

| Income Before Income

Taxes |

|

$ |

350 |

|

$ |

269 |

| |

|

|

|

|

|

|

The first quarter of 2018 includes $255,000 in cash basis

accretion income related to the early payoff of several acquired

loans, compared to $78,000 for the comparable quarter of 2017.

Net Interest IncomeNet interest income before the provision for

loan losses increased to $14,543,000 in the first quarter of 2018

from $13,134,000 in the first quarter of 2017, an increase of

$1,409,000 or 10.7%.

For the 2018 quarter, the net interest margin was 3.46% compared

to 3.44% for the same quarter in 2017, an increase of two basis

points.

Provision for Loan Losses and Allowance for Loan LossesProvision

expense for the first quarter of 2018 was ($44,000) compared to

$300,000 for the first quarter of 2017, a decrease of $344,000. The

$44,000 negative provision related to a favorable adjustment on the

specific reserve for an impaired loan loss allowance.

There was a decrease in the loans outstanding in the first

quarter of 2018; loans were down from year-end of $14.9 million or

1.1%. This decline, combined with continued strong asset quality

metrics, mitigated the need for provision expense.

The allowance for loan losses as a percentage of total loans was

1.03% at March 31, 2018 compared to 1.07% at March 31, 2017.

Noninterest IncomeNoninterest income totaled $3,333,000 in the

first quarter of 2018, compared with $3,271,000 in the first

quarter of 2017, an increase of $62,000 or 1.9%.

Mortgage banking income decreased $79,000 (14.9%) compared to

the first quarter of 2017.

Securities gains decreased $138,000 (53.3%) compared to the

first quarter of 2017. Gains in the 2018 quarter were almost

entirely related to changes in the market value of equity

securities held by the company, recorded in conformity with new

accounting requirements.

SBIC income increased $129,000 compared to the first quarter of

2017. The Company believes this is a volatile revenue source.

Noninterest ExpenseNoninterest expense totaled $10,702,000 in

the first quarter of 2018, compared to $10,441,000 in the first

quarter of 2017, an increase of $261,000 or 2.5%.

The major factor affecting expense was salaries, which increased

$198,000 or 4.1%, largely related to normal first of year

adjustments. Total bank wide full-time equivalent employees were

326 at the end of the first quarter of 2018, unchanged from the

first quarter of 2017.

Income taxes for the first quarter of 2018 were favorably

impacted by the change in the corporate income tax rate. The

effective tax rate for the 2018 quarter was 19.5%, compared to

28.3% for the same quarter of 2017.

About American NationalAmerican National is a multi-state bank

holding company with total assets of approximately $1.8 billion.

Headquartered in Danville, Virginia, American National is the

parent company of American National Bank and Trust Company.

American National Bank is a community bank serving Virginia and

North Carolina with 26 banking offices and two loan production

offices. American National Bank also manages an additional $826

million of trust, investment and brokerage assets in its Trust and

Investment Services Division. Additional information about the

company and the bank is available on the bank's website at

www.amnb.com.

Forward-Looking StatementsThis press release contains

forward-looking statements within the meaning of federal securities

laws. Certain of the statements involve significant risks and

uncertainties. The statements herein are based on certain

assumptions and analyses by American National and are factors it

believes are appropriate in the circumstances. Actual results could

differ materially from those contained in or implied by such

statements for a variety of reasons including, but not limited to:

changes in interest rates; changes in accounting principles,

policies or guidelines; significant changes in the economic

scenario; significant changes in regulatory requirements or law;

significant changes in securities markets; changes in technology

and information security; and changes regarding acquisitions and

dispositions. Consequently, all forward-looking statements made

herein are qualified by these cautionary statements and the

cautionary language in American National's most recent Form 10-K

report and other documents filed with the Securities and Exchange

Commission. American National does not undertake to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements are made.

