Alumasc Group PLC Trading Statement (6253H)

March 14 2018 - 3:00AM

UK Regulatory

TIDMALU

RNS Number : 6253H

Alumasc Group PLC

14 March 2018

IMMEDIATE RELEASE 14 March 2018

The Alumasc Group plc (ALU.L) ("Alumasc" or the "group")

Trading Statement

Alumasc has so far experienced a slower than expected third

quarter performance, both in terms of revenue and order intake. The

principal reasons are macro-economic and industry specific:

-- continuing delays in building contractor customers committing

to new work following recent margin pressures, exacerbated in

January by the insolvency of Carillion and the consequential impact

across the industry;

-- broader economic and political uncertainties impacting demand

particularly in the commercial new build sector, with recent

reports of construction output in this sector showing decline;

-- delays to public housing refurbishment contracts in Scotland; and

-- severe winter weather over the last few weeks.

These issues have had an impact particularly on Levolux's UK

Solar Shading business, the Roofing & Walling division and the

Gatic business within the Water Management division. It is likely

that the first three of these factors will also impact the group's

final quarter performance.

In contrast, areas where Alumasc's products and systems are sold

via building distribution channels continue to perform well, with

revenue growth remaining ahead of UK construction market growth at

Alumasc Water Management Solutions, Rainclear and Timloc.

In view of all the above, the Board's latest forecasts are that

group revenues for the year ending 30 June 2018 will be 4-5% below

previous expectations, with a consequential reduction in previously

expected underlying profit before tax of around 15%.

The integration of Wade, the specialist drainage business

acquired by Alumasc on 1 February 2018, is progressing well and the

Board believes that potential synergies as part of Alumasc's

broader Water Management division and its "rain to drain" strategy

are significant.

Whilst Alumasc is not immune to current market headwinds, there

have been numerous positive strategic developments across the group

over the last year that make Alumasc well positioned to continue

its recent underlying growth trajectory over the medium to longer

term. The level of specifications and the value of pre-order

pipelines remain strong across the group, particularly Levolux's

relatively new business streams of North American Solar Shading

& Screening and UK Balconies & Balustrading where market

share is growing rapidly from a low base.

The Board continues to have confidence in the future growth

prospects of the group in view of:

-- The strategic positioning of our businesses in specialist growth markets;

-- The consistent investment in recent years in growth resources

and additional capacity, including the successful commissioning of

the new Timloc factory in January;

-- Levolux and Alumasc Water Management's potential to further develop export markets; and

-- The recent acquisition of Wade, a high-quality business with

development and synergy potential.

Enquiries:

The Alumasc Group plc

Paul Hooper (Chief Executive) 01536 383821

Andrew Magson (Finance Director) 01536 383844

Glenmill Partners Limited

Simon Bloomfield 07771 758514

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFFTVRIVLIT

(END) Dow Jones Newswires

March 14, 2018 03:00 ET (07:00 GMT)

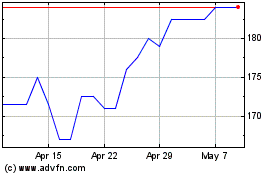

Alumasc (LSE:ALU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alumasc (LSE:ALU)

Historical Stock Chart

From Apr 2023 to Apr 2024