Amended Current Report Filing (8-k/a)

April 02 2018 - 5:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 6, 2018

SELLAS Life Sciences Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33958

|

|

20-8099512

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

315 Madison Avenue, 4th Floor

New York, NY 10017

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code:

(917) 438-4353

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of

the Securities Exchange Act of 1934

(§ 240.12b-2 of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note:

This Amendment to the Current Report on Form

8-K/A

(the “Amended Form

8-K”)

is being filed to amend and restate Item 4.01 of the Current Report on Form

8-K

originally filed by SELLAS Life Sciences Group, Inc. on March 12, 2018

(the “Original Form

8-K”)

to include additional clarifying disclosures in Item 4.01 regarding KPMG Bermuda’s reports on the Company’s financial statements for fiscal years ending

December 31, 2016 and 2015, which were inadvertently omitted in the Original Form

8-K.

This Amended Form

8-K/A

also amends and restates the exhibit index to include

KPMG Bermuda’s letter as Exhibit 16.1 and incorporate by reference those exhibits previously filed with the Original Form

8-K.

You should read this Amended Form

8-K

with the Original Form

8-K

for information regarding the other items reported in the Original Form

8-K.

|

ITEM 4.01.

|

Changes in Registrant’s Certifying Accountant.

|

During January 2018, the board of

directors of the Company determined to request proposals from auditing firms for the Company’s 2017 audit. This decision was made following the completion of the business combination with SELLAS Life Sciences Group Ltd. (“

Private

SELLAS

”) on December 29, 2017, and the subsequent relocation of the Company’s corporate headquarters and all operations of the combined company to New York, New York. As a result of the business combination, the financial

statements of Private SELLAS, for which KPMG Audit Limited (“

KPMG Bermuda

”) served as the independent registered public accounting firm, became the financial statements of the Company. After review and consideration of various

proposals, on March 6, 2018, the Company dismissed KPMG Bermuda as the Company’s independent registered public accounting firm, with immediate effect, and engaged Moss Adams LLP (“

Moss Adams

”) as the Company’s

independent registered public accounting firm for the Company’s fiscal year ending December 31, 2017. The decision to continue the engagement of Moss Adams as the Company’s accountants was approved by the audit committee of the board

of directors of the Company.

KPMG Bermuda’s audit reports on the Company’s financial statements (which, as a result of the

business combination, are now the financial statements of Private SELLAS) for the years ended December 31, 2016 and 2015 contained a statement that “the Company has suffered recurring net losses since its inception and has an accumulated

deficit of $30.4 million that raises substantial doubt about its ability to continue as a going concern. Management’s plan in regard to these matters are also described in Note 1. The consolidated financial statements do not include any

adjustments that might result from the outcome of this uncertainty.” In addition, KPMG Bermuda advised the Company that the Company has a material weakness in its internal control over financial reporting due to lack of sufficient management

and personnel with appropriate expertise in GAAP and SEC rules and regulations with respect to financial reporting.

During the

Company’s two most recent fiscal years and the subsequent interim period through March, 2018, the date of notification to KPMG Bermuda of its dismissal, there were no: (1) disagreements with KPMG Bermuda on any matter of accounting

principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG Bermuda, would have caused it to refer to the subject matter thereof regarding its report, or

(2) reportable events, as defined in Item 304(a)(1)(v) of Regulation

S-K

other than as noted above regarding the Company’s ability to continue as a going concern and the existence of material

weaknesses in its internal control over financial reporting.

Moss Adams has been acting as the Company’s independent accounting firm

since 2013 and reviewed the Company’s predecessor financial statements (e.g., prior to the business combination with Private SELLAS). Other than in connection with its engagement as the Company’s independent public accounting firm prior to

the business combination with Private SELLAS, during the two most recent fiscal years and the subsequent interim period through March 6, 2018, neither the Company nor anyone acting on its behalf consulted Moss Adams regarding the application of

accounting principles to any completed or proposed transactions nor regarding any matter that was the subject of a disagreement with the Company’s independent accountant or any reportable event, as defined in Item 304(a)(1)(v) of Regulation

S-K.

The Company provided a copy of this Form

8-K

to KPMG

Bermuda on March 12, 2018 and requested that KPMG Bermuda furnish a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above statements. KPMG Bermuda’s letter dated March 26, 2018 is

filed as Exhibit 16.1 to this Amended Form

8-K.

|

ITEM 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits. The following material is filed as an

exhibit to this Current Report on Form

8-K:

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

1.1

|

|

Engagement Letter dated January 16, 2018, between SELLAS Life Sciences Group, Inc. and Cantor Fitzgerald

& Co. (incorporated by reference to Exhibit 1.1 to the Current Report on Form

8-K

filed on March 12, 2018)

|

|

|

|

|

3.1

|

|

Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Current Report on Form

8-K

filed on March 12, 2018)

|

|

|

|

|

4.1

|

|

Form of Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form

8-K

filed on March 12,

2018)

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement dated March 7, 2018 (incorporated by reference to Exhibit 10.1 to the Current Report on Form

8-K

filed on March 12, 2018)

|

|

|

|

|

10.2

|

|

Form of Voting Agreement (incorporated by reference to Exhibit 10.2 to the Current Report on Form

8-K

filed

on March 12, 2018)

|

|

|

|

|

10.3

|

|

Form of

Lock-Up

Agreement (incorporated by reference to Exhibit 10.3 to the Current Report on Form

8-K

filed on March 12, 2018)

|

|

|

|

|

16.1

|

|

Letter from KPMG Audit Limited dated March 26, 2018.

|

|

|

|

|

99.1

|

|

Press Release dated March 7, 2018 (incorporated by reference to Exhibit 99.1 to the Current Report on Form

8-K

filed on March 12, 2018)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLAS Life Sciences Group, Inc.

|

|

|

|

|

|

|

Dated: April 2, 2018

|

|

|

|

By:

|

|

/s/ Angelos M. Stergiou, M.D., Sc.D.

|

|

|

|

|

|

|

|

|

|

Angelos M. Stergiou, M.D., Sc.D.

President

and Chief Executive Officer

|

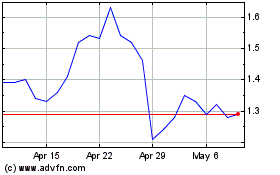

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

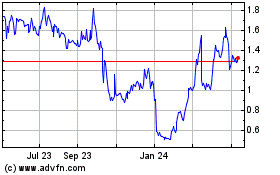

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024