New CEO will have to deal with increasing competition from

banks, fintech firms

By AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 21, 2017).

Entrepreneur Christopher Burch has been a loyal user of American

Express Co. cards since 1979. This year, he switched almost all his

spending to J.P. Morgan Chase & Co.'s Sapphire Reserve

card.

Regaining customers like Mr. Burch, who made the Forbes list of

wealthiest Americans in 2014, is one of the big challenges for

incoming AmEx Chairman and Chief Executive Stephen Squeri. Named

successor to longtime chief Kenneth Chenault on Wednesday, Mr.

Squeri takes over as the card giant stresses it is building

momentum after a recent rough stretch.

The reality is more complicated. AmEx is still dealing with

rising competition from banks and nimble fintech firms like PayPal

Holdings Inc., the Silicon Valley payments company whose market

value recently eclipsed AmEx's. Investors aren't clear, meanwhile,

on where long-term revenue growth will come from, or how AmEx will

deal with potential disruption to traditional payments channels

from new, mobile approaches.

When asked about competition at a shareholder lunch at Aretsky's

Patroon restaurant in Manhattan last year, Mr. Chenault put the

situation in a historical context, according to a person at the

meeting. But, Mr. Chenault added, the firm was under attack.

AmEx issues cards to consumers and businesses, both credit cards

and ones that must be paid off monthly. It runs its own card

network and also makes loans to people and companies.

The firm has spent recent years fending off rivals on several

fronts, which has worried some investors. Mr. Chenault's departure

is "good timing from a stock perspective but...there are still

challenges ahead," said Don Fandetti, a Wells Fargo & Co.

analyst.

Top of the to-do list for Mr. Squeri: regain the cachet of the

AmEx brand, both for millennials who don't view it the same way as

their parents and for established customers who have been wooed by

banks offering better services and more perks.

Mr. Burch, whose businesses include hospitality, technology and

retail investments, recalls that AmEx's concierge service in recent

years was unable to get him tables at several high-end NYC

restaurants; hotel upgrades became "bland."

Shortly after, employees of Mr. Burch suggested he try the

popular Sapphire Reserve card. He started using it.

In June, Mr. Burch emailed Mr. Chenault to share his

disappointment. A few weeks later, Mr. Burch said, he received an

email from a "customer relations representative of the executive

office" that read like a form letter.

As competitive pressures have mounted, AmEx has lost market

share to banks and to card networks such as Visa Inc. AmEx's market

share of total U.S. credit-card purchase volume fell to 22.9% last

year, according to Nomura Instinet, from 25.4% in 2015. It was

about 26% as recently as 2014.

The slip has in large part been the result of several co-branded

cards that AmEx has lost since 2015, including Costco Wholesale

Corp. and JetBlue Airways Corp.

Costco was viewed as a huge loss for AmEx by many shareholders,

but the company's earnings are starting to rebound from that. "It

turned out the decision on Costco was 100% the right decision,"

Warren Buffett, whose Berkshire Hathaway Inc. is the largest AmEx

shareholder, told the Journal in an interview. "Everybody thought

it was a mistake at the time, " but he said that since then, "the

progress is just terrific."

Mr. Chenault also defended his tenure, noting how he overcame

numerous challenges. "I've managed through three crises [including]

9/11 and the financial crisis," he said in an interview. "The

repositioning of what we did with co-brands was very

impressive."

Asked about the Sapphire Reserve card, Mr. Chenault said AmEx

has been "very focused on innovating" its Platinum card and that

the card is having "the best time ever."

To dig out of the company's slump and boost revenue, Mr.

Chenault leaned more on lending. That was a reversal from the years

after the financial crisis when he was wary of this business.

In the wake of the meltdown, Mr. Chenault opted to make the

company less bank-like and stay focused on revenue generated from

fees merchants pay it when customers use AmEx cards.

The company also put roughly $1 billion into a division that

focused mostly on the prepaid card market, according to a former

executive. But the effort failed to take off.

It wasn't until late 2014 when Mr. Chenault recognized the

disadvantage AmEx faced when competing with big lenders, according

to the person. Negotiations were underway for the Costco credit

card, and the deal appeared to be on the ropes.

Each time AmEx sweetened its bid, Costco told the company it

needed to do more. AmEx was ultimately outbid by an estimated $1

billion, the person said. Citigroup Inc. won the business.

The jolt changed Mr. Chenault's thinking on lending. At one 2015

meeting, he asked division heads how much revenue and profit they

could deliver in the next two to three years to fill the void left

by Costco. One executive said the firm could build U.S. loan

balances by 12%.

Mr. Chenault's response, according to a person familiar with the

meeting: "What would it take to make it even bigger?"

The company's lending push helped improve earnings this year,

but shareholders are becoming worried about future credit losses.

The firm's total provisions for losses jumped 53% in the third

quarter from a year prior. Competing in premium cards can be

costly, too; the company continued to increase expenses in the

third quarter.

"Their strategy has shifted to one that relies a bit more on

lending and it remains to be seen what the full effects of that

will be in the next downturn," said David Hochstim, a director and

senior research analyst at ClearBridge Investments, an AmEx

shareholder.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

October 21, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

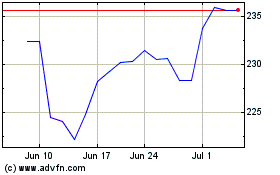

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

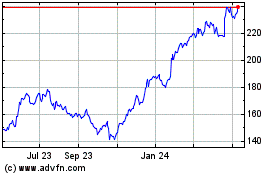

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024