| |

| American National

Bankshares Inc. |

| Consolidated Balance

Sheets |

| (Dollars in thousands, except per share data) |

| Unaudited |

| |

|

|

|

|

| |

|

March 31 |

|

ASSETS |

|

2018 |

|

2017 |

| |

|

|

|

|

| Cash and

due from banks |

|

$ |

18,772 |

|

|

$ |

27,418 |

|

|

Interest-bearing deposits in other banks |

|

|

57,881 |

|

|

|

67,372 |

|

|

|

|

|

|

|

|

Securities available for sale, at fair value |

|

|

312,668 |

|

|

|

292,567 |

|

|

Restricted stock, at cost |

|

|

5,221 |

|

|

|

5,492 |

|

| Loans

held for sale |

|

|

1,792 |

|

|

|

1,872 |

|

|

|

|

|

|

|

|

Loans |

|

|

1,321,221 |

|

|

|

1,219,958 |

|

| Less

allowance for loan losses |

|

|

(13,575 |

) |

|

|

(13,108 |

) |

| Net

Loans |

|

|

1,307,646 |

|

|

|

1,206,850 |

|

|

|

|

|

|

|

| Premises

and equipment, net |

|

|

25,759 |

|

|

|

25,658 |

|

| Other

real estate owned, net |

|

|

1,716 |

|

|

|

1,664 |

|

|

Goodwill |

|

|

43,872 |

|

|

|

43,872 |

|

| Core

deposit intangibles, net |

|

|

1,114 |

|

|

|

1,554 |

|

| Bank

owned life insurance |

|

|

18,566 |

|

|

|

18,270 |

|

| Accrued

interest receivable and other assets |

|

|

22,567 |

|

|

|

23,216 |

|

|

|

|

|

|

|

| Total

assets |

|

$ |

1,817,574 |

|

|

$ |

1,715,805 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

Liabilities |

|

|

|

|

| Demand

deposits -- noninterest-bearing |

|

$ |

400,225 |

|

|

$ |

381,247 |

|

| Demand

deposits -- interest-bearing |

|

|

233,973 |

|

|

|

222,356 |

|

| Money

market deposits |

|

|

409,290 |

|

|

|

314,495 |

|

| Savings

deposits |

|

|

134,171 |

|

|

|

126,774 |

|

| Time

deposits |

|

|

381,592 |

|

|

|

371,232 |

|

| Total

deposits |

|

|

1,559,251 |

|

|

|

1,416,104 |

|

|

|

|

|

|

|

| Customer

repurchase agreements |

|

|

10,466 |

|

|

|

47,776 |

|

| Long-term

borrowings |

|

|

- |

|

|

|

9,985 |

|

| Junior

subordinated debt |

|

|

27,851 |

|

|

|

27,749 |

|

| Accrued

interest payable and other liabilities |

|

|

10,166 |

|

|

|

9,950 |

|

| Total

liabilities |

|

|

1,607,734 |

|

|

|

1,511,564 |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

| Preferred

stock, $5 par, 2,000,000 shares authorized, |

|

|

|

|

| none

outstanding |

|

|

- |

|

|

|

- |

|

| Common

stock, $1 par, 20,000,000 shares authorized, |

|

|

|

|

|

8,675,033 shares outstanding at March 31, 2018 and |

|

|

|

|

|

8,638,744 shares outstanding at March 31, 2017 |

|

|

8,621 |

|

|

|

8,591 |

|

| Capital

in excess of par value |

|

|

76,525 |

|

|

|

75,445 |

|

| Retained

earnings |

|

|

131,299 |

|

|

|

121,590 |

|

|

Accumulated other comprehensive loss, net |

|

|

(6,605 |

) |

|

|

(1,385 |

) |

| Total

shareholders' equity |

|

|

209,840 |

|

|

|

204,241 |

|

|

|

|

|

|

|

| Total

liabilities and shareholders' equity |

|

$ |

1,817,574 |

|

|

$ |

1,715,805 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Consolidated Statements of Income |

