Amended Statement of Beneficial Ownership (sc 13d/a)

March 15 2018 - 9:17AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 16)

WYNN RESORTS,

LIMITED

(Name of Issuer)

Common Stock, $0.01 par value per share

(Title of Class of Securities)

983134107

(CUSIP Number)

|

|

|

|

|

Paul D. Tosetti

Latham & Watkins, LLP

355 South Grand Avenue, Suite 100

Los Angeles, CA 90071

(213) 891-8770

|

|

Donald J. Campbell

Campbell & Williams

700 South 7th Street

Las

Vegas, NV 89101

(702) 382-5222

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 14, 2018

(Date of

Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for

other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

This Amendment No. 16 hereby amends and supplements the Schedule 13D filed with the Securities and Exchange

Commission (the “Commission”) on November 13, 2002, as amended to date (the “Schedule 13D”) relating to the common stock, par value $0.01 (the “Common Stock”) of Wynn Resorts, Limited (the “Company”).

Capitalized terms used but not defined herein shall have the respective meanings set forth in the Schedule 13D.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 of the Schedule 13D is hereby supplemented with the following

information:

On March 14, 2018, Stephen A. Wynn (“Mr. Wynn”) and Elaine P. Wynn (“Ms. Wynn”) presented the Eighth

Judicial District Court in Clark County, Nevada (the “District Court”) in the case of Wynn Resorts, Limited vs. Kazuo Okada, et al., Case No.

A-12-656710

(the

“Litigation”) with a Stipulation agreeing that the Amended and Restated Stockholders Agreement, dated as of January 6, 2010, among Mr. Wynn, Ms. Wynn and Aruze USA, Inc. (the “Stockholders Agreement”) is now

invalid and unenforceable as a matter of law and that none of the parties to the Stockholders Agreement shall have any further rights or obligations thereunder. The District Court entered an Order approving the parties’ stipulation and

dismissing certain of Ms. Wynn’s claims in the Litigation on March 14, 2018.

Mr. Wynn may seek to sell all or a portion of the Common

Stock controlled by him pursuant to one or more registered public offerings, in the open market in transactions pursuant to Rule 144 under the Securities Act of 1933 or in privately negotiated transactions. If he elects to sell any such Common

Stock, he will seek to conduct such sales in an orderly fashion and in cooperation with the Company.

Any actions Mr. Wynn or the other Reporting

Persons might undertake may be made at any time and from time to time without prior notice and will be dependent upon the Mr. Wynn’s review of numerous factors, including, but not limited to: an ongoing evaluation of the Company’s

business, financial condition, operations and prospects; price levels of the Common Stock; general market, industry and economic conditions; regulatory considerations; the relative attractiveness of alternative business and investment opportunities;

and other future developments.

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

14

|

|

Joint Filing Agreement, dated February 8, 2018, between Stephen A. Wynn and Wynn Family Limited Partnership (previously filed as Exhibit 14 to the Schedule 13D/A of Stephen A. Wynn and Wynn Family Limited Partnership, filed February

12, 2018 and incorporated herein by reference).

|

2

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: March 15, 2018

|

|

|

STEPHEN A. WYNN

|

|

|

|

/s/ Stephen A. Wynn

Stephen A. Wynn

|

WYNN FAMILY LIMITED

PARTNERSHIP

|

|

|

By: Wynn GP, LLC, its general partner

By: Stephen A. Wynn Revocable Trust

U/D/T/ Dated June 24,

2010, its manager

|

|

/s/ Stephen A. Wynn

By: Stephen A. Wynn

Title: Trustee

|

3

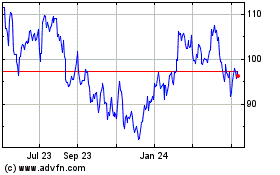

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024