| (Dollars in thousands, except per share data) |

| Unaudited |

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31 |

| |

|

2018 |

|

2017 |

|

Interest and Dividend

Income: |

|

|

|

|

| Interest

and fees on loans |

|

$ |

14,657 |

|

|

$ |

12,704 |

|

| Interest

and dividends on securities: |

|

|

|

|

|

Taxable |

|

|

1,324 |

|

|

|

1,154 |

|

|

Tax-exempt |

|

|

419 |

|

|

|

635 |

|

|

Dividends |

|

|

80 |

|

|

|

79 |

|

| Other

interest income |

|

|

188 |

|

|

|

109 |

|

| Total

interest and dividend income |

|

|

16,668 |

|

|

|

14,681 |

|

| |

|

|

|

|

| Interest

Expense: |

|

|

|

|

| Interest

on deposits |

|

|

1,825 |

|

|

|

1,200 |

|

| Interest

on short-term borrowings |

|

|

10 |

|

|

|

28 |

|

| Interest

on long-term borrowings |

|

|

- |

|

|

|

80 |

|

| Interest

on junior subordinated debt |

|

|

290 |

|

|

|

239 |

|

| Total

interest expense |

|

|

2,125 |

|

|

|

1,547 |

|

| |

|

|

|

|

|

Net Interest Income |

|

|

14,543 |

|

|

|

13,134 |

|

| Provision

for loan losses |

|

|

(44 |

) |

|

|

300 |

|

| |

|

|

|

|

|

Net Interest Income After Provision |

|

|

|

|

|

for Loan Losses |

|

|

14,587 |

|

|

|

12,834 |

|

|

|

|

|

|

|

|

Noninterest

Income: |

|

|

|

|

| Trust

fees |

|

|

929 |

|

|

|

912 |

|

| Service

charges on deposit accounts |

|

|

551 |

|

|

|

523 |

|

| Other

fees and commissions |

|

|

703 |

|

|

|

673 |

|

| Mortgage

banking income |

|

|

450 |

|

|

|

529 |

|

|

Securities gains, net |

|

|

121 |

|

|

|

259 |

|

| Brokerage

fees |

|

|

222 |

|

|

|

192 |

|

| Income

from Small Business Investment Companies |

|

|

155 |

|

|

|

26 |

|

|

Other |

|

|

202 |

|

|

|

157 |

|

| Total

noninterest income |

|

|

3,333 |

|

|

|

3,271 |

|

| |

|

|

|

|

|

Noninterest

Expense: |

|

|

|

|

|

Salaries |

|

|

4,997 |

|

|

|

4,799 |

|

| Employee

benefits |

|

|

1,175 |

|

|

|

1,120 |

|

| Occupancy

and equipment |

|

|

1,128 |

|

|

|

1,068 |

|

| FDIC

assessment |

|

|

146 |

|

|

|

129 |

|

| Bank

franchise tax |

|

|

281 |

|

|

|

256 |

|

| Core

deposit intangible amortization |

|

|

77 |

|

|

|

165 |

|

| Data

processing |

|

|

422 |

|

|

|

487 |

|

|

Software |

|

|

305 |

|

|

|

279 |

|

| Other

real estate owned, net |

|

|

30 |

|

|

|

43 |

|

|

Other |

|

|

2,141 |

|

|

|

2,095 |

|

| Total

noninterest expense |

|

|

10,702 |

|

|

|

10,441 |

|

| |

|

|

|

|

| Income Before Income

Taxes |

|

|

7,218 |

|

|

|

5,664 |

|

| Income Taxes |

|

|

1,406 |

|

|

|

1,601 |

|

|

Net Income |

|

$ |

5,812 |

|

|

$ |

4,063 |

|

|

|

|

|

|

|

|

Net Income Per Common

Share: |

|

|

|

|

|

Basic |

|

$ |

0.67 |

|

|

$ |

0.47 |

|

|

Diluted |

|

$ |

0.67 |

|

|

$ |

0.47 |

|

|

Average Common Shares

Outstanding: |

|

|

|

|

|

Basic |

|

|

8,669,728 |

|

|

|

8,633,219 |

|

|

Diluted |

|

|

8,687,351 |

|

|

|

8,651,139 |

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

American National Bankshares Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Dollars in

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

1st Qtr |

|

4th Qtr |

|

1st Qtr |

|

|

YTD |

|

YTD |

|

| |

|

|

|

2018 |

|

2017 |

|

2017 |

|

|

2018 |

|

2017 |

|

|

EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

16,668 |

|

|

$ |

16,480 |

|

|

$ |

14,681 |

|

|

|

$ |

16,668 |

|

|

$ |

14,681 |

|

|

| Interest expense |

|

|

2,125 |

|

|

|

2,117 |

|

|

|

1,547 |

|

|

|

|

2,125 |

|

|

|

1,547 |

|

|

| Net interest income |

|

14,543 |

|

|

|

14,363 |

|

|

|

13,134 |

|

|

|

|

14,543 |

|

|

|

13,134 |

|

|

| Provision for loan losses |

|

(44 |

) |

|

|

(74 |

) |

|

|

300 |

|

|

|

|

(44 |

) |

|

|

300 |

|

|

| Noninterest income |

|

3,333 |

|

|

|

3,804 |

|

|

|

3,271 |

|

|

|

|

3,333 |

|

|

|

3,271 |

|

|

| Noninterest expense |

|

10,702 |

|

|

|

11,021 |

|

|

|

10,441 |

|

|

|

|

10,702 |

|

|

|

10,441 |

|

|

| Income taxes |

|

|

1,406 |

|

|

|

5,100 |

|

|

|

1,601 |

|

|

|

|

1,406 |

|

|

|

1,601 |

|

|

| Net income |

|

|

5,812 |

|

|

|

2,120 |

|

|

|

4,063 |

|

|

|

|

5,812 |

|

|

|

4,063 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

| Income per share - basic |

$ |

0.67 |

|

|

$ |

0.25 |

|

|

$ |

0.47 |

|

|

|

$ |

0.67 |

|

|

$ |

0.47 |

|

|

| Income per share - diluted |

|

0.67 |

|

|

|

0.24 |

|

|

|

0.47 |

|

|

|

|

0.67 |

|

|

|

0.47 |

|

|

| Cash dividends paid |

|

0.25 |

|

|

|

0.25 |

|

|

|

0.24 |

|

|

|

|

0.25 |

|

|

|

0.24 |

|

|

| Book value per share |

|

24.19 |

|

|

|

24.13 |

|

|

|

23.64 |

|

|

|

|

24.19 |

|

|

|

23.64 |

|

|

| Book value per share - tangible (a) |

|

19.00 |

|

|

|

18.92 |

|

|

|

18.38 |

|

|

|

|

19.00 |

|

|

|

18.38 |

|

|

| Closing market price |

|

37.60 |

|

|

|

38.30 |

|

|

|

37.25 |

|

|

|

|

37.60 |

|

|

|

37.25 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

1.28 |

|

% |

|

0.47 |

|

% |

|

0.96 |

|

% |

|

1.28 |

|

% |

|

0.96 |

|

% |

| Return on average equity |

|

11.10 |

|

|

|

4.00 |

|

|

|

7.99 |

|

|

|

|

11.10 |

|

|

|

7.99 |

|

|

| Return on average tangible equity (b) |

|

14.29 |

|

|

|

5.21 |

|

|

|

10.56 |

|

|

|

|

14.29 |

|

|

|

10.56 |

|

|

| Average equity to average assets |

|

11.52 |

|

|

|

11.64 |

|

|

|

11.97 |

|

|

|

|

11.52 |

|

|

|

11.97 |

|

|

| Tangible equity to tangible assets (a) |

|

9.30 |

|

|

|

9.24 |

|

|

|

9.51 |

|

|

|

|

9.30 |

|

|

|

9.51 |

|

|

| Net interest margin, taxable equivalent |

|

3.46 |

|

|

|

3.46 |

|

|

|

3.44 |

|

|

|

|

3.46 |

|

|

|

3.44 |

|

|

| Efficiency ratio (c) |

|

|

59.79 |

|

|

|

59.93 |

|

|

|

62.97 |

|

|

|

|

59.79 |

|

|

|

62.97 |

|

|

| Effective tax rate |

|

|

19.48 |

|

|

|

70.64 |

|

|

|

28.27 |

|

|

|

|

19.48 |

|

|

|

28.27 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD-END BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Securities |

|

$ |

317,889 |

|

|

$ |

327,447 |

|

|

$ |

298,059 |

|

|

|

$ |

317,889 |

|

|

$ |

298,059 |

|

|

| Loans held for sale |

|

1,792 |

|

|

|

1,639 |

|

|

|

1,872 |

|

|

|

|

1,792 |

|

|

|

1,872 |

|

|

| Loans, net of unearned income |

|

1,321,221 |

|

|

|

1,336,125 |

|

|

|

1,219,958 |

|

|

|

|

1,321,221 |

|

|

|

1,219,958 |

|

|

| Goodwill and other intangibles |

|

44,986 |

|

|

|

45,063 |

|

|

|

45,426 |

|

|

|

|

44,986 |

|

|

|

45,426 |

|

|

| Assets |

|

|

|

1,817,574 |

|

|

|

1,816,078 |

|

|

|

1,715,805 |

|

|

|

|

1,817,574 |

|

|

|

1,715,805 |

|

|

| Assets - tangible (a) |

|

1,772,588 |

|

|

|

1,771,015 |

|

|

|

1,670,379 |

|

|

|

|

1,772,588 |

|

|

|

1,670,379 |

|

|

| Deposits |

|

|

1,559,251 |

|

|

|

1,534,726 |

|

|

|

1,416,104 |

|

|

|

|

1,559,251 |

|

|

|

1,416,104 |

|

|

| Customer repurchase agreements |

|

10,466 |

|

|

|

10,726 |

|

|

|

47,776 |

|

|

|

|

10,466 |

|

|

|

47,776 |

|

|

| Other short-term borrowings |

|

- |

|

|

|

24,000 |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

| Long-term borrowings |

|

27,851 |

|

|

|

27,826 |

|

|

|

37,734 |

|

|

|

|

27,851 |

|

|

|

37,734 |

|

|

| Shareholders' equity |

|

209,840 |

|

|

|

208,717 |

|

|

|

204,241 |

|

|

|

|

209,840 |

|

|

|

204,241 |

|

|

| Shareholders' equity - tangible (a) |

|

164,854 |

|

|

|

163,654 |

|

|

|

158,815 |

|

|

|

|

164,854 |

|

|

|

158,815 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Securities (d) |

|

$ |

312,783 |

|

|

$ |

304,254 |

|

|

$ |

324,588 |

|

|

|

$ |

312,783 |

|

|

$ |

324,588 |

|

|

| Loans held for sale |

|

2,037 |

|

|

|

4,269 |

|

|

|

2,414 |

|

|

|

|

2,037 |

|

|

|

2,414 |

|

|

| Loans, net of unearned income |

|

1,338,058 |

|

|

|

1,301,833 |

|

|

|

1,195,560 |

|

|

|

|

1,338,058 |

|

|

|

1,195,560 |

|

|

| Interest-earning assets |

|

1,698,451 |

|

|

|

1,695,091 |

|

|

|

1,574,460 |

|

|

|

|

1,698,451 |

|

|

|

1,574,460 |

|

|

| Goodwill and other intangibles |

|

45,031 |

|

|

|

45,109 |

|

|

|

45,517 |

|

|

|

|

45,031 |

|

|

|

45,517 |

|

|

| Assets |

|

|

|

1,818,429 |

|

|

|

1,820,499 |

|

|

|

1,699,730 |

|

|

|

|

1,818,429 |

|

|

|

1,699,730 |

|

|

| Assets - tangible (a) |

|

1,773,398 |

|

|

|

1,775,390 |

|

|

|

1,654,213 |

|

|

|

|

1,773,398 |

|

|

|

1,654,213 |

|

|

| Interest-bearing deposits |

|

1,157,122 |

|

|

|

1,109,286 |

|

|

|

1,021,110 |

|

|

|

|

1,157,122 |

|

|

|

1,021,110 |

|

|

| Deposits |

|

|

1,557,149 |

|

|

|

1,520,665 |

|

|

|

1,392,117 |

|

|

|

|

1,557,149 |

|

|

|

1,392,117 |

|

|

| Customer repurchase agreements |

|

12,247 |

|

|

|

42,540 |

|

|

|

45,106 |

|

|

|

|

12,247 |

|

|

|

45,106 |

|

|

| Other short-term borrowings |

|

2,183 |

|

|

|

951 |

|

|

|

11,833 |

|

|

|

|

2,183 |

|

|

|

11,833 |

|

|

| Long-term borrowings |

|

27,836 |

|

|

|

34,331 |

|

|

|

37,717 |

|

|

|

|

27,836 |

|

|

|

37,717 |

|

|

| Shareholders' equity |

|

209,433 |

|

|

|

211,864 |

|

|

|

203,459 |

|

|

|

|

209,433 |

|

|

|

203,459 |

|

|

| Shareholders' equity - tangible (a) |

|

164,402 |

|

|

|

166,755 |

|

|

|

157,942 |

|

|

|

|

164,402 |

|

|

|

157,942 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American National Bankshares Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

1st Qtr |

|

4th Qtr |

|

1st Qtr |

|

|

YTD |

|

YTD |

|

| |

|

|

|

2018 |

|

2017 |

|

2017 |

|

|

2018 |

|

2017 |

|

|

CAPITAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shares outstanding - basic |

|

8,669,728 |

|

|

|

8,648,494 |

|

|

|

8,633,219 |

|

|

|

|

8,669,728 |

|

|

|

8,633,219 |

|

|

| Average shares outstanding - diluted |

|

8,687,351 |

|

|

|

8,668,765 |

|

|

|

8,651,139 |

|

|

|

|

8,687,351 |

|

|

|

8,651,139 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWANCE FOR LOAN LOSSES |

|

|

|

|

|

|

|

|

|

|

|

| Beginning balance |

$ |

13,603 |

|

|

$ |

13,858 |

|

|

$ |

12,801 |

|

|

|

$ |

13,603 |

|

|

$ |

12,801 |

|

|

| Provision for loan losses |

|

(44 |

) |

|

|

(74 |

) |

|

|

300 |

|

|

|

|

(44 |

) |

|

|

300 |

|

|

| Charge-offs |

|

|

(44 |

) |

|

|

(280 |

) |

|

|

(49 |

) |

|

|

|

(44 |

) |

|

|

(49 |

) |

|

| Recoveries |

|

|

60 |

|

|

|

99 |

|

|

|

56 |

|

|

|

|

60 |

|

|

|

56 |

|

|

| Ending balance |

|

$ |

13,575 |

|

|

$ |

13,603 |

|

|

$ |

13,108 |

|

|

|

$ |

13,575 |

|

|

$ |

13,108 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction and land development |

$ |

93,031 |

|

|

$ |

123,147 |

|

|

$ |

130,691 |

|

|

|

$ |

93,031 |

|

|

$ |

130,691 |

|

|

| Commercial real estate |

|

624,164 |

|

|

|

637,701 |

|

|

|

538,069 |

|

|

|

|

624,164 |

|

|

|

538,069 |

|

|

| Residential real estate |

|

207,256 |

|

|

|

209,326 |

|

|

|

216,035 |

|

|

|

|

207,256 |

|

|

|

216,035 |

|

|

| Home equity |

|

|

108,024 |

|

|

|

109,857 |

|

|

|

110,844 |

|

|

|

|

108,024 |

|

|

|

110,844 |

|

|

| Commercial and industrial |

|

284,257 |

|

|

|

251,666 |

|

|

|

219,455 |

|

|

|

|

284,257 |

|

|

|

219,455 |

|

|

| Consumer |

|

|

4,489 |

|

|

|

4,428 |

|

|

|

4,864 |

|

|

|

|

4,489 |

|

|

|

4,864 |

|

|

| Total |

|

|

$ |

1,321,221 |

|

|

$ |

1,336,125 |

|

|

$ |

1,219,958 |

|

|

|

$ |

1,321,221 |

|

|

$ |

1,219,958 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONPERFORMING ASSETS AT PERIOD-END |

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans: |

|

|

|

|

|

|

|

|

|

|

|

| 90 days past due and accruing |

$ |

273 |

|

|

$ |

359 |

|

|

$ |

1,061 |

|

|

|

$ |

273 |

|

|

$ |

1,061 |

|

|

| Nonaccrual |

|

|

1,598 |

|

|

|

2,201 |

|

|

|

2,428 |

|

|

|

|

1,598 |

|

|

|

2,428 |

|

|

| Other real estate owned |

|

1,716 |

|

|

|

1,225 |

|

|

|

1,664 |

|

|

|

|

1,716 |

|

|

|

1,664 |

|

|

| Nonperforming assets |

$ |

3,587 |

|

|

$ |

3,785 |

|

|

$ |

5,153 |

|

|

|

$ |

3,587 |

|

|

$ |

5,153 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses to total loans |

|

1.03 |

|

% |

|

1.02 |

|

% |

|

1.07 |

|

% |

|

1.03 |

|

% |

|

1.07 |

|

% |

| Allowance for loan losses to |

|

|

|

|

|

|

|

|

|

|

|

| nonperforming loans |

|

725.55 |

|

|

|

531.37 |

|

|

|

375.70 |

|

|

|

|

725.55 |

|

|

|

375.70 |

|

|

| Nonperforming assets to total assets |

|

0.20 |

|

|

|

0.21 |

|

|

|

0.30 |

|

|

|

|

0.20 |

|

|

|

0.30 |

|

|

| Nonperforming loans to total loans |

|

0.14 |

|

|

|

0.19 |

|

|

|

0.29 |

|

|

|

|

0.14 |

|

|

|

0.29 |

|

|

| Annualized net charge-offs (recoveries) |

|

|

|

|

|

|

|

|

|

|

|

| to average loans |

|

0.00 |

|

|

|

0.06 |

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

0.00 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| Fiduciary assets at period-end (e) (f) |

$ |

509,668 |

|

|

$ |

518,284 |

|

|

$ |

519,901 |

|

|

|

$ |

509,668 |

|

|

$ |

519,901 |

|

|

| Retail brokerage assets at period-end (e) (f) |

$ |

316,064 |

|

|

$ |

321,151 |

|

|

$ |

292,505 |

|

|

|

$ |

316,064 |

|

|

$ |

292,505 |

|

|

| Number full-time equivalent employees (g) |

|

326 |

|

|

|

328 |

|

|

|

326 |

|

|

|

|

326 |

|

|

|

326 |

|

|

| Number of full service offices |

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

|

26 |

|

|

|

27 |

|

|

| Number of loan production offices |

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

|

2 |

|

|

|

2 |

|

|

| Number of ATM's |

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

|

|

34 |

|

|

|

34 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) - Excludes goodwill and other intangible assets. |

| (b) - Excludes amortization expense, net of tax, of intangible

assets. |

| (c) - The efficiency ratio is calculated by dividing

noninterest expense excluding gains or losses on the sale of OREO

by net |

| interest income including tax equivalent income on nontaxable

loans and securities and noninterest income and excluding (i) gains

or |

| losses on securities and (ii) gains or losses on sale of

premises and equipment. |

| (d) - Average does not include unrealized gains and

losses. |

| (e) - Market value. |

| (f) - Assets are not owned by the Company and are not

reflected in the consolidated balance sheet. |

|

|

|

|

|

| (g) -

Average for quarter. |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Net Interest Income Analysis |

| For the Three Months Ended March 31, 2018 and

2017 |

| (Dollars in thousands) |

| Unaudited |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Interest |

|

|

|

|

|

| |

|

|

Average Balance |

|

Income/Expense |

|

Yield/Rate |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

$ |

258,552 |

|

$ |

219,922 |

|

$ |

2,444 |

|

$ |

2,054 |

|

3.83 |

% |

3.79 |

% |

| Real estate |

|

1,077,243 |

|

|

973,215 |

|

|

12,189 |

|

|

10,624 |

|

4.53 |

|

4.37 |

|

| Consumer |

|

4,300 |

|

|

4,837 |

|

|

76 |

|

|

91 |

|

7.17 |

|

7.63 |

|

| Total loans |

|

1,340,095 |

|

|

1,197,974 |

|

|

14,709 |

|

|

12,769 |

|

4.40 |

|

4.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal agencies & GSEs |

|

103,199 |

|

|

96,965 |

|

|

517 |

|

|

442 |

|

2.00 |

|

1.82 |

|

| Mortgage-backed & CMOs |

|

108,826 |

|

|

78,054 |

|

|

600 |

|

|

413 |

|

2.21 |

|

2.12 |

|

| State and municipal |

|

|

86,336 |

|

|

131,397 |

|

|

634 |

|

|

1,152 |

|

2.94 |

|

3.51 |

|

|

Other |

|

|

|

14,422 |

|

|

18,172 |

|

|

175 |

|

|

186 |

|

4.85 |

|

4.09 |

|

| Total

securities |

|

|

|

312,783 |

|

|

324,588 |

|

|

1,926 |

|

|

2,193 |

|

2.46 |

|

2.70 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits in other banks |

|

|

45,573 |

|

|

51,898 |

|

|

188 |

|

|

109 |

|

1.67 |

|

0.85 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-earning assets |

|

1,698,451 |

|

|

1,574,460 |

|

|

16,823 |

|

|

15,071 |

|

3.97 |

|

3.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-earning assets |

|

|

|

119,978 |

|

|

125,270 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

1,818,429 |

|

$ |

1,699,730 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand |

|

|

$ |

232,383 |

|

$ |

215,930 |

|

|

11 |

|

|

11 |

|

0.02 |

|

0.02 |

|

| Money market |

|

|

410,171 |

|

|

305,639 |

|

|

783 |

|

|

241 |

|

0.77 |

|

0.32 |

|

|

Savings |

|

|

|

130,708 |

|

|

124,250 |

|

|

9 |

|

|

9 |

|

0.03 |

|

0.03 |

|

| Time |

|

|

|

383,860 |

|

|

375,291 |

|

|

1,022 |

|

|

939 |

|

1.08 |

|

1.01 |

|

| Total deposits |

|

1,157,122 |

|

|

1,021,110 |

|

|

1,825 |

|

|

1,200 |

|

0.64 |

|

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Customer repurchase agreements |

|

12,247 |

|

|

45,106 |

|

|

1 |

|

|

1 |

|

0.03 |

|

0.01 |

|

| Other short-term borrowings |

|

|

2,183 |

|

|

11,833 |

|

|

9 |

|

|

27 |

|

1.65 |

|

0.91 |

|

| Long-term borrowings |

|

|

27,836 |

|

|

37,717 |

|

|

290 |

|

|

319 |

|

4.17 |

|

3.38 |

|

| Total interest-bearing |

|

|

|

|

|

|

|

|

|

|

|

|

|

| liabilities |

|

|

1,199,388 |

|

|

1,115,766 |

|

|

2,125 |

|

|

1,547 |

|

0.72 |

|

0.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest bearing demand deposits |

|

400,027 |

|

|

371,007 |

|

|

|

|

|

|

|

|

|

| Other

liabilities |

|

|

|

9,581 |

|

|

9,498 |

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

209,433 |

|

|

203,459 |

|

|

|

|

|

|

|

|

|

| Total liabilities and |

|

|

|

|

|

|

|

|

|

|

|

|

| shareholders' equity |

$ |

1,818,429 |

|

$ |

1,699,730 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

rate spread |

|

|

|

|

|

|

|

|

|

|

3.25 |

% |

3.28 |

% |

| Net

interest margin |

|

|

|

|

|

|

|

|

|

|

3.46 |

% |

3.44 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (taxable equivalent basis) |

|

|

|

|

14,698 |

|

|

13,524 |

|

|

|

|

|

| Less: Taxable equivalent adjustment (a) |

|

|

|

|

|

155 |

|

|

390 |

|

|

|

|

|

| Net

interest income |

|

|

|

|

|

|

$ |

14,543 |

|

$ |

13,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) - Calculated using 21% and 35% statutory tax rate in 2018

and 2017, respectively, due to tax rate change. |

|

| |

|

|

Contact: |

|

William W. Traynham, Chief Financial Officer |

|

|

|

434-773-2242 |

|

|

|

traynhamw@amnb.com |

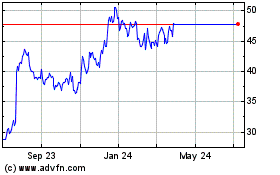

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Apr 2023 to Apr 2024